I've been looking at HSBC's accounts, out today.

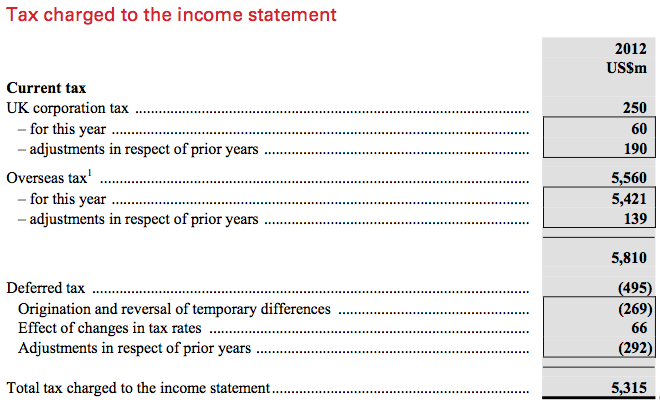

The company made pre tax profit of $20,649 million and had a tax charge of $5,315 million. That tax charge splits down like this:

That I can find HSBC does not say anywhere how much profit it makes in the UK. But since the UK tax charge for the year was $60m at a rate of 24.5% on average the taxable profit looks to have been $245 million.

Now, let's look at that a different way. Let's apply the unitary apportionment formula to group profits. From page 335 I know the company had 48,000 employees in the UK out of 270,000 in all.

And from page 40 of the media release I can get that $9,149 of income out of $68,330 was in the UK, whilst $18,391m of assets out of $79,935 were in the UK.

The classic unitary apportionment formula says that profit should be weighted to a country in proportion with one third of the weighting applying to income, assets and staff. So the maths is:

UK profit = $20,649/3 x ($9,149/$68,330) + $20,649/3 x ($18,391 / $79,935) + $20,649 / 3 x (48,000 / 270,000)

Now I make that $3,728 million of profit attributable to the UK on this basis. Tax on that would be $913 million. But $60 million was paid.

So for hosting HSBC and taking its risk the UK lost out on tax of $853 million, which is a little over £500 million - enough to pay outright for a couple of hospitals.

So, HSBC, tell us why that happened, will you? And how? And why you paid it somewhere else instead?

The case for country-by-country reporting for banks is compelling.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

In the results call, management said that the UK was an under-performing region compared. There are alos one-off costs in the UK, which would distort this years tax such as the $2.3bn provided for PPI and swaps misselling. ($1.2bn paid out in 2012).

They did also pay $571m in bank levy of which $295 was related to the non-UK operations.

So we bear the costs and lose the tax?

Interesting. You’ll have noticed that Vodafone is amongst the companies named by the Mail on Sunday for paying no tax last year. Vodafone blames the 3G licence of many years but the more likely explanation is the 2010 tax deal with Hartnett that stated that the UK CFC rule would not apply to them until the new rules came into effect this year when the new rules in turn would not apply. Giving that HSBC reached a settlement with HMRC last year, I won’t be surprised if they pay less tax than you’ll expect in the next few years.

Perhaps they based their tax bill on the current law rather than self electing into a hypothetical unitary tax regime thus avoiding tax that was never due?

But we can assess whether what is paid is fair or not – and I have

A really interesting piece of research will be a study of the % of the bank bonuses that made it to the public purse in tax and NIC. The public has long been deceived it is the full rates of tax but it’s nothing of the sort. Or perhaps we can simply get Margaret Hodge to extract it from HMRC and the banks?

But they have no other choice, unless you are asking them to make voluntary contributions? It’s the Governmnet that set the laws and like you generally say if you follow the spirit of those laws then you have acted properly.

Profit shifting always happens by choice

Are you honestly pretending companies have no options?

Id so you are very sadly deluded about the realities of corporate tax

But you have presented no evidence that they have shifted any profits based on current law. The fact that a unitary tax calculation will give a different result to the current calculation does not imply that there’s been profit shifting. The basis of calculation is totally different.

