David Howdle posted a comment on this blog in which he said:

Professor Murphy, thank you for your thoughts which I find most interesting. I share a lot of your blogs on pro Scottish independence Facebook group. I find that MMT resonates with many supporters. However, not with all by any means.

In response to sharing this blog someone has said “Check his blog. Murphy is peddling a new-ish economic fad called Modern Monetary Theory. This controversial and untested approach is evangelised by small clique of left-leaning economists and intellectuals mostly in the US who are looking for an unsuspecting guinea pig. Step forward Scotland”.

Are you able to point me to something robust to show that MMT is not as he labels it? That is “untested”. I'd be most grateful.

I take the comment seriously. Modern Monetary Theory does suffer from being called a theory. It also suffers on occasion from being a little too dogmatic (I include myself in that criticism, perhaps). And sometimes it just needs to be explained for what it is.

The truth is that modern monetary theory is as much a theory about money creation as sexual intercourse is a theory of how procreation in humans happens. In other words, it's a description of what happens and not an explanation of what might be.

Modern monetary theory says money can be created in three ways. First, it recognises that notes and coin can be printed or minted and they have value so long as the government promises to accept them as legal tender in payment of tax. That is what the 'promise to pay' printed on a note now means, and has done since gold ceased to underpin the pound. But modern monetary theory also recognises that note and coin represent a tiny proportion of what we use as money. It is less than 3% in the UK at present.

What modern monetary theory does, however, then recognise (I say recognise because it is a truth, not really open to debate) is that in the modern economy we have what is called 'fiat money'. Charles Adam has provided a good explanation of what fiat money is on the Progressive Pulse blog: I won't replicate it here. Suffice to say that fiat money is based solely on a promise to pay and nothing else. There is no gold or anything else to back up the value of this money. It is simply debt.

The question as to why we accept that this debt has value is where modern monetary theory breaks ground. Remarkably recently (2014, to be precise) the Bank of England finally recognised the reality of banking in a fiat money system. This is that, as it says:

Most of the money in the economy is created, not by printing presses at the central bank, but by banks when they provide loans.

This is, then the second way in which modern monetary theory says money is created. To add a little more detail, the Bank say:

Money is more than banknotes and coins. If you have a bank account, you can use what's in it to buy things, typically with a debit card. Because you can buy things with your bank account, we think of this as money even though it's not cash

Therefore, if you borrow £100 from the bank, and it credits your account with the amount, ‘new money' has been created. It didn't exist until it was credited to your account.

This also means as you pay off the loan, the electronic money your bank created is “deleted” — it no longer exists. You haven't got richer or poorer. You might have less money in your bank account but your debts have gone down too. So essentially, banks create money, not wealth.

Banks create around 80% of money in the economy as electronic deposits in this way.

We can debate the number and proportion, but that's not the point at issue. What is clear is that the Bank of England agree as, modern monetary theory suggests, that money is debt and can be destroyed when debt is repaid.

There is a third type of money according to the Bank of England. As they say:

This is called electronic central bank money, or reserves.

This, in the Bank's estimation, is about 17% of the money supply. They describe its use as:

[M]ost banks have accounts with us at the Bank of England, allowing them to transfer money back and forth.

The reserves are funds held in these accounts to ensure that banks can meet their obligations to each other.

Given that I have used Bank of England sources to this point (whilst noting that they agreed most of this under pressure from economists who in varying ways subscribe to ideas like modern monetary theory) it's hard to argue with the ideas being unconventional.

What MMT has done is go further. First it has pointed out that the third type of money that the BoE notes exist has increased dramatically in quantity since 2008: it now exceeds £350 billion (note 21, here). And at the same time it so happens that the BoE has been creating very large quantities of money on its own account. As they say of quantitative easing, which is how they have done this:

Quantitative easing involves us creating digital money. We then use it to buy things like government debt in the form of bonds. You may also hear it called ‘QE' or ‘asset purchases' — these are the same thing.

As they stress, this is not a cost to taxpayers: the money is made out of thin air. Technically it is done by the BoE lending the new money to a company that the Bank itself owns which both agrees to repay it whilst using it to buy bonds that the government itself has issued: the rule that money has to be debt has to be followed, even if in this case the Bank technically owes itself the money it creates and uses it to then buy the debt of the government, which itself owns the Bank.

This might seem convoluted. It is. But the net effect is that the Bank of England issues new money to fund government spending and does so by cancelling government debt that would otherwise have funded it. £435 billion of cash has been created in this way - which has cancelled about 25% of all UK government debt. This is proved by the Whole of Government Accounts, which show government debt net of QE. Page 84 of those accounts says:

Gilts held by public sector entities are eliminated on consolidation and removed from the balance above.

It so happens that this sum seems to be remarkably similar to the increase in reserve funds noted by the Bank of England: this is not a coincidence. The latest Whole of Government Accounts are likely to show these now exceed £400 billion as QE has now exceeded that sum.

But this means that the Bank of England really should be saying that the third type of money is government created, because it is. Modern monetary theory is explicit about that. MMT recognises that both government created and bank created money exist. Here I will borrow from another post by Charles Adam on Progressive Pulse. As he says:

Money is created either when the government spends, or when a bank makes a loan. We can think of government spending and bank loans as the beginning of two interconnected money circuits. The government and bank circuits form the duopoly of money creation.

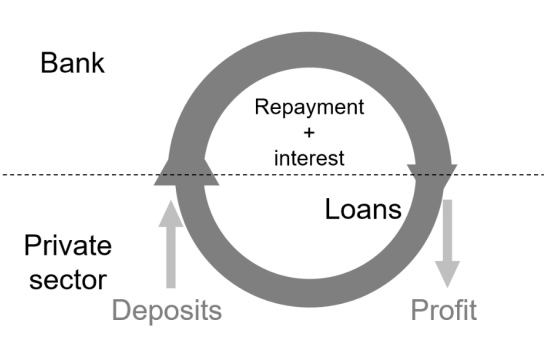

The Bank of England acknowledges the bank money circuit, which Charles draws as follows:

The bank lends money into existence. That creates private debt that is cancelled on repayment. I stress the point: repayment of loans does not provide new money for lending. It just cancels debt.

The money lent does not exist before it is lent. It is created by double-entry book-keeping and not by a printing press. Simply recording the debt in the books of the bank and customer creates the money because that is what is required to record the promise which gives fiat money its value. And repaying it reverse the entry and cancels the money. The promise has been fulfilled and is at an end.

And that's it, although interest does create another circuit, part of which leaks into bank profit. But the point is that there is public debt until the loan is repaid matched by public wealth - the deposits held at banks created by the people who receive the lent funds when they are spent by the borrower.

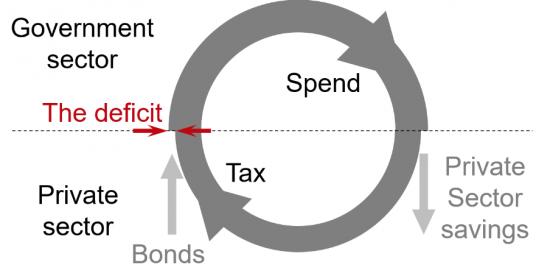

The government circuit is actually remarkably similar to this, and the logic is identical. This is the diagram:

Just as a bank does not wait for someone to deposit money to lend (and could not in the first instance, because until banks lent there would be no money to deposit) so governments don't wait to collect tax before they spend. Instead they tell their own bank (the Bank of England in the UK) to spend for them. And then when they have spent they have created the money that can be paid in tax. And they have also created the money that can be used to buy the bonds the government issues if tax receipts are less than the total spend.

Let me absolutely clear: what this says is that government spending actually creates the money to enable the apparent payment of tax that appears, in popular imagination, to fund that spend. It also creates the money to buy government bonds - which are private wealth.

In other words we don't have tax and spend. We have spend and tax.

And any shortfall in tax revenue compared to spend is either funded by the public lending the money the government has created back to it in the form of bonds, or is funded by government created money permanent as part of bank reserves - which is what QE does.

So MMT does not say anything except what happens to this point. As I noted earlier: this is not a theory of money creation, it is a description of what happens. And it has to be this way: if the government insists on being paid tax in its own currency (and it does) then it has to create that currency in the first place or tax could not be paid. The proverbial chicken and egg problem says spend has to proceed tax.

The bank money cycle does not change this. In principle, banks could create money debts for customers in any currency they and the customer likes and it would not matter. And of course, they do in fact do that for some customers. But in the UK (or any other country) the vast majority of loans will be created in the domestic currency. And that is precisely because the government does insist on having tax paid in its currency. When at least a third of all income is paid in some form of tax or other this means that receiving income in any other currency makes almost no sense for most people: they will not take the exchange risk of trading in one currency when they owe tax in another. This logic is core to modern monetary theory: it is tax that provides value to a state's money. nIt is the government's promise to accept its own currency in payment of tax that gives its money its worth.

And it is its promise to regulate banks in their issue of that currency by way of loans that ensures that the value is maintained.

And that regulation means that the bank money creation circuit is, in fact, a subsidiary one to the government money creation circuit: bank money would be worth very much less (or nothing at all) but for the fact that government regulates them and gives value through tax to the money that they create.

So money has value because the government endows it with that quality. And then, and only then, is the supposed left-wing quality added to this whole issue, because modern monetary theory then notes that when markets do not create full employment (and they usually do not, as Keynes first pointed out 80 years ago) then the government can create its own money to just to indirectly boost economic activity (which is exactly what QE was supposed to do, but was not very good at, to put it kindly), but to do it directly by investing itself.

And modern monetary theory says that this can be done until we reach full employment. Then, and only then, will we have inflation because of money creation (although we could have it for other reasons, such as a Brexit devaluation, but that's something quite different). Because we have not had effective full employment for a long time (bogus stats on self-employment levels do not indicate full employment really exists) we have also not had this type of inflation for a long time.

So, to answer the question, who has used modern monetary theory? And who believes in it?

First, proper Keynesian economists believe in it. We had it for thirty years post WW2.

And the Bank of England and the government have believed in a form of it, and done it through QE since 2009.

All they have not been willing to do is direct the funds to good use, instead letting the money boost house and share prices.

But that does not mean they have not done it.

There is then nothing faddish or outlandish, let alone cultish about this. The only twist most explicit modern monetary theorists add is that we could use this power of the government to create money out of thin air - which the Band of England says exists - for the good of everyone by trying to boost employment, investment, productivity and median wages by direct government activity or investment. If that's cultish, faddish, or left wing, then so be it, I say. Or rather, I actually say that those who say that this is cultish simply reveal their prejudice against those who might benefit from such policies.

Modern monetary theory describes the way money is created. And modern monetary theory says that if properly understood the power of government to create money could be used to create an economy focussed on benefit for the majority in any society where it can be used.

To return to the original question, does Scotland want that? As far as I can see it does. But it would not be an experiment as David Howdle's critics suggest. The sad fact is that we've done the experimenting with everything that does not work for the last decade or more. Now we need to do what can work, and that's modern monetary theory.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

You have been asked time and time again about the effect on the currency about giving control to the printing presses to a Government using democracy I.e the next election as the only check and balance to economic mismanagement. The currency markets will not wait that long. A fiat currency can’t default in nonimal terms, we know that but it can cause a massive currency loss to international investors / trading partners. It is an experiment and bacause the vast majority of practitioners don’t share your enthusiasm for PQE it would be a massive gamble destined to fail.

But as I point out – all governments with their own central bank and currency can do this now

And the UK does MMT

Now tell me why you think investing in infrastructure, productivity and R & D would be bad for the economy, please?

And how you propose to stop a government wanting to do it from doing so?

And as you also point out, this supposedly democratic control goes to pump up stock and housing prices rather than anything useful.

Of course, in a way this is responsive to public will — but only to the will of a certain public owning lots of assets. The rest of us who might be put to work doing something useful (a rarity!) or who might benefit from rational investments in basic services and infrastructure are left out.

Jason, perhaps unwittingly, you put your finger on it. The battle that Richard has called in a previous blog ‘ the battle for money ‘ should really be called ‘ the battle for democracy ‘ . In short are we , who supposedly live in a democracy, beholden to speculators ( that’s what the markets are ) because our governments are not prepared to stand up to them and if there’s a hit to take , well we just have to take it . It’ll be a flash in the pan anyway because the problem for speculators is we humans live on planet earth and not in outer space so they are always looking for safe havens for themselves and their money. Notwithstanding all the depredations in our civil society over recent decades this country, compared to many others , including the United States, is a safe and orderly place . So frankly nix the ‘ markets ‘ let our politicians stand up straight with their shoulders back and say this is what we are going to do for all the people of the United Kingdom. We had such a man for a short time . His name was Clement Attlee . He knew what needed to be done and did it. My parents , my sisters and I owe that man a debt of gratitude that we can never repay for creating the welfare state.

I come across precisely the same response! For those unfamiliar with MMT, but familiar with the conventional “wisdom” (which is in possession of policy and considered normal (heaven forfend!)), the problem is perhaps the “T” (Theory). It is the title of Wray’s book, which is my first advice tfor people to o read. Theory: gosh, that means “untested”! In Scotland the lace-curtains are already shivering. Need I go on?

It really should be the MMS – modern monetary system

I have no problem with that. Describe what the bankers are doing as the Modern Monetary System, and the heterodox economists’ formal description of it as the Theory. When we talk about facts on the ground, call them the System. I’ve started doing this, in the few comments I write.

I will try to do so

Well somebody needs to tell that to Head Office! The one thing we should not need to learn from the ‘status quo’ is that they are good at using the slick, glib line that has no substance, no credibility, is quite wrong, probably contradictory but is presented as unchallengeable (saturate the media with it, and ignore the rebuttal).

We would not wish to sink so low (I am glad to say); but we do need to find a crisper vocabulary.

It’s a funny argument to make, isn’t it, that something with a proven empirical track record like MMT is ‘untested’, whilst the vast panoply of neoclassical intellectual furniture, from pareto optimalities through the Lifetime Savings Hypothesis, all the way to ‘Light Touch’ Brown’s Endogenous Growth Theory were sucked up eagerly by the neoliberal establishment irrespective of a complete lack of empirical evidence, only because they seemed to provide the merest thread of Emperor’s Clothing to laissez-faire capitalism…

As Steve Keen was far too polite to point out in Debunking Economics, classical-neoclassical theorization of the capitalist economy has only ever been post-hoc, reverse-engineering of the status quo, whereby the elite at the top of the pyramid try and persuade the masses that the pyramid is ordained by God and therefore immutable, rather than an increasing and chaotic set of plates spinning on long poles, kept rotating by a small class of super-managers scurrying around desperately trying to hide their piles offshore before the whole lot fall.

Furthermore, what 2008 established (“He who has eyes to see, let him see”) is that power relationship between central banks and the commercial banking sector/financial services sector has been reversed and the tail is now wagging the dog. As usual however our corporate-friendly MSM have tried hard to persuade us that the FS sector has all been cleaned up, FSI now all had reserves to cover potential losses, move along there, move along, nothing to see..

Whereas in fact the reverse is true, and since the Strategically Important Financial Insitutions (SIFIs) were ‘discovered’ by central banks in the immediate aftermath of the global economic crisis, over the ensuing years globally the financial services sector has become even more sectorally concentrated (there’s a great paper on this by Vitali et alfrom 2011 I can send anyone who’s interested). Your friendly local central bank *cannot* let SIFIs fail and irrespective of a complete refusal to regulate the ever-more exotic chimaera of the modern financial world (more ETFs, vicar?) SIFIs have to be backstopped 360 degrees as they create more and more forms of money…up to the point where too big to fail becomes too big to save.

Thanks

Hope we can take this up at the Green Party monetary policy debate between MMT and Reform.

And that this is not too rude.

In all of the above, I can see no economic justification for council tax. Is there any?

No

It should be LVT

And remember to read my theory on tax alongside this

LVT is still a political ideological solution which benefits some and penalises others – maybe people with a big garden even, for a house they were brought up in and they can’t sell anyway, not easily.

Basing it on income tax could be better but that too is a political ideological …

The “garden tax” was the typical way the Neoliberal media was able to ‘spin’ AGR (annual ground rent – your LVT). AGR is Ricardian; it follows capital and is easily implemented in a non-regressive way. You are being seduced by Neoliberalist ‘spin’ if you think otherwise.

Even the Conservative Government is trying to introduce a form of AGR, by stealth through the back door with its ‘transport property charge’, in specified zones around new Crossrail2 stations. This is because the economic benefit of public investment in Crossrail is mostly hoovered up by landowners who have made zero investment in it; indeed may have blighted the area for decades with derelict sites. Here is a link to City AM’s coverage (11th May). Even this is ‘spun’ as a tax on homeowners, but it is a tax principally on big landowners, more typically non-domestic development (the term now used ‘land value capture’ offers the clue):

http://www.cityam.com/285621/homeowners-near-crossrail-2-stations-could-hit-new-tax

yesindyref2 says:

“LVT is still a political ideological solution which benefits some and penalises….”

Penalises ??? No it has nothing to do with penalties it has to do with paying a fair share for the exclusive benefit of assets which are thus prohibited to others.

The garden Tax nonsense should have had the back ripped out of it, but the Labour Party proposal was slipped into the discourse with no opportunity to challenge the hysterical criticism in an election campaign period.

Realistically the issue you raise about people already in possession of expensive property (in prime locations with or without a garden) would have to be (in fairness) ameliorated by incremental change from Council Tax to LVT over a number of years so that homeowners could reposition themselves and their affairs accordingly. (Not something the Thatcher government was much concerned about when the boot was on the other foot)

In the present economic conditions a house that can not be sold easily is probably carrying too optimistic a sale price.

Local income tax is an appalling idea as a scheme to replace property tax. Don’t even think about it.

Andy Crow “a house that can not be sold easily is probably carrying too optimistic a sale price”

You miss the point completely. LVT is about houses – properties – that the people DON’T want to sell, but would be forced to if the council tax tripled or quadrupled because of LVT. That would be grossly unfair, as unfair as the “bedroom tax”. Akin to the Clearances in a way “for the greater good, baaaaaaaa”.

This is not about 40,000 acre estates, or second homes or buy to let, it’s about a house with a big garden – a home – which “the state” decides people should pay for again, with them or their ancestors already having paid for it. That also has nothing to do with the services the council is providing.

LVT and council tax also have little or nothing to do with MMT, and it’s a shame that distraction was brought in to the thread.

Tell me why that would be unfair?

Is it fair that society has to build millions of new houses because many existing ones are largely empty?

should we subsidise that emptiness?

Richard, do you remember the Tory far right “bedroom tax” for people on benefits, which the SNP Government is mitigating? Where if a couple have a 4 bedroom house (with or without a large garden) they get penalised, and basically told to sell their house if they want to get benefits and get a one bedroom house, or even worse, flat. maybe not even ground floor?

Where their children who have fled the nest, will have nowhere to stay when they come home to visit their parents, or even care for them? A policy most of us were disgusted at as a heartless “far right” Tory policy?

Now, can you tell me what the difference is between that same couple being forced out of the home they brought their kids up in, many happy hours and memories around the house and garden, because they can’t afford to pay the LVT, a policy of the far left?

So basically we have a derived equation, an identity: far Right = far Left. Both totally inhuman for the sake of their “ideology”.

Well, far out, man, real far out.

I asked acreasonable question

And I have always offered roll up until sale as a solution….

Richard, here are your questions:

“Tell me why that would be unfair?”

I think I answered that one.

“Is it fair that society has to build millions of new houses because many existing ones are largely empty?”

That is a non-sequitur, and a very vague presumption, with a totally unproven connection. But does it include, for instance, that a couple with 4 bedrooms should be forced to have complete strangers staying in their house to make use of the other 3 bedrooms? Does it include the policy that every couple should be allowed as many children as they want, rather than a policy of one child per couple, or even 1 for every 2 couples, decided by lottery? Or perhaps that people with big houses should be forced to adopt children taken away from other couple because they don’t have a house to live in? These are all policies Richard, quite unfair ones in some cases, frankly, but policies all the same.

“should we subsidise that emptiness?”

What susbsidy, and what emptiness? Who is subsidising a house with a big garden, standing in the middle of nowhere minding its own business? And why stick at taking away houses with more than 1 bedroom from a couple? Why not have 4 couples per bedroom – by law? Or make every large house open themselves up as a self-catering hostel?

This, by the way is reducing the argument to “absurdity”.

Anyway, even the wording of your questions is of an ideological nature, a party political nature, and proves my initial statement: “LVT is still a political ideological solution”.

Of more relevance to MMT is this – why should councils have to raise money directly from their citizens by any means of “taxation”, whether it’s council tax, LVT, local income tax, poll tax, existence tax, air tax, road tolls, direct billing for services, pay to see a doctor, go to school, etc etc, when central government can just print money for public spending, and use taxation more generally as an equaliser, or for economy stabilisation?

Personally I want Scotland to be Independent so that our government can make these decisions, and all of them, for us, and we vote for whom we think best represents our own “ideological” values the best on balance.

And since your last para will hold true what are you worried about?

Why seek to suppress debate?

Are you worried you’d lose the vote? If so, what sort of democracy do you really want?

yesindyref2 says:

“You miss the point completely. LVT is about houses ”

Actually it isn’t.

LVT is about land tax and that’s quite a different thing.

