The Public Accounts Committee cross-examined HMRC on the subject of tax abuse on Monday. The indefatigable Richard Allen has shared part of his transcript of the hearing with me. This is the pertinent exchange. Trust me. it's worth reading:

Shabana Mahmood: Regarding the written evidence by RAVAS and VAT fraud; one of the things they talk about is in relation to the seizing of stock freezing of funds and the blocking of listings. Their own examples that they give relate in particular to Amazon. What are your powers in relation to the seizing of stock and so on? What can you do when you issue a notice?

Jim Harra HMRC: Generally speaking we've got two seizure powers. One is under customs legislation which we do use, and we've used that for example in some fulfilment houses where we find that goods have been misdeclared, then we've got the right to seize them. Furthermore, we have a got a right of access to goods basically under bailiff legislation - if we have an unpaid debt, which I think is probably more relevant here, so if we, for example, make those assessments and then those assessments are unpaid, then one of the things we would look to would be, are there goods that we could take to help to pay towards the debt? Our powers are greatest where the goods are held in the debtors own premises, where goods are held in a fulfilment house belonging to a third party then under UK law, as it currently stands, we have to see a warrant to gain access to the premises for that, so it becomes less and less of a sort of practically viable way of doing things and we are engaging with the ministry of justice about whether those powers really meet our needs.

Meg Hillier MP: But you can get a warrant?

Jim Harra HMRC: You can but you have to go through with it and we discussed this earlier with regards to Lycamobile and there are quite stringent sets of evidence we need to go through and it causes delays and it causes costs (in Lycamobile they said it wasn't clear which company was which in this case HMRC have already identified the VAT evader and issued a notice to Amazon under legislation with the VAT evaders name on it) so it becomes less and less of a cost effective way of covering your debt so we so we are looking ….

Meg Hillier MP: Yes but it's not just about debt is it? It's about the impact on other businesses who are being screwed because of the VAT…

Jim Harra HMRC: Yes, I appreciate that. I think what we are engaging with is whether we can get a more streamlined set of powers that would be are more useful to us

Shabana Mahmood MP: Are you saying the warranty regime is too stringent for these sorts of cases?

Jim Harra HMRC: I think from our point of view it doesn't necessarily make sense from where we sit for why there is a more stringent set of rules for goods that are in a third party's premises than when they are in the traders and in these cases the traders generally do not have their own premises in the UK.

Meg Hillier MP: Is this the reason that, according to Amazon, who wrote to Chris-Heaton Harris MP a former member of this committee they said “ to our knowledge HMRC has never issued a notice to Amazon to seize goods the third party goods belonging to a seller in respect of whom they have issued a joint and several liability notice “

Jim Harra HMRC: I mean that that's correct. It's not part of our current sort of compliance method of tackling this risk because we don't think that as our powers currently stand it's a practical way of us making any meaningful difference here buts it's definitely an area we want to look at to see if we can use it.

So, HMRC won't issues warrants to search for evidence or relevant documents in these case because the costs and hassle are too great.

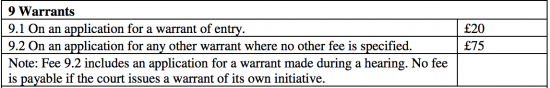

Richard then researched the costs. They are here, and don't look to be beyond the wit of the average law enforcement officer to me, which is of course, the intended case. But the cost issue is also well worth noting. The fees are:

And just for the record, if the JP is satisfied that it is necessary to authorise multiple entries in order to meet the purpose of the warrant, they may specify that the warrant is for an unlimited number of entries or limited to a maximum number of entries. Despite this HMRC apparently have been unable to fork out this extortionate sum to gain entry to Amazon's premises to seize the goods of those partaking in a multi billion pound fraud (I stress, that is billion).

I do wonder if they can't afford the cost whether we should do a crowdfunding to help them out? them? 20p a shot, anyone?

You really could not make arguments this ludicrous up.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Compare and contrast the powers of the DWP.

A comparison of the staffing budget alone would probably say it all.

To be fair Richard the relevant costs are the elaborate web of oversight required to ensure over enthusiastic tax officials don’t accidentally raid Conservative party donors and supporters.

Ouch ! But so right.

I’d be interested to see what powers were required and exercised in order to recover overpayments of tax credits. The zeel and energy used to recover seems to be inversely proportional to the size of the debt.

I can’t keep up with sharing all these wonderful blogs on Facebook;o)

Sorry…

Someone I know saw an individual taken to court twice for a cock up by HMRC …so much so the Judge told them to go away and stop wasting everyone’s time. On the 2nd go the Judge called him over and said “do realise these idiots at the Tax office even though I found in your favour will still be back again to have another go and waste more time and money…”