I had a phone call with Centrica's finance director yesterday, followed by a mail. This followed my suggestion in a blog yesterday that:

And this brings me to my second point: we have a regulator for energy who does even have the gumption to demand that these companies produce data fit for regulatory purposes that they put on public record. So even a company like Centrica that owns British Gas does not reveal enough UK data in its accounts to show just what it makes in this country, making a mockery of its name.

Nick Luff from Centrica said I was wrong, saying in his mail that:

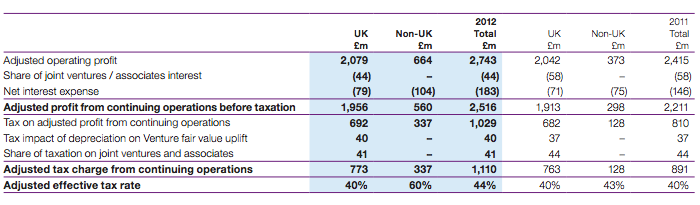

As discussed, can I refer you to page 37 of our 2012 annual report which shows the split of our pre-tax profits and tax charge between the UK and the rest of the world. You'll see that our effective tax rate in the UK is 40%, significantly higher than the normal corporation tax rate because of the supplemental tax paid on upstream oil and gas production profits. The non-UK effective tax rate is even higher, at 60%, mainly because a significant part of the non-UK profits come from Norwegian upstream oil and gas production, which is also highly taxed.

So I went and looked at the accounts in question and this is what is said on page 37:

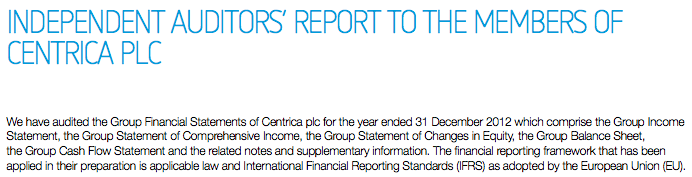

So there we have a profit figure - albeit a fairly selected one and not for the group as a whole, which includes discontinued operations, of course. We even have a tax figure. But before we get too excited this figure is not audited. The auditor's report says:

Page 37 is not covered in that case.

Now, admittedly they add:

But let's be clear: what the auditors are saying is that they have only looked at but not audited the data on page 37. So it's not actually in the accounts as such, it's in the unaudited directors report. So my question to Nick Luff was why should I rely on this? He was surprised by the question, but I wonder why. After all, it is very clear that the directors think this data important and it is clear that they must use it for management purposes and have it prepared for their use.

Now as International Financial Reporting Standard 8 on segment reporting says:

Operating segments

IFRS 8 defines an operating segment as follows. An operating segment is a component of an entity: [IFRS 8.2]

- that engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same entity)

- whose operating results are reviewed regularly by the entity's chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance and

- for which discrete financial information is available

Reportable segments

IFRS 8 requires an entity to report financial and descriptive information about its reportable segments. Reportable segments are operating segments or aggregations of operating segments that meet specified criteria: [IFRS 8.13]

-

its reported revenue, from both external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments; or

-

the absolute measure of its reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss; or

-

its assets are 10 per cent or more of the combined assets of all operating segments.

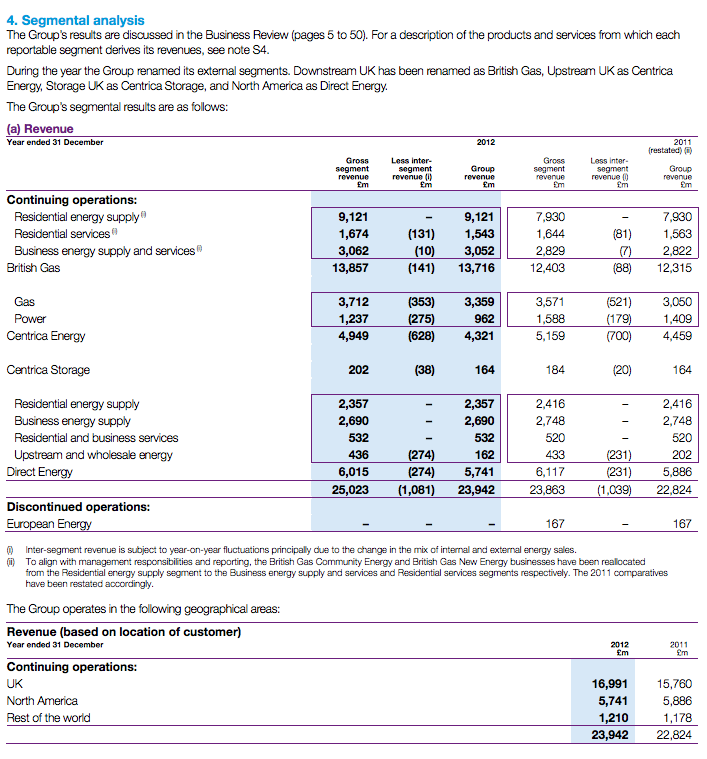

Now the very fact that data is reported fro the UK on page 37 says to me that UKL data is available in Centrica and is reported and therefore presumably used for decision purposes. This is also implied in the segment note in the audited part of the accounts which says:

So everything but Direct Energy seems to be in the UK based on the narrative note at the top. European Energy is discontinued.

