The autumn statement matters.

It matters because millions of people's wellbeing in this country depends on whether or not our economy recovers.

It matters to public services.

It matters to those who are dependent upon the state.

It matters to the next election and the future direction of this country.

This statement is the battleground on which the next election will be fought: on whether there is a feel good factor in 2015, or not.

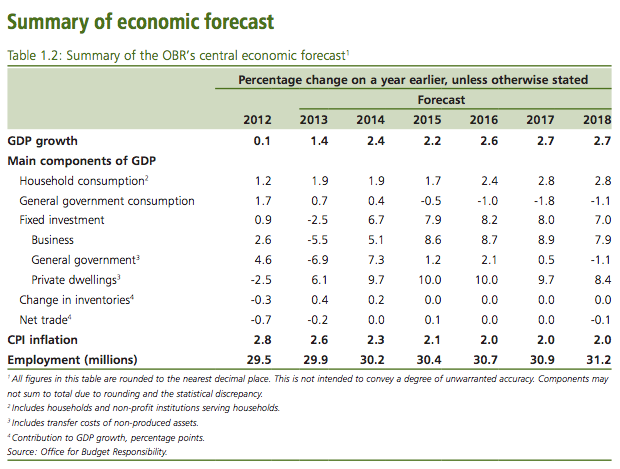

I will look at some tax issues relating to the statement later, but this was not as big a tax day as it was an economics day. This is the Treasury's own summary of the main economic forecasts:

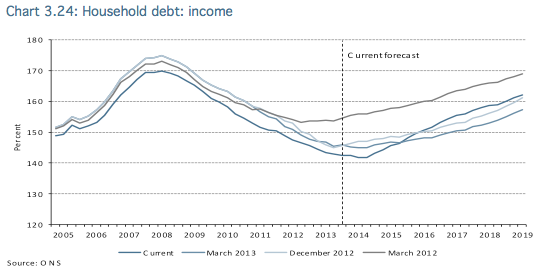

Let's chart a few of those and some others, using OBR data. Start with household debt:

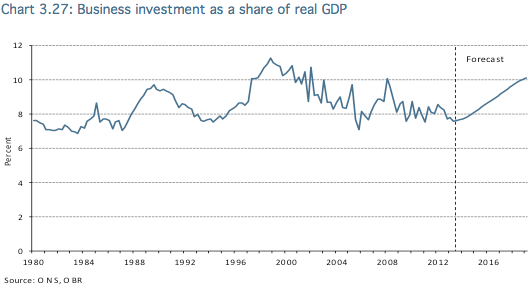

And business investment:

And exports:

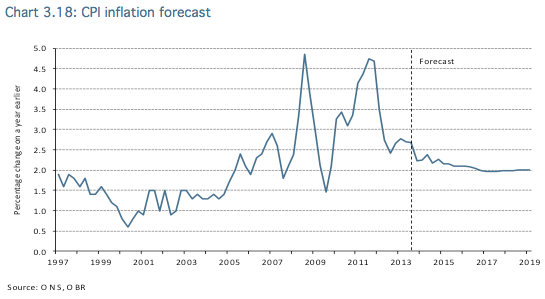

And inflation:

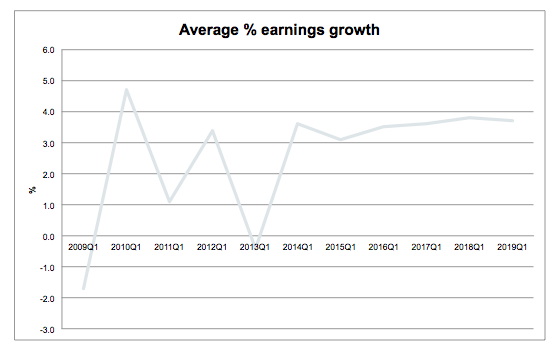

And wages growth:

(They didn't chart that one)

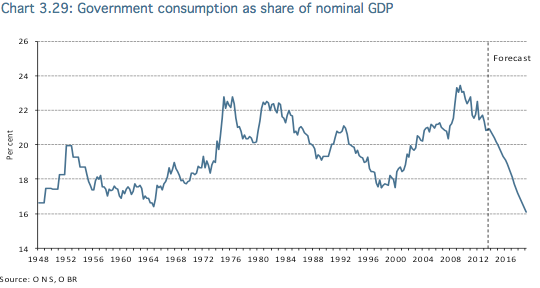

And government consumption:

And not charted is the fact that house prices are forecast to grow by 18% (I haven't found the data, yet)

Now, let's draw that together. GDP is going to rise. That's because:

- we're all going to spend more

- business is going to invest lots more

- housing is going through the roof

- and despite all this government consumption and investment will fall

- and trade will be stagnant.

Now consider the chance of this. First, consumption will rise because we're all going to increase our household debt - by about 20% of our incomes.

That's because we're all going to have inflation busting pay increases of 3.8%.

But inflation will be only 2%.

Now how likely do you think that is without serious increases in interest rates?

Despite which business is going to see the biggest increase in investment for decades to reach near record levels, almost unknown in the past. Although we won't sell any more abroad as a result.

The more I look the more I think this is George's wish list to Santa. He told the forecasters to deliver graphs ion everything he likes going up and everything he dislikes going down and don't think about the causality between the two.

And that is what we have got: a make believe forecast from a make believe chancellor.

In the past (March 2o012) he's delivered disastrous tax measures, but this is just fantasy economics.

The only question is, will it all go wrong before May 2015 or not, because no one can believe this will happen.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: