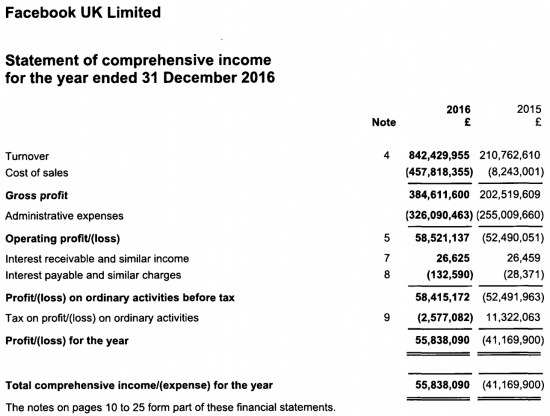

A year ago Facebook said it would shift its billing for its UK operations to this country from Ireland so that we could see what tax was really due in this country. The result is this UK profit and loss account for Facebook in the UK for 2016, which it has just published at the very last moment that was legally possible under UK company law:

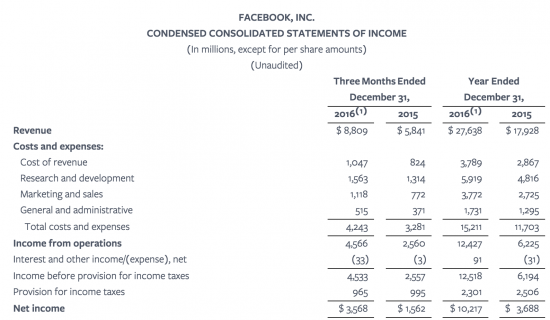

As I always tell my students, no data makes sense unless it's compared with other relevant and reliable available information. It so happens that Facebook provides me with that alternative data. It's in their 2016 worldwide accounts, published much earlier this year in the US, which data does, of course, include the UK result. This is their global income statement for 2016:

What I then ask my students to do when offering data driven essays is 'some analysis'. I don't actually specify what because I am well aware that at City we are open minded on the mathematical aptitude we require of students. In this case the data processing required to sense that something feels seriously amiss is limited,

Looking at the worlwide accounts sales are $27,538m and profit before tax $12,518m whilst the tax provision is $2,301m. That means the pre-tax margin is a staggering percentage 45.3% and the tax provision rate is 18.4% on profit.

In the UK in contrast the pre-tax profit rate is 6.9% and the tax provision rate a somewhat low, and unexplained by the tax notes, 4.4%.

It's really not hard as a result to form the impression from this new data that Facebook is declaring vastly lower profit rates in the UK than it is, overall, worldwide. And candidly, when the worldwide profit margin is 45.3% it is very difficult to think of any commercial logic that might justify that profit differential. I know that it will be claimed to be due to the intellectual property having been developed in the USA. But let's be candid; IP is worthless without a customer and it is UK customers who create the value added in this country, and not the IP as such.

In that case I am of the opinion that in such an extraordinarily high margin business the only real basis for allocating profit to a country is on the basis of revenues earned there, which are what create the value in the IP. And in that case if profits were allocated to the UK at the worlwide profit margin then Facebook would be declaring £380 million of profit here. If they paid tax of about 20% on that, as we'd expect, that would be £76 million in 2016. The reality is that instead they eventually expect to end up paying just £2.6 million on their 2016 UK results.

That does not make sense. It feels like Facebook are still making a mockery of the UK tax system and their UK users by not paying their fare share of tax in this country, whilst their accounts, which they said would help us understand what they do in the UK, do nothing of the sort. In fact, they're massively opaque and give us little clue as to why profits are so low. Indeed, you could call the accounts pretty unforthcoming with some justification. Nor do they try to explain the low tax charge in any meaningful way, whilst the accounts are published as late as they could possibly file them as if to show how embarrassed they are about what they're doing. Overall they can fairly be described as a tax PR disaster.