In some, perhaps many cases the built property on a piece of land is of very little consequence relative to the value of the land it’s standing on.

You have been gulled by the Garden Tax narrative I think. Certainly sounds like it. This really isn’t what the LVT discussion needs to be about.

And to say that it is a distraction in this thread may be true, but that doesn’t detract in any way from the important role LVT could play as a n element of a functional economy.

The current system of council tax is long overdue for reform. Michael Heseletine lashed up a half baked stop gap and we’ve still got it.

Yersindyref2 says:

“Richard, here are your questions:

“Tell me why that would be unfair?” ”

“I think I answered that one.”

I don’t you did, yesidyref2. I think you made a very poor case which shoots itself in the foot and and then choose not to thin it through.

In your reply to me you say, I’m missing the point, when in reality I think It is you who are missing the point. Let me explain.

You say, “This is not about 40,000 acre estates, or second homes or buy to let, it’s about a house with a big garden — a home — which “the state” decides people should pay for again, with them or their ancestors already having paid for it. That also has nothing to do with the services the council is providing.”

You’ve just become an apologist for the status quo, because it very much IS about 40,000 acre estates and land banks held (much of it offshore) by rentiers and property speculators. By putting all the emphasis on the ‘little old lady’ who is still rattling round a four bedroom family house which is deteriorating around her and which she thinks of as her inheritance to her children you are buying into the neoliberal fantasy.

You have become the small guy who supports the bully in the playground because you think you are part of his gang. You aren’t.

While the lord knows how many ‘little old ladies’ are rattling round unsuitable family sized property for reasons of learned sentiment, a similar number of families are living in sub optimal hosing conditions.

I find myself staggered by the extent to which people have bought this Thatcherite narrative thinking its being told to their advantage not to their cost. Just because you’ve been fed this BS for forty years doesn’t make it true.

It’s completely skewed.

You have bought the right to hold property as a sacred cow – In perpetuity you say, or imply. If title to exclusive access to property is a disbenefit to the rest of society. In a well ordered society you should be prepared to pay something for that.

Current property-based taxation ‘nudges’ in all the wrong directions. Did the imposition of the Poll Tax in Scotland and then beyond into rUK teach you nothing ?

Yesindyref2 also says:

“Personally I want Scotland to be Independent so that our government can make these decisions, and all of them, for us, and we vote for whom we think best represents our own “ideological” values the best on balance.”

I guess I’m pleased to see someone who is so ardently in favour of neoliberal right wing policies is not blind to the idea that Scotland should be independent.

The line you are spinning is one I associate mostly with ardent would-be ‘No’ voters. The ‘YES’ campaign is clearly garnering support across the board.

Oh, and in answer directly to Andy Crow, I’m neither left wing nor right wing nor any wing. If I wanted wings I’d become a bird.

I see my longer post hasn’t appeared, can’t be done with blogs that don’t post all your postings, while freely posting those that attack you or misrepresent you – that’s the same as my little venture on Kevin Hague’s blog a long time agao where I pointed out how he’d contradicted himself while trying to put me in my place. BC does the same.

But I just noticed this from Andy Crow, SELECTIVELY quoting this from me, a common unionist trait, didn’t expect to see it here:

“yesindyref2 says:

“You miss the point completely. LVT is about houses ” …”

No, what I did say was this:

“LVT is about houses — properties — that the people DON’T want to sell”

because the implication in an earlier posting was that people were putting their houses up for sale at too high a price. To make it clear, it’s people who don’t want to sell their houses, not people who do want to sell their houses, hope that’s clear now.

No of course it’s not just about houses, for your information LVT stands for Land Value Tax, not House Value Tax. It’s an “L” not an “H” in LVT.

Anyways I’m off, MMT is interesting, GERS is interesting, party politics ain’t.

I have been doing a public meeting

But you are so egostitsical you think I am here to serve you

Go well

But don’t bother coming here again

One of the simplest ways to understand MMT is to recognise that human beings in variably always want to be able to have a store of money that is divorced from the risks of the domestic real economy. Obviously stocks and shares and house prices are examples of those that aren’t, they’re “informationally sensitive” to use an economist’s term. Technically MMTer’s call such safe money “net financial assets” and these can be found in various forms with decreasing level of risk examples being from current account money, to saving account money to government gilts money. We might even consider foreign public and private sector investments on the basis that they not likely to be affected by any turbulence taking place in our own economy. Having a “safe” money store means we have money available for example to set up a new business, to deal with any unforeseen eventuality and to augment our pensions on retirement.

The question therefore is where at a country’s macro economy level can this money come from to provide a safe store or “net financial asset” for all citizens requiring it. Clearing or commercial banks can’t provide it from their creation of money from nothing since all loans must be repaid with interest and as soon as a bank loan is spent into the economy it is progressively and rapidly destroyed by taxation (VAT at 20% for example). This leaves only two other possible sources a really adequate trading surplus with other countries or in the case of a foreign trading deficit government creation of money from nothing. Of course in an age of “barge economics” where mobile capital can fairly easily set up production where labour costs in particular are low and governments are willing to unfairly manipulate exchange rates and provide subsidies to attract that capital with its accompanying expertise achieving foreign trade surpluses are not easy to achieve.

Here is an MMT progenitor, Randall Wray, explaining the creation of net financial wealth in balance sheet terms and effectively if government is to be the main provider of “net financial assets” it cannot balance its books as Neoliberal ideology insists:-

“One’s financial asset is another’s financial liability. It is a fundamental principle of accounting that for every financial asset there is an equal and offsetting financial liability. The checking deposit is a household’s financial asset, offset by the bank’s liability (or IOU). A government or corporate bond is a household asset, but represents a liability of the issuer (either the government or the corporation). The household has some liabilities, too, including student loans, a home mortgage, or a car loan. These are held as assets by the creditor, which could be a bank or any of a number of types of financial institutions including pension funds, hedge funds, or insurance companies. A household’s net financial wealth is equal to the sum of all its financial assets (equal to its financial wealth) less the sum of its financial liabilities (all of the money-denominated IOUs it issued). If that is positive, it has positive net financial wealth.”

http://neweconomicperspectives.org/2011/06/mmp-blog-2-basics-of-macro-accounting.html

Of course for those familiar with it these arguments put forward are part of Sectoral Balances Accounting.

It’s important to decouple MMT from how value-added is created. MMT says nothing at all about how additional value is generated. There are many who claim that any and all government spending adds value, which is a remarkable claim given that government can spend to reduce the size as well as increase the size of the economy. Nevertheless the claim that government spending always and everywhere adds value is not part of MMT, which is really a description of reality, and those who claim it does have misunderstood it.

Donny Littlechef (My cursory investigation indicates there is no Little Chef at Doncaster, and the nearest is probably Pontefract…so I assume you are for some reason adopting an alias…I expect you have your reasons) says:

“It’s important to decouple MMT from how value-added is created.”

