Barclays has put out its first country-by-country reporting. This is not a statutory report: it has been published in anticipation of the requirement that banks produce this data for results from July 2014 onwards.

As the creator of country-by-country reporting I thought I should take a look. This is my analysis of what Barclays has published:

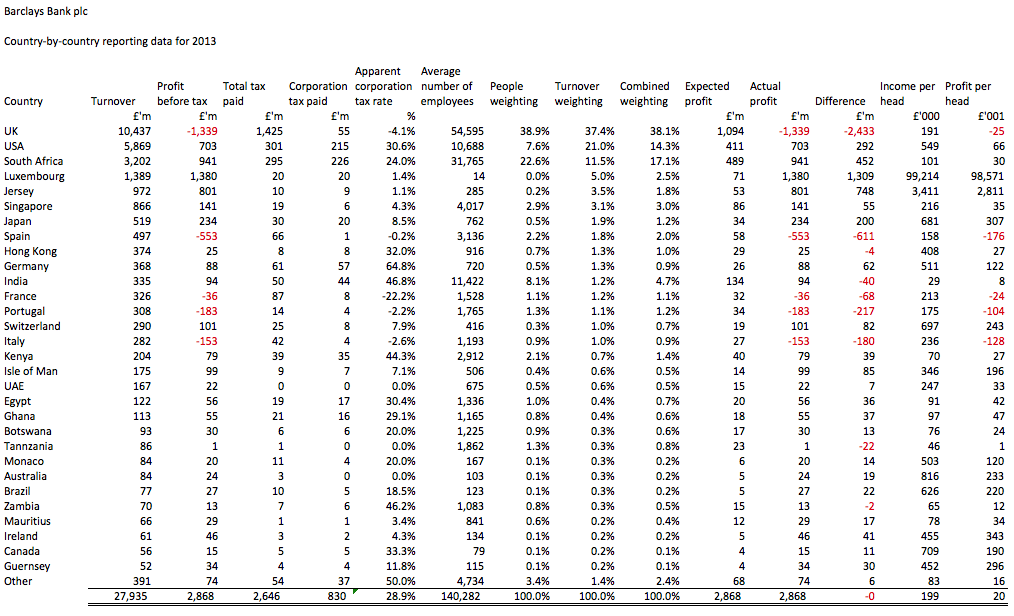

Click on the image to see a bigger version. The Excel file is here in case you want it. Barclays CBC 2013

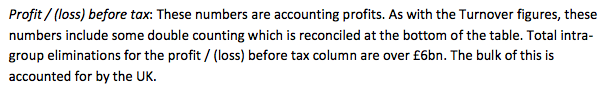

I stress, the underlying data is from Barclays bar one thing. They say this:

I have therefor allocated all the £8.5 billion of turnover and £6.2 billion of double counted profit to the UK, as that is the only clear clue they give me as to what to do with it. They could have provided a better and clearer analysis, but they don't.

Having done this I then proceeded to ignore all the data that Barclays publish on VAT and NIC paid: this is all nonsense. Those are business costs like any other and are deducted from profit and subject to tax relief in their own right. They have no role to play in considering taxes due on profits.

What I wanted to see is whether or not it was likely that the claimed allocation of profits and losses by Barclays accords in any way with the likely allocation of profits by Barclays to the UK, in particular. To do this I treated Barclays as one single economic entity (which, as a matter of fact, it is or it could not publish a statement like this, so I suggest those arguing on this point are wasting their time). Then I worked out the ratio of sales by country and ratio of staff employed by country. Barclays do not provide data to calculate assets by country. I averaged the two ratios for good reason, which is that they can be very different due to the games companies can play. Luxembourg is an example here where sales are very high and staff almost non-existent. The result is the best approximation I can get to of what is called a unitary formula apportionment allocation of profits.

You will immediately note some surprising differences. Suddenly the UK does not make a loss, which Barclays admit they report in this country. Instead a profit of almost £1.1 billion is reported. And Luxembourg does not make a profit of £1.38 billion as is claimed in the original data, but ends up with just £71 million. Jersey also drops, in that case from £801 million of profit to £53 million.

It could be argued this is misleading in some cases: Spain, Portugal and Italy have all reported losses and it is known that these are difficult markets to work in. But then it has to be remembered that there is no independent and free-standing decision by Barclays to be in these places: it was a corporate decision to be in those countries and so the losses should rightly be shared - because this is a single business, as a matter of fact, where cross subsidy really does take place, as a matter of fact.

