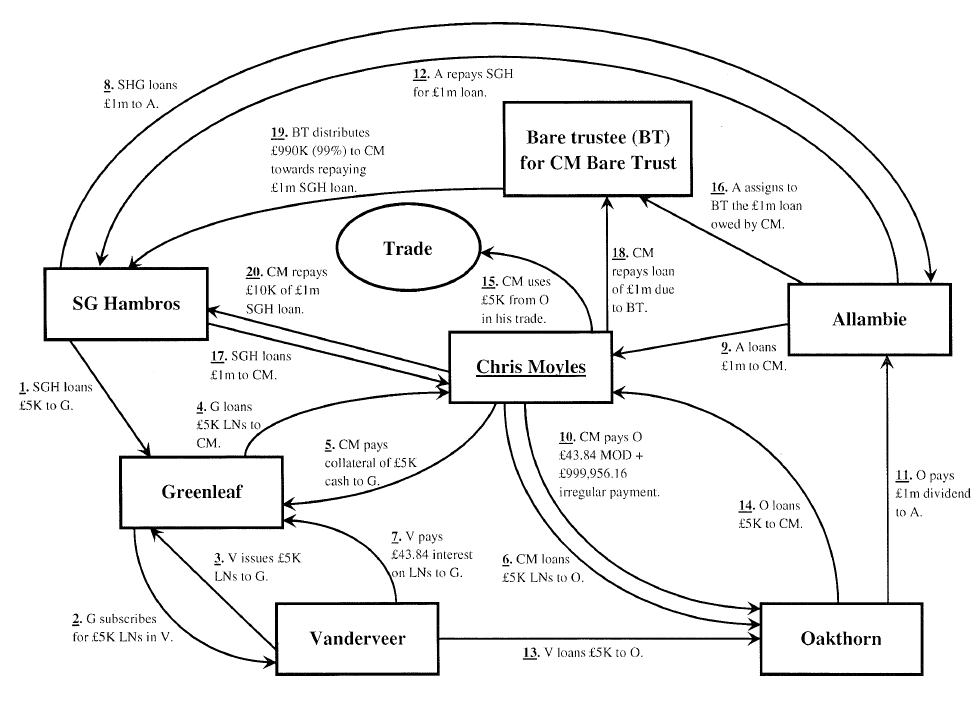

Attached to some version so the tax tribunal hearing decision that ruled that Chris Moyles had unsuccessfully sought to avoid paying tax was this diagram which shows what supposedly happened:

The supposed trade in cars is right in the middle. The Tribunal ruled there was no such trade.

All the rest are arrangements to create a massive supposed fee for arranging a loan - a fee of £1 million in this case.

SG Hambros is a Channel Islands bank. The money involved never left that bank.

The 'bare trust' and its 'trustee' (a functionary in the words of the ruling) were in the Channel Islands, clearing doing nothing more than lending their name to a sham arrangement.

The weirdly named boxes are all British Virgin Island companies.

The aim was to create what was called a manufactured dividend on a loaned stock which, it was claimed, was greater than that due if a dividend had been paid and so was a fee for arranging a loan (here £1 million) that was then, it was claimed, capable of offset for tax against trading income.

It was ruled there was no trade.

It was also ruled that there was no manufactured dividend as the payment made clearly did not relate to any reasonable dividend due.

And it was ruled there was no right to tax deduction on the supposed fee.

At every level the scheme failed. But the diagram shows the lengths such shenanigans go to. I doubt Moyles had a clue what was going on, but I do suspect, very much that he knew what the aim was.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

VEry dodgy – looks like fraud to me.

It strikes me that NT Advisors should be in jail.

So the net result was Chris Moyles gets fictitious tax loss of about £1 million, leaving him better off and the country worse off by the tax consequences of this.

Presumably there is also a transfer of real money from Chris to an entity controlled by NT Advisors to pay for their good work.

Forgive me if I’m being lazy or slow but where is that on the diagram, and what happens to that money after this court case?

