Over the weekend the Treasury shut down an abusive tax scheme that was costing £100 million a year in lost UK national insurance. The scheme depended on employers being located in Sark and then claiming employer's national insurance was not due as a result on agency payments to teaches, nurses and others. Tens of thousands of people have been involved in schemes supposedly run from leafy cottages on Sark.

I said on Saturday this was a Guernsey tax scheme. Some in Guernsey erupted in fury. Comments from someone who has said rather a lot, who passes by the name of Patrick, were typical:

Why do you suggest that Guernsey would be responsible for regulating such a Sark scheme? Was it part of a regulated Sark fiduciary's business? I would advise you to research thoroughly and think hard before you answer that one.

and:

Guernsey simply cannot stop somebody forming companies in the UK and elsewhere, and then contracting directly with Sark residents who are not carrying out any regulated financial services business to provide certain services from there. Guernsey can only intervene if the activity which is being carried out from Sark is one which should be regulated. Running a payroll company is very likely to fall outside of that scope altogether, as its simply a trading business of a non-financial services nature.

I really don't think that your arrows are being aimed appropriately at Guernsey re. this payroll scheme.

and:

Sark is NOT in Guernsey. It is part of the Bailiwick but it is self-governing. Mail is routed to Sark via the Guernsey Post Office (in the same way that overseas mail to Guernsey arrives via the UK).

I am reliably informed that company number 84559 in Jersey is ISS. It seems to be a Jersey-registered company, with a so-called administration headquarters (yeah right) in Sark, but with everything carried out from the UK.

Absolutely NOTHING to do with Guernsey…..

Well, all that seems heated, so let's now deal with some facts.

First, Sark is in the Bailiwick of Guernsey. Sark does have some separate laws, but saying Sark and Guernsey are not connected is like saying England and Scotland are not connected as they have separate legal systems and yet are members of the UK. So, the claims made are disingenuous.

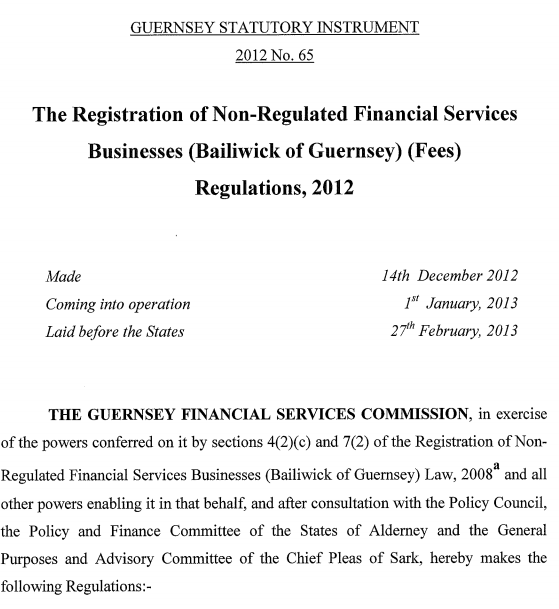

Second, Guernsey does regulate financial services in Sark. Take this for example, which I found on the web:

The evidence is clear: non regulated financial services businesses in Sark pay fees to Guernsey for regulation or Sark would not be consulted. So I looked at those regulations. They're here. One of the regulated activities is:

Issuing, redeeming, managing or administering means of payment, means of payment includes, without limitation, credit, charge and debit cards, cheques, travellers' cheques, money orders and bankers' drafts and electronic money.

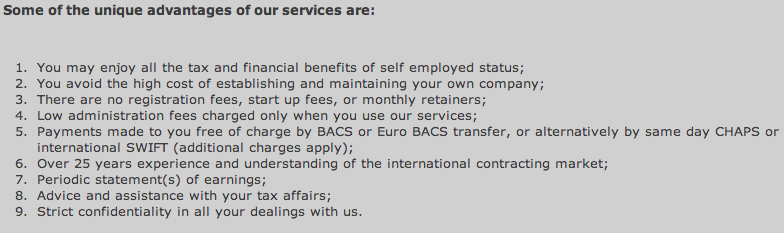

So then I looked at CSS, a Sark payroll company that says rather more on its website than the better known ISS. It says:

Note point 5. Are they managing payments? I would say so. In the UK this would be regulated activity. In Guernsey it's not clear.

Now, remember Guernsey is a secrecy jurisdiction. Secrecy jurisdictions are places that intentionally create regulation for the primary benefit and use of those not resident in their geographical domain. That regulation is designed to undermine the legislation or regulation of another jurisdiction. To facilitate its use secrecy jurisdictions also create a deliberate, legally backed veil of secrecy that ensures that those from outside the jurisdiction making use of its regulation cannot be identified to be doing so. So, of course, it keeps regulation limiting activity as tight as possible.

I'm not saying CSS or ISS have breached any regulations. I am saying that it looks to me that whilst Guernsey is responsible for Sark it has made sure that those undertaking this tax abuse (as it clearly is in the UK) have fallen out of their regulation. That's an act of omission and not one of commission. But you can be culpable for both and that's precisely what I am saying Guernsey has been. This UK tax abuse happened because Guernsey permitted it by an act of omission. And yes, I am holding it responsible for that.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Guernsey isn’t a person, and as such you can’t hold “Guernsey” responsible for the omission of this from it’s, admittedly poor, regulatory processes.