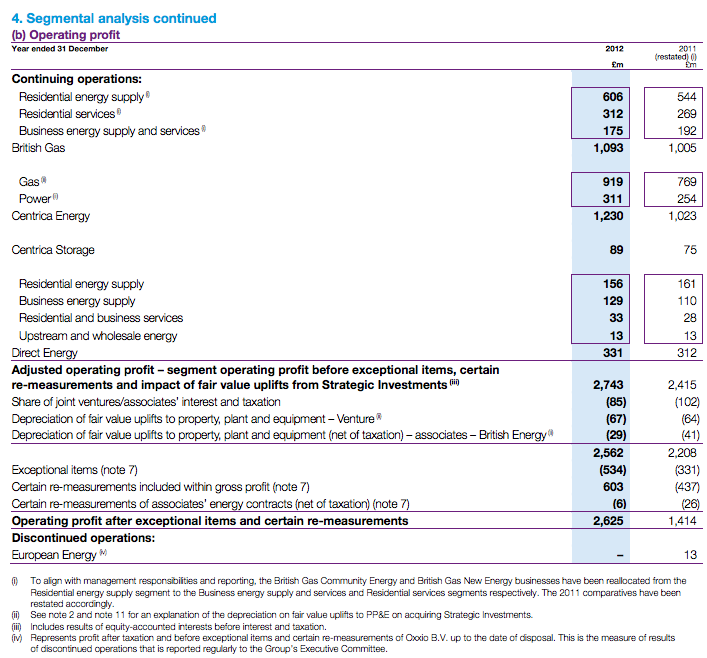

But the segment report on operating profit shows this:

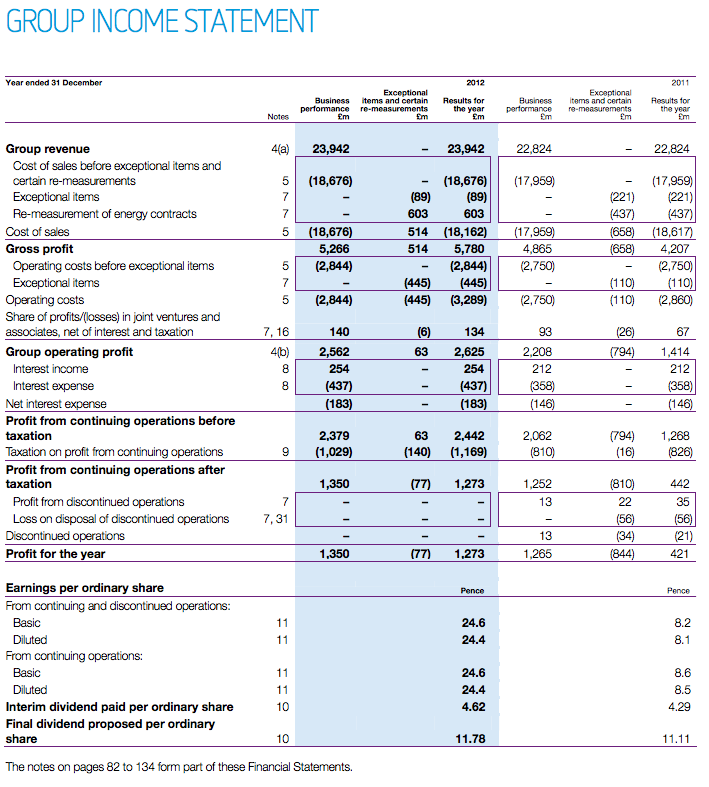

Now, here for good measure is the group P & L account:

Now I can spot the £2,625m group operating profit that ties to the segment note in there. But can you find the £2,516 referred to on page 37? No, neither can I.

And is the tax charge on page 37 the same as the group P & L? Not unless £1,169m is now the same as £1,110m.

And can you tell how much of the £2,625m operating profit is in the Uk from the segment note? Is it that sum less the Direct Energy profit of £331m? If so that's £2,294 but page 37 says the UK operating profit is either £2,079 or more likely for comparison here £1,956m.

So do I think Centrica is telling me what I need to know about UK profits and tax? No, I don't.

Nor do I think its IFRS8 segment reporting is complete because I think it should be reporting the UK as a segment as it clearly has data for the country as a whole.

And the result of all this is that I think my claim is more than justified having spent some more time looking at this today.

But I promise - if Centrica want to tell me where I've gone wrong and why someone should spend several hours trying to answer such a fair question from their accounts, I'm more than happy to publish the explanation. But right now I also wonder how the auditors did not spot the difference either. But that's another issue.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

I’d sort of hope that by signing an audit report on the consolidated accounts, the auditors would have audited the consolidation process, which by default would include looking at figures on an individual entity level?

