This weekend much attention will be drawn to the use of the Isle of Man for VAT abuse. It is a story I know well, and in which I can fairly say I have played a part. This is because in 2007 I noted something odd about the Isle of Man government's accounts. As I put it at the time:

To put to simply I noticed an odd fact about that income. When I compared the VAT that it claimed to receive in its government accounts with its declared GDP the ratio was 21.7%. That's odd as their maximum VAT rate is 17.5%. It's even stranger as the UK, using a slightly more onerous VAT regime which is however broadly similar to the IoM's collects just 6.1% of GDP as net VAT revenue.

As a result I said that the UK was subsidising the Isle of Man to the tune of at least £233 million a year to be a tax haven - which was well over a third of its government's income at the time.

To understand this it has to be appreciated that the Isle of Man and the UK share a VAT system. The Isle of Man might be a tax haven, but unlike Jersey and Guernsey, it operates UK based VAT, as it had prior to 1973 and the arrival of the EU operated UK purchase tax for many decades. There is literally no difference between the two jurisdictions' VAT systems.

And, to make the admin easier what happens is that the UK and Isle of Man operate the systems in common. As I put it in 2007:

The ... UK and the Isle of Man share a ‘common purse' agreement on VAT. This means the Isle of Man's VAT is paid into the UK Exchequer, in effect. And then the UK gives it a payment in exchange based on a formula which is unpublished but which clearly has nothing to do with the real level of economic activity in the Isle of Man.

In 2007 the Isle of Man was none too happy about my allegation, which was reported in the Observer. All sorts of unkind things were said of my abilities but the simple unavoidable fact was that no state could recover more in VAT then the headline VAT rate multiplied by GDP. Why I was the first to spot this is a good question. If just so happens that I was.

Suffice to say that I was proved right. The UK was, in effect, wholly inappropriately giving the Isle of Man a significant part of its government income without there being any economic justification for doing so. This money it then used to offer low and zero rate taxes to tax abusers who in return undermined the UK tax system. It would have been hard to make up a story much more bizarre.

To cut a long story short, I repeated my suggestions in 2009 and in October of that year the UK government announced a change in the rules. My popularity in the Isle of Man was not too high at the time, and fell further when the rules were revised again in 2011, by which time pretty much all the change that I had said were required in 2007 had taken place. In addition, welcome transparency had been added into the arrangements, part of which let me appreciate that the Isle of Man was not above restating its GDP to try to gain favour in this relationship.

As I noted in 2011, by then the withdrawal of the subsidy had cost the Isle of Man a total of £215 million a year, which was very close to the sum I first calculated in 2007 of £233 million. This amounted to about a third of the Isle of Man government's income at the time. My role in denying them this revenue has long been acknowledged in the island.

Now stories relating to the Isle of Man and VAT are back in the news, so I wondered if the abuse reached government levels, again. A little research shows that quite emphatically they do. The reality is that it still appears to be true that the UK is subsiding the Isle of Man to be a tax haven. My estimate that the current subsidy may be more than £70 million a year. The scale is not as big as it was, but it's still serious. As ever some data helps explain the conclusion.

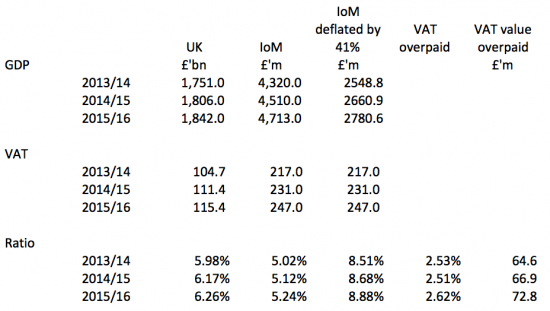

All the data referred to in what follows is summarised in this one table:

UK GDP data is from HM Treasury and VAT revenue from budget data. Similarly, Isle of Man data for GDP and revenue comes from Isle of Man government published sources. The first two columns compare these ratios at face value. The Isle of Man now seems to collect less VAT as a ratio to GDP than the UK, which is a complete reversal of the situation observed a decade ago, and so it would appear that all is now OK with the world, and that the shortfall might be explained, logically, by the higher level of supply of financial services in the Isle of Man economy, with these sales being considered exempt for the purposes of VAT.

