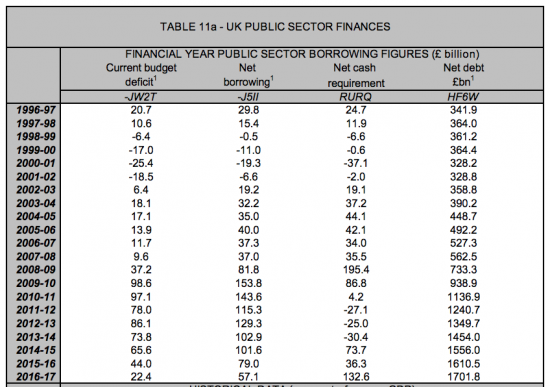

The National Audit Office published a review of UK debt last week. It was an incredibly important document, and I managed to miss it at first. Its relevance comes down to one key issue. It tells the truth. This is rare on this issue. By this I mean it reports the true level of UK government debt. This is its opening presentation of key facts:

This suggestion that the UK government's debt is £1.3 trillion contrasts dramatically with the Treasury view of debt, which is reflected in this data, issued recently, and which is what the media usually report in their desire to suggest that the UK economy is being crushed by a government debt mountain that is apparently unsustainable and a burden on generations to come:

As will be noted, the Treasury say UK government debt was £1,610 billion in 2015/16 and the NAO suggest it was £1,261 billion.

It is now some years since I suggested that UK government debt data was mis-stated because of the impact of QE, which is the data that reconciles the above two positions. I said in 2012:

The reality is ... that in any proper accounting system that produced a single set of accounts for the government that debt that was repurchased [by the Bank of England under the QE programme] would be considered to be cancelled. That's because you can't meaningfully owe yourself money, and yet that is precisely what is happening here. The Treasury owes the Bank of England money but as it in effect owns the Bank of England it therefore owes itself the money and as such the debt has simply been cancelled.

What the National Audit Office is now doing is recognising the truth of what I said back then. Or as I put it at that time ( and I have edited slightly):

QE hides an economic reality, which is that when all the mumbo jumbo is cleared away what is happening is that money is being printed under the QE programme to clear the government's deficit and that much of the claimed increase in debt is not really being issued at all.

That is precisely what the NAO is now recognising. The UK is not nearly as much in debt as HM Treasury claims precisely because it cannot owe itself money.

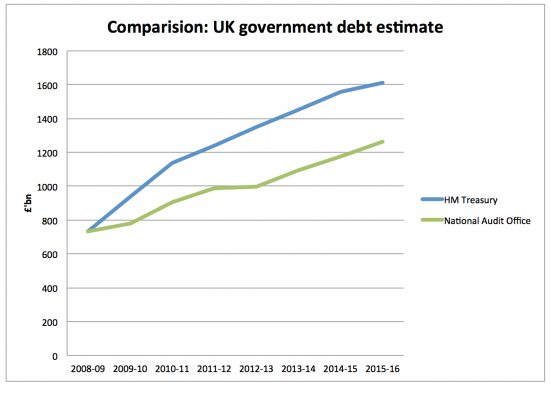

That has ramifications. First, it means the whole debt paranoia is wrong. Debt is not rising at the level claimed by the government. This is apparent from this comparison:

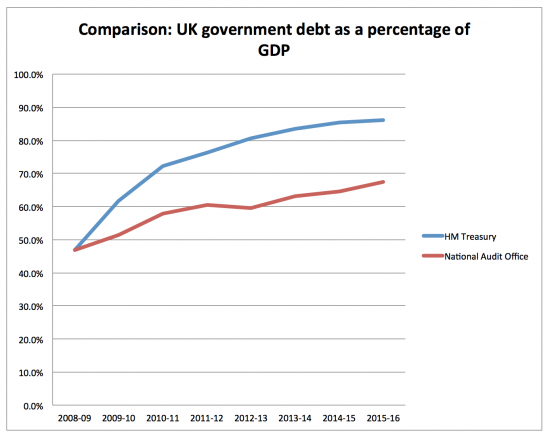

This is even more apparent when expressed as a percentage of GDP:

Debt has grown, but by nothing like the amounts the government claims.

Secondly, this then means that the focus can then move instead towards how to use debt more creatively to solve the issues that we as a country face. As organisations as diverse as the IMF, OECD, CBI and left wing think tanks all say, now is the time for infrastructure investment, especially when (as is the case at present) money is available to the government at negative interest rates.

