Cyprus continues to confuse people, so some fact help. I;ve been scanning around for some given pressure on my own time and two blogs gave really helped. The first is Bill Mitchell's blog, which includes the following:

The European Central Bank publishes its — EU Banking Structures 2010 — the last publication being in September 2010.

It provides detailed information about the size of banks and other interesting financial data.

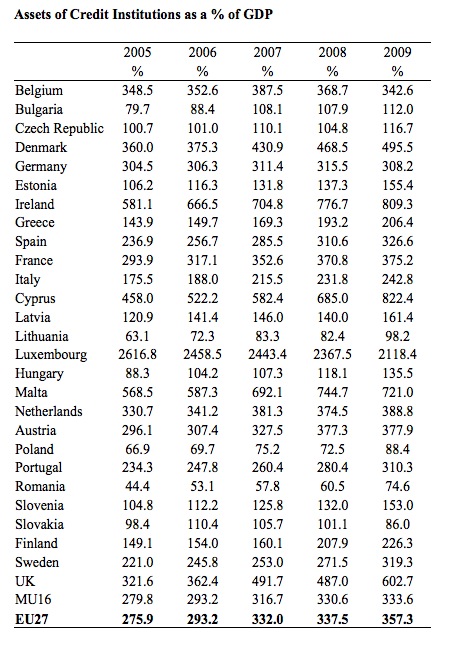

The following Table is constructed using data in that publication and shows the total assets of credit institutions in Europe as a percentage of GDP (a measure of the size of the economy).

It is clear that since 2005 the size of the banking sector in Cyprus has grown rapidly but not all that differently to say the United Kingdom or Ireland.

And certainly, this growth was very evident at the time Cyprus joined the Eurozone in 2008.

Much of the data is, in itself, worrying; not least the UK ratio. But what is clear is that Cyprus grew disproportionately and finance was disproportionate. Only Ireland and Luxembourg (which is off all scales) match it for disproportionate finance.

Luxembourg's exposure is extraordinary. Ireland has already crashed. The UK remains in trouble. But watch out for Malta, where risk is now very high I suspect, and Denmark is also over-exposed, but outside the Euro (which should, like the UK, save it).

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I updated the figures using ECB figures and Eurostat GDP numbers for 2012

http://equology.blogspot.be/2013/03/an-approach-we-should-take.html

Thanks