I have been asked to comment on the paranoia some on the political right are displaying at present about the cost of interest on the national debt which is, supposedly, a burden on generations to come.

First of all let me offer some data:

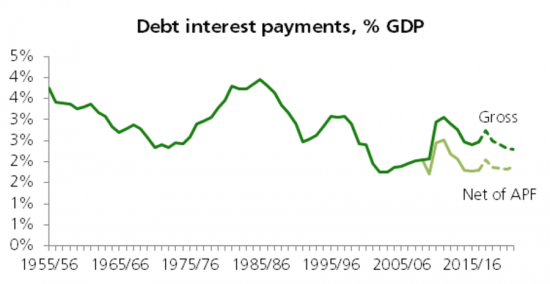

The chart comes from the House of Commons Library in June 2017: this is up to date. And what it shows is that the gross cost of UK national debt in terms of interest is about £49 billion nominally, but in reality it is at least £13 billion lower at £36 billion because of quantitative easing. The government cannot, of course, owe itself interest on its own debt that it owns itself, and so that part is not paid. If you want the clearest possible indication that QE debt only notionally exists then this is it.

So what is the reason for the obsession with the remaining £36bn or so cost? It can't be because it is excessive in proportion to the sums owing in our recent past, because it clearly is not. What is also very obvious is that the cost of our national debt is running at exceptionally low levels. We paid a lot more interest as a proportion of GDP in past decades when the debt to GDP ratio was much lower. If you want evidence that the paranoia about the national debt is misplaced right now then this is that.

And then I have to dutifully remind you who receives this relatively modest income. Pensioners are by far the most significant recipients. Government debt underpins most UK private pension annuities because the whole thing about an annuity is that you want it to be secure, stable, reliable, boring, but to at least be income paying to some extent for the rest of your life, which you can no better estimate as to duration than can your friendly neighbourhood actuary. In our national economy this is by far the most important role gilts have to play.

Now of course we can hate paying private pensioners a return on their savings. And you can, of course, hate their desire for a safe, stable, boring place to locate their money. It is, very obviously, utterly unreasonable of them to want to lend to the government in this way with no likely net return being earned, having allowed for inflation, at present. I mean, why wouldn't the Tories hate the Tory voting pensioners who are the biggest recipients of payments on the national debt which doesn't actually burden the next generation but is mainly designed to benefit the last? Perhaps it's because they think it was pensioners, like nurses, teachers and firefighters who crashed the economy in 2008 and we should now seek to wreak revenge upon them by denying them the chance they want to save in a way that technically costs us nothing.

And how do I know it costs us nothing? Because of inflation. That is running at about 2.9 per cent right now. Given that net national debt after QE is about £1.3 trillion this means inflation is writing off the national debt at a rate of £37.7 billion or so a year right now - which is slightly higher than the annual cost of interest paid, meaning the net cost to the nation of national debt each year right now is near enough precisely nothing.

But of course this net return of nothing is not only paid to pensioners. Some goes to banks which need gilts as part of their portfolio of ultra safe asset holdings. And some goes to insurance companies who need assets that behave remarkably like cash but don't carry the risk cash does of default if a bank goes down. And some just belongs to individuals. But it makes no difference, because they are all making nothing, and what is more, some of them might even be paying some tax on the privilege of doing so.

But the Tories are apparently still deeply resentful of this non-cost which is apparently, despite being in net terms nothing at all, a massive burden on future generations who try as they might will, in the Tory imagination, never be able to save up enough to pay that net nil rate of return.

As an example of economic madness the complaints currently being made about the cost of national debt by the Tories come as close to total economic illiteracy as it is possible to get. But they remain, despite that, the supposed party of economic competence in the public imagination. To say I despair grossly misstates my sentiment on that issue. And in the meantime the country is denied the benefit of the free money that could be used to invest in the future our children need because a net cost of zero per cent is apparently too high for them to bear.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The Tories are implementing disaster capitalism in order to strip the country of its assets. In the absence of any genuine disaster, to further their aims they’ve invented a couple, namely, the deficit and the debt. Simples! It works because people are too uneducated in these matters to be able to recognise this shabby little con for what it is.

According to HM Treasury overseas holdings of UK debt exceeds that held by ‘insurance and pensions’. Servicing that overseas debt takes over 2 days of national income.

If you could find a way to bring that debt servicing cost down and redistribute it so we all had an extra 2 days off work a year, then you would become even more popular then you are already!

And they are being paid net nothing

Can’t you follow on argument?