We do not have a debt crisis.

We do not need austerity.

We do need social housing, new green infrastructure in every constituency of the UK, better local transport, investment in small and medium sized business that banks are not delivering and and end to PFI. All this is possible. And we are in no way constrained by debt from delivering any of these things.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“now is the time for infrastructure investment, especially when (as is the case at present) money is available to the government at negative interest rates.”

Ten years ago would have been even better. But we really do have to start sometime and better late than never.

I think Phillip Hammond’s budget is going to very depressing.

As usual, Richard, you are going too fast for me. The first graph shows the 2 lines rising in parallel but then the top line flattens. So the WGA figure is now rising faster than the Treasury numbers.

The same is happening in the second graph. The NAO figures are rising faster than the Treasury figures albeit they are a bit smaller.

It doesn’t look encouraging to me but I defer to your expertise on this

That’s because QE has been halted

When you say QE has been halted it is still running at something like 10 billion a month of churn I believe but the total is no longer increasing. Have I got that right?

Nice little earner for the brokers I expect.

Less than £10 bn

There is a churn

It gets worse, for surely foreign exchange reserves could be used to cancel out a further tenth of the remaining debt.

Take a look at this graph

https://tradingeconomics.com/united-kingdom/foreign-exchange-reserves

and switch to 10 year mode and you can see the Treasury have been gradually doubling the size of their reserves. It’s utterly disgusting. Here we have the UK, a self-governing nation, which has stashed enough foreign money sufficient to run the government for two months without recourse to sterling at all in round numbers.

Who on earth do the mandarins think they are? Some combination of councils and China it seems.

Mike Pendant says:

November 16 2017 at 2:42 pm

“Who on earth do the mandarins think they are? Some combination of councils and China it seems”

Perhaps the clue is in ‘mandarins’ ?

I hope your comment doesn’t indicate sinophobic tendencies. I would be careful if I were you they could be running the country before long the way our lot is carrying on. {:-)

John Weeks in “Economics of the 1%” said that understanding public debt was no simple matter: “Demonstrating [the] apparent heresy [that the PD of advanced economies was not worthy of much concern] requires a branch of advanced mathematics, known as basic arithmetic. To make the task even more difficult, assessing the danger of indebtedness requires common sense.” And agreed that debt owed to oneself was not debt.

Unfortunately, few politicians or opinion formers have both of these abilities, it would seem.

He went on to look at the nature of the debt, whether it was for consumption or investment in assets and, in the case of the US, to whom the debt was owed and what risks were attached, for example, would the Chinese be likely to use their ownership of 1tn to speculate wildly.

An interesting aside, similar to points made on here, while the US has always met its debt obligations it has failed to invest in US institutions or infrastructure. Ring a bell?

you said that there is no need for austerity so how are the government getting away with pushing that narrative, today in the I news paper the front pager and on 3 pages inside talks about Mugabe, when on page 13 it talks about how Austerity has contributed to 120,000 extra DEATHS. Were is the anger in the country that 120,000 people have died so the BANKERS CAN KEEP ON EARNING BIG MONEY the BANKER/TORYS have blood on their hands

I wish I could understand why people are not angry

“I wish I could understand why people are not angry”

People aren’t angry because the media sources they take their information from haven’t told them to be angry. It really is that simple.

Instead of being angry people are encouraged to beat themselves up about their own supposed inadequacy. And then feel guilty about burdening the overstretched NHS with their mental health problems.

Media control does work. Especially if you pay the media personnel just enough to keep their self-righteousness intact.

Sadly it’s a numbers game. There just aren’t (yet) enough people really hurting – or compassionate enough – for it to register significantly on the political spectrum. Most people, i.e. 51%, are preoccupied with their lives to the exclusion of campaigning for change. Overall, they prefer stability even if the status quo is unsatisfactory even by their own standards. Yes, there is a tipping point but one never knows where or when it is and it’s never as near as ‘progressives’ think it should be.

This article in today’s Indie kinda’ sums up where we’re at in political terms – https://www.independent.co.uk/voices/vote-tory-conservative-universal-credit-brexit-bill-rebel-revolt-labour-theresa-may-jeremy-corbyn-a8058021.html.

