Two regulatory agencies have responsibility for administering companies in the UK. One of course is Companies House. Companies House is an executive agency of the Department for Business, Innovation and Skills (BIS). I've already catalogued some of its failings in this area - allowing 500,000 companies a year to disappear, more than 325,000 at its behest and with no evidence available as to what those companies have done in the vast majority of cases.

The other agency that has this responsibility is H M Revenue & Customs.

Tax Research UK's new report, 500,000 missing people: £16 billion of lost tax looks at the workings of both departments and finds weaknesses in both. Data from both departments, and parliamentary answers, suggest both departments have a 'blind eye' approach to regulation.

Concentrating on the tax year 2009/10, H M Revenue & Customs did, for example, request corporation tax returns from just under 70% of all companies. This is despite the fact that fewer than 19% were recorded as dormant at Companies House.

Worse, of those who received a request for a tax return only 65.9% had submitted those due during 2009/10, or late (meaning by November 2010). That means, given that only 69.3% were asked to submit returns, that just 45.7% of active companies left on the register at the end of the year submitted corporation tax returns. And of those, based on HMRC data, just 33.6% of companies in existence at the start of the year paid corporation tax - or just 915,000 out of some 2,723,000 companies existing in April 2009.

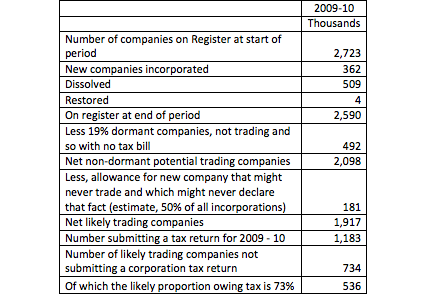

Of course, not all of the companies not paying tax should be. But it's very hard to believe that is true of all of them. Take the following table.

This needs some explanation. The ratio of dormant companies is consistent over time at 19% (surprisingly).

It seems entirely reasonable to assume that a special case should be made for new companies incorporated which will be struck off before never recording that they are dormant, but which are struck off for that very reason. An allowance for fifty per cent of all new incorporations falling into this category has been made in the above estimate of the likely number of trading companies — i. e. it is assumed that half of all new companies formed are never used by their new owners for the economic activity that they intended for them and as a result never trade. This effectively inflates the ratio of dormant companies to allow for the fact that these entities never get as far as recording the fact that they have this status because they are struck off before ever having the chance to do so.

This still leaves a potential 1.9 million trading companies on the Register of which in the year ended March 2010 just under 1.2 million had filed tax returns. Of those that filed tax returns the Revenue reports that about 915,000 paid tax. This is a ratio of about 73% paying tax of those submitting returns. This has to be allowed for in estimating tax lost and it is assumed that none of these companies would have any tax liability in the estimates that follow — although not having a corporation tax liability does not, of course, mean that liability for other taxes does not arise, so this assumption is generously cautious.

The average corporation tax owed by the average small company that pays tax in the UK amounts to more than £10,000 a year, based on HMRC data. VAT, PAYE and other taxes due on activity undertaken to generate that profit would be several times that sum in all likelihood. As PricewaterhouseCoopers noted in March 2011:

Corporation tax is still the largest tax borne by these companies but the survey results show that for the year to 31 March 2010, for every pound paid in corporation tax, Hundred Group members paid £1.97 in other taxes borne and £6.79 in taxes collected.

There is no doubt at all that these ratios are lower for small companies: a ratio of one to almost nine with regard to corporation tax due to total tax liabilities settled is obviously unlikely for small businesses as some will not be VAT registered and the employment ratios of such entities is bound to be smaller than for larger companies. But profits do not arise without labour being expended in the vast majority of cases and VAT being due in many more. If corporation tax is not being paid it is highly likely that settlement of these obligations is also not occurring. A ratio of one to three, corporation tax to other taxes owing does seem conservative in that case given that corporation tax is due at relatively low rates after other costs have been settled for most small businesses. In that case it seems fair to assume that total taxes lost for each company trading fraudulently might amount to £30,000 a year on average.

If £30,000 a year is not paid on average in tax by each company (some 536,000 in all) that seem to ignore their regulatory obligations to file accounts or annual returns or a corporation tax return then the tax lost would be £16 billion a year — almost 23% of the estimated tax evaded in the UK each year.

Of course that's an estimate. I accept that. But even the Oxford Centre for Business Taxation speculated in its recent report on corporation tax on why up to a million companies were not paying tax - without seeking to answer the question. I have sought to answer that question using official sources and data others like to quote as reliable - such as data from PWC.

I don't think all those companies should be paying tax. I allow for the fact that some will be loss making and some will never trade - having already allowed for the official dormant companies.

But it's absolutely impossible to think that the number of companies in the UK grew by a net million in little more than a decade without their being strong economic reason - and that reason implies trade.

Despite that more than 500,000 trading companies appear to not be accounting for their profits each year - and it's impossible to believe that the loss is not of extraordinary scale. I think it may be £16 billion. It may be a bit less. It could be more. That would be especially true if struck off companies carried on trading after being removed from the Register and so entirely slipped out of tax view - which seems entirely plausible in many cases.

However viewed then this is an issue that needs addressing. It costs just £4.4 billion a year to run HMRC and only £66 million to run Companies House. If only effort were put into ensuring they had the resources they really needed - and that's people in the main - to recover tax owing then the rate of return on employing those people to make sure accounts were filed, corporation tax returns submitted and tax paid would be phenomenal.