The real problem is though that the biggest cross subsidy of all is very clearly from the UK. It is complete nonsense for Barclays to claim they make a loss in the UK of significant amount (as seems likely) when in practice more than equal and opposite sums turn up, virtually untaxed, in Luxembourg and Jersey within their own accounts.

So, what is happening? I have a long list.

First, Barclays is, very politely laughing out loud at the UK and is failing to pay its way as a UK bank. So much for the contribution the City makes: this bank is not making it. And ignore those other taxes again: Barclays is employing people who would otherwise be employed elsewhere. The NIC would happen in another company if not Barclays. The same may be true of the VAT and as for the banking levy, that's a tiny contribution to the cost of having effectively been bailed out by the UK taxpayer in 2008 - which all banks were as it was the system as a whole that failed. So let's ignore claim that Barclays is contributing to the UK in these ways: it is not doing anything more than it should.

Second, Barclays is a massive user and maybe abuser of tax havens, and especially Jersey and Luxembourg.

Third, it is clear that transfer pricing of head office operations is not taking place effectively in the case of this company. HMRC must have the power to say that a company must reallocate costs to the group it manages from the UK or a mockery is made of our tax system. The need for reform in this area is obvious.

Fourth the question has to be asked as to why we are so keen to have companies headquarter in the UK when it is very clear that many other countries benefit more than us by not having Barclays' head office in their domain. Barclays could bank here by all means, but candidly we would be better off without their head office.

Fifth, the evidence is clear: country-by-country reporting delivers invaluable data, as I always suspected it would. We could do with more from Barclays but even at this level what we can say is that the internal allocations of income and profit between Barclays group companies appears to make no sense at all.

Sixth, we can ask in that case how the Barclays's auditors (PWC) signed off these accounts as true and fair when that is the last thing they look to be.

I could go on, but you get the message: this analysis suggests that Barclays is massively under-declaring profit in the UK at cost to all of us. I estimate that the loss to the UK could easily exceed £150 million based on the above data. And in that case it is time for serious tax reform in this country.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Great table. Country-by-country reporting makes it plain what is going on, and also that it is unacceptable.

Thank you for this analysis, Richard – and of course for pushing for country-by-country reporting in the first place.

It’s most interesting to learn what Barclays have done, and there’s no way I would have been aware of any of this without your explaining it. Thank you.

I don’t entirely understand your argument. I thought the whole point of Country-by-country reporting was to show that multinationals were avoiding tax by moving it to low tax jurisdictions.

Barclay’s numbers seem to show the opposite. Their overall corporation tax rate is 28.9%, which is significantly higher than the UK rate for 2013 of 23%.

Now you seem to be complaining that it is simply that Barclay’s aren’t paying as much corporation tax in he UK, and other countries are benefitting from it?

Barclays are moving profits to low tax jurisdictions – as a matter of fact

The UK is losing – as a matter of fact

The problem is with the data – tax paid does not relate precisely to these profits

Barclays acknowledge that and do not correct for it

If Barclay’s were moving tax to low tax jurisdictions, why does it not show up in their overall corporation tax rate? The UK might be “losing” but it seems other countries are gaining.

I would have thought that you wouldn’t have a problem with this?

Nor does it seem the countries gaining are tax havens, with only small amounts of tax being paid in the typical tax havens (Jersey, Luxembourg, The Isle of Man, Monaco, Mauritius and Guernsey) one would expect the overall corporation tax rate for Barclays to have been low if aggressive tax avoidance had taken place. In the above data, it seems that the average corporation tax rate is higher than expected, and is mostly paid in non-tax haven countries. This would suggest the opposite of your view that Barclay’s engage in aggressive tax avoidance.

I understand that tax paid does not directly relate to profits – not least with corporation tax which does not necessarily relate to profits in the same tax year. That said, I don’t think that CbC reporting gives you any clarity on how much and where tax should be paid, as it is impossible to determine the nature and domicile of transactions given the data you have.

I have offered a very clear insight that whatever the imperfections in this data, and there are many of them, the evidence is abundant that tax is not being paid in the right place.

It is also abundantly clear that profit is not being declared in the right place.