By any ‘normal’ management criteria May would be fired. But politics aren’t ‘normal’ especially with our completely inadequate democratic model. of course, she might be replaced by someone the Tory grandees think would be a more sure-fire election winner – but they’ll be struggling to find someone. I think May gets the benefit of her gender with the electorate.

On the other hand, Corbyn – as the only viable ‘agent of change’ – is simply not (yet) providing the social centre ground with sufficient confidence to justify it ticking his box. Unfortunately it would seem that the Tories will have to commit the country to still further socio-economic failure until there’s a critical mass of opposition that would translate into a change of government. And that’s not any time soon 🙁 🙁 🙁

The article came across as a mix of poorl;y informed (with respect to Labour policies) and “I’m all right jack” – the latter being the big problem – the “doing OKs” will inevitably vote for the status quo. However, I pin my hopes on the Tory party………to continue to implode.

Mike Parr says:

November 16 2017 at 8:17 pm

“The article came across as a mix of poorly informed (with respect to Labour policies) and “I’m all right jack” — the latter being the big problem — the “doing OKs” will inevitably vote for the status quo. However, I pin my hopes on the Tory party………to continue to implode.”

About par for the course in the MSM then.

In this part of Scotland it would probably come under the general categorisation of ‘blethering shite’.

It is, as you say, Mike the complacent ‘I’m all right jacks’ who swing it. They don’t mind who governs; they survive, like cockroaches. What terrifies them is negative equity – because they have been brainwashed into believing their house is an investment and that a mortgage is not a debt, but a wise investment. They think, many of them, that they are just about managing. Austerity has been OK because it hasn’t touched them. And after all what was needed was a bit of financial responsibility; a firm slap from nanny. Not that nanny slapped THEM because they are the good boys and girls, she only slapped the bad people. Poor is bad. We get what we deserve in this life so we look at what we’ve got and we can see we are deserving people. We must be. Poor people must therefore also get what they deserve. Stands to reason.

I remember sagely predicting that it would take a generation to undo the damage Thatcherism was doing to this country. I was well wrong. It will take at least another one. And that generation hasn’t been born yet.

The other side of the coin is that the left will not appeal to their core voters, the people who would benefit from a more socialist agenda because they are wholly obsessed with placating the swing voters in marginal seats whilst keeping the UKIP fringe on board. The manifesto will simply not inspire the would-be beneficiaries to turn out and vote because it will sound like more of the same old same old.

Labour will only win the next election, by default, if the Tories lose it.

The usual suspects that the indy scribbler wants in the shadow cabinet are the people Corbyn should have embarrassed out of the party by now. That he hasn’t done so speaks volumes. I’d as soon vote Tory as have another Blairite travesty. You know where you are with Tories. It might not be nice but it doesn’t mess with your head.

Richard – bravo! I’ve just noticed you have ‘spell-check’ installed 🙂 🙂 🙂

Have I?

It’s news to me – it must have come with the latest upgrade, yesterday

The NAO review is a model of clarity and as you say truth . Paragraph 1.17 especially ‘ Similarly to the UK, debt rose globally in response to the financial crisis. In 2016 UK government debt was 80% compared to a range of 48% – 121% . Nonetheless as highlighted by the IMF in 2016, there is no recognised level at which debt becomes unsustainable .’ So much for Rogoff’s discredited 90% embraced by Osborne , but then as Keynes remarked so long ago ‘ Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back . ‘

Indeed

[…] Cross-posted from Tax Research UK […]

@Andy ” it would take a generation to undo the damage Thatcherism was doing to this country” Politicians face no sanctions when they mess up big time, tell lies or introduce policies that are so partisan that a large segment of the citizenry end up being punished for their contemptible behaviour. Oh, they can be voted out – and into the HoL, with their gold-plated pensions and offers of directorships. And of course, so many occupy safe seats that they wouldn’t be voted out anyway in this farce of a voting system.

Osborne & co pursued their policy of austerity – cutting spending, punishing the poor, the unemployed, the sick – based on an outright lie. Yet they face no consequences. The least that should have happened is that they should be in gaol, not collecting 6 jobs. It makes me very angry.

(BTW, my hand-sharpened pitchforks will soon be on eBay)

Richard,

You write that:

The reality is … that in any proper accounting system that produced a single set of accounts for the government that debt that was repurchased [by the Bank of England under the QE programme] would be considered to be cancelled. That’s because you can’t meaningfully owe yourself money, and yet that is precisely what is happening here. The Treasury owes the Bank of England money but as it in effect owns the Bank of England it therefore owes itself the money and as such the debt has simply been cancelled.

