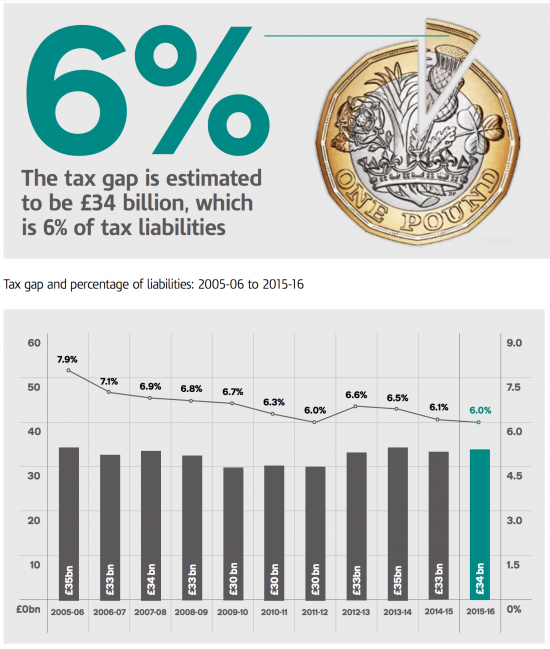

HMRC has literally just published its 2017 tax gap estimate. And, as I predicted to many, the answer is, as it has almost invariably been, that £34 billion of tax was lost in 2015/16. To put this in context look at this chart:

I have over time been deeply critical of HMRC's tax gap estimates, and I will be reading the latest report in detail this morning. But there remains at the core of HMRC's work a question of credibility.

The first issues relates to the credibility of these estimates. The chance that a pattern of behaviour such as this would, in value terms, be so consistently reliable over such an extended period is very low indeed. The very fact that it is now possible to say, with almost certain accuracy, that the UK tax gap will, according to HMRC, be a number falling between £30 and £35 billion is too predictable for the estimate to be entirely believable.

The second issue of credibility is that if this behaviour is so reliably predictable why has so little been done to address it? The claimed fall in the yield lost is noted, but does not answer that question.

The risk is that HMRC is producing data that looks like Soviet style tractor production statistics. And that helps no one.

I have suggested mechanisms to help address this issue already this morning.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The proportionate size of this estimate (6%) is so small and the consistency of it over time so regular that it beggars belief.

It is as though someone wanted to devise a figure (regardless of truth) that was small enough to seem reassuringly acceptable but large to seem real. But it doesn’t seem real at all.

You might say that

I couldn’t possibly comment…..

[…] credibility of the HMRC analysis. Richard Murphy, a tax expert and former adviser to Jeremy Corbyn, wrote on his blog: “The risk is that HMRC is producing data that looks like Soviet-style tractor production […]

[…] credibility of the HMRC analysis. Richard Murphy, a tax expert and former adviser to Jeremy Corbyn, wrote on his blog: “The risk is that HMRC is producing data that looks like Soviet-style tractor production […]

[…] credibility of the HMRC analysis. Richard Murphy, a tax expert and former adviser to Jeremy Corbyn, wrote on his blog: “The risk is that HMRC is producing data that looks like Soviet-style tractor production […]