I think your time here is nearly over

@Chun-ying

“Because of inflation. That is running at about 2.9 percent right now.”

UK gilts running yield is in a range of 0.128819 percent to 1.254027 percent Figures from UK debt management office.

Even at the highest thats 1.25 – 2.9 or negative 1.6 percent return and if you have to pay tax on that coupon even less!

“Pensioners are by far the most significant recipients”

Yeah, right.

In any event, whenever you delve into financial services you always see a disclaimer “past performance is no guarantee of future results”. However on past results, i.e. 2010-2017, it looks like a good job was done because the cost of servicing the debt really is the main thing. Whether you want to claim it as nil or as 6 days national income as I do, it is a heck of a result.

You do realise interest paid is in national income?

It has a recipient?

I just thought I should ensure you knew all transactions have two sides

And don’t tell me some is paid abroad without ignoring we earn from abroad, please

The latest fixed interest gilts sold on 22 Jun 2017 were 30 year gilts at 1½% (TREASURY GILT 2047 – £2.25 billion – bids were 2.1 of available gilts), which even at the target 2% inflation is the government being paid to give a safe haven for private sector money –

http://www.dmo.gov.uk/documentview.aspx?docName=/gilts/press/220617conventional.pdf

The reason they are as Prof Murphy says are making nothing is that their repayments are made in pounds Sterling. Those pounds Sterling are declining, in real terms relative to other currencies and due to inflation both.

If the Chinese govt for eg gets £100 of UK gilts in interest payments and repayments (amount not to scale) that £100 buys less and less Renminbi when converted. This works for pretty much any foreign currency wrt Sterling.

One of my sisters was over from New Zealand last summer and couldn’t believe how cheap stuff in London was. Yes, the puny NZ$ is well up on Sterling.

Precisely

Your logic Richard is unassailable, but as becomes clearer to me as each day passes thinking about all this business of the ‘ deficit ‘ and pay etc etc is that whilst the picture we have collectively in the West of the World being divided up into ‘ good guys ‘ and ‘ bad guys ‘ which translated in the world of money is ‘ surplus ‘is good ‘ debt ‘ is bad trying to convince people by logic alone is not enough. And working from the part to the whole isn’t either . I’ve just read the Guardian piece about the debate yesterday where May compared our situation to that of the Greeks and put a comment on essentially saying there is no comparison, but whether or not she believes it she knows that pretty much every informed person knows the Greeks have had and continue to have problems over debt, without having the faintest idea other than what they are told by the BBC or elsewhere precisely and accurately what those problems are. But to say ‘ we don’t want to end up like the Greeks ‘ resonates at a gut level and she’s a canny enough politician to know this and then lay claim to being ‘ responsible ‘ . It’s a pity Corbyn doesn’t have either the knowledge , or the courage, or both to rebut this nonsense.

There’s a blog coming….

“It’s a pity Corbyn doesn’t have either the knowledge , or the courage, or both to rebut this nonsense.”

Depressing, isn’t it?

https://www.theguardian.com/politics/2017/jul/06/jeremy-corbyn-uk-firms-must-pay-more-tax-to-fund-better-education

When will they ever learn…?

As discussed on another thread, a standard letter which could be sent to all our MPs, setting out the reality of money creation in the UK, drafted by Richard, and perhaps open to editing suggestions from commenters here before being finalised, could be in order?

It could be re-sent, and re-sent, every time one or other of these absurd utterances passes the lips of politicians!!

Give me time….

In a Guardian article today Polly Toynbee tells us “The social care crisis can only be tackled by taxing old people’s property”. Does that fall under the same falacy?

Yes

And no

I do think we need to txt property, but for different reasons

“Give me time.”

Of course it should really be the other way around: letters explaining the reality of money creation in the UK, with its own sovereign fiat currency, should be sent *from* every MP, *to* every voter, so that the general population fully understands *exactly* how public finances work.

In fact, it should really be mandatory for any MP to have an understanding of, and a duty to communicate, the truth as to how money, public spending, and taxation, function in the UK.

Not to do so is not only negligence, but tantamount to misrepresentation and fraud.

Agreed

Yes, please do it! I find I have to re-read and re-think these explanations several times because of the overwhelming presence of the blind assumptions underlying almost every news bulletin or political comment. So the politicians, who are always adapting their focus to current political interests and thereby blinding themselves even more, need to have their attention drawn to it all even more frequently.

Even if Corbyn did say this, most people would not get it.

It’s only me but I have tried even amongst supposedly educated middle class professionals to discuss this matter and it’s always ‘Well, I don’t about that’ or some other dismissive comment that sums up their culture of contentment.

