The Tax Justice Network's 2013 Financial Secrecy Index exposes yawning gap between G20 rhetoric and reality. Issued today, this is their press release on the new FSI (this blog can also be viewed here):

Today the Tax Justice Network launches its 2013 Financial Secrecy Index, the biggest ever survey of global financial secrecy. This unique index combines a secrecy score with a weighting to create a ranking of the countries that most actively and aggressively promote secrecy in global finance.

This new edition of the Financial Secrecy Index shows that the

United Kingdom is the most important global player in the financial secrecy world. While the UK itself ranks only in 21

st place, it supports and partly controls a web of

secrecy jurisdictions around the world, from Cayman and Bermuda to Jersey and Gibraltar. Had we aggregated the entire British network it would easily top the index, far above Switzerland. (

Explore the British Connection here.)

Claims in September by British Prime Minister David Cameron that the UK havens are no longer a concern are baseless: our

research demonstrates that while the British Virgin Islands, Cayman Islands and some other British jurisdictions have recently curbed some secrecy offerings, others have expanded theirs.

[i] (

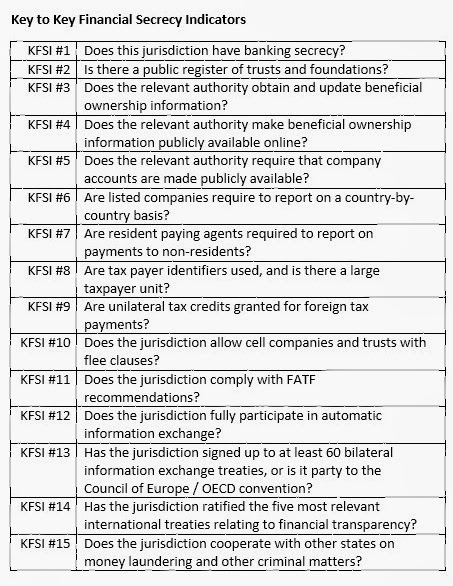

See also our full narrative reports on the Cayman Islands, on Jersey and on theBritish Virgin Islands.) The table

below shows the extent of the gap between the political rhetoric and the on-the-ground reality of British

tax havens

(click on the table and accompanying key to enlarge).

Our index, now expanded to cover 82 jurisdictions, also reveals how broader claims by the G20 and leading powers to have cracked down effectively on tax havens are bogus.

While some welcome promises have been made and modest improvements seen, we remain light years away from seeing the transformative changes the world so urgently needs.

Some positive trends are evident. With public tolerance for offshore financial secrecy having fallen sharply in many countries since our last index in 2011, we see potential for real political change: for example, citizens are demanding full disclosure in public registries of the beneficial owners that lie behind offshore shell companies, trusts, anstalts, foundations and so on.

Secrecy comes in

many flavours, and we have seen progress in some areas. Crucially, automatic

information exchange is now recognised as the effective global standard for tackling

tax evasion, which was not the case when we published our last index in 2011. More countries are joining the

OECD/Council of Europe

Multilateral Tax Convention which, while flawed, is the first that could in principle benefit developing countries with automatic information exchange. Two useful multinational initiatives — notably the European Union's

Savings Tax Directive and the U.S.'

Foreign Account Tax Compliance Act (FATCA),both involving automatic information exchange - are making headway. Country by country reporting is gaining traction, particularly

in Europe.

But the index reveals that overall, financial secrecy remains alive and well.

PDF of article

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Bermuda claims it does keep details of beneficial ownership as per requirement KSFI#3

Why is it that Bermuda and all other jurisdictions don’t meet this criteria?

I have searched the report and criteria details but cannot see what would preclude Bermuda from getting credit for keeping such information with the Registrar of Companies.

I think you will find that a) beneficial ownership is not recorded and b) it is not on easily accessible public record

An aside question. Is there a definition of a share register. Bermuda Registrar of Companies says that just a “current list of registered shareholders needs be available at the registered office of a company. Yet the Bermuda Companies Act refers to “register of members”

That is a register

That is a register of members

That’s good enough – if we truly want free trade there should be a level playing field globally – companies should be required to file accounts in the jurisdictions in which they are registered – alarm bells should be ringing if they aren’t, because in economic terms we have assymmetic information issues!

Richard, as an accountant and as an auditor (not a lawyer), I suggest otherwise. The Companies Act envisages a register that records all additions and reductions in shareholding and in particular detail. The register is a source of data of members past and present. A current list of members is that a list of members.

I have reviewed many register of members and as an auditor I have never had to accept a list of current members in the course of my audit work. Please comment.

Well of course there has to be a record of movements

I agree

Thanks for your remarks on ownership data. I will challenge my colleagues on this issue. I believe you are right.

Except that b) is not part of KSFI #3. Or is it?

Yes

Bermuda Finance Minister calls survey total nonsense!

http://www.royalgazette.com/article/20131108/BUSINESS/131109779/richards-calls-tax-report-total-nonsense&utm_source=newsletter20131108&utm_medium=email&utm_content=toparticle_morelink&utm_campaign=newsletter

That has been true for each tax haven for each such survey to date