I wrote the following blog in June.

With right wing think tanks proposing to cut 1 million government jobs it seems timely to republish it.

There’s been a lot of discussion about the need for public sector cuts. Give or take the public sector employs about 5 million people. If, as is demanded, there should be public sector cuts of 10% then maybe 500,000 people will lose their jobs.

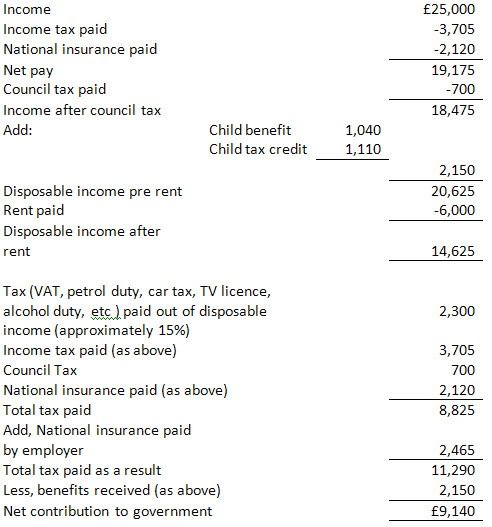

I have considered the consequence of this by doing a simple exercise. I have done a case study on the cost of a person earning £25,000 per annum who is a single parent with a child of school age, paying £500 a month in rent and £700 a year in council tax losing their job. The assumptions are slightly simplifying: benefits are harder to calculate in more complicated households. The rate of pay is slightly above mean and significantly above median UK pay. But £25,000 is a good, round number.

The total tax paid and benefits received by this person look like this:

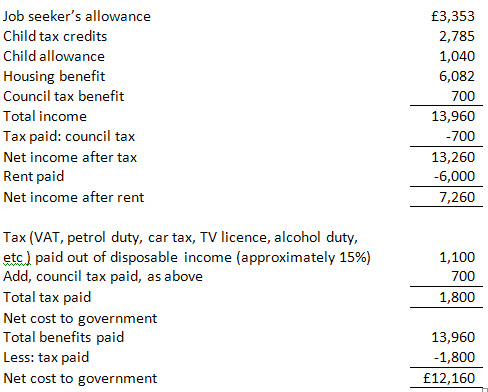

Now assume the same person was unemployed. They would get the following benefits:

Now assume the same person was unemployed. They would get the following benefits:

The total lost to the government if this person loses their job in the private sector is the addition of the total contribution lost plus the total cost paid. That is £21,300.

It could be argued that the cost is less in the public sector because tax deducted goes straight back to pay the employment cost. It so happens the net effect is the same. In that case the comparison with the private sector is maintained here.

The actual cost is higher though. The person in work has disposable income of about £14,625; the same person unemployed spends £7,260. That is a difference of £7,365. In other words they are twice as well off in work as out of work. But, most importantly, of that difference at least 65% (http://www.statistics.gov.uk/pdfdir/qna0609.pdf table D using 2008 figures) will support other people’s wages plus the taxes they spend on goods and services. Assuming these other people pay taxes at about the same overall rate as the person in the above exercise (and this is likely) that means about 36% of that difference will indirectly go in tax as well. That’s about £1,700. So now the benefit of keeping the person in work is £23,000 and they are only paid £25,000. Put it another way: 92% of the cost of cutting a £25,000 a year job when we have less than full employment is paid by the state.

In that case it is abundantly clear that paying to keep people in work pays — especially and even particularly if what they do has long term benefit that saves cost into the future. That cost saving — for instance from green efficiencies - has only to be £2,000 for it to be entirely worthwhile creating a job out of government spending to keep this person in work.

And that is before any account is taken of the social costs of being in employment, which are substantial in terms of reduced crime, improved educational outcome, better health, and more besides.

Now let’s reflect on the fact that in reality the average direct cost of employing an average public sector employee is less than this. Let’s make it around £21,000 — more like median pay — and then note that 500,000 at this pay rate will supposedly save £10.5 billion in the wage cost of the government. Putting these half a million people out of work will save us about £0.8 billion. That’s misery for 500,000 people and their dependents to save just £1,600 per job lost.

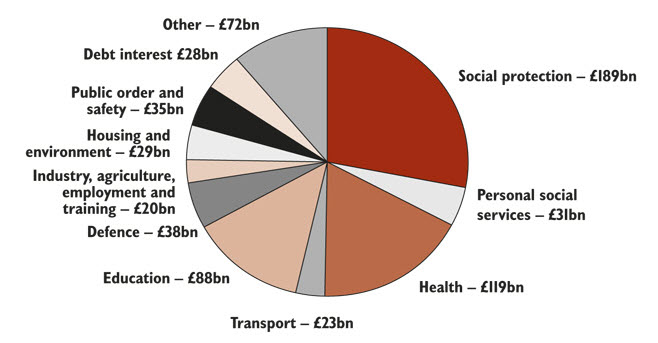

That though is not the end of it. Total government spending is £671 billion, split down like this:

So to cut spending by 10% £57 billion of extra cuts are required on top of sacking 500,000 people. These savings would need to be made up of:

So to cut spending by 10% £57 billion of extra cuts are required on top of sacking 500,000 people. These savings would need to be made up of:

1. Reduced benefits, which will result in reduced consumer spending, or

2. Reduced payments to private sector contractors to provide work to the government.

Either way there is reduced demand. £57 billion of reduced demand. Of which 65% approximately will go to labour. That’s £37 billion of labour cuts then. At £25,000 or so a head (approximately) that’s over 1.5 million more unemployed.