One ex head of education services I raised it with told me it was ‘just theory’!!

Do any of them realise that they are next? Apparently not!

This is so true. I’m relatively new to this blog and have also recently started reading Richard’s book. It is all lot to try and get your head around and figure out even though my interest in the subject is growing all the time.

I suspect some folk just don’t want to research and are happy to be peddled the same old rubbish from certain outlets of the MSM.

DEBT INTEREST IS HISTORICALLY LOW! Great post, regrettably I admit to believing part of their propaganda, prior to following your blog. Thanks [for bothering] and for a plain English and more importantly a numerate explanation.

How can something so obvious be hidden – in plain sight? The ‘magic’ of Tory and Establishment being “not straight” with the UK population, as Sir John Chilcot said yesterday. Or as Enoch Powell bitterly complained “the Whig’s true vocation of detecting trends in events and riding them skilfully so as to preserve the privileges, property and interests of his class” [1].

Interest rates are kept close to zero, which the BoE can control, however inflation is not under direct BoE control and the effects of poor exchange rate and Brexit are yet to fully come though. The wealthy are more afraid of inflation than this fictitious debt burden, where in contrast for the ordinary citizen rent and private debt is the crushing burden.

[1] Like The Roman: The Life of Enoch Powell by Simon Heffer (pub. Weidenfeld & Nicolson) 1998.

It’s staggering that they can get away with these lies

they’re OK with inflation so long as it only is in asset prices

Spot on! No-one seems to pointing out that debt interest payments are at an historic low.

Given that this interest goes to the wealthy I am always puzzled why they worry anyway – but I guess they are clever enough to figure out that extracting rent directly from the workers gives a better rate of return so shrinking the state is their preferred option.

There was so much economic nonsense in PMQs yesterday I do not know where to begin. I think the PM should pay a fine every time she says something that is technically wrong or misleading otherwise we cannot hope to have a sensible discussion.

Agreed

A hefty fine to indicate the significance of the crime and its impact

“Given that this interest goes to the wealthy I am always puzzled why they worry anyway”

I think it’s known as having your cake and eating it!

Richard, I think this proves conclusively that austerity has never been about the supposed economic risks of excessive debt. It has always been, and remains, an ideological assault on the public sector and collective action. The tragedy is that the narrative of profligate public spending by Labour and dangerous levels of debt that the Tories and their right wing media friends started back in 2010 was never effectively challenged at the time by the Labour Party and it became conventional wisdom. Thankfully, that conventional wisdom is now being seen for what it is — a simplistic piece of ideological nonsense – largely because of your efforts and others like you. But please do not let up, the ideology of austerity is reeling but it is still very toxic and powerful. Indeed, I had the unfortunate experience of reading the Spectator the other day and the revolting spectre of complacent (and downright nasty) right wing thinking is still alive and well amongst the privileged of this country, even as the ship of state crumbles on the rocks of Brexit. If you need to put some fire in your belly I suggest reading it from time to time. Keep up the good work.

Has anyone told the Norwegians that their Sovereign Wealth Fund is pointless? They’ll be furious.

Have you noticed that is not national debt? It is national capital, which is something very different?

Imagine a new graduate going for an interview at the NHS and he is offered two jobs. One is a middle management position with a salary of £55,000 pa and the other is as a lavatory attendant at the minimum wage. The first option will involve paying some income tax at 40%, with the second he will pay virtually no income tax and possibly be eligible for working tax credits etc. Which option is he likely to accept?

The obvious point is that the next working generation must be paid enough to keep the whole system rotating.

Again another well-argued and presented piece from a master. BTW, I am a great fan of yours, especially after reading your recent advocacy of Scottish Independence and your reasoned arguments on the flaws in the GERS figures.

However, (& excuse my ignorance) can you explain the label in the graph, APF. Despite Googling the term I cannot find a plausible explanation or definition for it. Can you enlighten an ignoramus?

No problem!

Try here http://www.bankofengland.co.uk/markets/Pages/apf/default.aspx

Is this a blog post correct and if so is this something that the UK should be doing?

https://blog.p2pfoundation.net/sovereign-debt-jubilee-japanese-style/2017/07/06

This is just a description of quantitative easing, which works for debt cancellation

If you search my name and quatntitave easing you will find I have written a lot about it

Very clear analysis. One thing was bothering me yesterday – lots of government ministers running round saying we’d be the new Greece if we didn’t get the deficit under control. If all that you say and write is true (and I’ve no reason to doubt that) then why did Greece end up with such a real problem? I’d love the ammunition to combat the Greece argument.