One of the primary problems i have with your attacking Guernsey is that you treat it as a single entity, from the way you write – the people, the government and the geographic location are somehow responsible for the situation they find themselves in, when the reality is that the vast majority of the things you discuss are pretty much news to the locals, many of whom are not involved in anyway that they might be able to understand not only which is implicated by the actual rules which are written for guernsey – but, as in this case – they are being blamed for not knowing what has been left out of a piece of legislation.

This might be a legitimate criticism of say, the states (which had a major re-shuffle just recently, it’s worth noting) on Guernsey, but it’s not legitimate to blame “Guernsey” for it, any more than the poor financial regulation in London is anything to do with someone living in a council house in Tower Hamlets.

The vast majority of people on Guernsey are normal people who do normal boring jobs – much of their income might well be predicated on banking income, but the teachers, the cleaners, the builders etc. who you are blaming for this are, to all intents and purposes blameless, yet you continue to do so, it’s pretty dreadful.

I think the people of Guernsey have the power to change Guernsey, more than most places do

If it’s a democracy that sells abuse can’t I hold the place to account and the failure of people to replace them as an indication of their failure?

What are your election turnouts?

Sark? Um, who is it that lives on Sark and who is Sark twinned with? Perhaps they are papering over the cracks. I understand the wine they are trying to grow is not very good.

It appears you have misunderstood the facts here, although i admit the website is not very clear.

This is the part you have wrong:

“The evidence is clear: non regulated financial services businesses in Sark pay fees to Guernsey for regulation or Sark would not be consulted.”

If you are non-regulated, then you don’t pay fees to be regulated. You pay fees to be registered, which is completely different to paying fees to be regulated.

The list of activites which you quote from are activites that are not regulated. For example, Stanley Gibbons are only registered with the GFSC (and not regulated by the GFSC) as trading stamps is not a regulated activity.

I understand that fully

That’s an act of omission under the guise of regulation

It appears there is regulation when there is none

And then important sectors are omitted none the less

What shall we call the end result? Is deception fair?

I dont think a payroll services company should be subject to regulation by a financial watchdog. I doubt UK companies offering the same service would need to be regulated by the FSA.

I think you will find they are regulated – or should be – HMRC is responsible

I left Guernsey more than 10 years ago – so it’s not “my” election turn out – I’ve not been a registered voter there for some time.

The election turn outs in Guernsey are incomparable with the UK – individual rather than household voter registration being a significant part of that, this means that it is much less likely that people are registered to vote and that the overall turnout figures look much more representative than they really are – none the less, 20,459 people cast their vote a turnout of 71.4% in the last election, but the last census puts the population at 65,000+ meaning that voter registration is only about 1/3rd of total population. Even accounting for demographics (and they have votes at 16 rather than 18) that’s very very low.

Secondly, the lack of, and indeed distinct opposition to political parties, and organised political action of any kind means that the political climate on the island is one which is predicated against change – even when there is significant change (as there was at the last Guernsey election) it’s from one set of people with a certain set of views to another, and it is in fact almost impossible to get elected on anything but a status quo sympathetic ticket, even someone on “the left” in the island (would not be on the left in the UK) like Matt Fallaize stands on a platform which is principally about maintaining the status quo.

I disagree that people on the Island have significant opportunities to change things, the eggs have been placed so firmly in one basket that to throw them out as they are would mean that they would lose their very comfortable way of life – and you don’t move (back) to Guernsey and stay in Guernsey for anything else.

I think that if there were the options on the table – that is candidates who stood for even half the things you are talking about, on the ticket (and as I say, most people are oblivious to this) and people did not vote for them, then it would be a legitimate criticism that they don’t – but given that the procession of candidates are overwhelming identikit financial industry (rejects) clones then it’s hard to level the criticism at voters.

Which opposition politicians in Guernsey have you been in contact with?

So what you are saying is that Guernsey is captured client state for the finance industry?

I would agree

I would happily debate with Guernsey politicians on the basis of facts – but they just hurl abuse. As you have noted, I don’t

Maybe that’s why my side has won the argument

Richard

It is a fact that Sark is self-governing, with its own Parliament. Guernsey has no more power to legislate for Sark than the UK or the EU does for Guernsey. Scotland elects MPs and they have representation at Westminster, and Westminster legislation is automatically law in Scotland. That is simply not the case re Guernsey and Sark. (Alderney yes, Sark no). You can argue that one all you like, but you will be wrong.

Does an employment company constitute “non-regulated financial services” or is it simply a non-regulated, non-financial services business? I don’t think you are correct with your analysis. A Sark hotel handles money and makes payments. Does that make it a financial services business? Of course not.

I think this is a business which is outside the scope of regulated financial services business, no different from many other types of business. Should it be covered by such legislation? Personally, I think a very strong case could be made to say that it should be, but as a question of fact I don’t think that it actually is.