Yep this is a good old fashioned fraudulent scheme.

Except it was cleared by a lawyer first

So those who used it had a defence

I have to make that clear, even though I find it objectionable

“I doubt Moyles had a clue what was going on, but I do suspect, very much that he knew what the aim was.”

Of course CM knew what the aim was – to save him money – but that is a world away from saying that CM knew it was dubious. After all, if the scheme is covered by advice from both M’Learned Friends and assorted wizards of the Accountancy Profession…..why wouldn’t he have gone for it…..

I have now answered this point in a new blog

So long as all the transfers of money really took place & all the necessary paperwork was really in place (assignment deeds, votes of dividend etc) then it is avoidance. Its only evasion if they claimed those transactions took place but they really didn’t.

You’d struggle to get a rizla paper between avoidance & evasion.

And in this case whilst all the flows did take place one critical thing did not

It was ruled there was no trade

And curiously, it was noted Moyles knew this – the one easy bit to understand, his buying and selling cars – was something he knew he did not do. Others did it, and it was clear he knew that

In that case it’s hard to see how he did not know this was all a charade. He possessed some common sense, I presume

Allan

“Of course CM knew what the aim was — to save him money — but that is a world away from saying that CM knew it was dubious. After all, if the scheme is covered by advice from both M’Learned Friends and assorted wizards of the Accountancy Profession…..why wouldn’t he have gone for it”

Er, because he, or members of his family benefit from the NHS, because he, or members of his family benefit from universal education, because he, or members of his family benefit from clean streets, water, sewerage etc, because he, or members of his family benefit from the protection of our armed forces, because he, or members of his family benefit from having a police force. The latter seems particularly relevant to me because I’ve been forced to listen to Moyles once & was filled with an overwhelming desire to give the swine a damn good hiding. As a good Catholic I subsumed that desire in prayer but I do think he should value the services of our police more than anyone.

Err, I’m sure plenty of wealthy people would argue since they pay a shed load of taxes, they take steps to pay what they consider a fair share in tax.

Are you seriously saying that if you were extremely well off, you’d take no steps what so ever to reduce your tax bill to ensure that you only pay your fair share in taxes and that of the cash & wealth you’ve worked hard for, more of it, stays with ‘you and yours’ rather than being spent by HMG (on things you may or not want)….

…thinking on wouldn’t that be interesting idea though….making sure that the NHS and education is paid for automatically via taxation and then having a public vote on each of the other line items so that the Great British Public could decide where they want the rest of their taxes spent….

This comment has been posted further to point 5 of the comments policy to which attention is drawn.

“in this case whilst all the flows did take place one critical thing did not. It was ruled there was no trade”

Are we saying that this could work if there was some trade? Say, Chris took the trouble to buy and sell a few cars on ebay. Or maybe bought the rights to some of his old programmes and tried to sell stuff connected to them or pay to listen (could probably manage a small genuine loss on that).

He might get away with generating losses from supposedly paying fees of millions to arrange loans of thousands?

There must be a lot of ways to go about this which are less greedy and blatant than the NT way. You could make the fees an loan appear a lot more proportionate.

Some one said earlier that schemes like this “rarely succeed”. I suspect they usually succeed, and mainly because HMRC does not have the will and resources to challenge them all.

Which suggests there is a lot of illegal avoidance around. It is not evasion because it has not been looked at properly to ascertain that. If dissected by HMRC to will probably fail, but as it won’t be it must be counted with avoidance.

Thankfully it failed on all counts

But the absence of a trade helped!

The amazing thing Is that the issue of such a blatant raid can ever be in doubt, that they expect to succeed.

I like the privacy case from Moyles’ advisers as well. He shouldn’t be named and shames as a tax crook because that might damage his reputation? Why on earth should this even have a chance of success?

¨ He possessed some common sense, I presume¨

He also possesses an extreme level of arrogance, coupled with intolerance.

It is quite possible that he considers tax to be ¨for the little people¨

Ahh we have found someone who has heard one of his shows.