Facebook has a long way to go before it can be said to have appropriately explained its UK tax payments. And that failure is perhaps the most baffling thing about all this because it really does not look like, based on its worldwide tax rate, that doing that would be hard to do.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It sounds like a good settlement would be half way between the established situation that content creators are the value adders, and your claim that content buyers are the value adders.

This can easily be achieved by setting corporate tax at 0, and taxing land value and consumption instead. It would also liberate all those accountants involved in various ahem ‘schemes’ to go and work elsewhere doing something useful like planting a few trees.

Ah, so you’d like the owners of capital to go untaxed and instead impose the most regressive taxes of all – on consumption – which the rich do least of in proportion to income.

Are you a man possessed of a small fortune wishing to make it bigger Paul?

Consumption taxes can be designed to be regressive , flat or progressive. Even you have said progressivity can be designed in. It’s entirely within the power of the State to understand about optimal tax design and implement accordingly. Again something you have said.

As things stand in the UK, VAT is regressive because of the exemption on food. I’ve seen what the poorest eat, and it is overwhelmingly not in the VAT exempt categories. Applicable amounts of benefit claims can be increased accordingly.

Consumption taxes can be made more progressive than they are

Only income and wealth taxes are truly progressive

And you are ignoring entirely that governments do not tax to raise revenue: they tax to achieve social and economic goals, inclduing curtailing inflation

Check out the Joy of Tax, I suggest

Inflation has averaged 2% over the last 7 years or so.

You recently recommended a target of 4% and a central bank that is part of the Treasury.

If inflation is below recommendation that suggests that taxation is too high, and tax cuts would be an excellent way to achieve that higher inflation target, especially ones that encourage investments that make us more productive.

Thi have no problem with appropriate tax cuts

I would start with VAT and employee NIC

Those woul deliver

Yours would do the reverse and reduce growth

You must have done the SES course and be thoroughly indoctrinated in Georgism;o)

If Facebook are under paying tax surely they need to be reported for criminal proceedings. To whom? And will you do it Richard? I know if I under pay my tax HMRC come knocking.

No one is saying this is criminal

There is an interesting parapgraph or 2 in the notes section of the accounts:

1. General Information

“Facebook UK limited provides sales support, marketing services and engineering support to the Facebook group and acts as a reseller of advertising services to larger UK customers”

Which makes me wonder where advertising services to smaller UK customers (and how small / large is defined) are sold from.

12. Debtors (always worth a look)

Trade Debtors is up from – to 203m and Amounts owed by Group is up from 30m to 146m. Which makes one wonder about the routing of money to the UK business

13. Creditors (always worth a look) shows that the actual amount of £ paid over as corporation tax is lower for 2016 than for 2015 £2.68m versus £3.49m

And that the money the UK co owes to other parts of the group has rocketed from £7.3m to £196.5m

Finally in 15, the deferred tax balance is up from £25.1m to £28.1m. It will be interesting to see when the future taxable profits against which this can be used appear

I think the £196m the most telling – it gives a clear idea of the amount that must be shifting out of the HUk with tax relief attached

Also, in that note 1 above, “reseller” is a very carefully chosen word isn’t it?

Not seller, but reseller

Implication is that the UK company merely earns a commission, or a mark up on the advertising it sells….

The company appear to have been quite generous, paying out £ 207 million (The majority of its ‘administrative expenses’) to their 1,000 or so staff, at an average of around GBP 200K each. Wouldn’t the tax take on these earnings be at the higher 40% rate on the majority of each individual’s earnings, rather than the 20% Corporation tax rate if the earnings had been retained as profit by the company ?

I’m probably missing something, but surely the overall tax take to the UK is higher because of the high levels of rewards given to their staff ?

Much of this is share based

The tax due on that is not clear

Its a corporate tax issue and needs to be considered in those terms. The staff are not Facebook.

I have some experience with Share Option grants, and the company have 1 potential route to granting share options in a non-tax efficient manner, and 4 options in a tax efficient manner.

