The EU issued a summary of a new report today on the EU wide VAT gap that says:

The VAT Gap across all 26 Member States in 2011 accounted for €193 billion, or 1.5% of GDP. This amounts to 18% of the theoretical VAT (i.e. all expected revenue).

Italy (€36 bn), France (€32bn), Germany (€26.9bn) and the UK (€19bn) contributed over half of the total VAT Gap in quantitative terms, mainly because these are the largest EU economies. In terms of ratio to their own GDP, Romania (€10bn), Greece (€9.7 bn), Lithuania (€4.4bn) and Latvia (€0.9bn) were the countries with the largest VAT Gap in 2011

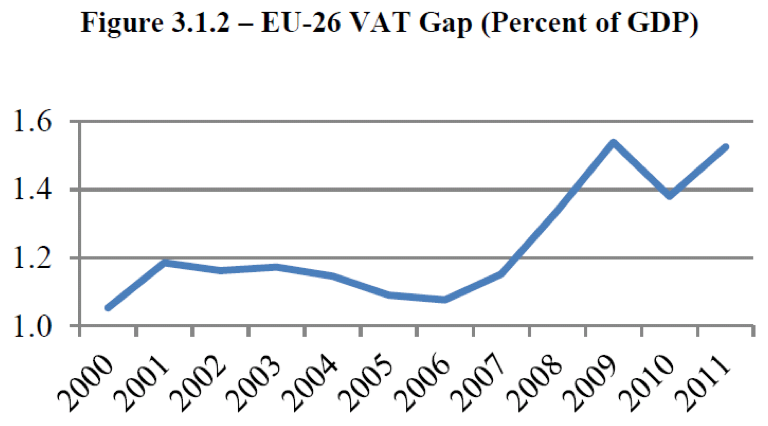

The study shows a marked upward trend in the VAT Gap in many Member States since 2008, as a result of the economic crisis. This was especially the case in Spain, Greece, Latvia, Ireland, Portugal and Slovakia. On average across the EU, the VAT Gap increased by 5 percentage points once the economic crisis hit.

What has been the effect of the economic crisis on the VAT Gap?

The data show that up to 2008, there had been a moderate declining trend in the level of the VAT Gap, particularly in a number of post-accession countries.

However, from 2008, the VAT Gap in many (but not all) countries increased with recession and the financial crisis from 2008. Spain, Greece, Latvia, Ireland, Portugal and Slovakia saw the highest increases in their gaps.

On the other hand, Sweden, Poland, Malta, Bulgaria and the Czech Republic were able to improve VAT collection levels during this period, and reduce their VAT Gap.

Taking into account the various components of the VAT Gap, there are several factors which can explain the increase in VAT GAP in times of crisis. On the one hand, sharp increases in VAT rates to redress public finances, particularly when coupled with poor enforcement, may have deterred compliance to some extent. On the other hand, the increase in insolvencies and bankruptcies, and a drop in imports (which often represent the easiest VAT collection to enforce) would also have contributed to the increase in the VAT Gap.

I am not surprised by the overall estimate: it is just a little less than my estimate of the overall proportion of tax lost to evasion in the EU economy.

I do hope HMRC take note. They claim that the UK VAT gap from all causes in 2010-11 was £9.6bn (€11.4bn). That's some €7.6bn (£6.4bn) less than the EU estimate. This implies a UK VAT Gap of 16.8%, which is higher than anything the UK has ever admitted to, and higher than even I would expect.

But I know who I am inclined to believe on this issue, and it's not HMRC, whose latest VAT gap data has looked decidedly strange and seriously understated.

I feel my work is vindicated, yet again.

NB Added 20.9.13: It has been suggested it is inappropriate to extrapolate 18% of lost theoretical VAT to GDP. I disagree. VAT is charged on sales. The loss is motivated by a desire to avoid tax and regulation. There is not reason to think that the loss is any less on exempt or zero rated sales whilst the losses in other elements of GDP e.g. profits, are all too well recorded to think they will be proportionately less

I agree I am extrapolating: I think the extrapolation reasonable

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

And one third of the UK VAT GAP in 2009-10 was due to ‘legal avoidance’.

So over €6bn lost due to rules that don’ work as intended and exploitation of loopholes. Surely HMG can close those and that’s a potential quick win. If the EC can identify it then surely HMG can too.

No doubt they’ll say they’re aware and have closed down those already. But not sure I have faith and it’s a nice indication of the level of avoidance (just on VAT) that goes on and is no doubt continuing.

But that still leave €13bn lost through (presumably) evasion. That really is scarey. Presumably HMRC don’t do as much checking of cash businesses etc. as they used to when I were a lad.

If you sack your staff you can’t

And I don’t believe remote audit can always work

Why would the EU estimate be any more reliable than the HMRC one?

How about they employed people who asked the right questions, used a decent methodology, and are neutral as a management team to the outcome

I wouldn’t trust any statistics that the Treasury dominated HMRC release!

“The VAT Gap — 18% of EU GDP”

It’s 1.5% of GDP or 18% of VAT according to your own posting.

If you lose the VAT that part of GDP is untaxed