I think that is self evident from experience of the past ten years. The MMT(System) undoubtedly allowed the banking crisis to be resolved after a fashion. Vast amounts of ‘cash’ were pumped into the banking sector to prevent total collapse (I have my own theory as to why Lehman brothers was allowed to sink without trace first, which we can safely ignore here)

What we can see beyond doubt is that money creation by government/central banks certainly bears no direct relation to value added at all. The financial industry for the most part provides no value added. (It handles other peoples money with sticky fingers, would be one description) The oft quoted fear of inflation resulting from money printing proves to be well justified. Inflation of property prices and share prices in particular have demonstrated a remarkable propensity towards unsustainable bubble territory, from which they will inevitably collapse. (Assuming there is no radical change in current government monetary and fiscal policy—and I see little likelihood of that)

“MMT says nothing at all about how additional value is generated. ”

Quite so. It doesn’t actually purport to do so. It merely explains the behaviour of fiat currency. What a government chooses to do with that understanding is a purely political/social engineering question. The current regime in Westminster has used it to create a huge disparity in income and wealth to the detriment of well-over half the population of the UK. Some would suggest only the wealthiest ten percent benefit, but in truth there must be benefit lower down the economic scale in order to have maintained support to keep the government in power, albeit only-just in 2017. The shoring-up of house prices is a significant element of this.

“There are many who claim that any and all government spending adds value……”

They are wrong. It does depend entirely what government spending is directed towards. shoving it all into the market casino can be seen to have been unbelievably stupid. (If the intention had been to stimulate the real economy as was claimed.)

“Nevertheless the claim that government spending always and everywhere adds value is not part of MMT, which is really a description of reality, and those who claim it does have misunderstood it.”

Absolutely right. Vociferous critics mostly ‘misunderstand’ it (actually, misrepresent it) wilfully in my estimation in order that they can continue to screw government spending for their own benefit.

The majority of the population is either too stupid or too busy getting on with the day job of everyday life to even try to understand ‘economic’ reality.

Donny did as usual say MMT said something that it does not

MMT could be left or right wing

It just explains what is

What happened to MMS – already!

A theory is a hypothesis that is proven to fit the facts until new evidence appears which does not fit the theory. I could argue that there is nothing wrong in sticking with MMT, since no counter-evidence has been produced. Actually, enunciating MMT is like stating the earth is an oblate spheroid, so there can be no new evidence.

However, to quash the nonsense that it is “only a theory”, perhaps MMS is better.

If we were not starting from here, FMS (F being Fiat) might be even better since, as has been pointed out, the system is not modern.

Neoliberals (and others?) are using a “mere hypothesis”. Their hypothesis is easily demolished by evidence and logic, as Richard and many others have done here and elsewhere, so perhaps we could call it the Neoliberal Monetary Hypothesis (NMH).

Left wing hypothesis: The NMH can only be right wing!

QED 😉

I rather like the FMS

Or even MS…

And we know the NMH was wrong….

Note to self: remember this

In my experience talking to economists about MMT ideas I find that the main difference in thinking is the following:

Those who agree with MMT tend to think that additionally created fiat money will only be inflationary when the economy is at capacity, whereas those who disagree think new money will always be inflationary even when the economy is below capacity.

QE has thoroughly tested this proposition. In the wake of QE only one viewpoint can be seen as credible.

Angus Groom says:

Those who agree with MMT tend to think that additionally created fiat money will only be inflationary when the economy is at capacity, whereas those who disagree think new money will always be inflationary even when the economy is below capacity.

QE has thoroughly tested this proposition. In the wake of QE only one viewpoint can be seen as credible.

Well not so really. Because QE has indeed produced massive inflation in asset markets. That inflation has not shown in the bottom end of the economy just tells you where the money was available.

Had there been appropriate mechanisms to control and direct the QE bounty in a productive manner it might have been a much more instructive experiment.

But remember money printing for full employment might be much less than QE for asset inflation

“But remember money printing for full employment might be much less than QE for asset inflation”

Depending where one is starting from yes.

I agree that going from where we are now (or indeed where we were ten years ago, which would have been a better place to start) relatively small amounts of well directed government spending would have created a growing productive economy. (once the immediate peril of banking collapse and associated collateral damage had been contained)

Some fiscal adjustments would probably still have been required to stem the asset inflation, …….unless we had been deliberately pursuing the old strategy of inflating away debt, in which cast the rest of the economy would have to have been pumped up to keep pace with asset prices. (It would be easy for that sort of strategy to get completely out of hand. I think we’ve been there before have we not. It doesn’t really get us anywhere useful)

Andy –

“Because QE has indeed produced massive inflation in asset markets.”

Do you think that QE really produced the asset inflation? I always preferred the view that hyperactive property markets and really questionable mortgage sales techniques produced the asset inflation and that QE was forced to underwrite that bubble rather than create debt hell for millions should property prices revert to a sane level.

It’s a real question, cos I’m happy to learn (as ever).

I think it was QE…..

Geearkay says:

“Do you think that QE really produced the asset inflation? ”

oOoooH dear….

Geearkay, I thought this was a statement of the ‘bleedin’obvious. I wasn’t expecting to have to justify it as if it was some radical novel insight.\

It doesn’t matter a toss what sort of ‘hyperactive property markets and really questionable mortgage sales techniques’ are rattling around the markets if nobody has any money. (OK or a a decent credit balance – same thing in effect: spending power)

Marks and Sparks and House of Fraser have just announced significant store closures. Why ? Because their would-be customers, who are legion, have nothing to spend.

The demand is constant; the ability to purchase is at the whim of the market, OR the government if it would only accept that it has responsibilities and control of what is going on.

Jeez! and they wonder why Scotland wants out of this ?

I always preferred the view that produced the asset inflation and that QE was forced to underwrite that bubble rather than create debt hell for millions should property prices revert to a sane level.

It’s a real question, cos I’m happy to learn (as ever).

David might want to post this on his Facebook page. “Taxes for spending are obsolete”. Published in 1946..!

http://home.hiwaay.net/~becraft/RUMLTAXES.html

How interesting. Thank you.

Staggering that something that has been known for so long is still not known. It must be that governments of all flavours don’t want us to know this. Why don’t they want us to know it, would it supercharge democracy to the point where governments do what the people want them to do and they would lose control? The political party that wakes up to this fact could truly transform the landscape. Or am I only dreaming?

I hope you are not

Rod White says:

” Or am I only dreaming?”

You gotta have a dream.

If you don’t have a dream,

How you gonna have a dream come true ? 🙂

[…] Cross-posted from Tax Research UK […]

Here’s a thing I was thinking of, quite tangential. Many years ago I worked on a project to make different departments “cost centres” in a large company. Now the thing is outsourcing became popular, contracting off parts of a business so as to focus on the prime business, and perhaps to get the befit of scale (though I doubt it happens generally). But clearly each part hived off had to be profitable for them, for the companies contracting to perform.

So when I had to change direction because of RSI, I costed my business so as to allow for scaling up (sadly never happened), but instead of looking at each part – like the post room – as a “cost centre”, I regarded it as a “profit centre”. Done informally, I negotiate with myself, basically.

No idea if this is done generally, I’m out of touch with that sort of thing from a position of internal detail. But the advantages are obvious, or if not I can charge the perfectly reasonable fee of £1,500 per hour for a minimum of 4 hours plus travelling time and expenses to explain it 🙂

Professor Murphy, many thanks for that very full description. I’ll share it asap.

I had some coffee by the river and wrote you a blog

What Sunday is for

You’re a good man!

I think two things really need to be made clear in support of Richard’s excellent exposition.