1) Unapproved Share Options – These will be subject to income tax at the recipients marginal rate, plus NI

Tax Efficient Route

1) Share Incentive Plan – The company is entitled to provide the employee with ‘free shares’ up to £ 3,600 per year, with the possibility of an additional £ 1,800 per year which can be bought by the employee

2) Save as you Earn – Allowable up to £ 500 per month per employee over 5 years

3) Company Share Option Plan – Maximum Option Value Is £ 30K

4) Enterprise Management Incentive – Not available to companies with over £ 30 Million in assets or over 250 Employees.

None of these would appear to offer sufficient routes to avoid higher rate tax on the majority of share grants, if we are talking about average compensation packages of £ 200K. (Unless the share grants are actually within any of the above limits, in which case the earnings would still be around £ 170K, so suffering a considerable percentage of that compensation at 40%).

Mr Fante – The decision the company appear to have taken to reward their staff has apparently quite legally reduced their corporation tax bill. Are you saying that you would have preferred them to retain the earnings as profit and paid their staff less, resulting in a higher level of corporation tax being paid, but with the exchequer losing out overall because of a reduction in the 40% rate which would have been levied on the higher earnings per employee ? Ideologies are fine, but they don’t pay the rent !

These may well be US options

I don’t have experience of US treatment of option grants, but I’m not certain what consequences there would be in the US if they have been granted to UK employees, and appear in the UK accounts ?

You may be able to throw light on this ?

I do not have the time

The consequences can be uncomfortable for tax

US options are taxed in the UK in the same way as UK options are.

The main difference is that UK options are more likely to be tax-efficient, as US option plans are not usually drafted with UK tax reliefs in mind.

The majority of US share plans I have seen (probably all, come to think of it – though I have discussed with some US clients how to get UK reliefs, they’ve normally decided not to bother) have been either unapproved options, or grants of Restricted Stock Units (essentially phased gifts of shares). Both of these result in the employee paying full UK income tax (usually under PAYE, with NI too) on the shares received.

In my admittedly limited experience, I can only see that a UK liability would have been created by the granting of options to UK employees, especially given its effect of reducing the UK operation’s corporation tax bill. Perhaps it creates some sort of tax advantage elsewhere ?

There is undoubtedly more to it, to which you are no doubt privy, so it’s a shame you do not have the time because it would have been instructive

I am not privy: what I know is Facebook only has US shares over which to grant options and they create problems

“…what I know is Facebook only has US shares over which to grant options and they create problems”

What problems are you talking about? US shares cause no tax problems in the UK.

So far as I’m aware they cause no tax problems in the US either, but I’m not a US tax expert.

I was merely pointing out that US options are not UK tax favoured

Is that contentious?

If so, why?

Not problems which would result in less tax being paid in the UK. That was my point. Was it yours?

I have no idea what point you are trying to make

Tell me what is your goal?

If IP should be taxed where customers are, does that mean that IP held in the UK in the aerospace and motor industries should be taxed in the UAE because we sell a lot of planes and cars there? This would be a boost for our industries as they have very low taxes there.

I can see the point you are making now.

I have to accept the consequences when appropriate

Surely the consequence of taxing profits from sales of IP products in the country of sale rather than the country of origin will result a virtually impossible tax situation for IP producers? If instead of aggregating all the profits from worldwide sales to one tax jurisdiction (where the IP was created) and dealing with the tax authorities there, one has to deal with the tax authorities in every country where sales are made, it would soon be impossible for people to sell IP abroad, certainly in a small way.

For example I know of a design artist (who lives in UK) who sells his work to customers worldwide, using the internet to deliver files. Are you suggesting he should have to deal with the tax authorities in every country he sells a single picture? Even though he’s never been to most of them?

This is an issue being actively addressed

It all depends on whether there is likely to be a virtual presence in the end destination

If there is no server and no physical presence there it is likely a destination basis wouyld not be imputed

If there is, then it would be

A physical presence may be quite limited though under plans under discussion

But I stress, the situation is fluid

But for your individual I suspect they’ll only be taxed in their home state

I can help you here Richard if you are busy.