If reported profit does not reflect underlying economic factors even the OECD say there is prima facie evidence of profit shifting

“But we can assess whether what is paid is fair or not — and I have”

What you assess as being fair or not has no bearing on the tax they, or any other company pays. That is dictated by the law. That will remain the case until such a time that you dictate all the relevant laws.

I wish you the best of luck with that….

Sounds like you are supremely satisfied with the status quo. I wonder why.

I note from HSBC’s web site that they do indeed seem to publish country by country information in the form of the accounts of each of their local banks (at least for the UK, Hong Kong, US, Australia, France, Germany, Malta, Malaysia, Brazil, Egypt, Mexico, Bermuda and Canada).

So they seem a bad target for this particular critisism.

Where’s Switzerland?

And Cayman?

Useless without them all

Switzerladn is on its web site, Cayman not so, but how woudl that change the amount of the UK profits (which is what your original post seemed to be about). That is, it is clear what profit HSBC plc made.

Maybe you haven’t heard of profit shifting

If so, where have you been. The world has left you behind

One of us has wandered off the point.

I thought the point you were making in your original post was that banks should be forced to make disclosures of where they made their profits. My point was that it seemed as if HSBC does that.

It now seems that you are saying that such disclosures aren’t any use in defeating abusive tax planning. I am not expressing a view on that, other than to wonder why you suggested banks should be made to make such disclosures in the first place if they are in any event useless (or to put it another way, what was the point of your original post?)

No it does not do that

It does not disclose most of the countries where it trades

Therefore you are wrong

So the effective tax rate is 26%, and you posit that they moved profits out of the UK, where they would be taxed at 24.5%, to achieve that?

Would they not be better off moving profits *to* the UK, if they’re seeking to avoid tax?

So you haven’t heard of profit shifting either?

Maybe it’s time you did

I thought I explicitly mentioned it in my post?

If they shifted all their profit into the UK, they’d pay tax at 24.5%, or $5,059m.

They’ve actually paid $5,315m. So if all their profit were made in the UK, they’d be $256m better off in tax terms.

Why does that make you suspect that they’ve deliberately shifted profit out of the UK?

That’s challenged by their own notes to the accounts – where disallowable obviously explain the higher tax rates

So please let’s not be ridiculous because the UK effective rate would have been much higher for the same reason

I am not sure the unitary approach will always give a good answer, and sometimes more complex/sophistictaed allcoation methodoligies might be more appopriate. I do, for example, think there’s an argument for looking at what functions people are doing and how much they contribute to an organisations profits and factoring that into an allocation.

Re doing it in practice: In one of my previous jobs we did use a profit split method which was pretty similar to the unitary calulation you’ve done above.

Did it work? Internally yes – It was an easy way to apportion profits around the group – It was not a ‘simple’ spreadhseet but not that difficult a spreadhseet either. There were some admin’ difficulties in some countries, but the real problem was that some tax authorities hated it. In some cases that was undoubtedly because the group was making losses at the time so we were apportioning group losses. But some just simply wanted to stick to more tradtional transfer pricing methodolgies and refused to accept any form of profit split.

It seems to me that unless a lot of countries sign up to a unitary tax system it will never fly and experience of the EU CCTB idea (which drags forward at a crawl) is that getting any agreement that is wide enough to make it practical, is unlikely in my lifetime.

Re the PPP, I can see why some might say there an argument to say the costs relate solely to the UK and so should be apportioned there seperatley even under a unitary system. But perhaps that is too simplistic on a pure unitary approach since the income from the PPP will have been apportioned on a unitary basis in past years so the recapture of that profit – by settling the claims – and so, it seems to me, should be apportioned on the same basis.

However for this anaylsis, I am thinking that becasue profits from the selling of PPI were soley taxed in the UK in the past (and not under a unitary scheme) then doing a simple unitary calulation as above is not appopriate, so we should perhaps exclude those costs. Otherwise we’re comparing apples and pears.

But even excluding those costs (only about 10% of the group profit)the unitary approach still suggests an apportionment to the UK of some $3.3m.

You are ignoring the fact that the OECD says reform is essential

Arm’s length does not work – there are no comparables

Why do we insist on taxing a fiction?