Thirdly, it is obvious that tax haven abuse is rampant within Barclays. We should remember, in this context, that the UK is now a corporate tax haven.

Last, the fact that the overall rate appears higher than the UK rate is neither here nor there: I want the tax to be paid in the right place, at the right time and at the right local rate. That is not happening. Country-by-country reporting has more than justified the fact that it can reveal this.

“It is also abundantly clear that profit is not being declared in the right place.”

There is simply no data provided to prove this.

“Thirdly, it is obvious that tax haven abuse is rampant within Barclays. We should remember, in this context, that the UK is now a corporate tax haven.”

As I mentioned, it seems like Barclays pays most of its tax in non tax havens. Describing the UK as a tax haven seems a bit absurd. Apart form the fact that Barclays is based in the UK, you are also arguing that they haven’t paid enough tax in the UK.

Yet if the UK is truly a tax haven then moving profits back to the UK to enjoy a lower tax rate (though still higher than true tax havens) would surely be wrong in your view.

You are arguing both sides here, with the result being that Barclays simply can’t win. Either way you are attacking their behaviour. It is this kind of doublethink that suggests that your point of view starts from the point that Barclays has somehow done something wrong, following which you set out to prove it.

“I want the tax to be paid in the right place, at the right time and at the right local rate. That is not happening. Country-by-country reporting has more than justified the fact that it can reveal this.”

CbC reveals nothing of the sort, as the data holds little information about the nature of the transactions generating profits. Simply stating that because Barclays use tax havens there must have been profit shifting isn’t evidence. Barclays have paid out 92% of total profits as tax (from the data above). It seems to me that if they truly are avoiding tax, they are doing a particularly bad job.

“There are also further issues with what you have written in your post.

Having done this I then proceeded to ignore all the data that Barclays publish on VAT and NIC paid: this is all nonsense. Those are business costs like any other and are deducted from profit and subject to tax relief in their own right. They have no role to play in considering taxes due on profits.”

VAT and NI are deducted from profits, and there might be some reliefs on VAT, but on the whole there are no reliefs available for NI.

“To do this I treated Barclays as one single economic entity”

Barclays is not one economic entity. Through M&A aquisitions many of it’s groups are not wholly owned by Barclays. Barclays Group Africa/ABSA is 62% owned, for example. BGA is a separate entity.

“Barclays is employing people who would otherwise be employed elsewhere. The NIC would happen in another company if not Barclays.”

Certainly untrue, especially for those in the capital markets divisions. Those jobs deal with global financial markets, and could be based almost anywhere. If nothing else, if those people could be employed elsewhere, why is Barclays then reducing is headcount by thousands?

“Barclays could bank here by all means, but candidly we would be better off without their head office.”

This is very tortured logic. Barclays is paying 1425m tax in the UK, before accounting for the tax their employees are paying. I’m pretty sure that if Barclays moved their head office UK tax revenues would drop dramatically, judging by the tax paid in the US and South Africa, Barclays other two main operational centres.

“Sixth, we can ask in that case how the Barclays’s auditors (PWC) signed off these accounts as true and fair when that is the last thing they look to be.”

I’d hazard a guess that PWC have a lot more information regarding this than you do.

“I could go on, but you get the message: this analysis suggests that Barclays is massively under-declaring profit in the UK at cost to all of us. I estimate that the loss to the UK could easily exceed £150 million”

Barclays are paying on average above UK corporation tax rates. It is also apparent they made a loss in the UK. You view the UK as a tax haven, yet in the same breath are arguing that Barclays should be bringing MORE of their profits back to the UK – I assume at the cost of other countries. Maybe at the cost of South Africa, a developing country. I note that you are involved in the BEPS process, saying that it adversely affects developing countries. Now it seems you are in favour of profit shifting if it favours the UK.

I could spend a lot of time debunking this nonsense but perhaps one example will highlight just how absurd what you have written really is.

You say “As I mentioned, it seems like Barclays pays most of its tax in non tax havens”. Somehow you think that an argument that country-by-country reporting does not work. Don’t you realise that by definition Barclays is bound not to pay much tax in tax havens, because the definition of a tax haven is that they do not charge tax?

The rest of your argument is about as illogical as that first claim is, and so I will not waste my time with it.

This was my point. If Barclays were aggressively shifting profits to tax havens you would expect their overall corporation tax rate to be lower.