It makes no difference to UK taxation on UK individuals if their options are US or UK.

Robert Ley’s summary is a good one. If Facebook paid their UK staff less they would pay more corporation tax but the exchequer would be worse off.

But UK options can be more effective and are not available here

No. Given the amounts involved UK options would make no difference.

I do appreciate when you said above that you don’t have enough time to learn about these things.

Your contributors here can be your tutor.

What the heck are you talking about?

I said US based options are not UK tax favoured

I was right

And you choose to be rude

I presumed you were a troll, and you are

No Richard you are wrong. It is perfectly possible for share options over US shares to be UK tax favoured.

You could read read HMRC’s ETASSUM to bring yourself up to speed on the matter.

I hope this helps.

Are the Facebook accounts simply yet another justification for what I have called “Infrastructure Charge” (see: http://outsidethebubble.net/2016/10/20/fair-taxation-on-corporate-profits-3/ ) and you have called “Alternative Minimum Corporation Tax” (see: http://tinyurl.com/ho6yy73 )?

These big companies seem to have no compunction about lying through their teeth. Look at this piece about Google: http://www.itv.com/news/2017-03-31/google-accused-of-being-less-than-transparent-after-revealing-latest-uk-tax-payments/

Something has to be done. The Conservative government simply don’t seem to be bothered about this but I hope that Labour really start to move on this. Corporation tax laws far too complicated and this approach, whatever it might be called, completely sidesteps the whole business. The increase in income to the Treasury would be quite considerable although I’m not sure I know how to estimate accurately.

As Andrew suggests above, these are restricted stock units, which have an advantageous tax and accounting treatment in the US (where Facebook is based and I presume most of its employees are) but not in the UK. They are treated like unapproved share options, taxable as employment income when they “vest” on the difference between the value of the shares granted and the amount the employee pays for them (mostly at 40% or 45% it seems here, if the average salary is £200k). See for example https://www.gov.uk/hmrc-internal-manuals/employment-related-securities/ersm20193

There were about 3m of them outstanding on 31 December 2016, worth about $85 per share, or $255m of value. That will give a significant tax deduction eventually, hence the large provision of a deferred tax asset.

About 1.4m were settled in the year to 31 December 2016, giving a potential tax deduction for about $130m, which at 20% is about the £22m listed in the tax reconciliation as “additional expenses deductible for tax purposes” (just under a disallowance which I expect relates to the RSUs granted in 2016 for which there is an accounting charge but no tax deduction). That explains why the accounts show a corporation tax charge in 2016 of just £2.6m not £11.6m – in effect, they are giving a large chunk of the profits to the employees, who pay a higher tax rate (and NICs to boot).

I would expect the UK company would be required to compensate its ultimate parent for providing the RSUs to its employees somehow. Perhaps an accountant can disentangle that more from the published accounts (which seem to be hosted for Companies House by Amazon Web Services, incidentally). In addition to the £196m intragroup payable there is a £145m intragroup receivable; coincidentally, the £50m difference is close to the UK operating profit.

If the options were tax-favoured in the UK, there could well be less income tax for the employee *and* a corporation tax deduction for the employer. Does that make them more effective?

That all goes to the UK tax charge, not the operating profit. Richard’s larger point is, I think, that the UK operations seem to be operating on a much lower profit margin than the workdwide business as a whole. You’d need to understand much more about the business to know whether that is justifiable. I wonder how much profit might be attributed to the UK under a formulary apportionment. The UK balance sheet seems very light, apart from debtors and creditors, but at a very broad brush level, if there are 1,000 staff here, compared to about 17,000 worldwide, that is about 6%. Taking that 6%, that might be about $200m of net income, compared to £60m in the accounts.

who audits FB accounts?

I think it’s EY

But I am working from memory