Auditors don’t even look at all entities when signing the accounts

One reason why they and multinational corporations hate country-by-country reporting is that they’d all have to be audited

Most companies that send numbers and information up to head office for consolidation will have had some level of audit performed on those numbers/information.

But of course for the group audit, materiality will be the group level materiality. So if cut off at group for materiality is say £500k then a small company with say £200k turnover and £400k of assets/liabilities, will likely only get a perfunctory audit of the numbers going into the consolidated accounts.

If that same company has to produce local audited accounts then local materiality will be much less. This can lead to there being no audit adjustments for consolidation purposes, but there being audit adjustments for local audited accounts. And hence a mismatch between what goes into the group consolidated accounts and what goes into the local accounts.

But clearly if the adjustments are small (which by definition they are) then the fact they’re not made in the group accounts should not change one’s perception of those accounts – i.e. they should still show a true and fair view. And those adjustments should feed into the next year’s consolidated accounts so the group will end up with the right profits shown anyway over time.

For bigger companies in the group this is less of an issue, but for the smaller one’s it can be interesting! Especially when I try to compare the tax charge in consolidated accounts to what goes in the local accounts and the local tax return.

How much more does country-by-country cost if auditing costs rise.

E & Y have said it could increase audit fees by 25%

I suspect that is over the top

If it meant we had a proper audit it would be worth every penny

Did they explain how they arrived at that estimate?

And you think the last sentence will hold true? Dream on.

“Auditors don’t even look at all entities when signing the accounts”

I admit it’s a good ten years since I was an auditor, but I can tell you I was never involved in an audit with did not review every constituent entity accounts at a level sufficient to identify any issues of note (and material to that entity) save for outright fraud. My experience since then, as an audit client, is that the work is even more detailed now that it was then.

Of course, I’m only one person. And all my experience involves a single (Big 4) firm. Still, I’m not sure the modern process is as lax as you suggest.

My comment is based on discussion with the Big 4 of multinational audits

Are you going to respond to this or admit you have got this wrong?

http://www.fcablog.org.uk/2013/11/this-is-why-ritchie-needs-to-stay-away-from-accounting/

I do not respond to anyone who breaches almost every rule on professional ethics ever written

If you think that then surely you have a duty to report him?

Richard,

Your response really does undermine your credibility and therefore your whole worthwhile fight.

Why don’t you just accept the point that the reconciliation was perfectly possible and instead rephrase your argument. The fact that it was possible does not undermine your broader point that it was quite a difficult task and would be near impossible for a layman, and therefore clearer reporting is necessary.

It really does upset me when you respond to valid factual criticism with puerile ad-hominem statements – better to rise above their level. Accepting that sometimes we all make mistakes is a strength, not a weakness.

The comment was not an ad hominem, it was an observation of fact

And nor do I for a moment accept I made a mistake

A reconciliation is possible – but hard to achieve. That opacity cannot be desirable in any set of accounts

That was my point. It is correct

It is your suggestion that is, respectfully, wrong

“The comment was not an ad hominem, it was an observation of fact”

Richard, you should be aware that members of the ICAEW are liable to disciplinary action “if in the course of carrying out professional work or otherwise he has committed any act or default likely to bring discredit on himself, the Institute or the profession of accountancy” (Disciplinary Bye-law 4.1). As “it is the duty of every member, where it is in the public interest for him to do so, to report to the head of staff any such facts or matters of which he is aware” (Disciplinary Bye-Law 9.1), I take it you have already made the evidence of these breaches of professional ethics available to the ICAEW?

I can’t

I have no idea who the person is

I can’t report an avatar claiming to be an ICAEW member

“I have no idea who the person is”

So what basis do you have for claiming that he has “breached almost every rule on professional ethics ever written”?

The answer is none. It was an absurd thing for you to say. As someone with something of a public profile, aspirations of political influence, and an apparent interest in people behaving morally, maybe you should be a bit more thoughtful when throwing allegations around?

Your comment was the very definition of an ad hominem, and your aggressive and obstinate reaction does great discredit to you, as an ICAEW member who represents himself as much more than an avatar.

I have thought

I think it is a breach of all professional rules I can think of for an FCA to blog in the way this person does

I am not alone

I value by profession, integrity, transparency and accountability and have no time for those who do not share those standards

Christie Malry likes to play the camp commedy villain – think of Herr Flick out of Allo Allo!

If country by country reporting will increase audit fees by 25% why isn’t every single accounting firm campaigning for it?

Because they make much more from the tax abuse it might expose

Even if he breaks all the rules surely we need to know if his apparent reconciliation of the numbers is wrong?

His numbers work

I never denied a reconciliation was possible

My point it is absurd to publish numbers that few could reconcile

I stand by the point; indeed if accounts are to be meaningful it has to be right