In fact, we see they have a rate of 28.9%, higher than the UK’s 23%.

This would suggest that they are not using tax havens to shift profits.

There do seem to be high turnovers and profits in some of these tax havens you mention. However, as I point out, Barclays tax rate doesn’t seem to have benefitted from this.

There is, of course, a rational explanation for this (outside tax aggressive avoidance) if you understand the mechanics of global transactional finance and tax. Dual taxation, in short. Lots of countries do not have dual taxation treaties set up with each other. So, to legitimately avoid paying tax on a deal twice the deal gets routed through an intermediary country which both other countries have a dual taxation deal with. You should approve of this, in fact, as it means all the tax gets paid in the country of origin of the deal.

Tax havens, particularly Luxembourg, happen to have been pretty proactive in making sure dual tax treaties exist with most other countries. Between that and the added feature that most tax havens are very cheap to have a small operation in, a lot of deals go through legitimately go through tax havens with as you call it “the right amount of tax being paid in the right place at the right time”.

Of course Barclays have benefitted: their overall rate would be higher still – and maybe legitimately so – without this fact

Tax havens by and large (some excepted) do not have dual tax treaties

I believe in residence and source taxation

Luxembourg is not used to ensure tax is paid once only – as all evidence shows. Please do no misrepresent the truth

“Of course Barclays have benefitted: their overall rate would be higher still — and maybe legitimately so — without this fact”

Their tax rate is higher than the UK corp tax rate. 92% of their profits are already paid out as tax, and they made a loss in the UK. How much tax do you want them to pay?

“Tax havens by and large (some excepted) do not have dual tax treaties”

This is demonstrably false. For Luxembourg:

http://www.kpmg.com/lu/en/services/tax/tax-tools-and-resources/pages/luxembourg-tax-treaty-network.aspx

“Luxembourg is not used to ensure tax is paid once only — as all evidence shows. Please do no misrepresent the truth”

What evidence? You have a single line in a spreadsheet as hard evidence, plus your own assumptions. The whole point of dual taxation treaties is to make sure people justifiably do not pay taxes on the same income twice. If anyone is misrepresenting the truth it is you.

You still have not answered the simple questions I put to you. If Barclays are aggressively avoiding tax then:

a) why is their overall corp tax rate higher than the UK corp tax rate?

b) why are they paying 92% of profits in tax?

c) why are you against BEPS style profit shifting when it hurts developing countries but also against it when it is benefitting them at the expense of the UK, and the company in question is actually paying a higher tax rate?

Your comments remain ridiculous.

I made very clear that some havens do have tax agreement networks: Luxembourg is one of them. Your pointed out that I’d already said.

The evidence that Luxembourg is used for tax abuse is widespread: I do not need to reiterate everything in one blog post.

But the absurdity of your comment is apparent from your claim that 92% of the profits of Barclays are already paid out as tax. That is completely and utterly untrue. Employer’s National Insurance is a cost of doing business: it is not a distribution of profit. The same is entirely true of disallowed VAT input tax for a bank. And in both cases the costs are tax deductible before property is computed, and therefore corporation tax is paid. In other words, the corporation tax bill is reduced because these other taxes have already been settled as a cost of doing business. Your logic is therefore not only wrong, it is circular.

Barclays Did not pay 92% of their profits in tax. They paid, at most, 28.9%. But, that may also be completely untrue because this payment relates to another year, and not the year for which the profits are declared. In addition, the profits are accounting profits, and are not the same as taxable profits. We have to assume that there is some link between the two, but we cannot know what it is.

To answer your questions:

a) You please tell me why Barclays paid more than the UK tax rate: the data does not offer explanation in itself. I argue for more comprehensive information

b) They are not paying 92% of profits in tax

c) I am against the artificial reallocation of profits and losses for tax purposes: this data proves that that is taking place in the case of Barclays.

I’m sorry but it is your comments which are ridiculous.

Barclays paid 28.9% of profits in corporation tax.

Other taxes also come out of profits, or EBIT if you want to use the correct accounting term. VAT (some of which may be deductible, but the numbers Barclays provide are after deductions) and employers NI to name the two important ones.

As you say, corporation tax might not be entirely for the single year in question, but given you have used single year data to make the argument you have, I feel justified in doing the same.

