The way George Osborne tells the austerity story you'd think that it followed automatically that if he imposes austerity by cutting government spending it will automatically follow that the government will balance its books. I think it vital that everyone realise that this does not follow.

I keep coming back to a simple fact which cannot be avoided. This is that there are at the end of the day four components to our national income. They are consumer spending, private sector investment in business and housing, government spending and net trade balances. That's it.

The inevitable and obvious consequence of cutting government spending is, then, that GDP will fall. This has to be pointed out. Fewer people working for a government that does less means that the government generates less wealth for the country. Unambiguously that is what George Osborne is saying he will do over the next five years. He is planning to reduce the wealth generation for which he might be responsible. As I explained yesterday, that is a dogmatic decision and not a logical one, but it is one he is making nonetheless.

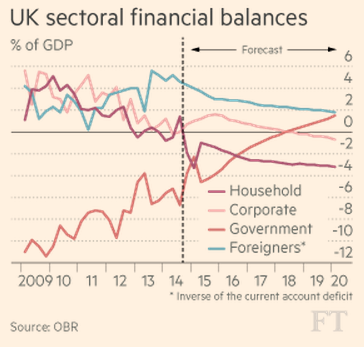

What that then means is that if we are to have growth - and the OBR is forecasting growth of between 2 and 2.5% over this five year period - it has to come from some pretty spectacular economic change in performance from elsewhere in the economy. This was the purpose for sharing this graph from the FT, which I also did yesterday:

If GDP is to rise, as is forecast, and the government is to despite that cut its spending and at the same time move into a surplus instead of borrow then the only way that can happen is if households spend more, business invests more and foreigners buy more than now. And that means each of these has to save less - or borrow more - to achieve that and so compensate for the government borrowing less. This is an accounting equation: it has to happen in this way in some combination if growth is to occur and the government is to borrow less.

This morning the FT notes that worldwide wages are stagnant. There appears to be little prospect for change.

And Gillian Tett in the FT also notes that "It has been lamentably difficult to get private sector investors to fill the infrastructure void".

And as the Guardian reported last month:

Over the third quarter, the trade deficit widened by £900m to £29bn after exports fell by £300m but imports rose by £600m.

The UK recorded its largest ever deficit with Germany in the third quarter, amid a deteriorating economic situation in Europe's largest economy. Meanwhile the UK's surplus with the US was the lowest in almost eight years.

If you can see radical reform on that front, I can't.

So where is this growth coming from? Well, as many have noted, one basis for it is an assumed increase in UK personal debt to 180% of GDP - higher than before the crash and assumed then to be a major component of it. It is assumed by George Osborne that people will borrow more as their earnings stagnate. But, in 2010 when George made exactly the same assumption he did so on the basis that people would borrow because they would celebrate cuts knowing that tax reductions would follow that would let them repay their borrowings. Paltry tax offers at the end of the next parliament provide no such justification this time - even in George's warped theory. This time he is assuming people will borrow firstly because they cannot make ends meet and secondly, maybe, because the UK house price will continue to rise. That's it. He's on Desperation Street now.

Now you have to decide: that's all the evidence you need to make an informed decision on whether or not business investment, foreign trade and household consumption will fill the gap that George is planning to leave in the economy.

Personally I think there is no chance that will happen: households that realise the safety net is being pulled from under them whilst they are paying the same amount of tax do not increase their spending, let alone their borrowing. That then means there is no incentive for business to invest, and it won't. And since the same basic situation is holding true across many of our export markets there is no hope of salvation there.

All of which means austerity is a programme that is now designed to make us much worse off. The one million public sector workers who will lose their jobs in the next five years will be unemployed. Those who business can no longer employ because of falling demand, which I think likely, will add to that number. And incomes in real terms will continue to fall, especially if, as has happened over the last five years, productivity declines. I cannot see another consequence of this austerity policy.

And what happens in that case to the deficit? It continues. Cuts will not make any difference to that outcome. All we will get is a situation where the government continues to borrow but does so in an economy that is shrinking.

And that's all because the government cannot at the end of the day control whether it is in deficit or not. Its own behaviour is so significant to the economy as a whole (a fact that George Osborne's 'household economy management theory' does not acknowledge) that unlike you and me, if it cuts the impact is invariably seen in the national accounts and as a result growth has to be picked up by others if recession is to be avoided as a result of a massive onslaught on government spending.

So, given the implausibility of increased household consumption, business investment and net exports over the next five years what Osborne set out this week was a plan for a recession, increasing unemployment and a collapse in UK well-being.