I’ll do a blog

I look forward to that!

Neil

Greece doesn’t issue its own currency, therefore cannot monetise government debt and does not set its own interest rate. It is therefore put into the same disadvantaged economic situation as a company, a household or a local authority in that respect.

See blog now out

Thanks – that seems clear.

I was wondering about the Greece comparison, can it not be debunked because Greece is part of the Euro and thus do not have monetary sovereignty? I assume Greece don’t have access to an unlimited amount of cash (like the UK etc.) to invest in public services to boost growth. Also I think theres a lot of corruption and people not paying taxes which didn’t help the situation, but I could be wrong.

A blog on this now published

Richard, have you read this by Prof Richard Werner of Southampton Business school – https://professorwerner.org/shifting-from-central-planning-to-a-decentralised-economy-do-we-need-central-banks/ He sounds a bit kooky to me claiming that central bankers are deliberately trying to obfuscate any empirical research into the fundamentals of their economic theory and more suprisingly deliberately trying to create asset bubbles(and all the suffering that goes along with it) to structurally change their respective countries. What is your and other professionals/academic’s more informed opinion on this?

Richard has his merits: his impact on the world has been enormous because he created the idea of QE in Japan and it has spread

But I have to admit I find his political judgements (and they do inform all our work) rather difficult on occasion. The result is I attach little credibility to his work and it seems to be generally treated as very peripheral because his framing is so hard to accept

Sorry I didnt quite understand you properly. Are you saying that he is right about the technical bits but his politics is difficult? Can you give an example please?

I am sorry – but I cannot see to what you are replying when I moderate

Who and what are you referring to?

I think Werner’s POV is informed by his work in his book The Princes of the Yen – where he depicts the battle royale between the American influenced Bank of Japan and the Japanese Finance Ministry over fiscal policy that the bank eventually won. The consequences of this has been written in the history of the state of Japan’s sclerotic economy ever since.

I understand why he might have a bias against central banks therefore. But that does not mean that they will all behave the same.

But then von Hayek (the Arch Deacon of neo-liberalism) distrusted the State because of hos witnessing of Nazism . And that anti-state ethos is a central pillar of the neo-lib world.

@richard – I was replying to your comment –

“Richard has his merits: his impact on the world has been enormous because he created the idea of QE in Japan and it has spread

But I have to admit I find his political judgements (and they do inform all our work) rather difficult on occasion. The result is I attach little credibility to his work and it seems to be generally treated as very peripheral because his framing is so hard to accept

Richard has his merits: his impact on the world has been enormous because he created the idea of QE in Japan and it has spread But I have to admit I find his political judgements (and they do inform all our work) rather difficult on occasion. The result is I attach little credibility to his work and it seems to be generally treated as very peripheral because his framing is so hard to accept”

To that my reply was – “Sorry I didnt quite understand you properly. Are you saying that he is right about the technical bits but his politics is difficult? Can you give an example please?”

I think Richard has done some interesting technical work

But his politics seem dedicated to some rather odd views about dismantling functions within the state that I do not think if can function without, such as central banking

Yes, I found his suggestion to do away with a central bank quite odd too considering it was the private banking sector that came up with the idea of a central bank to backstop them. Maybe what he should have suggested is to do away with the idea of a central bank so independent that an elected govt cannot scrutinise it and bring it back under the purview of a government.

It astonishes me that as Tories they would not cash in their assets for short term gain, nor would they minimise borrowing for their businesses when the alternative is to fund expansion from dividend, so why then do they insist on selling off every public asset and refuse to borrow to invest when it comes to State Finance.

They tell us they model the State Finances on domestic or business finances (which is not exactly a sound thing to do) yet even this doesn’t compare with reality.

Were it not for a tame Press their lies would expose themselves.

Don’t be too hard on Leung, Richard, it’s often useful to hear what counter arguments might be made (although he made it a bit personal!). So if about 30% of bonds are held by “overseas” investors, and if you strip out the BoE holdings that approaches 50%, are there no implications? I get your point about inflation reducing the debt by even more than the interest paid out, but will that not lead to overseas investors looking elsewhere? Do we not need them to continue to want to buy them? This is a complex area that also involves our balance of payments deficit and the sterling exchange rate which makes it easy for the debt paranoia to thrive.

We don’t need debt!