That, with the losses from the public sector adds more than 2 million to unemployment — making well over 4 million in all. Some consider this likely, I know.

But what is the effect on public spending? Maybe 92% of the cost of this cost in lost wages will fall on government either by benefits paid or lost revenue. That’s £34 billion. And that’s before we deal with the massive social and crime related costs of that level of unemployment and the collapse in our long term prospects.

So, to achieve total savings of maybe a net £4 billion in borrowing (£3 billion net from private sector cuts and about £1 billion net from public sector employee cuts) this policy would put 2 million people out of work.

Now I know all the problems of extrapolation in here, and I know that not everyone will get benefits in the way I have outlined above (but those that don’t will suffer even more extreme losses in income — compounding losses elsewhere) but frankly all analysis in this area is moving into the unknown, economically and statistically speaking. And losses to government may also be bigger than I suggest — after all out of the £57 billion of non-labour cost cuts required £20 billion will be lost profits and rents — and they could result in £6 billion of additional government tax losses, tipping the equation in the direction of any cuts in government spending creating actual cost for the government.

Which makes clear that the logic of cutting government spending now when we have no jobs for those we make unemployed makes no sense at all. It’s profoundly annoying to have to reinvent the whole Keynesian argument in this way — because that is exactly what I am doing — but needs must precisely because so many do not seem to understand this obvious fact.

Of course this situation will eventually change: private sector demand will pick up and employment with it. But right now there is no sign of that and to cut now would, I can confidently predict, produce something like the outcome I predict here. Put simply: cut spending and we’ll increase government debt. Perverse you might think — but true, and exactly what Keynes predicted.

What is more, the reverse is true. Increase spending now and the multiplier effect which compounds the impact of cuts in the above analysis goes into reverse: more jobs are created, revenue flows to government, benefit spending falls and government debt goes down with it.

The answer is simple: if we want to get out of the mess we’re in we spend. It’s the only way to reduce government debt at this stage in the economic cycle. It worked in the 30s. It will work now. Let’s do it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Actually you can also cut government debt by printing money (debt-free issue) and buying back debt. It’s been shown to work in France (1719, 1790), US (1861, 1963)… sort of. There are two challenges. Firstly, you have to avoid assassination, secondly, you have to regulate the quantity of money in circulation.

The way you regulate the quantity in circulation is by enabling the *real economy* to thrive, and ensuring the government collects the full unearned economic rents. The best way of doing this is to cut taxes on production while expanding taxes and charges on government issued privileges. So eliminate those income, corporation and value added taxes, and expand taxation of land values and coal/oil/gas production/import. Means-tested welfare should be abolished. *Universal* welfare, through a Citizens’ Income is how the government should dispose of the overall financial surplus (ie payout the government’s profit in per capita dividends).

The idea of maintaining, promoting or even expanding a bloated finance sector, a bloated real-estate sector, and a bloated bureaucratic sector, as most politicians aspire to, is ridiculous. Shrinking these should be a policy goal. A profitable government, like any profitable business should be *paying out dividends* to its owners, the citizens, not taxing them!

The economy is in a mess because of chronic abuse of the money issue privilege and of the government’s taxation privilege. The scale of the problem is vast, and the present circumstances show the urgent need for systemic reform. Advocating the continued use of jobs as the main means of taxing and distributing money to ordinary people is the crucial error TRUK is perpetuating in this blog article. Once you shed this “axiom”, simple, plausible reforms become obvious.

My question for Richard is “why is the government paying the banking system to create new government-backed money, when issuing money directly is a sovereign right?”. Not only would an issue of money directly by the sovereign be cheaper, it would help shrink the finance sector. No need for a windfall tax then!

I have found no economist, nor economic text with a credible reason for *any* government to be in debt in its own fiat money.

This of course also assumes that those being let off do not find work in the private sector.

By this reasoning, why not just have the Government hire all the unemployed? It seems that the Government is paying them already. Put them to work.

Adrian’s solution gets to the heart of the problem with banks: they get their main materials for free. There is no reason at all for giving them this amazing power. No wonder they can make excessive profits. It should be the prerogative of govts only to create money/credit. Banks should have to pay for the money they then sell on and govt would collect seignorage (a further source of revenue). It’s all so simple, as is collecting land rent for public benefit.