I've noted the usual nonsense from the right wing - let alone the CBI - has been trotted out today that the only reason large companies don't pay the tax expected of them is that they claim capital allowances and research and development allowances. Respectfully, this is not true.

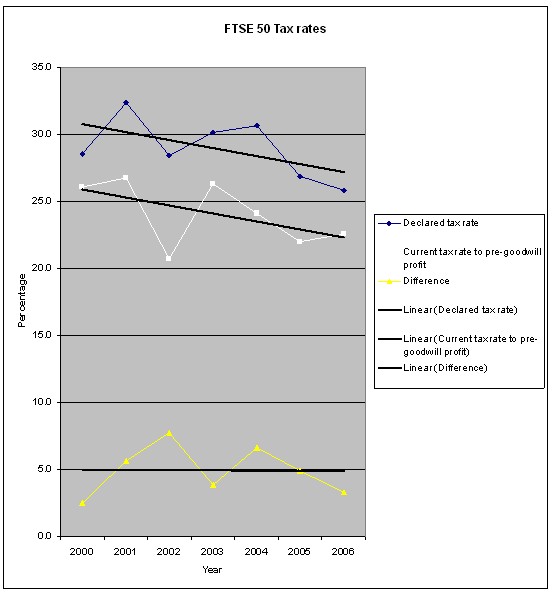

This graph is from my 2008 publication, The Missing Billions:

As my research has shown, using the data published by the 50 largest companies in the UK in the period from 2000 to 2006 and considering just the current tax charge and profits with goodwill added back, because the goodwill charge in a set of accounts is almost never allowed for tax, an extraordinary trend is apparent. In 2000 the ratio of current tax declared to pre-goodwill profit was 26.1%. By 2006 it was 22.5%. On a trend basis the decline was just over 3.5% during the seven year the period even though the UK corporate tax rate throughout this period was flat at 30%.

Throughout this period the current tax rate was almost exactly 5% less every year than the declared tax rate placed upon the proper loss account of the companies in question: in other words, always and persistently the companies paid at least 5% less in tax than they declared on their profit and loss accounts.

There was a flat tax rate of 30% over this period: there were no changes. R & D allowances were tiny. Capital allowance rates hardly changed bar minor details. But there were big cultural changes. The Westmoreland case overthrew Ramsey in 2001. Barclays Mercantile was on its way with hints of the liberality to come. Tax haven use was rising rapidly - and being sold heavily by the Big 4. SPVs and other entities were being used heavily. Derivatives were used much more extensively (and have a big role to play in tax avoidance). Transfer mispricing was not being tackled. Tax havens were out of control under the influence of George Bush.

And I suggested in my report that the decline in tax paid over the period - and maybe a part of that before it started was due to these factors. It was impossible because of the inconsistencies in data in the accounts of the companies surveyed to be sure quite how much - which is a condemnation of the quality of corporate reporting - but the chance that the increase was for the reasons the CBI and others claim was and remains in my view minimal.

That was my claim. And when most factors bar tax avoidance were controlled for by their consistency in this period I am sure I was and remain right. And quite specifically the only people who tried to prove me wrong - Deloitte - simply assumed I was: they presented no data to that effect because they could not find any. Their assumption was that big companies did not evade so all deferral was with the explicit approval of governments. That's the quality of the thinking of the opposition on this issue. They make lots of noise, but all the evidence supports my case.

So I stick with it. And slowly but surely people agree with it, like the CBI have been forced to today, at least in part.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I agree with your comments totally. Its not ethical that the big 4 push the tax avoidance schemes, but in the end money talks. The R&D concession sounds great in theory (lucky to inspire research and development) but in practice the companies driven by the big 4 put all there expenditure through as R&D and get the free kick. Hard to contol as it all gets very technical and the R&D in theory is approved by a separate body (ausindustries) and when reviewed at by the tax authorities the clients say the expenditure has been approved by ausindustries.

the big 4 put all expenditure through R&D…………oh really. I wasnt aware that any tax advisor was just able to ignore all the conditions required to be met before a relief can be claimed……….. you do know that qualified regulated professionals arent actually allowed by their institues to file tax returns that they know to be technically incorrect dont you?

Now remind me, how man conviction and censures have the big 4 had.?