HMRC has said for the last few years that closing the tax gap is its number one objective. I think that appropriate.

The tax gap is made up of tax paid late, tax evaded and tax avoided.

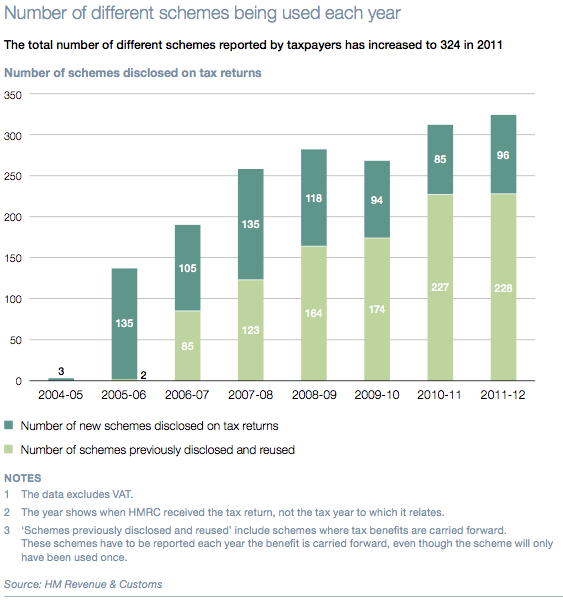

One significant part of tax avoided is that lost to marketed tax schemes. These have had to be disclosed since 2004. If HMRC was winning you would expect the number of such schemes to be going down. As the latest NAO report on this issue shows, they aren't. The number in use is going up:

I think that's one of the clearest indicators yet of HMRC's failure to come to terms with tax avoidance.

It's also notable that numbers have increased significantly under the current government; I suspect people no longer think there is the willingness to tackle this issue. They also know that so many staff are being sacked at HMRC the chances of losing from using such schemes are low. And when there are 41,000 cases outstanding, they're almost certainly right to think so.

When we have a government that is not able or (more importantly) willing to collect tax but is willing to cut services, benefits, education, healthcare, pensions and investment the country needs to worry.

Now, then, is that time to worry because there are only two ways to explain this phenomena and its recent increase. One is incompetence. The other is a willingness to turn a blind eye to it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard – doesn’t this explain why the numbers of disclosures has gone up (i.e more scehemes have fallen into scope over the period)?

From the NAO report

“4 Not all tax avoidance needs to be disclosed under DOTAS. Initially, only two types of scheme which HMRC judged to be particularly high risk had to be disclosed. DOTAS has been expanded over time to include more taxes and more types of avoidance.”

Only marginally- look at the data for pre-disclosed schemes, it has also increased significantly

Thought that you might not have seen this:

http://blogs.channel4.com/factcheck/factcheck-are-the-pms-tax-claims-avoidance-or-evasion/11919

The clue to David Cameron’s claim of investing £900m to tackle tax avoidance/evasion is that it is re-investment. In other words, instead of cutting by 25%, HMRC is only being cut by 15% .. on top of all the previous job losses.

Thanks

had not

Will blog now…

“When we have a government that is not able or (more importantly) willing to collect tax but is willing to cut services, benefits, education, healthcare, pensions and investment the country needs to worry.

Now, then, is that time to worry because there are only two ways to explain this phenomena and its recent increase. One is incompetence. The other is a willingness to turn a blind eye to it.”

Please refer to this article in today’s DT. “Our own research shows that tyranny does not result from blind conformity to rules and roles, it is a creative act of followership that flows from identification with authorities which represent vicious acts as virtuous”.

Hence, ‘There is no alternative to austerity’ when there is an alternative.

Hence ‘We have no choice but to cut’ when we do have a choice.

http://www.telegraph.co.uk/science/science-news/9694194/Nazis-werent-just-following-orders-but-took-pride-in-atrocities.html

Here is a web page on the Labour site inviting submissions and comments about tax avoidance and evasion and comments on cuts to HMRC.

http://www.yourbritain.org.uk/agenda-2015/policy-commissions/stability-and-prosperity-policy-commission/tax-avoidance-tax-havens