Surely, if you wish to ‘merge’ the balance sheets of the Treasury and the Bank of England (which is what you are suggesting), you must include the liabilities which the Bank of England took on when it ‘bought’ the QE assets (as well as the the QU assets themselves). Those Bank of England liabilities would balance the assets the Treasury took on when it ‘sold’ those QE assets. Zero-sum.

Surely, the whole QE concept (peoples, green or secular) is just administrative obfuscation (as is the distinction between assets/liabilities deemed to be ‘money’, and asset/liabilities deemed to be ‘not-money’). Just back off to assets and liabilities; end of.

The liability is a bank account

That’s what banks have

But it’s not part of national debt. It’s a reserve account and interest need not be paid on it

Next problem?

Richard,

You write that:

But it’s not part of national debt.

Surely, if you wish to ‘merge’ the balance sheets of the Treasury and the Bank of England (which is what you are suggesting), you must ‘merge’ the WHOLE of BOTH balance sheets, and the WHOLE of BOTH balance sheets WOULD be ‘part of the national debt’.

National debt has a particular meaning

What I said is true

Bank of England deposits remain something else

Hopefully not a completely stupid question, but why are we paying interest on the debt? And if so who are we paying it to? Have we borrowed from outside the UK at some time? If the BoE creates the budget for government spending, why would we be paying interest on it?

We do borrow outside the UK, albeit in sterling

Interest is paid by convention. It is a legacy of the pre 1970s banking era

Why do we do it now? Because EU l;aw effectively still requires it

It is one of the reforms of the EU that is overdue

I want in. And I still want reform

OK, so we are having to pay interest not only on money borrowed from outside the UK but also on money ‘borrowed’ from (would that be equivalent to created by?) the BoE…

And when it comes to the money creation that’s classed as QE (though not substantially any different to the money created for every day government spending), we are able to avoid the EU convention of having to pay interest on it. Is that right?

Apologies and thanks, I’m still learning!

But we can’t differentiate money borrowed in that way: anyone can buy UK government debt (although we might ask why that is the case)

Re QE we get round that by the government being able to cancel interest on the debt it pays itself

Well said Richard. We also need to reverse most, if not all, of the cuts to social security benefits and tax credits (abandoning the Universal Credit roll-out in the process) and also reverse the cuts to spending on public services, many of which have been gutted since 2010.

Agreed

Richard, good piece, but has the Bank of England said that the purchase of government debt is permanent, i.e. is there is no intention to unwind (the money to be unprinted so to speak)?

If so then I could understand how the NAO’s perspective better reflects the government debt position, but if the purchase is simply temporary (or at least currently intended to be so) then there appears to be merit in the reflecting the government debt’s position as the Treasury currently do

Your question is absurd

Let me put it like this. Suppose a truck company buys a vehicle. It will have no intention of keeping it forever. Does that stop it being a fixed asset for as long as it is retained? No, of course it doesn’t, despite the fact that it will always be sold on

So, the BoE bought gilts. It has no idea if or when it may sell them. What is clear is that right now it has never sold nay back to the market. And there is no plan to do so. And the government is meeting the demand for new debt with its deficit funding. So sale looks exceptionally unlikely. But despite that you want to treat the gilts is for sale when it is abundantly clear they are not: so clear that interest is not paid on them.

Candidly, why are you asking for fraudulent accounting, because that is what pretending they are debt would be?

I’m sorry, I don’t accept the question is ‘absurd’, which seems a rather unecessary way of responding, particularly if you genuinely had confidence in your own argument. It was after all, only a question.

So, it has got me researching on this subject and a very quick google demonstrates that there is active debate about when to unwind quantititaive easing within the BoE. See here for example:

http://www.independent.co.uk/news/business/news/bank-of-england-quantative-easing-programme-end-435-billion-ian-mcafferty-interest-rates-qe-a7838581.html

So the current, at least stated intention from the BoE, appears to be to unwind QE at some stage.

On this basis I’m afraid I don’t agree that it is absurd to take this into account in the national accounts, particularly if the potential for unwinding is real, which it appears to be in this case. I’ll be the first to admit that I do not know if there are any internationally recognised standards in this rather specialist area of how to deal with to sovereign debt in the national accounts (this is not my direct area) and if so what they are, but as a general principle of accounting I would expect that if there is a good chance of incurring a liability in a business, its balance sheet should reflect this as a matter of prudence, and I would be concerned if there was no allowance at all made for it.

Likewise, if a company has a goodwill asset in its balance sheet, which no longer aligned with the expected future cash flows deriving from that asset, I would expect that asset to be written down as a result.

I admit there is not a perfect crossover from these examples to the case in hand, but I think they are nevertheless instructive, and to my mind a prudent approach is to be preferred. To write this prudence off a ‘fraudelent’ seems odd, particularly as there seems to be transparency in the method of calculation, and it is not designed cover up a worse situation (eg it not like the case of Greece’s stated govt debt position pre financial crisis, which very much did strike me as being a case of fraudulent accounting).

So in answer to your question, I am candidly asking for transparency and prudence in the preparation of national accounts, which is the same standard that I would expect any other entity to be held to. There is undoubtedly a grey area in this case, but HMT’s approach does not strike me as unreasonable in the circumstances

You cannot reflect what someone might do in accounts

In principle every asset in every company is for sale, but until the decision is made to seek it then it is not

There has been no decision to sell QE assets

No circumstance where they might be sold has practically been imagined as yet

And in the meantime on consolidation the only possible treatment of the debt owned is that it is cancelled (also true in commercial accounting, of course)

And the fact that interest is not owed in this debt proves this is the commercial substance of what has happened

So what you are asking for is accounting that does not reflect decisions made or the commercial reality of the fact the government owns its own debt

Now tell me why you are so keen that the accounts be misstated so that they do not reflect the truth because I cannot think of a single reason why they should be?

You say there is no circumstance in which they may be sold, but you have members of the Bank of England discussing those very circumstances (eg whether soon, or whether waiting until short term interest rates rate to circa 2%) so this is not true.

This is a decision that would be made by the BoE, which (in principle at least) is undertaken independently of HMT.

You say that the accounts are misstated, but it seems to me that the calculation methodology is transparent, so that users of the information may choose to adapt the figures to ensure they are appropriate for the purposes to which the information is going to be used. (You are for example, at liberty to argue that the amounts should not be included in the national debt – the amounts are easily found and not hidden)

As to what HMT’s headline figures should reflect, to my mind, given the still stated temporary nature of the debt purchase by the BoE and the fact that there appears to be a good chance of sale of assets in the future, quite possibly the near future, the prudent thing to do is to exclude the impact.

The alternative could be do see a potentially significant and rapid increase in the national debt figures at the time of sale, which is reflective of nothing more than the BoE unwinding positions that they have always stated will be unwound at some stage. That alternative position, and using the logic of your article (I admit to breaking point in order to illustrate), suggests that the time of BoE sale would be the right time to unleash an austerity max programme as it was not necessary before this because the NAO version of the figures prior to that date did not show UK debt levels warranted it.

The basic point here, is that there seems to be significant merit in HMT’s figs reflecting the true underlying debt position and not fluctuating wildly in response to BoE decisions outside its direct control that are stated to be temporary. To my mind this does not reflect a misstatement. It reflects a best attempt to assess and reflect the true underlying debt position, which is I think what those preparing accounts ought to strive to do.

The only argument I can see for not doing this would be a technical one, where internationally accepted standards for preparing national accounts deemed that central bank purchased govt assets should be excluded from the national debt, in which case I would still expect the government to prepare accounts on its current basis as well so that observers get a better understanding of the underlying position.

I am not sure what the benefit of repeating what I have already said is

But the reality is that

A) The government bought its own debt

B) Under accounting rules properly applied that cancels it

C) It has confirmed that the debt is effectively cancelled by not paying interest on it

D) There has been no resale of any urchases debt

E) Around the world there have been almost nil resales of purchased debt – the US has just tried it, very, very gingerly

F) There is then no evidence dent will, be resold F, and if so in what amount

G) There has been no decision here to try doing so

H) It can fairly be argued this is new debt if it is sold

So accounting follows substance, and that is the debt is cancelled

And that’s the right treatment, correctly applied in this case

And with respect, whatever your motive form the false accounting you request it is not evidenced based

It would be fraudulent accounting in that case

So, respectfully, stop wasting my time

Repetition will now lead to deletion: I have addressed all issues