The first is that in response to David Howdles original question re: “who are looking for an unsuspecting guinea pig. Step forward Scotland”. It should be noted all the above only applies in a situation where a country has its own sovereign currency. At the moment Scotland does not have its own currency and central bank. As long as it continues to use the pound sterling it cannot create its own money and none of the features of MMT apply or can be made to apply.

Second re the very dubious threat of the international money markets it needs to be noted that in 2007 forex transactions amounted to 3.3 trillion dollars a day while one days exports and imports of all goods in the world amounted to about 2% of that figure – which means 98% of forex was pure speculation and the situation can only be worse now. (I am loosely quoting Bill Mitchell.) Given then that the level of gambling that already exists in forex is so huge a threat to us all why would anyone think a bit of PQE in the UK would be a bigger worry? Jason Says says PQE would create a ‘massive loss’ to external investors. Well not really – massive in terms of forex it isn’t.

I should make clear the 3.3 trillion includes services too.

What’s the difference between MMT and the Positive Money approach?

Please search positive money on here

I have written extensively on why they are wrong recently

Thank you Richard – that is the clearest and most concise explanation I’ve read to date.

Thank you

Seconded, Martina. This should be in the Wiki.

I will do….

Trying to raise awareness of MMT’s importance/ relevance to Scottish independence is a tough job. Anyone who understands and is willing to help spread the word, educate and inform, and is on Facebook, there is a group just for this purpose. Please join!: https://www.facebook.com/groups/1466864300089196/?ref=group_header.

I have joined

My biggest concern if Scotland ever became independent is once the correct structure is in place they will hire the wrong people to manage that structure.

For me what is really important is that you need the right people in place that know how to run a central bank in the correct manner. That means not hiring from the usual pool of suspects.

It is imperative that the government of the day get MMT’rs to run the central bank and the treasury otherwise the whole thing will be doomed to fail from the start. Which means they have to hire from the Universities that produce MMT students.

It is very easy to imagine a situation where these institutions get hijacked politically as we’ve seen all over the world by the likes of a Carney or a Draghi. That will not support the nation but vested interests that will be ideologically driven.

This could happen at the start during the interview process or whenever a poltical party gains power and changes the people at the controls.

Something has to be put in place to stop these institutions from being hijacked. Which could be very difficult since the right way to do it is bring the Central bank back under control as a consolidated sector with the Treasury. Which makes the government of the day more accountable and responsible at the ballot box.

How many times have we seen neoliberals hijack these structures for their own needs. Yes, they could be voted out the next time around but the damge they can do can last for decades. It’s a huge problem nearly every country experiences.

I’m nor sure what the answer is for this in the democratic society we have today. When those who control the narrative and the media normally win.

But how can an MMT cognisant structure be worse than what we have – which is MMT by subterfuge for the few?

I stress though – I think MMT is always run from a Treasury – and never from a central bank which just has a technical role in an MMT system

“My biggest concern… is once the correct structure is in place they will hire the wrong people to manage that structure.” This is a very well made point; perhaps especially in the case of senior, politically made – or influenced – appointments to non-political institutions (of whatever kind). It is an issue insufficiently examined, and (on the basis of actual institutional performance) I hypothesise that errors are made.

Even where sound policies are identified, the capacity to make sound judgements about key people who are ‘drivers of change’ are of a quite different order. I do not particularly wish to single out Scotland when I say that the selection of key posts in politically influenced appointments throughout Britain (I surmise) do not provide much confidence in the wisdom of the choices often made. I cannot say more than “surmise”, because how is the public supposed to measure this; save through catastrophic institutional failure, then requiring some independent review (and when described in these terms we can all make sufficiently sobering lists; but far from “we have learned the lesson” being something we can rely on, we soon enough learn – we simply can’t).

Let me put this in simple terms; the cream does not rise to the top naturally; it simply doesn’t. What we have reflects the judgement of politicians: and the judgement of politicians is, on the basis of past experience, I suspect at best scarcely inspiring, and often worse.

So if Scotland had MMT’rs in charge of both the Treasury and new Scottish central bank they know that.

1) The central bank is constitutionally barred from dealing in the foreign exchange markets, and margin trading is banned.

2) Banks can only lend (i.e. create money) for the capital improvement of the country. Since traders then know that there will be no ‘patsy’ in the market and no leverage available to them, they have no effective mechanism to attack anything. They would run out of liquidity. To sell the new currency you have to have them.

3) No need of foreign currency in the central bank. The foreign currency, if any, is held by the government to allow it to make necessary purchases in an emergency. Most importantly it is never used to settle foreign financial liabilities. Any entity that cannot service foreign financial liabilities goes bankrupt and the foreign debts are wiped out by the bankruptcy process. Creditors then get paid in the new currency achieved by selling the assets. The reason for that is straightforward — when you bankrupt a foreign loan you destroy their money.

4) Banks would always be under threat of being placed in administration and their shareholders wiped out if they break the rules regarding the currency. That’s how you keep them in line. They’ll be no socialising the losses in an independent Scotland

5) You tell banks what they are allowed to do, and NOT what they are not allowed to do. When you tell banks what they are not allowed to do, they will always find something you forgot.

6) Bank lending is to be limited to public purpose, which means you cannot use financial assets as collateral. You can’t borrow against financial assets from the member banks. If somebody in the private sector wants to make a loan, that’s okay. But not the banks with insured deposits.

7) And lending is done by credit analysis and not market prices of the assets underneath. You must lend by credit analysis to serve public purpose.

8) You don’t need foreign money. Foreign firms need the custom of the Scottish people because they have nowhere else to sell their stuff. To do that they need to either take the output of Scotland, or hold the new currency. If they don’t then they won’t make the stuff, which creates space for Scotland to make it for itself.

9) There is no need to issue public debt. MMT’rs know Overt money financing is the way to go.

http://bilbo.economicoutlook.net/blog/?p=34071

10) Introduce a job guarentee.

11) You introduce capital controls on FPI and encourage FDI. Foreign Direct Investment (FDI) where a foreign investor provides funds to a productive enterprise in another nation, from Foreign Portfolio Investment (FPI), which represents foreign investments in a nation’s financial assets which bear no interest in an underlying productive activity in the real sector of the economy.

Interesting – you are pushing boundaries and I like that

I still think banks have more of a role than you may be giving them, but I certainly agree more direction has to be given

Overt money financing is the way to go but you could easily just use the Ways and means account Instead of issuing public debt.

The main contention made to support Gilts is that they manage the risk profile of private pension firms. And it is true that they do. In fact Indexed-Linked Gilts were introduced in 1981 by the Thatcher government specifically to do just that. The rationale behind them is a triumph of monetarism.

Of course what that tells you straightaway is that the private pension industry is incapable of managing the risk profile of pensions on its own within the private sector. It requires permanent government assistance to do so. The question then is what is the purpose of the private pension industry if it can’t deliver the outcome that is required?

A simple pension savings plan at National Savings, along the lines of the Guaranteed Income Bonds and Indexed Linked Savings Certificates, would solve the problem permanently, would be limited to individuals, and would allow them to manage their risk profile as they approach retirement (they would sell out of risky assets and transfer the money to National Savings).

Since it would be only available to individuals and there is no need to pay middlemen, it is clearly far more efficient than the current Gilt issuing system.