Given that, we can see that Barclays had pre-tax profits (EBIT) of 2868m and paid taxes of 2646m. So overall, paid 92% of profits as taxes, with corporation tax making up 28.9% of that. How much more tax do you think Barclays should be paying?

You still seem unwilling to provide an answer as to why you think the “artificial reallocation of profits and losses for tax purposes” is unfair in this case, where it seems that Barclays are moving profits from a lower tax jurisdiction to a higher one. You regularly attack profit shifting to lower tax jurisdictions, so one would have thought you would be happy, yet in this case because you allege that the UK happens to lose out, it is suddenly unfair.

Your argument is literally unwinnable by Barclays. If they paid a low overall corp tax rate you would attack them. Now you accuse them (with little evidence) of tax avoiding, yet they are paying a higher overall marginal rate. You are even directly contradicting some of your previous arguments surrounding CbC and BEPS. You simply take the fact that they use tax havens and make wild accusations, without having nearly enough data to validate your point.

It seems to me that you simply don’t like big multinational corporations, using the fig leaf of tax avoidance to make the point. It also points out the desperate problems with your CbC reporting. It’s also pretty clear you don’t like having these flaws in your work pointed out – your answers have been nothing but high-handed, rude and arrogant. If it was as simple as you suggest, why can you not answer the questions I put to you?

You are repeating falsehoods

I will not repeat the answers I have already given

I can see I am getting nowhere in asking what should be relatively straightforward questions. My guess is that you simply can’t answer them because they expose rather large logical flaws in your argument about Barclays and CbC in general.

Let me be clear.

There is no data whatsoever in the table you present that can definitively say that Barclays is or is not avoiding tax. By this measure, CbC has provided us with little or no new information. It certainly gives absolutely no information pertaining to paying tax “in the right place, the right amount and at the right time” as you call it. You would need details of all the individual transactions to truly determine if that were the case.

It looks on balance that Barclays is probably not avoiding tax, given their overall tax rate. Certainly, if they are doing so they are doing a very poor job of it.

The use of tax havens cannot simply be used as “evidence” that tax avoidance is taking place.

It is pretty contrived to argue this case against Barclays for not paying enough tax in the UK when their overall corp tax rate is higher than expected and they have even made a loss in the UK, just because they use tax havens when you argue exactly the opposite when you discuss BEPS. It looks like a pretty hypocritical attack.

I have no way of answering someone – maybe someone who is paid – who denies the obvious evidence of abuse in Luxembourg and Jersey.

Please tell me how and why the distortions in those places arise?

And then tell me if we knew about them before we had this data?

Please also explain why you think they are so much more profitable than the UK

And please explain why Barclays should record almost all its losses in the UK

Right now you have ignored all these issues and I have addressed every issue you have raised

“I have no way of answering someone — maybe someone who is paid — who denies the obvious evidence of abuse in Luxembourg and Jersey.”

I’m not paid or in any way currently or ever have been associated with Barclays. Trying to paint me as some kind of paid agent provocateur is nothing more than a basic attempt at a smear.

There are profits in Luxembourg and Jersey. I am not denying that. What I am saying is that you have absolutely no evidence to prove there was any wrongdoing.

“Please tell me how and why the distortions in those places arise?”

I’m sure there are quite a few reasons, but I would hazard a lot of it is through double taxation treaties, where tax has been paid on a transaction in the country of origin already. I would also guess that these tax havens get used when global deals involving companies from various countries, with the deal going through in various currencies occurs – especially in non-deliverable currencies like CNY. I am speculating (from experience) but I have no more evidence than you do, so by default my explanation is no more or less credible than yours.

“And then tell me if we knew about them before we had this data?”

Yes we did. All this data comes from Barclays annual statements.

“Please also explain why you think they are so much more profitable than the UK. And please explain why Barclays should record almost all its losses in the UK”

Again, look their annual statement and you will see that Barclay’s simply lost money in the UK (and Europe). Which is why they are cutting 14,000 jobs in those areas.

“Right now you have ignored all these issues and I have addressed every issue you have raised”

I have answered every point you have made, so I can see how I have “ignored” these issues. You have ignored most of the direct questions I have asked you and instead resorted to rhetoric, assumption and assertion. Being quite arrogant and rude with it. I suppose that one reason you can’t answer some of these questions is that it is very hard to maintain credibility whilst arguing both sides of the same argument at different times, not withstanding that doing so blows various holes in them.

