David Davis said yesterday:

[Europeans] fear that Brexit could lead to an Anglo-Saxon race to the bottom. With Britain plunged into a Mad Max-style world borrowed from dystopian fiction.

These fears about a race to the bottom are based on nothing, not our history, not our intentions, nor our national interest.

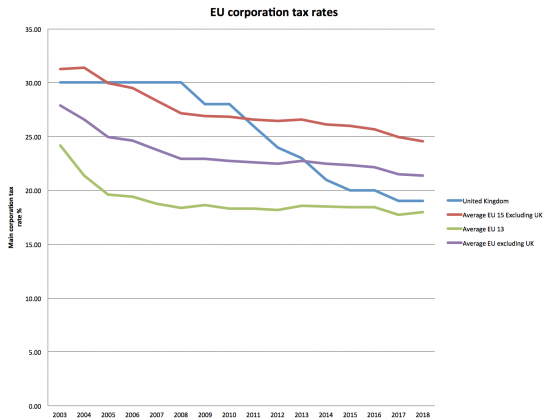

I thought some evidence might help appraise the claims he made. This data is on EU tax headline corporation rates compered to that for the UK for the last sixteen years. The data comes from KPMG (corrected for an error in the 2018 UK rate).

Now unless I am deeply mistaken that blue line, which is the rate, falls headlong below that for the EU 15 excluding the UK and the EU average excluding the UK t head towards the average for the EU 13 accession states, mainly in the EU's eastern areas.

You could argue that is not quite a race to the bottom because there is a little way to go as yet. But that's nit picking: since 2010 the UK has been heading the charge to cut rates.

In that case I'm sorry Mr Davis, but the evidence is that the UK is committed to a race to the bottom and has been since 2010. No wonder no one believes him.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

According to that chart, the race to the bottom was started by other EU states.

The trend is universal and worldwide

The UK’s part is aberrational

[…] there is misjudgement in the claims made by David Davis that are flatly contradicted by […]

Did you read the article?

David Davis was actually talking about health and safety regulation after the EU said Brexit will make it more likely people in the UK get cancer because of less regulation. I joke not.

He wasn’t talking about tax – there are quite a few places in the EU with lower corporation taxes than the UK.

The issue hecwas addressing was systemic

Your claim is simply not true

Which part? That Davis was talking about regulations after various EU scare stories, or that several EU states already have lower corporation tax rates?

Davis was addressing the widely held belief that the UK is dedicated to relaxing necessary regulation to secure competitive advantage and suggested it has never happened

I am suggesting that he is knowingly not telling the truth and everyone else knows that

I provided evidence that the UK is, contrary to his claim, dedicated to a race to the bottom under this and the last government

And that is, I suggest, very obviously true

I don’t think it’s “very obviously” true just because you say it is.

So the UK has cut corporation tax – as have a lot of other European countries. You’d hopefully also notice that corporation tax reciepts have gone UP.

And it’s the EU – who are a massive protectionist block – who are saying that the UK is going to cut regulation. The UK is saying the regulations will stay fairly harmonised.

Basically you are saying that the EU is trustworthy (and they haven’t exactly proven themsleves paragons of virtue) and the UK government isn’t.

But I guess it’s basically because you hate the Tories and attack literally everything they ever do. I’ve seen some of your other hyperbolic posts – you are basically accusing the government of collaberating and allowing crime in some of them.

I try to offer evidence

I think you are misreading my motives

I also criticised Labour for its failings when in office

It does not matter what the rate is if companies don’t actually pay it.

Or to put it another way, the tax rate is not the only important thing. The tax base matters too. (Just look at the US, with its historic high tax rate, but gaping holes in the tax base, so the effective rate actually paid is much lower.)

That said, there is little justification for the rate of UK corporation tax being below the basic rate of income tax, and I don’t know anyone who has been asking for it to decrease further.

“…..corporation rates compered ……[by] KPMG ”

The revolving door from politics to commerce is now shifting to the revolving door between politics and entertainment.

Don’t you just love spellcheckers 🙂

Yep

But on of my editors has got to it, before me….

Thanks to whichever one did it

Trends for air pollution are probably the worst of all. Massive clean-up in the EU. Almost nothing in the UK. In London alone there are an estimated 28,000 extra deaths annually.

There is growing evidence of a link between Alzheimer’s and living adjacent to busy roads. The burden of caring for those afflicted with it is rising. The policy reactions seem guaranteed to further increase the burden on society.

So, yes, not just on tax, it looks like a race to the bottom.

The average Corp tax rate in EU is 21.82% The UK 19% G7 29.57% OECD 24.18% World 22.96%. If that is not a race to the bottom what is

Over the past 37 years, the corporate tax rate has declined. In 1980, the average worldwide statutory tax rate was 38.68 percent now the average rate is 22.96 percent, or a 41 percent reduction over the same period.

It’s interesting to compare the actual receipts of corporation tax in the same time period here https://www.statista.com/statistics/284319/united-kingdom-hmrc-tax-receipts-corporation-tax/ which shows 2017 as the highest.

Race to the top in terms of receipts, maybe?

If you adjust by number of companies, not at all

Richard,

Am I right in saying that Corporation tax is really mis-named, in that it is actually just a profit tax? And that since taxing something more means less of it is created, meaning that if we tax profits more, we will see less investment in efforts to improve productivity?

I also suppose that, with a fall in the Corporate tax rate, there would, I imagine, be a rise in income tax paid, and probably a rise in VAT, fuel duty, insurance levy and so on. So the end result is probably just a relocation of tax incidence?

Might you show the relationship between CT and profits and prove that a) profit making is discouraged when in fact you might imagine the opposite since the desire for a return would enhance effort and b) the impact on invetsment?

You offer conjecture. But do you have evidence?