If they don’t want it QE it out of existence and they have sterling instead

There is no issue here. You are subscribing to myths

When foreign exporters earn sterling, they can do three things with it:

1: Invest it in sterling financial assets (ie Gilts)

However, like you point out, if they suddenly decide, nope… We”re not doing that any more, they can proceed to:

2: Exchange their Sterling holdings for their own, or another currency (the upshot of which will be to improve circumstances for our exporters as sterling declines, but make those foreign exporters’ goods and services more expensive, losing them market share), or:

3: Sell their sterling assets and purchase any goods and services available for sale in Sterling.

Neither of those alternatives are necessarily a bad outcome for the UK!

I’m going to be really naive, apologies in advance….There has to be a ‘but’ here, a caveat. Ok, so we don’t actually have the debt that the politicians say we do; we just do QE, maybe raise taxes a little, inflation at a steady and controlled level pays down any debt that’s created and use the QE to pay teachers, firefighters and nurses a little more and invest in schools, hospitals and social care. Everything will be just dandy…but…but…what?

Let’s make an assumption (this might stretch credulity for some people) that politicians – including anyone to the right of Jeremy Corbyn – are not evil people, that even Tories go into politics thinking that the policies they espouse are for the health of the nation, that entrepreneurs and risk takers should get a little more and trickle down works (I read Ha Joon Chang’s “23 things…Capitalism” book, which says it’s nonsense). As I say, let’s make the ‘MPs are not evil and doing it for the best’ assumption, then why don’t they see these facts about national debt? What would they say is wrong with your opinion Richard? If there are no ‘buts’ then surely not following this basic concept is just an act of harm on themselves and the country.

I said a couple of weeks ago that the Tories are effectively killing off any future electoral prospects by not dealing with housing and student debt. The journey that many people in their 40s/50s/60s took from being a ‘right-on’ student to a ‘true blue’ due to the acquisition of a house, wealth and stuff is shutting as people in their 20s/30s have massive debt and no prospect of owning a house. Do the Tories even realise they are killing themselves off? Apologies if I rambled a bit, but if there is no ‘but’ to what you suggest on these pages, then why is it not being done?

These politicians are the slaves of defunct economists

They may think they’re right but the reality is the ideas they use are from deepest darkest history

So if they’re benign they’re ignorantly so, in which case they might as well be malign because the outcome is the same

And they are responsible for their ignorance

But so far people won’t kill them off, politically, of course

They want to nurture the increasing trend towards oligarchy in the hopes they maybe part of it. That’d be as Eloi, of course, not Morlocks 🙂 Power-mad, basically.

“Debt” is an interest-rate control mechanism. Let me explain.

Government spends by instructing the Bank of England to credit the commercial banks with the required reserves. This is then reflected in the bank account of the target of that spending (a pensioner, for example)

Those reserves sitting in the commercial banks Reserve Account at the BoE earn no interest, so the banks will naturally try to lend it to other banks (they are not allowed to lend to other non-government entities) to earn interest. Without intervention, this would chase the Interbank rate to zero, or towards the IoR rate if there is one in place.

Instead the Bank of England offers the commercial banks interest-bearing bonds, or gilts, at the target interest rate to soak up the available reserves, and stops the interbank rate dropping below it.

Agree with that

Thanks

the problem is not just the debt compared to GDP which has been argued out of the equation, the biggest problem is personal debt per capita. Inflation as such is a good tool to putting money back into the system nd interest rate rises help to counteract this, and promotes a healthy economy. However, with people maxed out on borrowing due to the belief that borrowing more when the interest rate is low, should first have looked at what is sustainable for them personally, factoring in the inevitable rate rises, as otherwise the negative equity factor will impact people massively when the housing bubble and equity mkt bubble pop, due to QE finishing

Respectfully Brian, that’s asking people to do due diligence to a level most organisations cannot and what you are actually espousing is libertarian individualism in absurdum

Couldn’t you and Ann Pettifor pitch to the BBC five half hour slots over five weeks to educate the media types and the general public about Money and Tax?

I know as ballance they may have to give Mat Ridley and James Delingpole a five week slot too but it would be worth it.

I will talk to Ann

I just posted a video of Ann, by pure coincidence

[…]But they remain, despite that, the supposed party of economic competence in the public imagination.But they remain, despite that, the supposed party of economic competence in the public imagination.[…]

This is actually a logical consequence. Most people understand how to run their own finances where debt is indeed a burden.

Now clever think tanks used this knowledge and transferred it one on one to the public sector to argue that only austerity can and will fix all problems.

Their interest however is more or less to just shrink the government so that it can be drowned in a bath tub but that is a lot harder to sell (well, except when you live in the U.S.).