The Ways and Means Account is just an infinite overdraft with the Central Bank, and it grows over time to balance the net-savings of the private sector just as the Gilt stock does now.

HM Treasury simply doesn’t issue any Gilts any more. Any funding of private pensions in payment should be done by offering annuities at National Savings, which would also have the neat side effect of ‘confiscating’ net savings and making the deficit go down.

It’s irrelevant what interest BoE charges on the ‘Ways and Means’ account since any profit the BoE makes from it goes back to HM treasury anyway. So it can 50% if that gives the necessary level of satisfaction to mainstream economists and the gold standard fiscal conservatives.

What you have is a standard intra-group loan account between a principal entity (HM Treasury) and its wholly-owned subsidiary. Normally those sort of loans are interest free for the fairly obvious reason that interest charging is utterly pointless, and they are perpetual for the same reason. Rolling over is totally pointless.

Any term money can then be issued to the commercial banks directly by the Bank of England – up to three month Sterling bills.

If you are a member of a pension scheme then the savings of the current generation, plus the interest on Gilts and any income from the other assets owed pay the pensions of the current generation of pensioners. They are all, in effect, private taxation schemes that circulate money around the system.

You’ll note that when there was a threat of people failing to save in pensions, the government introduced compulsory retirement saving – which is of course a privatised hypothecated tax.

So in essence rather than the assets of a pension scheme being used to purchase Gilts, the assets would be used to purchase an annuity from the government dedicated to an individual. The result is that rather than the private pension receiving Gilt income from the state, to then pass onto the pensioner, the state would cut out the middleman (and their cut) and pay the pensioner directly as an addition to the state pension.

There’s a whole private pension industry out there literally doing absolutely nothing of any real value. They can’t provide a guaranteed income in retirement without state backing in the form of Gilts. So what is exactly the point of having them?

Get rid of the middlemen that take a hunge chunk of our pensions in the form of fees just for putting our money into state backed gilts. Get them do something useful in society instead.

Fascinating idea

So as you can see economic students who are leaving MMT universities know how to run a modern monetary economy.

It won’t be an experiment they know exactly what to do. Why ? Because that’s how the monetary system operates now. The reason things are so bad now that those who are using it think they are driving a car when they are actually flying an aircraft.

As for adding Vaule people should read economist Mariana Mazzucato’s work.

The value of Everything

Debunking private and public sector myths.

Mariana has worked with MMT’rs for years and is working with Stephanie Kelton as we speak. If you asked Mariana would MMT’rs be able to put her ideas to work for the best outcomes.

Her response would be – Absoloutely ! MMT’s are the only ones who know how it works.

So it worth repeating MMT would only be an experiment in an independent Scotland if you put people in charge who didn’t know what they were doing. Exactly, like we have now.

Lucky for Scotland there’s plenty of MMT’rs who do with more economic students leaving MMT universities every year.

Remember the Crash? Virtually only MMS (I am trying, Richard – against the odds!) economists forecast the Crash. Only you wouldn’t know it now. The Neoliberals have been busy re-writing their history. Their 20/20 hindsight is now 20/20 foresight. It is what they do. It will be politicians who will still hire them as “the” experts. Cynicism? Sure.

True

[…] MMT: economics for an economy focussed on meeting the needs of most people Tax Research UK […]

[…] MMT: économie pour une économie centrée sur la satisfaction des besoins de la plupart des gens Tax Research UK […]

Let’s start here :

“”Let me absolutely clear: what this says is that government spending actually creates the money to enable the apparent payment of tax that appears, in popular imagination, to fund that spend. It also creates the money to buy government bonds – which are private wealth.””

No, it’s not the ‘popular imagination’, and it doesn’t say what you claim, except for the empty chicken and egg (constructed logic) money argument, but more importantly it is contradicted by reality and denied as a reality in the US Treasury’s Annual Fiscal Report – an annual, audited document by Treasury’s Chief Financial Officers that says where every dollar of revenue comes from (taxation and increased Bond proceeds) and where every dollar is spent.

None of it says it is received from government spending seigniorage.

MMT feigns an understanding of stock and flow analysis.

So regards money creation and issuance, here it is in reality.

In the US, except for coins, all money(stock) is issued by banks, where it flows to households and businesses, from where taxes are paid(*) and Bonds purchased(*) that flow into the Treasury’s TGA account, from where that TGA pays (flows) that same money to the expense side of the approved US Budget to private bank accounts. Government is a user of the private money system.

No change in the money supply happens in all of that – it is merely a flow of a stock that the banks created.

(*) Notably, the TGA accepts private bank-credit, and NOT government-issued money in payment of taxes, and on-pays that bank-credit money back into the private economy. The same is true for government accepting the payment for GI Bonds. It’s all bank-credit money.

That’s why, in reality, it IS merely money theory.

Thanks.

With the greatest of respect for centuries it was said that banks were intermediaries that received depositor money and then lent it

Everyone knew that was true, it was said.

Most textbooks said it. In fact, most still do. And now they say this:

The reality of how money is created today differs from the

description found in some economics textbooks:

– Rather than banks receiving deposits when households

save and then lending them out, bank lending creates

deposits.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

So they were wrong, at least from 1971 to 2014 on this. And MMT was right.

Just as the US Treasury is wrong

And you are wrong re bank credit: that is sterling. That is government created money for the reasons I note.

And one day the world will have to realise that.

And in the meantime I am sure you would have been all for saying Copernicus was wrong with considerable confidence

Richard,

Thanks for the reply, but please be careful to not hit your head on the ceiling there, grabbing the cloak of the Copernicus of modern money reality.

Sure I read all those errant interpretation of money creation, taught in well-financed business schools (for some reason) and all the textbooks, but fortunately my Dad understood money and taught it to me well.

So, about Sixty years ago (including 1971(?) to 2014) the Federal Reserve published a Bulletin on money and credit creation in a modern monetary economy, and in there

http://www.rayservers.com/images/ModernMoneyMechanics.pdf

(The publication is sub-titled “A Workbook on Bank Reserves and Deposit Expansion”

And, its Introduction begins .. “The purpose of this booklet is to describe the basic process of money creation in a “fractional reserve” banking system.”)

It states VERY CLEARLY that money-creation takes place in commercial banks – and includes the role of the CB in LATER providing settlement (reserve) balances to manage the payments system just as BoE recently acknowledged.

Look it up on page 3.

It says nothing about the MMT meme of keyboarding.

No need to continually send the BoE link, I read it the day it came out as a Central Bank Research Hub paper.

But you have made a serious claim here – that the Treasury’s Annual Fiscal Report is in error. Being a document I have read and trusted for many years, and given the plethora of Financial Service Administration handbooks that MUST be followed when managing the public purse, I ask if you, or ANYONE you know at MMT, has any evidence that the writings in that Annual Fiscal Report are, in any way, in error. Any proof, Richard?

Or, do just go by other unsubstantiated MMT allegories and constructed logic, where facts are vacant?

Such as, Richard, where is there any proof of the government spending any money into existence such that it has any impact on the money supply, and where is there ANY record of the amount of government money created in any year? Ever?

Answer: There is none. In either case.

Thanks.

Your move.