And no one seems to be saying so, which baffles me.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I would not be surprised if Osbourne, or more likely his shadow advisers, know exactly what they are doing. I’m not disagreeing with you simply pointing out that ‘they’ know it too. Another crash seems inevitable and now likely to happen during the next parliament and possibly during a Labour government. This and Labour’s own fondness for austerity will see few reversals in cuts leaving the next Tory government to finish the job.

Meanwhile the ridiculous and unaffordable housing market will drive more and more families to the brink whilst simultaneously feeding repossessed and auctioned housing into the buy to let market.

Trying to look at this optimistically I can only hope that, for commercial reasons, we are keeping quiet about a large future export opportunity, perhaps new oil wells, fracking or the development of a new long-range electric car with batteries, charging equipment etc.

Those who attend Tri-lateral commission and Bilderberg meetings would know about this and “the markets” will still be happy to invest in us.

Alternatively, Richard, we may well be on the road to ruin.

Ruin, I fear

And voluntarily chosen

New oil wells..

Fracking..

Check-out the oil price today. Applications to develop new fields in the US have dropped through the floor.

Quite simply, unconventional oil/gas is expensive to develop. At 100$ barrel it happens, at the present price, it does not.

So OPEC is keeping “the taps open”, and the price low. What a [not] surprise. US production is slowing, RF production isn’t, but the price means their economy is disappearing up its backside.

This is an accident?

No, this is not an accident

The reporting of the UK’s dire economic situation leaves a lot to be desired. Even for a novice like me, I can find out that over the last three fiscal years the deficit has been £120bn, £115bn and last year £107bn.

Osbourne had planned that by this year the deficit would be £0.

Yet we still have mainstream media telling us that ‘we’re 40% through austerity cuts, another 60% to go’.

If the plan was to cut to reduce the deficit to £0, then how on earth do these figures tally up ?

As Richard has pointed out, tax receipts from business are not going up, trade deficits are increasing so business receipts aren’t reducing the deficit.

The cherry on the cake was yesterday when Paul Johnson, Director of the IFS told the BBC that this year’s deficit figures were disappointing, only dropping £6bn to £90bn.

What ! We’re only 8 months into the year, the fiscal year runs March to March – how on earth can he make that claim and get away without being questioned by BBC journalists.

Good question

The deficit, around £90 billion, is predicted to hit the £100 billion mark. If Osborne plans to cut £100 billion from public spending, which cutting the deficit to zero will do, then would the Chancellor like to inform us where the money is going to come from to cover this?

If you keep cutting taxes, wages and benefits and there is little investment in the economy, then how are they going to cover this shortfall? The fact is, getting rid of the deficit is a fantasy anyway. There is only being a few extremely rare instances where we have had a surplus. Cutting back severely without investment shrinks your GDP and consequently you find that that your tax take is down and you do not have enough money to cover previous debts, meaning you have little choice but to borrow again in order to balance the books. This is what most of Europe have been experiencing for the past few years, as austerity leaves them far worse off than when they started.

Austerity is only working for one group – the better off. For everyone else, it is a nightmare without end.

Time it was ditched.

‘The one million public sector workers who will lose their jobs in the next five years will be unemployed. ‘

The way the Tories will deal with this is, as recently happened, a programme of sanctioning people into very low paid, part time jobs, so the figures don’t appear to worsen.

To try and equate accounting identities with economics is a highly egregious error.

Are you aware that just about all macroeconomists would do this – and the FT and OBR certainly do

I am not sure what you think you mean

They are all wrong. They’ve replaced economics with the comfort of mathematics. That is why there is such a gulf between their overconfident predictions and reality. Economics is a social science and human behaviour cannot be reduced to a balance sheet.

James

I have to disagree

I argue, often, about the flaws in economics. BUT if the debate is on the monetary economy and its functioning – and this debate was – and how GDP works – and that is the focus of this discussion – then what was said was categorically right

You can say that’s the wrong debate. I think you are. Bt if that is the subject then accounting constraints very definitely apply

Richard

James G

You’re absolutely right, but I don’t think Richard was doing that. If a ChEx targets this in Y1, this in Y2, this in Y3 etc,its surely not unreasonable to point out that he doesn’t meet any of the targets?

Richard

I think the most important thing to say is that, as Keynes forecast, austerity actually means that we can never balance the books.

Compare our deficit as a share of GDP to that of the USA, which adopted Keynesian policies throughout, & the answer is crystal clear. Keynes forecast all this.

Things can only get worse (at least for most of us) but, since money is purely & only a measurement, it can only get better for those at the top as it worsens for those at the bottom. I think many Tories hope for a recession that never ends.