HM Revenue & Customs published new estimates of the cost of major tax reliefs last week. This is an issue on which I am doing a lot of work at present. I strongly suspect that these estimates are too low, but the reason for my interest is to ask questions on the alternatives that are implicit in the data.

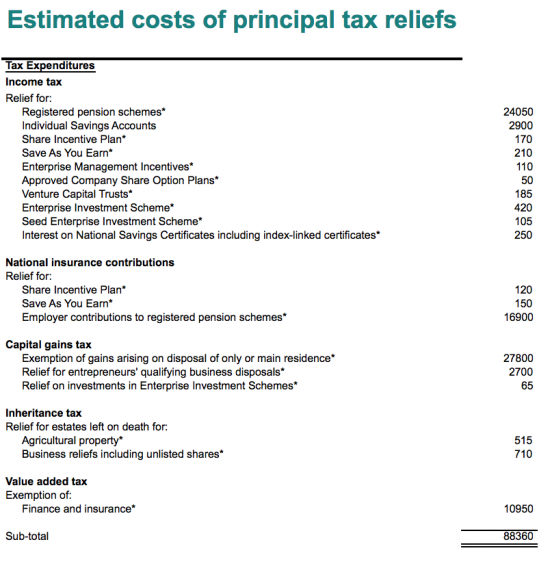

We all now know, of course, that tax does not pay for government services as such. But that said the way we tax has enormous implications for the distribution of wealth in society. One of the reasons for tax is redistribution, after all. In that case look at the cost of subsidising wealth in the UK:

That is £88 billion that is, broadly speaking, directed to making those already better off in our society better off still.

For the record I am not suggesting all those reliefs go in their entirety, at least, not yet: transitions help. Nor am I saying that all these subsidies go to the ultra wealthy. What I am doing is asking if this spending is wise. Are these good choices?

Compare these costs with these spends:

Subsidising wealth is nearly as expensive as the UK education budget.

It costs the same as we spend on transport, housing the environment, industry, agriculture and employment.

Is that really a good idea?

I doubt it.

So the question is, why are we doing it? And what should be done about it?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Start with a theory of tax relief and its purposes.

I am working on it…

31% of that is people selling their main residence.

As you say this is abhorrent, I assume you voluntarily sent a cheque to the Treasury for the gain you made selling the Downham Market house?

You are also sending payments tax relief for your pension and employer’s pension contributions?

I know you have difficulty with anything but personal abuse but for your sake a) Tax is not voluntary b) I am seeking systemic change c) I am arguing to increase my own liability

There is no issue here

Except that you keep making a fool of yourself

c) I am arguing to increase my own liability

I assume this phrase was often heard at Davos last week…

It seems to me that the Billionaires who were kicking around Davos haven’t realised the sort of world they are creating and the troubles they are brewing. For if they did they would be designing a wealth tax before one was imposed on them – or some other redistributive tax.

(I know many of them give vast amounts of money to charities but it should be the state that is the prime enabler. )

I would happily pay a wealth tax of say 1% on my net assets per annum.

If I ever get to the point on having net assets of over £1 million I may feel moved to start doing it voluntarily

but if I ever became a billionaire I would presumable just hid my money in a tax haven…

Noted Ken

I assume this figure doesn’t include the cost of trusts like that of the Dukes of Westminster either.

Oh no

Or the cost of the CGT allowance

Or CGT lower tax rates

These are issues I am working on….

“a) Tax is not voluntary”

“c) I am arguing to increase my own liability”

You can make a donation if you feel you should pay more. It’s not very popular though:

https://www.ft.com/content/4b3e6db0-e57a-11e7-8b99-0191e45377ec

“b) I am seeking systemic change”

Ah, what you mean is you want other people to pay more.

I reiterate, tax is not voluntary. This is a discussion I had with Bill Dodwell last week

And you are of course quite right: I do want some others to pay more. That is what redistribution involves

I may well want many to pay less too, for the record. You ignored that bit. You often do.

I have had the “you could make a donation” retort aimed at me when I suggested that the fact that the last budget benefited higher rate tax payers more than the poorest was reprehensible.

I regard it as an utterly infantile response. Tax works (or should work) because everyone believes that the same rules are being applied consistently to everyone.

Precisely

[…] at large. Such 'adjustments' tend to impose substantial costs on society at large, which makes asking why we subsidise wealth so heavily entirely […]

It’s striking that only four line items account for almost £70 billion of this. It would be interesting to have a rough idea of how much could be raised from a few relatively digestible proposals, namely:

– scrapping higher rate income tax relief on pension contributions (and imposing some form of withholding tax equivalent on employer contributions in respect of higher rate employees),

– imposing secondary Class 1 NI contributions on employer pension scheme contributions (they are, after all, just another form of remuneration),

– capping (at e.g. £100k plus £20 for each year of ownership) PPR relief from CGT and

– scrapping the VAT exemption for finance and insurance (although it may be fair to partially counterbalance this by scrapping or substantially reducing IPT).

In addition, the table does not show the revenue foregone by the tax free uplift on death for CGT purposes but I bet this is also quite a lot and this inheritance subsidy could also be scrapped.

It would be even more interesting to compare this with how much BoJo thinks we can lavish on the NHS by raising a two fingered salute to our 27 closest friends and neighbours.

Let the people see where the serious money is being wasted.

It is work I am doing….

Personal Income Tax Allowance is not included in the HMRC release (although some allowances such as Married Couples Allowance are). I am sure their are technical justifications for this but if we are looking at the issue of reliefs and allowances it would seem strange not to include it.

As I am sure you know the moving of this allowance has been a tax cut to middle and higher earners disguised as helping the poor.

It is there

£101.3bn

No break down on how that is estimated

And if we let this continue to happen, this is what we might get:

https://www.theguardian.com/global/2018/jan/30/us-crumbling-infrastructure-trump-state-of-union-address

Imposing CGT on residential property is an interesting one as surely you have to take account of the destabilising affect it would have on the economy. It is massively recessionary and would lead to an immediate hit on consumer expenditure and force many into negative equity as the housing market would be crushed.

No one would suggest it would be a full hit at once

It took some time to remove mortgage interest relief, but it was achieved

So could this be, over time

Full LVT would remove all capital gain for property. Buildings do not gain in value any more than cars.

Full LVT would remove all capital gain for property. Buildings do not gain in value any more than cars.

Good point, Carol.

It’s possible to increase the value of property by eg by installing a new kitchen, but you would be unlikely to get your money back if you do the accounting correctly without the other influences of the rising property market. Very like putting new tyres on the car and hoping an increased sale price will cover the outlay. As, logically it shouldn’t, because you bought new tyres and sold them on second hand .