In the meantime if you want to know why the tax gap is so big - here's one of the reasons why.

And what is more - it is very obvious a great deal could be done about it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I think there is no reason to assume that because every small company that does pay corp tax owes £10,000, then every small company who doesn’t file a return owes this amount. It is likely to be significantly lower. I doubt HMRC are turning a blind eye to 536,000 companies with profits of £50,000.

And also I would query the £10,000 tax figure in the first place. In my experience the average small company earns profits significantly less than £50,000. If only because the owner takes the vast majority out in salary.

from my experience on the frontline -when those companies are chased for returns, they go into liquidation. Post liquidation HMRC just gives up. Phoenixism is rife and again HMRC does nothing.

“The average corporation tax owed by the average small company that pays tax in the UK amounts to more than £10,000 a year”

But therein lies a fundamental flaw, surely? Not every small company pays tax. But you extrapolate to the £30,000 figure as if every small company does. That is fatal to the reliability of your findings, is it not?

And that is quite a separate issue from how one defines “average small company” in the first place.

And whilst I am at it, the £10,000 tax for a small company seems quite high, too.

Interesting post, Richard. Two questions:

1)Do you think HMRC and Companies House focus too much on big companies and not enough on the huge numbers of very small ones? The revenue benefit from chasing large companies is of course potentially much greater given that the majority of corporation tax received by HMRC comes from the very largest companies.

2)Do you think the same also applies to sole traders and partnerships?

@bob

I’m sure you’re right

@Frances Coppola

£16 bn would be one third of peak CT revenue

Surely that’s worth chasing?

I agree big companies are chased – but relatively softly

Businesses are allowed to simply disappear – as Bob says – this has been a long time trend

Small errors are chased hard

But bucking the system is ignored – both by small companies and individuals

That’s wy I think it’s possible £70 bn could be evaded – and this report explains part of that

HMRC need to invest much more in this

@Richard Burdett

Please read the report – the £10,000 figure comes from HMRC consistently over a lot of years and hundreds of thousands of companies each year

Why should it be less for those who don’t report?

And why should I ignore the evidence?

See the report for sources

@Bryan Hoffman

I have gone to the bother of showing I do not do what you claim – at all

I allow for all dormants to be dormant which is unlikely

And I allow for 200,000 more to not pay tax as they’re new

And well over another 100,000 to be loss making

So your claims on my extrapolation are simply wrong

It would really help if you did not make wild claims

I have not

Just as I use HMRC data on average tax paid

Hello,

Couple of points – firstly the ‘missing’ companies and tax returns need to be explained by the two regulatory agencies – that is their job and responsibility to the public. Have you asked them to comment, and if so what has the response been?

Secondly, despite your response to Bryan Hoffman, I can’t get past you saying 500,000 odd companies owe £30,000 in tax – this is an assumption and not a fact. This seems a lot. This would require each of those companies to have NET UK taxable profits of more than £100k each. Following this through, they would likely have turnover measured in the £1m bracket.

Are you suggesting that total economic activity of £500bn has vanished from the radar and has slipped through the net? This seems pretty impossible to me – that would be what, 35% or so of total UK GDP? I can see where your £30k average comes from, but that is bound to be skewed by the handful of companies that pay a large chunk of the total take, rather than the smaller amounts paid by the larger majority.

Interested in your thoughts. HMRC should chase everything owed to them – but there isn’t an infinite pot of missing cash out there.

@Chris

I am baffled by your logic

£30,000 lost implies activity of nor more than £100,000 – some VAT, some PAYE, some corporation tax

I didn’t for a minute say it was all CT lost – I said if CT was not paid then it was highly likely other tax was not as well

And remember the stats are for small companies – not all companies…so there aren’t really large ones to distort it much

And if I’m wrong – suppose it’s only £10 billion lost – action would still be worthwhile

But I doubt I’m wrong – I reckon I’m conservative. I always try to be

@Richard Burdett

Richard – you clearly don’t deal with or know anything about the tax affairs of small companies. They don’t take out the majority as salary. They take out £6000 as salary and the rest is dividends, so subject to corporation tax. This, if you don’t know, is to avoid NIC. IR35 companies are an exception of course, but there aren’t many of those.

Good article RM ( and I don’t always agree with you).

Another reason for the shortfall is that HMRC are no longer blocking all strike off procedures for companies. The result is that Corporation Tax is not being paid for the last period of trading. This means that you can earn bumper profits, get the company struck off and dissolved and then for £60 or so set up a new company and do it all over again

@Stephen Griffiths

Thanks

And you’re right – that’s exactly what I’m highlighting

All the evidence supports that

Of course not in every case – but in hundreds of thousands maybe

It’s just too easy

Happy to clarify my logic: a company need file neither accounts nor CT returns to be fully compliant with VAT and PAYE obligations.

I agree 100% that the regulators in question should be assiduous in pursuit of defaulters whatever the tax shortfall generated by them is: but, in this case I think that your £16bn figure is founded too much on assumption eg, that these companies are ‘highly likely’ to be in default on all their obligations – this is speculation. Possibly that has been your experience in professional life: mine has been that late accounts are never, ever, ever hiding good news in terms of results.

Is it possible to go over earlier years, and look at the catch up in terms of late accounts and tax returns to try and support the missing tax argument?

@Chris

You iss the point – you’re looking at accounts that are eventually filed

I’m looking at those never filed

If they never file why be PAYE and VAT compliant?

Of cours eit’s an estimate – these things always are

Suppose I’m 50% out and the real number if £8 billion

Do you say we ignore it then?