Respectfully, there is so much drivel in there – such as the fact that we already knew all this – that it is not worth either commenting further or posting any more of your comments.

We did not know this

And we now have massive evidence of profit shifting by Barclays

Those are facts that only CBC delivered

Your further response will be considered astroturfing whether you are paid to do it or not

I’ve been reading these posts with interest. I initially thought that Barclays would definitely be in the wrong. Reading what Dennis has to say I’m not so sure. It looks to me like Richard hasn’t exactly done his homework properly.

Richard says that Barclays are using tax havens to avoid tax. Reading through the link to Barclay’s country by country stuff, they’ve brielfy explained in the commentary for each country what is going on.

For Jersey they say a significant part of the profit comes from investment banking but that is ultimately taxed in the UK. For Luxembourg they say that profits weren’t taxed because of offsets against tax losses or because the were dividends which aren’t taxable.

The other tax havens seem to be mostly wealth and investment management businesses. Barclays say the tax paid is low simply because the tax rates are lower in those places.

It doesn’t look like they are shifting profits around to dodge tax, and they even give brief explanations as to what is going on. I guess they might be moving money around, but as Dennis says why would they bother if it means they end up with a higher overall tax rate? But it doesn’t look like Richard’s claim that it is all tax avoidance is true.

Richard, can you explain why you don’t seem to have looked at what Barclay’s themselves say about what they do in every country?

Of course I have looked at what Barclays say

First, I dismiss it as PR when it does not accord with the data – as it does not in the case of Jersey and Luxembourg – or the facts, as it does not in either case

As a matter of fact Barclays give no clue why or how the Jersey profits are taxed in the UK. I would be curious to know the mechanism – because superfically I can’t see what it is or why they would use it

Secondly, to say taxes are low because of low rates is really rather odd – of course they are – but that is precisely why the profits are shifted to these places in the first place. Your causality is exactly reversed from the reality of what is happening

Third, yes Luxembourg has low tax on dividends routed through there – but that is exactly why it is a tax haven for these purposes and so why profits go through there. Again, you accept at face value what Barclays says without realising what they are actually saying is that they deliberately structured themselves to achieve this outcome. It is not chance. It is what they planned. That is what fax avoidance does.

What you’re saying is Barclays is not tax avoiding because is says it successfully avoided tax by moving profits to tax havens where by chance it paid low rates of tax when that is precisely the abuse I am accusing them of

It might be PR, but if it is I don’t see how that fits in with the fact that they are paying a higher tax rate than they could do, as Dennis says. Just because you dismiss it as PR doesn’t mean you are right, and as Dennis also says you don’t seem to provide any hard evidence to show you are right and Barclays are wrong.

Dennis also talks about dual taxation as a reason why profits in Luxemborg are taxed in the UK. I used to work abroad and also benefitted from dual taxation (actually the other way around in my case) so I can believe this. I agree though when Dennis says its not possible to say one way or the other because you need to know whats going on in the original deals to make those profits. Neither of you have real evidence, so why is he wrong and you right?

It looks like at least some of their business in tax havens is not because of money being funnelled through them, but instead banking and wealth management in those places. Doesn’t this mean that Barclay’s are doing exactly what you say they should by paying the right amount of tax in the right palce at the right time?

You still don’t tell us why if they are using these tax havens their tax rate is higher than the UK rate? I doubt the people at Barclay’s are stupid so why aren’t they showing all the profit in a tax haven and paying very low tax? It looks like you only have a problem with it because they aren’t paying that much in the UK, but they made no money in the Uk so why should they?

Luxembourg is widely recognised as a place that does not just prevent double tax but now facilitates double non taxation – an issue driving the OECD BEPS project

I suggest that could be a good reason for Barclays being there

It is utterly implausible that Jersey employees of Barclays are more than 15 times more productive than UK employees

And why is the tax rate higher – either because of data mismatch, already explained, if because Barclays actually owes more than headline rate and has only mitigated it in some but not all states

Is that so hard to imagine?

It might be imaginable, but as Dennis says, you have no evidence for it. As an old lefty I’d be the first to campaign if they really were doing something naughty, but I also happen to have a sense of fairness. It looks to me like you are simply attacking them because of who they are and don’t really have a case.

Saying that each employee at Barclays is worth the same is also complete and utter rubbish. I doubt that the people working in the high street branches are anywhere near as individually profitable as most of the investment bankers. Cashing granny’s pocket change is never going to be as profitable as working on multi-million dollar deals but you seem to think it would be, judging by your article.

I wonder what evidence of tax haven abuse bare extraordinary profits and very low tax located in these places you would need to persuade you?

That’s enough for the G8, G20 and OECD to act but not here.

Let me be candid; your argument simply does not stack.

There may be nothing wrong but to say there’s no smoking gun is, bluntly, absurd

Barclays explain why little tax is paid in Luxembourg though – they specifically say that those profits are taxed elsewhere.

As much as I’d love to believe you, I can’t see any real evidence for the “smoking gun” you are talking about. It looks like Barclays have paid lots of tax, and it is entirely possible they have lost money in the UK. As Dennis says, why would they be cutting so many jobs if the company wasn’t losing money? You just don’t have any real evidence, and it looks like you are trying to score some cheap political activist points.

Actually they do not say the profits are taxed elsewhere

They may be

They may not be

They not be taxed at all

That’s the wonder of Luxembourg

I don’t know

Nor do you

And they do not say how much is taxed elsewhere, and nor do they re Jersey

And since the OECD et al think there is abuse in such places so do I unless there is clear evidence to the contrary

And this is the point you miss: the OECD accept that data of this sort will provide the basis for tax risk assessments. I am saying there is prima facie risk here and the OECD would, inevitably, agree. So how come you say there is no evidence and that I am merely scoring points when this is the way the world is moving?

I thought that HMRC already had the necessary powers to deal with transfer pricing.

Perhaps you shpuld put up an explanatory blog post on powers that HMRC have and haven’t – and on powers that they choose not to exercise when confronted with evasions measured on billions of pounds.

As is widely known, existing transfer pricing arrangements simply do not work properly. I’ve explain why at length on this blog over time. I also did so in my book ‘Over here and under taxed’. What may be going on a Barclays is an example of why that arrangement does not function properly. That this is the case is widely knowledge, not least by the OECD’s Base Erosion and Profits Shifting project which would not exist if my argument was not correct.

You say

“Don’t you realise that by definition Barclays is bound not to pay much tax in tax havens, because the definition of a tax haven is that they do not charge tax?”

Earlier you said that the UK is a tax haven. With a minimum CT rate of 20%, it can’t be by your logic?

Tax is a combination of base and rate

20% of nothing – which is what the UK let Barclays record – is nothing, whatever the rate

That’s the tax rate most havens aim for

“That’s the tax rate most havens aim for”

I am not sure this argument furthers your case. At best, the UK is not one of those ‘most’ tax havens, and so the point is irrelevant. At worst, it is, and Barclays appears to be (from a UK POV) blameless.

If the low rate paid is as a result if a deliberate move by the state to create a tax haven, then surely, like an individual investing in an ISA, Barclays is fully compliant in taking advantage of this (as I say, from a UK point of view. Other countries might be losing out unwillingly)

Tax haven states deliberately encourage tax abuse for an elite

That is one reason why we name them

The UK is doing that.

When the state has been captured the concept of compliance becomes meaningless by those who did the capturing

If compliance is a meaningless concept in this scenario, so too must be its complement, non-compliance. If we are not complaining about non-compliance, what is there left to criticise Barclays for?

Of course, we complain about the current state of the law (and the democratic process generally), but you have to date not been a great supporter of “don’t hate the player, hate the game”-style arguments.

What us left to criticise Barclays for is capture of the tax system

So if a new bank were to enter the market, and arrange their affairs as Barclays have done then (as they have taken no part in the capture of the system, but merely taken the world as they found it), you would have no objection to their actions?

Yes I would

Because no bank acts in isolation

So even if the bank itself has taken no specific action you object to you still criticise it for the offence of… being a bank?

I have no clue what you are talking about

“I have no clue what you are talking about”

The scenario is that a new bank enters the market and structures it’s affairs as Barclays has. You state that this would be objectionable, and I ask on what grounds (noting that we are limiting ourselves to the effect on *UK* taxes).