In answer to your questions re electoral turnouts, in the 2012 election the turnout was 71.4%, which was a new record for any Crown Dependency. By contrast, in 2011 the Jersey turnout was just 48%. (Once again, I would suggest that you are allowing your hatred for Jersey to cause you to conclude that Guernsey is very similar to Jersey – it is not!).

Rather more revealing is the fact that in the UK 2010 elections the turnout was just 65.1%. So Guernsey’s elections turn out to be considerably more democratic than the UK’s What do you make of that?

Absolutely enyone is free to stand for election in Guernsey if they are proposed and seconded by two people in any electoral district. Elections are totally open and free. There are strict limits on what candidates can spend on their election manifesto and lobbying efforts. 71.4% of the electorate turn out to vote. All 45 elected candidates (plus 2 in Alderney) have an equal vote in the House, and there are no political parties whatsoever. How much more democratic can it be than that?

Richard, your continual attempts to chip away at Guernsey are getting very tiresome. There are several of us who will continue to correct you every time you get it wrong about us. We are not Jersey. We are nothing like Jersey. You are blinkered because of what you know and believe about Jersey. Those of us who jump on your inaccurate comments about Guernsey do so because we are sick to death with how you falsely portray us, and understandably so. All we ask is that you judge us on our own merits, and not on your view of Jersey.

Guernsey election turnouts are of the order of 75%. Better than the UK’s.

Then you chose abuse

Oh, come on. We are one of, if not the, most transparent and best-regulated of all offshore jurisdictions. When will you final,y accept that? Your views would gain far more credibility if only you would accept that and turn your efforts to attacking those who actually deserve it.

We don’t condone tax evasion at all, and even more aggressive types of tax avoidance are discouraged.

What more do you want?

TJN clearly acknowledges you are mot one of the worst tax havens

So do I

But your available for tax abuse and your systems allow and even encourage evasion in other countries in ways undetectable by them

Abandon your secrecy and I’ll acknowledge change

You have a long way to go

But so too has the UK

I notice you have abandoned your other arguments

Thank you

Most of the candidates have very little of substance to say on any matter, and in general wouldn’t understand 75% of the topics and points you post on this blog.

Richard

What “other arguments” have I abandoned? I have done no such thing!

Secrecy? Your “secrecy” is everyone else’s “privacy”, as is the case the world over. You seem to be expecting is to take the lead when the US, Germany, the UK, France, Japan, Canada, Australia et al are not remotely interested in abandoning the right to privacy. If and when the rest of the world moves on that direction, I have no doubt that Guernsey will follow suit. You want us to be first and lead the world? That is just totally ridiculous.

What we are doing, and have already done, more so than many other jurisdictions including many of the above, is steadily eradicate the ability to abuse privacy rights in relation to Guernsey’s financial services industry.

There are NO jurisdictions anywhere in the world, from the biggest G7 countries to the smallest coral atolls, which publish the identities of beneficial owners of companies, or of parties connected to trusts or foundations, or of owners of bank accounts. That is an indisputable fact, yet you criticise for not doing so, which is utterly ridiculous.

You wonder why Guernsey politicians abuse you. That’s one of the reasons. Your stance against us is wholly unreasonable, seemingly solely because our trust and company records are not available to prying eyes who have absolutely no need to know that information.

I don’t expect that you will publish this post. This is usually about the stage when you block posters who stand up to you.

Once slavery was normal you know

It didn’t stop a few pointing out it was wrong

And they changed the world

Your abuses also abuse people and enslave them

And we will change the world and stop it

And it will happen

Because the world will not tolerate your abs much longer

Richard

If you were to admit that you may have been unduly critical of Guernsey in light of progress made over the past couple of years, and accept that we are committed to being recognised globally as a responsible and respected financial services centre, with standards right up amongst the very best, in relative terms, then I do think that you would have far more respect from Guernsey.

That would mean not attacking us for not operating to even higher standards than G7 and G20 countries, and accepting that no international financial centre operating to such high standards should be criticised for not committing economic suicide by throwing out the baby with the bathwater.

Give us credit where credit is due, and of course criticise us where criticism is due. But don’t pick on us merely for being an international financial centre, genuinely trying to set very high standards on all fronts. No – of course we can’t go as far as you would like on some fronts until G7 and G20 countries do, but a recognition by you that despite your wish to see that, its perfectly reasonable for us not to lead the rest of the world, would be very well received.

A deal?

Osborne gave you the credit you need

He recognised you as a tax haven

Not to pick on Collas Crill, but section 7 of the following makes interesting reading!

http://www.collascrill.com/media/53178/3653_cc__image_rights_guernsey_d2.pdf

“Privacy” is great isn’t? It enables people to get away with all manner of things. Funny how Guernsey’s form of privacy is only open to a small minority. Who might they be I wonder? Of course, multinationals and the wealthy don’t pay tax any more. I guess this burden should be left to the little people.

In relation to financial services, Guernsey, Jersey et al are carbuncles on the backside of the UK.