As I noted, the BoE were wrong for centuries

So are the Treasury

And so was your Dad

And the reason for saying so is easily explained: ypu ignore the fact that the government has its own bank – and it creates a share of all that bank money

Not all of it of course

About 38% in the UK

That’s government spending

And to be candid – I am not really goping to discuss it further because it is perfectly obvious that you are not here for a rational discussion

“where is there any proof of the government spending any money into existence such that it has any impact on the money supply,” Bradburys. Cash money I know, but still money.

Please, Bill Kruse

This is a discussion of the mythical tenets of MMT.

MMT never says that government spends cash money into the economy – it’s ‘keystroking’, remember?

And besides, if you don’t mind me saying so – given the difference between US and UK central bank functions….. when has the government ever spent non-coin ‘Cash money’ into circulation, except for Lincoln’s Greenbacks , which required statutory authorization?

Thanks.

With respect Joe, if you want to be here stop being rude to fellow commentators or you won’t stay

I don’t accept your aggressiveness to others as appropriate

And yes, MMT does say money is spent into the economy

It is not keystroking per se – that’s a ridiculous idea

The keystroking records the activity – it does not create it – the promise to pay does that

Have you really studied this, at all, because it does not look like it?

And maybe you also do not know of the Bradbury pound? I really think you need to do some studying

Joe Bongiovani

The commercial banks can create ‘money’ (liquidity) by creating loans (credit). But they cannot create new net financial assets because the asset (loan) is offset within the non-government sector by the liability (debtor).

Only transactions between the government and non-government sector can create or destroy net financial assets.

The government is also the monopoly issuer of the currency (notes and coins). The commercial banks can get access to that and distribute it (vault cash) but only by sacrificing bank reserves held at the central bank.

These are the facts.

It’s also a fact that the government has its own bank

And all other banks are dependent upon it

And could not function without it

And it can and does lend to government short term (within the week) and long term via QE

So, the claim that all money is made by banks is technically true

But all banking is dependent on government and that government uses that to ensure it can create the money it needs on demand and that is absolutely true

Richard, ​the renowned Hyman Minsky wrote the following which is very similar in spirit to what you have repeated in several posts on the need for : “a financial system that is consistent with a full utilization of resources and which provides for the broad based economic well-being that is a prerequisite for a strong and viable democracy.”

​What changes or policy measures or protocols, if any do you think are needed, given the trend referred to by the Respected Dominion Bond Rating Service study​ when debt first took off? : ‘The Massive Federal Debt How did it happen? February 1995’. The study addressed why the Canadian $27 billion debt in March 31, 1975 increased to $508 billion in debt (at March 31, 1994). The study concluded that ‘84%’ of the increase was due to compounding interest on the relatively modest program expenditure deficiency.

Thanks

” It’s also a fact that the government has its own bank”

Do you mean each government?

All governments?

The US government?

The UK government?

The CLOSEST historical construct of a government having its own bank to fund its own spending was in Canada, circa 1935 to 1975.

For a relatively complete accounting, please read Joyce Nelson’s Beyond Banksters.

Then, the BIS came in and shut them down.

So, as a comparison to that Canadian experience, please say which government has its own bank that finances government spending debt-free.

None do.

Another MMT myth.

You mean the UK government has not?

I think you are getting beyond ridiculous now

Tell me who owns the BoE, might you?

And tell me you have read the 1998 Act that governs it as well, please

The answer my question

To Derek Henry.

Thanks.

But, actually, those are not the facts.

First, what are ‘net new financial assets’ but a string of words put together by Warren Mosler about a dozen years ago while he was spell-bounding the progressive post-Keynesians with his ‘monetary’ footwork.

I was in on that chat room for a couple of years.

I attended the 2010 MMT Fiscal Sustainability Teach In at GWU.

I’m a student of the money system .

My question to ANY thinking MMTer is this …..

Why do you care about the creation of net financial assets?

How can that be important to anything?

Are you, like Warren Mosler, a financial asset manager?

Are you in need of more financial assets that are not available in the market ?

Is there a shortage of financial assets in our economy, or are financial assets choking the ‘money’ out of our productive economy?

And, obviously, by statements of both Treasury and the Fed in the US, the government is NOT the issuer of FR Notes, the FR banks are.

So there’s not half a grain of truth, or any real facts, in these seemingly ‘logical’ statements.

Pity.

Joe

Can the central bank create money out of thin air for its customer, the government?

Yes, or no?

Richard

Derek –

I am not quite following your logic. While a commercial bank can create liquidity via credit, that credit is recorded as an “asset” on the balance sheet of the individual recipient. So yes, the original creation process balances the loan (asset) with the deposit (liability), that deposit once withdrawn and used as payment becomes a free and clear asset usable to pay taxes. What am I missing here? Thanks.

Richard,

You have used the term ‘money’ here.

And also ‘customer’ … and ‘the government’.

That presumes the government is the central bank’s customer, I think.

So, first, ALL money is created out of thin air. How else can it be added?

Then, as far as I know, no central bank is empowered to create (issue) money for anyone, let alone to support the government’s spending. It is my understanding, again, that the many commercial and trade agreements among nations prevent such – being why the BIS stopped Canada from doing so.

However, as with the Fed, the CB creates ($US) dollar-denominated assets known as ‘reserves’ that they use to manage the balances of their Member Banks – especially in the clearance (settlement) of these balances in the payments system

But when you talk ‘money’, again, legally, you are discussing the universally accepted circulating media – the official means of exchange of the national economy of the issuer.

The ill-fated Swiss Referendum was intended to change all that and to authorize the Swiss CB to do exactly that. It would be the same for all nations, again, as far as I know.

Central banks are banks Joe

And they maintain accounts for their customers Joe

Including the central government

£435 billion made for them by QE Joe

I am sorry – but you really have not got a clue what you are talking about

Please don’t waste my time again

This is excellent! A (relatively) brief yet powerful description of this important tool to understanding our economies and thus our lives. Thank you very much!

joe bongiovanni says: June 11 2018 at 7:33 pm “…please say which government has its own bank that finances government spending debt-free. None do. Another MMT myth.”

This is a straw man question: MMT is at pains to demolish the idea of “debt free” money, e.g.

http://hipcrimevocab.com/2016/05/21/the-impossibility-of-debt-free-money/

Richard, this was really terrific, and I have bookmarked, read a few times, and shared it.

THANK YOU!!!

Could you ponder and consider a couple future topics?

a)The US coining several Trillion Dollar platinum coins. Instead of Hank Paulson panicing at the podium with his yellow legal tablet throwing out a back of the envelope 7-800 Billion , into the fractional reserve banking system…

b) debt jubilee in MMT (MMS!!)

It seems the basic difference is that some of these ‘solutions’ inure to the broader economy and individuals, and others go right into the pockets of Bankers, Wall Street, and the Swamp Monsters.

I will see what I can do

But I am finite

[…] http://www.taxresearch.org.uk/Blog/2018/06/10/mmt-economics-for-an-economy-focussed-on-meeting-the-n… […]

Indyref2 ….

Believes that he (not likely to be a she – is far to opinionated, and yes I understand the irony contained in that comment) is a ‘centrist’. Neither left nor right wing.

Hmmmmm…. I could give him some clues.

If that doesn’t tell you how far the political spectrum has shifted……

By current standards Harold Macmillan was ‘f**king commie ba**ard’.