Big multinationals are paying significantly lower tax rates than before the 2008 financial crisis, according to Financial Times analysis showing that a decade of government efforts to cut deficits and reform taxes has left the corporate world largely unscathed.

Companies' effective tax rates – the proportion of profits that they expect to pay, as stated in their accounts – have fallen 9 per cent (two percentage points) since the financial crisis. This is in spite of a concerted political push to tackle aggressive avoidance. Governments' cuts to their headline corporate tax rates only explain around half the overall fall, suggesting multinationals are still outpacing attempts to tighten tax collection.

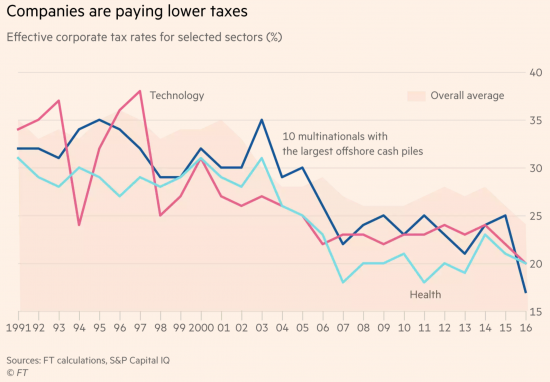

The FT has this chart:

And as they report on methodology:

Drawing on 25 years of financial statements, the FT examined the tax rates paid by the world's 10 biggest public companies by market capitalisation in each of nine sectors. The tax rates reported by the 10 multinationals with the largest offshore cash piles were also examined. The results show that the corporate contribution to public finances has fallen since 2008 as a proportion of profits – whether measured by headline rates, reported effective rates, or the rates actually paid to governments.

And as they add:

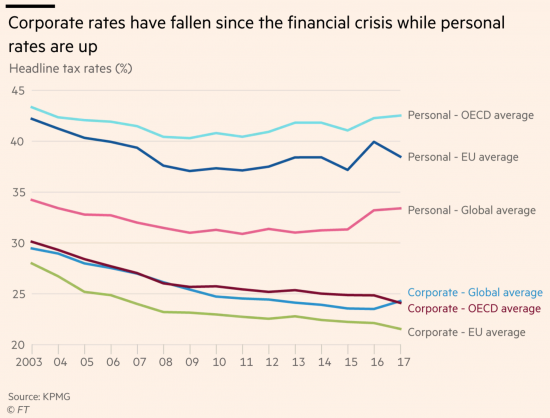

The results highlight how the long downward trend in corporate tax rates set by the countries that make up the OECD continued at a time when taxes on consumers and workers were rising after the financial crisis. Since 2008, countries have cut headline corporate taxes by 5 per cent while governments on average have increased personal taxes by 6 per cent, according to figures from KPMG, the accountancy firm.

So what is happening?

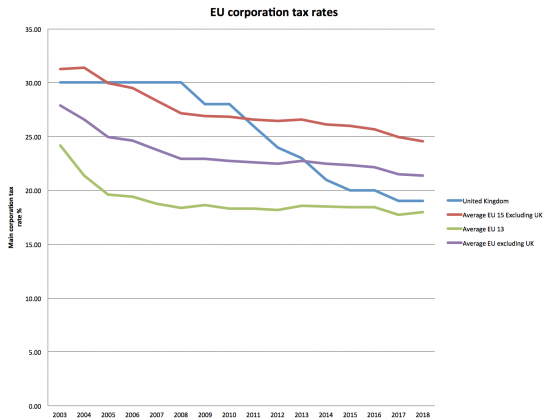

The fact is that despite all the efforts to end international tax abuse by multinational corporations a Faustian pact has been made between these entities and governments, including that of the UK. As a result whilst measures have supposedly been taken to tackle abuse, tax rates have come down rapidly. As I showed recently, this is the plot for the EU, with the UK highlighted:

And rates are not the only story. The UK has massively shrunk its corporation tax base since 2009 by taking all dividends from subsidiaries outside the UK form tax, by relaxing its controlled foreign company regime considerably meaning few tax haven subsidiaries are now challenged, by being lax on transfer mispricing and by introducing schemes like the patent box to encourage tax competition and low effective rates of tax.

The UK is not alone in this, of course. But the result is that despite abuse probably reducing yield has fallen further.

And don't believe the stories that the UK corporation tax yield is rising. That's the unadjusted figure. Yield is only rising because there are three times as many companies in the UK now as there were in 2000: of course it should have risen as a result. But that ignores the massive cost in lost national insurance as a result of avoidance by contractors that has driven much of this.

The reality is that the UK government has, like others. driven inequality upwards by adopting this approach. Another chart in the FT illustrates the point:

The burden of tax is being shifted from business to individuals, and from those who do not work to those who have to work for a living.

And then people wonder why populism is on the increase. The reason is obvious: the politics of countries like the UK promotes populism as surely as it promotes inequality, social stress and the injustice that results when austerity is imposed as tax yield is given away to those who could afford to pay it.

People have a right to be very angry. I just wish they were more so: then we might get change.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“by being lax on transfer mispricing”

Can you give any actual concrete examples of this? Which companies? Which goods or services? What are the prices and what are your arguments that support a different price?

Easy to claim something is happening.

But it’s just an empty echo of a claim without evidence.

The evidence is in the low number of people employed on the issue

Laxness is the inevitable consequence

It still may not be 100 people

David Marks

This whole issue is so well known. Your comment couldn’t possibly be more daft. I suppose you think that BEPS is addresssing a non-existent problem.

Here – it took me 1 minute to find this on Google:

International Transfer Pricing and Tax Avoidance: Evidence from Linked Trade-Tax Statistics in the UK

https://www.sbs.ox.ac.uk/sites/default/files/Business_Taxation/Events/conferences/symposia/2017/liu-transfer-pricing_6222017.pdf

You know how to use Google. Maybe you could try that instead of wasting people’s time with absurd questions.

I agree. For some more evidence that companies have all the money see the chart in

http://www.progressivepulse.org/economics/economics-101/follow-the-money

which shows the sectoral balance data for the UK. Companies are in surplus whereas households and government are in deficit. What this does is increase wealth inequality and eventually the majority are milked dry and the economy grinds to a halt.

[…] The news that large companies are enjoying a steady decline in their real rates of tax, revealed by the FT, comes as no great surprise. As I have commented this morning: […]

“Big multinationals are paying significantly lower tax rates than before the 2008 financial crisis, according to Financial Times…….”

Precisely how not to use the mechanisms of Modern Monetary Theory. Bung money at the top end of the economic pile then don’t tax the proceeds.

Meanwhile measure inflation at the bottom end of the economic pile and pretend there isn’t any.

Brilliant.

“….The results show that the corporate contribution to public finances has fallen since 2008 as a proportion of profits ….”

Or to put it in Cameron-speak , being ‘all in it together’.

Sniff, and it’s fairly obvious what the ‘it’ in question is composed of. As the product of a ‘good’ school I’ll leave it up to him to translate and complete the saying ‘Semper in excretum est……’

(Hint. It translates as ‘it’s only the depth that alters’)

[…] Cross posted from Tax Research UK […]

Worth pointing out that despite the fall in corporation tax rates, the total haul has increased slightly over the last decade from £47bn to £50bn.

https://www.statista.com/statistics/284319/united-kingdom-hmrc-tax-receipts-corporation-tax/

You could argue the burden is shifting to individuals, but only to those on higher incomes. During this time, lower and mid-paid individuals have benefited massively from an increase in the personal allowance for £5,250 to £11,850 and a new Savings Allowance.

Meanwhile, very high earners have seen their rate increased from 40% to 45% (via 50% for a while of course) and lost their personal allowance over £100,000 and seen the amount they can save into a pension tax free slashed. Those earning over £50,000 have lost child benefit, and the new dividend tax rates will increase taxes on most people who earn significant income via that route.

In short, those earning over £50,000 pay considerably more as a slice of the income tax pie today than they did in 2007/08. The top third of taxpayers by income pay over 80% of all income tax received. All this rarely seems to be mentioned on this blog, but surely it should be acknowledged.

It would seem we are all in this together, thanks to the increased tax contributions of higher earners.

You ignore almost all relevant facts

First there is the very large increase in profits: yield has fallen in comparison

Then you ignore the massive increase in the number of companies

And you ignore the impact of VAT increases

And pay freezes

And declining self employed profits whilst numbers shot up

And the massive increase in top wages

This blog seeks to look at all relevant facts. Unsurprisingly it comes to a much more balanced view than you seem to do as a result

Yes but yield fell because governments took the decision to reduce the rate of corporation tax. The fact that it has fallen is not really news therefore. The resultant increase in bottom-line profits benefits most of us through our pension funds (who hold and therefore own these companies).

The increase in company numbers is largely due to the rise in self employed, is it not? So the number of companies with sales of £5m+, to pick a random number, has increased by far less.

Yes, there have been pay freezes, a VAT increase, and increase in top wages – I would certainly agree the first and third of these are bad for society (the second a little less so as I think we overspend on stuff we often don’t really need), but this doesn’t alter the fact that lower earners (and corporations of course) have received favourable tax treatment and those higher up the pay scale have largely paid for this.

You do a lot of a great work, but I suspect your impact could be even more positive if you didn’t use every little bit of data out of proper context to demonise people you disagree with.

I note you also ignore benefits except those paid to those earning more than £50,000

As for your last para: I have been told over so many years that if only I was ‘nicer’ I would be so much more effective.

If I had been ‘nicer’ I would have got nowhere

Omelettes are not made without breaking eggs

And there are people who really have set out to exploit the majority and it is entirely appropriate to say so

But boy have I had to get tough to endure the backlash, a lot of which has not been much fun

Stuart –

Surely it’s right that those who earn more pay more? Isn’t that pretty much the central tenet of a welfare state? Those who can afford help to support those who can’t?

If tax needs to be collected, it should be collected from those that can afford it. Whilst tax doesn’t pay for government spending, the collection of it (T) does increase the available amount of (G) before we have to borrow or create. The more tax there is, the less “new” credit the government has to extend to pay for the vital services we all need as a society.

In short, I don’t really see the problem with those earning over £50K paying more than those less fortunate* than themselves.

Full disclosure – I am lucky enough to earn enough to pay higher rate tax. I live very comfortably after those deductions are made. I can’t remember the last time I was hungry or cold (although there was a time!). I even get to save a little each month. I am privileged by comparison to the vast majority of my fellow countrypeeps and I hope I’m aware of by how much. I am also extremely happy and proud to pay the taxes that I do. I don’t need a medal for it.