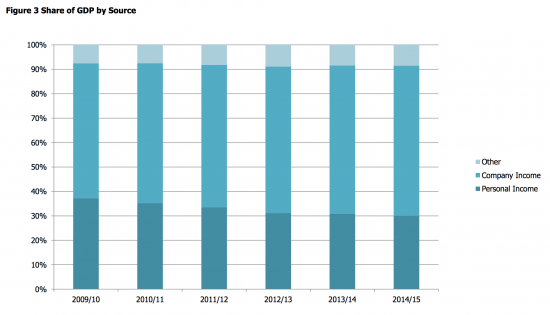

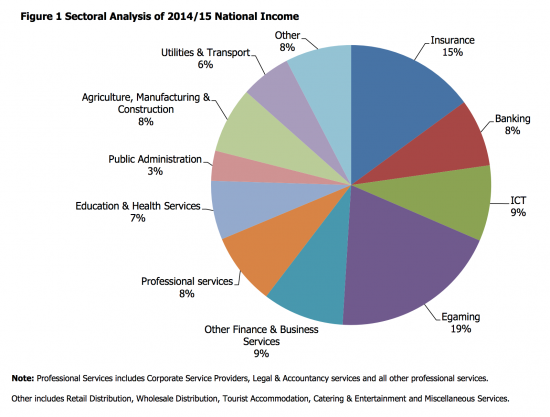

Experience has, however, taught me not to take numbers at face value. I thought I'd rummage a little deeper because what we now know is that GDP is a notoriously unreliable indicator of national income in a tax haven, as Ireland has proved. As we now know the real economy there is vastly lower than the GDP figures imply. So I looked into the Isle of Man's GDP and found this (page 8, here):

Sixty two per cent of the Isle of Man's GDP is corporate profits. For comparison the UK equivalent data (from table D in the PDF download here) is 21%. To put it another way, 41% of Isle of Man GDP is made up of corporate profits that flow through the place, but which do not stick there (of course), which do not represent sales arising or value added in the island. Knock this out and the result is a much better indication of what really actually happens in the island on real economic activity that might happen there, which is, of course, the basis on which VAT can be recovered because VAT relates to sales, not corporate profit flows. And when this is done then it is readily apparent that the rate of VAT attributed to the Isle of Man is still way over the odds when it comes to the VAT common purse. It is collecting nearly 9% of GDP in VAT whilst the UK, which has an identical VAT system, collects just over 6%.

The result is obvious: we are still paying the Isle of Man to be a tax haven. The subsidy is now likely to exceed £70 million a year.

And in case you are wondering where all the profits come from, page 6 of the Isle of Man data already noted explains this.

Let's be quite clear that the egaming earnings of the Isle of Man are not domestic. It's a pretty bleak place, but the whole island does not egame constantly as a consequence. Nor are 15% insurance or 8% banking or 9% other finance sectors mainly domestic either (and all are VAT free, of course). Finance makes up about 10% of UK GDP (give or take). Add these together and they are 51% of GDP. If 10% out of that total is domestic I'd be surprised. The rest is excess profit flows having nothing to do with domestic activity. That's 41% to eliminate then - or exactly the difference in profit rates, noted above, corroborated in a different way.

The evidence is clear: current rules are still letting the Isle of Man get away with VAT claims against the UK which seem excessive. I am aware that the situation has been under review, but the reality is that it's now clear that nothing has yet stopped the VAT subsidy to the Isle of Man to be a tax haven. It's time it was made clear that this has ended, for good.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Habe I got this right: you knock out 41% of the IoM’s GDP to remove “excess profit flows having nothing to do with domestic activity”, but then compare to 100% of the UK GDP?

How much of the UK’s GDP is “excess profit flows having nothing to do with domestic activity”? Surely not all of the work of the bankers and insurers in the City of London, or of the investment managers in Mayfair, relates to domestic sales? No UK VAT on most services if the customer is in business elsewhere in the EU, or outside the EU.

I left normal profit rows in other words

I restored parity

That’s what real comparison requires

Yes, but it looks like you are comparing 60% of IoM GDP with 100% of UK GDP. To be consistent, surely some of the UK GDP should be left out of account in exactly the same way, for exactly the same reasons.

If not, why not?

