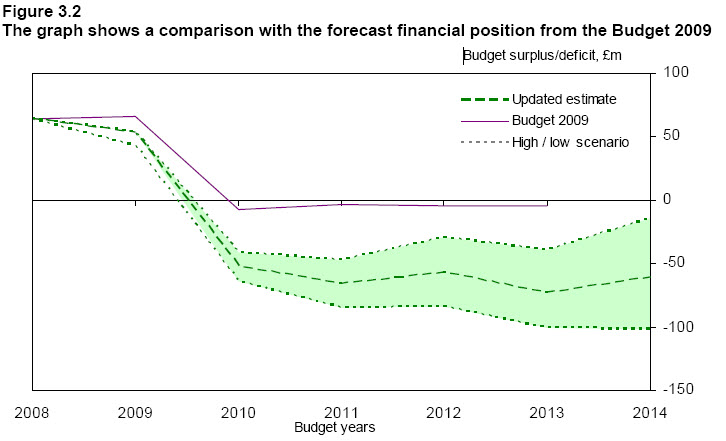

Sorry to brag — but I’ve just read the Jersey Business Plan for 2010. And this is where it now forecasts its finance will be over the next few years:

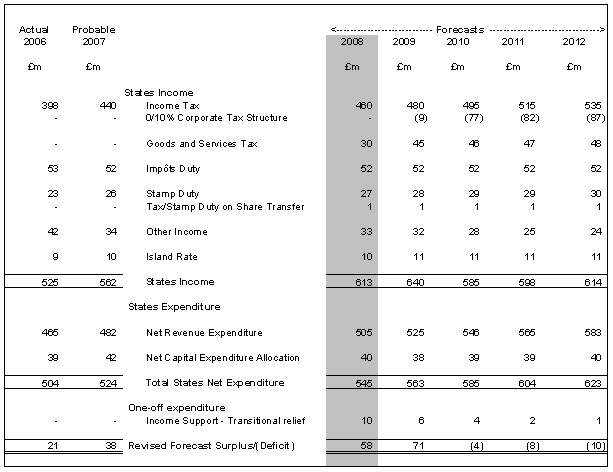

Back in 2007 when Jersey published its business plan for 2008 I said its predictions were ludicrous. They claimed the following at that time:

This is pretty much the red line noted above.

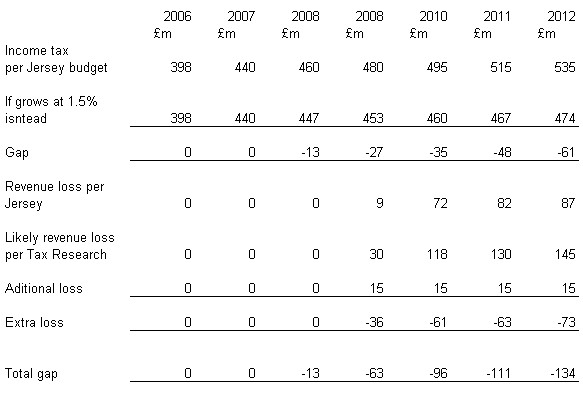

I said the following was much more likely (the second column headed 2008 should read 2009 — apologies):

So, OK, I forecast the decline would be faster than it has actually been. But I note I was a lot closer, a lot sooner, to the true likely long term picture than the States of Jersey were.

Respectfully, their forecasts never did make sense — and I remain quite convinced they will be at the bottom range of their current forecast.

Tow final thoughts: first they can find only £6 million of cuts in response to this — about 1% of spending. And apparently this includes such things as cutting baby milk in their maternity unit! I think this a significant indicator of what will happen in the UK — talk of 15% cuts is ludicrous — they just aren’t there to be had. Second, they are saying the obvious response is new taxes and charges. Sorry to brag again, but I told them that in face to face discussion with Senator Le Sueur — their first minister — way back in 2005.

They didn’t listen then. I don’t suppose they will now. But it might have paid them to do so. they’d be a lot better off if they had.

As it is, I confidently predict that my other prediction - that Jersey is heading to go bust - remains likely.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard,

Could you do a similar exercise on Britain’s public finances? You may as well…

Peter

If HMG followed my advice they’d be spending hard, tax revenues would rise and debt would fall

And my predictions would be as accurate as they have been for Jersey

Richard

The problem with your predictions, Richard, is that you make them and then they are only revisited when they are correct. So, for example, when the FTSE hit its lows earlier this year of 3,500, you said it was headed towards 2,900, which was in your view “fair value”. Instead it has risen to 4,500.

So you got that one dramatically wrong, predicting a 15-20% decline when a 30% rise was what actually transpired. Similarly, HMG won’t follow your advice and so we’ll never know whether you are right or not. But how would the gilts market hold up if spending did increase from the current level?

Paul

I remain confident in the prediction of a fall to 2900

4500 is madness and without any foundation at all

Richard

So Richard I assume you have heavily shorted the FTSE ? What’s your timeframe for it hitting 2900 ? Personally I don’t see it going that low but purely for the reason that with cash returns so low, I don’t see where else investors will put their money to earn a return. Pension fund money is almost obliged to be in equities and that will underpin the market. The economic news was so bad for the past 12 months that there is quite a widespread view that the bad news was already reflected by the equity markets, and that the government bank rescues have prevented the bad news from hitting equities as badly as first thought, hence the markets going up so much from their low.