Non-compliance is excluded because the concept is meaningless in a captured state

The act of capturing the state is out because this is a new bank, so it did not (and could not) take any action on this when it occurred (what with the new bank itself not yet existing)

You state your objection is on the grounds that “no bank acts in isolation”. I point out that short of not being a bank at all there is little NewBank can do about this. (I did not ask the other obvious question, namely “why is acting in isolation important to avoid criticism?”)

For the sake of clarity, the questions are:

1) What action is NewBank taking that the UK should find objectionable?

2) What criteria does the action in (1) satisfy that identify this as an action that the UK should find objectionable.

Read my blog in the ethics of tax compliance, published yesterday

Mr Murphy is contradicting himself… This is what happens when one adopts a blanket approach of “only the UK should be entitled to tax, no other country should.”

Utter nonsense

I want genuine source countries to tax first and residence second or unitary for all

That is tax justice

And yet the current global trend is towards territorial taxation.

That is deliberate

It is intended to create opprtunities for tax abuse

When almost 75% of OECD member states have a territorial system I suggest it has little to do with what you refer to as tax abuse and is more inclined towards pragmatism. Even Sullivan and Avi-Yonah have moved to support territorial taxation in the US.

Frankly I’m surprised – You seem to advocate the collection by a state of in more earned within its borders, that is what the territorial system is.

I have always allocated comprehensive tax systems where tax is paid at origin first and residence first or unitary as a whole

Without that tax haven abuse always pays

I have never advocated anything else. CBC is an accounting system – not a method of taxation

Oh dear Richard. Your responses to posters are most unbecoming. Particularly when the figures are detailed to you and your response is an aggressive ‘I’m not listening’

Doesn’t help you cause really. Why not just explain?

I gave explained, time and again

Perhaps I should have deleted all the repetitive questioning

If Barclays are avoiding tax then they don’t appear to be very good at it given their effective tax rate. Are they subject to the banking code? I wonder whether that is having an impact here, it’s certainly impacting the tax behaviour of other taxpayer rescued banks from my experience

They are really very good at it

The fact that some states are even better at collecting tax suggests that the UK has even more to learn

Notice none of these guys are your regulars? Fuuny that 🙂

I did

Hello from one of your regulars Richard.

I note you say “And ignore those other taxes again: Barclays is employing people who would otherwise be employed elsewhere. The NIC would happen in another company if not Barclays. The same may be true of the VAT…”

Is there a particular labour theory you are relying on here/ and does it also apply to, say, public sector workers?

I have no clue what you are driving at

What I am suggesting is that if Barclays did not exist there is high probability someone else would employ these people

Is there something wrong with that hypothesis?

Yes there is something wrong. First you say there are no new real jobs, okay. Then you accuse the government for making false claims about employment, okay.After all your negative claims about employment you now suggest that the hundreds of people who work for Barclays, then the people who benefit from Barclays will all have a job. I don’t see how your comments about unemployment is from the same person who says that all Barclays people will be working elsewhere.

Also if they were working then what kind of job. Why hasn’t that happened over the past few years to create more jobs and reduce unemployment. Where are the risk takers.

What I am saying is that Barclays can’t claim credit for tax effectively paid by their employees who could work elsewhere

I am not sure what you are saying

Nothing at all I suppose. There is no knowing under what terms of course of course or whether it would generate the same NI, but I take your point. But then the same is true of all workers, for all employers, including the public sector. In fact that is precisely – precisely! – the argument behind reducing the public sector workforce.

I expect an abusive responce to this Richard.

I presume there is a logic that you think inherent in your comment

You do not disappoint!

I’ll take you at your word Richard and take this exchange as proof that you do not understand what you yourself are saying. You’re making it up as you go along aren’t you.

You have always thought that

You always will

There is no news in you saying so now

It does not make you right

Or me wrong

Wow – so first you take credit for what Barclays have done voluntarily and then you rip them to sheds because you “assume” they are tax abusers while their overall tax rate is higher than their effective UK tax rate.

Sounds like you are grasping as straws now that your blog is in danger of becoming irrelevant.

Or maybe its just as Jesus once said… “there’s just no pleasing some people”

All of which points I have already and comprehensively dealt with

I could swear someone’s growing a lawn on your blog Richard 🙂

It does feel like that, doesn’t it?

Odd that so many new names appeared this week

Some gave shared IP addresses. Also very odd…..

The election looms… expect more! 🙂