Vodafone wrote a letter to the Independent on Sunday on 13 December saying:

Your article of 6 December (“Tiny new fines no threat for global firms”) asserts that Vodafone has engaged in “abuse” in its tax affairs. I would like to make clear we reject this suggestion entirely. We do not artificially divert profits to reduce our tax liabilities or otherwise operate in a manner amounting to “abuse”. Furthermore, we already report our tax contribution on a country-by-country basis; we were the first telecoms company to do so.

Nick Read

Chief financial officer, Vodafone Group

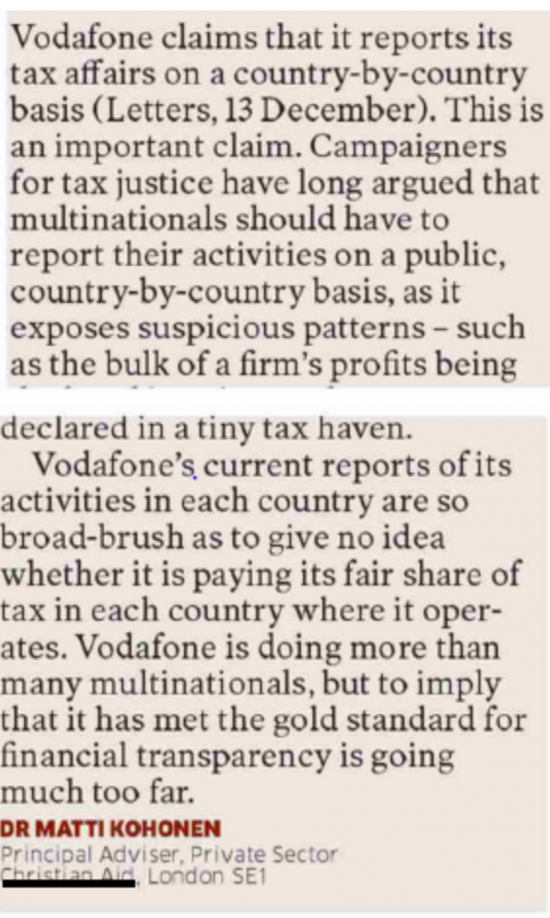

Yesterday Christian Aid replied saying:

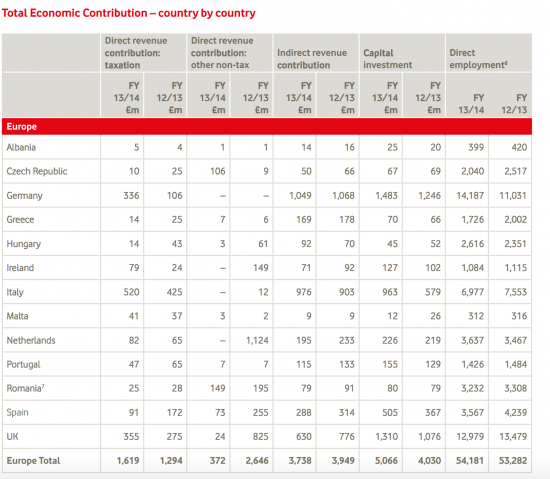

Matti Kohonen is right. Here's an extract from Vodafone's latest report:

So we have all the usual tax paid nonsense from the PWC total tax reports disclosed in some detail. And the number of employees and investment. But almost all of it is meaningless for three reasons. These are that:

- we have no clue what sales are, and what part of that is intra-group, by country,

- we have no idea what profits are by jurisdiction, and

- we have no idea what employees are paid by place.

To be useful accounting data has to be:

- Relevant

- Reliable

- Consistent

- Complete

- Comprehensive

- Comprehensible

The omitted data means that most of what Vodafone supplies does not meet these criteria. In fact, it's worth little more than PR, and has to be treated as suspect in the same way as a consequence.

Vodafone know all this. They're not stupid. It's time they stopped the BS and started delivering what's needed.

What is needed is explained here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: