The criticisms of the People's Quantitative Easing idea by Ben Chu in the Independent and in the Economist. These seem to come down to the following issues:

1) Why not just borrow from the markets?

2) It may cause inflation

3) It may force Mark Carney onto a plane to Toronto as it threatens Bank of England independence

4) It did not work in Venezuela.

I should add, however, that Ben Cu agrees that:

a) There is a need for new investment

b) There is no need for the government to run a surplus

Let me deal with all these issues since it seems important to do so.

The economic background

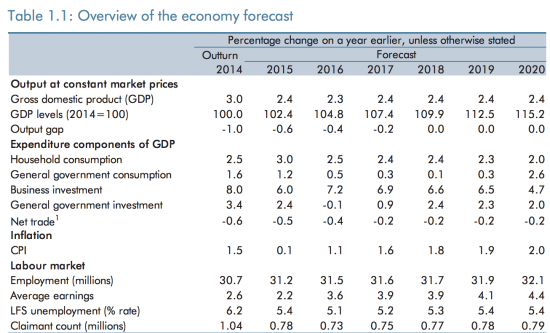

First, let me contextualise this. This is a summary of the July 2015 economic forecast for the UK as summarised by the OBR:

There are three things to draw out of this:

a) Falling government investment

b) Massive increases in anticipated business investment

c) Above inflation increases in household consumption supposedly matched by significant increases in average earnings.

I accept that the forecast on falling government investment is real, and may not even reach the levels noted.

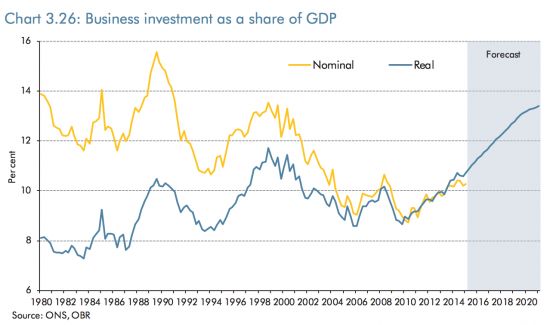

The figures for business investment are surreal: in terms of time trend the requirement for business investment looks like this according to the OBR:

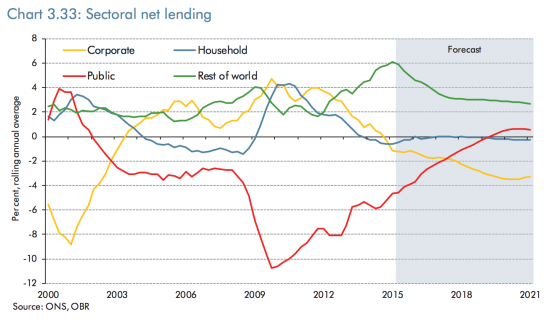

Real investment by business has, to make the economic forecast work, have to reach unknown record highs. To achieve this business has to borrow heavily. The sectoral lending balances show this:

What this means is that moving from a position of net saving business is apparently going to move to borrowing maybe £60 billion a year, or a little over £300 billion over the period (table 1.10 in supplementary economic tables, here).

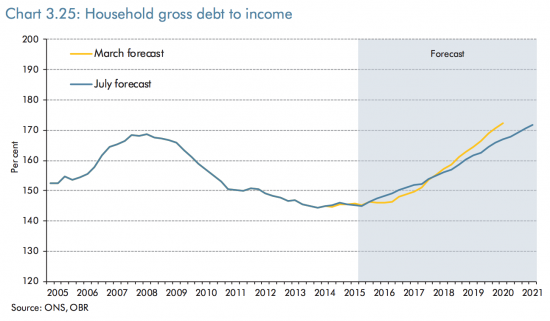

And this is the data on household borrowing:

The OBR forecast on personal debt suggests that between 2015 and 2012 it will increase by £810 billion (from £1,700 billion to £2,510 billion) from the beginning of 2015 to end of 2020 according to the OBR (table 1.11 in supplementary economic tables, here).

I will be candid, I think that these forecasts are utterly implausible. In particular, I cannot see any reason whatsoever why business should invest in the way that is forecast when this is contrary to all recent past trends and nor can I see the enormous increases in household borrowing arising unless there is a massive house price boom despite restrictions on tax relief for by-to-let borrowing and the substantial difficulties most younger people are facing getting onto the housing ladder. But that being said is forecast to indicate that:

a) The economy can absorb investment of more than £50 billion a year, and

b) Can absorb new money creation of almost £200 billion a year (because all new lending is new money creation, by definition) and

c) Not suffer an increase in inflation in the opinion of this government.

In reality I accept the first of these, think that the second is too high to be realistic, and think that if a more realistic figure of money creation was substituted then it is true that the risk of inflation will be limited precisely because even at the end of this period I suspect there will be net under employment of labour in the UK and continuing poor productivity.

Using this background data on the capacity of the UK and the potential borrowing risks it faces let me answer the questions.

Why not just borrow from the markets?

There are at least three totally reasonable answers to this question.

The first is why do so when Peoples Quantitative Easing avoids a real interest rate charge arising? What is the point in making such payments when they are not necessary?

Second, if George Osborne is right in his analysis then there would be no capacity to borrow (as the sectoral balances indicate) but there would remain, as is clear from the lack of forecast govern investment a need for that investment to take place. In that case People's Quantitative Easing would be the only option available for funding this investment.

Third, why over heat the economy with more debt when it is obvious that this has caused financial crises and the government may need that capacity in reserve to deal with any financial melt down, the prospect of which looks very high if anything like the increased forecasts in debt were to occur?

Will it cause inflation?

Inflation happens, according to the quantity theory of money when (in broad summary) the amount of money increases faster than underlying economic activity.

I am bemused how PQE funding of, say £50 billion a year over a few years, could give rise to inflation when, apparently the economy can absorb £1.1 trillion of new money created by bank lending over the same period. This simply makes no sense at all. PQE created money has no more, and because interest need not be paid, may well have much less inflationary effect than privately created money and yet the focus is being given to PQE funds. I cannot see why. Worse than that, I think the suggestion is just wrong, most especially if, as seems certain these OBR forecasts are as wrong on growth as all that have gone before them have been but we do have the real under-utilisation of capacity in the economy that they imply.

It may cause Mark Carney to get on a plane to Toronto

Let's be clear about this: if the governor of the Bank of England does not like what an elected government wants to do then he has to go. If anyone is suggesting otherwise would they like to suggest what form of government we have in this country?

And if they also think that Bank of England independence means it can act above and beyond the will of parliament likewise can they say what they think that also means?

So, in my view if Mark Carney does not like the plan for People's Quantitative Easing if it were ever to come to pass my answer is that he should then apply for a P45 and a job vacancy will be advertised.

And might I at the same time counter the nonsense from both Ben Chu and the Economist that if people thought that the Bank of England was not in charge of inflation policy then inflation will become rampant? First, I would wager that the vast majority (well over 99% of people) in the UK have no clue that the BoE has such a responsibility. Second, if those who do really think that such decisions are wholly uninfluenced by the Chancellor of the day then I very politely suggest that they have suspended their disbelief in ways that our counter to sound analysis. I am quite sure that it does not happen like that, whatever the rules might say. The fact that the OBR is forecasting rate rises at the end of the year is, for example, the surest indication from the Chancellor to the BoE as to what they might do. Let's not pretend otherwise.

And finally, no one is saying that this puts the BoE in charge of investment policy. It is just the purchaser of debts, as is the ECB right now to the tune of €60 billion a month. The decisions on how the money is used will rest solely with the government. The BoE is simply acting as a bank, providing funding for that purpose in a way that Mark Carney and Mario Draghi have both said is technically and legally possible.

And nor is that monetary policy. It may well be sound fiscal intervention in an unconventional wrap to reflect new understandings of how money, debt and accounting really work but it is far, far removed from monetarism and the absurdities of things like helicopter money.

It did not work in Venezuela

I will not stop to the Economists depths of desperation to answer that one.

Conclusion

People's Quantitative Easing:

a) exploits the capacity in the UK economy

b) massively reduces debt risk and so the chance of another crash

c) has vastly less inflation risk in it than George Osborne's current plans

d) is realistic in what can be delivered, unlike Osborne's hope for business investment

e) meets the need for infrastructure investment which is absent from Osborne's plans

f) preserves the government's ability to borrow for when it is really needed

g) has no net interest cost

h) makes clear there is democratic control of UK economic policy.

What is there not to like?

NB: Repetitive trolls will be deleted if they try to comment. I am only interested in serious debate.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“The first is why do so when Peoples Quantitative Easing avoids a real interest rate charge arising?”

Genuine question: why does any government borrow and incur interest charges then? Why don’t they just print money which would avoid interest charges?

Sorry, I can’t help but get the feeling there is something wrong. If this was a panacea why hasn’t it been tried before? And if it has, kindly provide examples. If something sounds too good to be true, it usually is. Good luck trying to fool the electorate with this one.

Excellent question

It is now being seriously asked

The reason why they have is down to the fact that money has only recently been properly understood for the first time

The BoE caught on in 2014!

Just consider the consequences for the class structure of a correct and widespread comprehension of the nature of money. To say the least.

Hi Richard,

I agree, I think Green QE is a great idea and the financial press are attacking it with the usual comparisons to Weimar Germany or Zimbabwe printing money. When economists explain these ideas clearly and succinctly we have a real chance of getting more popular support for these policies.

I wanted to ask whether you had thought of included full reserve banking / Positive Money proposals in your ‘Corbynomics’ economic proposals? The Green Party has already supported this proposal (see article here – http://positivemoney.org/2013/09/green-party-passed-a-motion-to-place-money-creation-into-public-hands-and-end-fractional-reserve-banking/), it has similarities with Green QE, and I believe that if the issue can be framed simply enough to be understood by the electorate than it could be a really popular policy.

I have warm relations with PM but we do not agree on their version of the idea – which I and many economists think technically flawed

Sorry!

For example, the Icelandic government are looking into monetary reform – http://positivemoney.org/2015/04/iceland-fundamental-reform-monetary-system-must-considered/ and http://positivemoney.org/2015/04/economists-saying-icelands-sovereign-money-proposal/

I struggle to get my brain around this. So we can just print money and the only reason why no one has done it before is because our theories of money have ‘developed? Are you suggesting that we fund our entire debt by ‘creating money’ including the proposed new universal benefits for child are and university education that Mr Corbyn is suggesting?

This seems completely revolutionary. Why doesn’t every country with its own currency do it? Never mind if they are left or right. No need to borrow ever again

There are limits to how far it can be done, of course

Read Modern Monetary Theory economics, I suggest

And yes, it is revolutionary

You say that all money is created either by the government or bank lending. I might have got this completely wrong, but am I right in thinking that bank-created money is impermanent (as it is cancelled upon repayment) and PQE money is permanent (as it is never repaid) and so this means that in the long term there is a finite limit on the use of PQE?

So if banks lend £50bn each year and £50bn is repaid from previous lending each year then over time the total amount of money is constant, but each time PQE puts £50bn into the economy that effectively stays there forever, so over time the more PQE we have, the more there is an increase in the “baseline” amount of money (permanent money, not including temporary, bank-lending money).

As you say, PQE is fine now with a shortage of money in the economy, but theoretically could the use of PQE over time ratchet up the “baseline” supply of money to a certain desired level and so effectively rule out further large-scale PQE forever, as the “baseline” amount of permanent money wouldn’t be able fall? Would there be any way to reverse this and so open up PQE to future governments?

If I’ve understood you right and PQE is a finite resource then it would be even more important to invest it responsibly for the benefit of future generations

There is a limit on PQE, I agree

But given growth it would be a long time coming

And given how little money is created by the state I’d say a trillion could be done to fairly balance up private sector created money

But that’s just an instinct right now

This is why PQE MUST be used for investment too

“and PQE money is permanent (as it is never repaid) and so this means that in the long term there is a finite limit on the use of PQE?”

Over time the money is destroyed through taxation so no, it doesn’t last forever. The more demand that is created in the economy, the faster taxation destroys the money and so helps to control inflationary pressures. Taxation is an automatic stabiliser – that is one of its primary purposes. Taxation doesn’t fund anything.

Indeed not, as I will argue in The Joy of Tax

Why don’t Greece exit the euro and do it?

Excellent question

Sad fact is, it could be done for them inside the euro

Richard, if you use printed money to pay for investment, who is actually paying for the investment? Are you suggesting that no one is paying for it? As an economist, you should explain who is paying for that extra investment.

The investment is paid for with printed money

Just as all bank loans are printed money and the investment they permit is not paid for by anyone

In both cases you can, of course, ask that those using the asset created pay for that use: that is how banks hope (and only hope) to cancel the money they have created (loan repayment cancels money, it does not return it to anyone else)

In the case of People’s QE you can also choose not to charge: the cost then is a subsidy in future years. Governments can choose to make such subsidies, if they wish. There are very good reasons why on occasion they choose to do so.

But let’s be clear banks also face the risk of not being paid

The processes are in fact so similar a Martian would have difficulty spotting the difference

Only right wing economists think they can tell the difference

If PQE funds affordable housing will it deflate house prices and is this one reason those with vested interests will fight it tooth and nail ? And presumably those that profit from the current system of borrowing will be as well?

Probably

The great pity is that no one credible seems to want to take on your ideas.

You seem to quote press hacks I would not believe anyway and those supporting you on this blog would believe in fairies if it had the usual left wing dogma.

By pity I mean that I think there is something in your views but the lack of expert opposition so far means your ideas can’t be refined and tested.

Wait for the next blog