I am just cutting out of IoM GDP the misrepresentation created by profit flows that have nothing real to do with the IoM at all

That means I am trying to compare like with like which is what any logical basis for comparison requires

You have a problem with that? Would you rather use distorted data?

All I am doing is leaving the same amount of profits data in both accounts. What’s wrong with that? Are you saying the Uk is not big enough to be benchmark data?

I am just trying to make sure we are comparing apples with apples here, but clearly I am not expressing myself very well.

Let’s take 2015-16 as an example.

You compare UK VAT revenues to UK GDP – 115.4 / 1,842 – and get 6.26%.

You compare IoM VAT revenues to IoM GDP – 247 / 4,713 – and get 5.24%.

So as a percentage of the gross GDP, the IoM is collecting less VAT revenue than the UK. Perhaps because it has a larger fraction of revenues from activities that are exempt from VAT, such as insurance or financial services. Perhaps there is another reason.

Then you cut the IoM GDP by 40% to remove “excess profit flows having nothing to do with domestic activity”, and say that the IoM is collecting 8.88% of this reduced GDP as VAT, giving it a VAT surplus compared to the percentage based on the gross GDP of the UK.

So my simple question is, are there any “excess profit flows having nothing to do with domestic activity” in the UK? Or to put the other way, does the UK’s GDP have any “misrepresentation created by profit flows that have nothing real to do with the [UK] at all? If so, shouldn’t that be taken into account too? If no, why not?

(You appear to be saying that only a third of the IoM’s corporate profits relate to domestic activity, but all of the UK’s do. And that all of the VAT relates to domestic activity in both cases. Given the place of supply rules, that is not necessarily the case, of course.)

I have adjusted the IoM to the UK profit rate – which presumes the UK has a normal profit rotate, which given disparate sized is a wholly reasonable assumption

I have normalised in other words

And then done the comparison

What I am saying is that if the UK has a foreign profit element it’s wholly logical that the IoM should have the same rate and adjusting to that normal rate is what is required to get a fair comparison

I think statistically that’s very hard to argue with

As a Manx resident I would take issue with your assertion that the Isle of Man is a bleak place.

I was being a little tongue in cheek

Can I ask, for how many years had this overpayment been going on at such a scale?

40

What!!!

Now come on Richard, that’s ridiculous. So you are suggesting that such overpaymnet of VAT on this scale had been going on since soon after it’s introduction in the 1970s?

(I don’t want to question your credibility, maybe you misunderstood my query?)

I was right in 2007

I am right now

How do I know I was right in 2p007? I’ve already cost the Isle of Man £215 million a year

Now I want to call for the rest

My credibility is 100% intact

Maybe the VAT comes from all those (900-odd?) corporrate jets that everybody on the island seems to own 🙂

The IoM incorrect vat figures appear to be of a single order of complexity.

I imagine that GERS calculations/guesstimates are of a different magnitude.

Andrew makes a good point. You’re numbers are voodoo, just plucked out of the air. On the basis of what research do you get 60%? On the basis of what research are almost all your numbers? You are making arbitrary decisions about just about everything based on …what? …Gut feeling? Arbitrary comparisons with the UK are also questionable, since the economies of the Isle of Man and the UK are entirely different in just about every sort of metric you could mention. The demographics are different. Government different. Health Care. Welfare. you name it.

You answer Andrew with “Would you rather use distorted data?” – which is exactly what you are doing. If you want to pontificate on the Isle of Man and its economy, perhaps you should do a bit of real research first, hmm?

I plucked nothing I out of the air

I used published data and adjusted it for an obvious aberration

Do you know nothing how cut things work?

Andre let me assure you – most people couldn’t spot the differences, the financial services sector apart between Douglas and its near neighbours

And talking of near neighbours, if such an adjustment can be made to normalise Irish data it can be in the IoM

My statistics are valid

They are arbitrary. As clear as day.

It’s good economic analysis

Suggest an alternative if you don’t like it

And remember, it’s the logic that transformed the IoM government’s finances. It’s tried and tested

[…] Dame Margaret Hodge called an adjournment debate on tax abuse and the Isle of Man in the House of Commons yesterday. Her closing comments were of particular interest to me, referring as they do to suggestions first made on this blog on Monday: […]