The Telegraph have run a bizarre story today that restates something so well known it has not been news for a considerable period. They say:

In the 2009-10 tax year, more than 16,000 people declared an annual income of more than £1 million to HM Revenue and Customs.

This number fell to just 6,000 after Gordon Brown introduced the new 50p top rate of income tax shortly before the last general election.

The figures have been seized upon by the Conservatives to claim that increasing the highest rate of tax actually led to a loss in revenues for the Government.

It is believed that rich Britons moved abroad or took steps to avoid paying the new levy by reducing their taxable incomes.

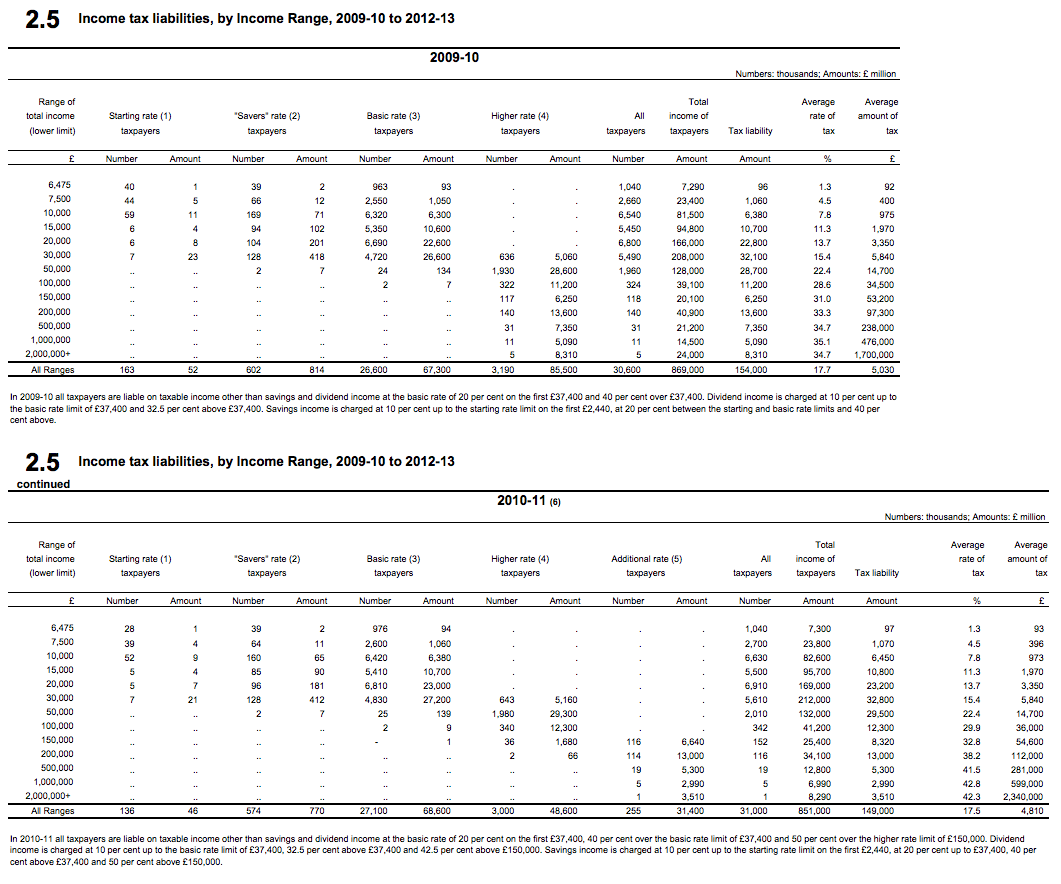

The stats on which they base this are here. For the record they're also here (click for a bigger version:):

You will note that there were indeed, based on this data, 16,000 people with more than a million of income in 2009-10. And there were just 6,000 a year later. But that was because, as Faisal Islam of Channel 4 News best reported in March this year, it was by then known that something like £18 billion of income was 'forestalled' from 2010-11 unto 2009-10 to avoid the 50p income tax rate. That meant income was simply shifted from the later year into the earlier year to get round the additional tax charge.

In round sums the above data shows those earning more than £150,000 paid tax of £33 billion in 2010-11, implying taxable income of about £88 billion, based on the data (not all will be taxed at 50%, of course).

The previous year the income of those earning over £150,000 was about £121 billion.

Forestalling would explain maybe £18 billion of this change. Even the Treasury agreed that. But remember that means an adjustment is needed to both years. In other words 2009-10 was overstated by £18 billion. It should have been £103 billion as a result. And 2010-11 was understated by £18 billion. It should have been £106 billion after the forestalling effect was removed.

So there was actually an increase in income in 2010-11 for those earning over £150,000 but for a massive and one off exercise in tax avoidance. And there was no impact at all of people leaving the country.

And the Telegraph story is utterly bogus.

And the claim that there was a Laffer effect is also completely bogus.

The right wing economists claiming this is some massive proof that tax drives people out of the country or discourages work need to think again. All it shows is that people tax avoid. And that is something I have said, for a long time.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] She claims this because of the data I analyse here. […]

The Daily Telegraph are very good at churning out previously well debunked stories and recycling them as new news. It must be the cuts…

One other thing that strikes me is that the government has admitted that by forestalling, some people were taking what are seen by many people as morally dubious decisions in avoiding the higher rate of tax. But instead of legislating against that, they decided to cut the top rate of tax; isn’t this a little like lowering the legal drinking age because some unscrupulous shops sell alcohol to underage drinkers? Or lowering the age of sexual consent because some people like having sex with minors?

We were led to believe that people did not change their habits or move due to tax increases. I suppose that is out the window.

Can we make a case that those who forestalled their incomes took action and engaged in tax avoidance?

They did tax avoid

Everyone knows it

Can they be prosecuted?

No

Why not? That is an outrage!

Slightly off-topic, but as someone who left the UK almost 30 years ago and can no longer remember (if I ever knew) how the UK tax system works, I’d be glad if someone could clarify for me exactly to what income or part of income the top (50%) rate applies. ie is it applied to ALL taxable income for someone with over £150,000 a year, or just to that part of their (taxable) income over £150,000 (with the rest being taxed at the basic rate)?

In France, where the system seems to be much more progressive, with currently 5 ‘tranches’, the new top rate of 75% applies only to that part of taxable income over 1 million euros (yes, that’s 1,000,000 euros – an annual income way beyond my imagination!). Up to 1 million euros, the top rate is 45%. I get so so tired of seeing the comments in the UK press that the rich in France are being asked to part with 75% of their income, when it is nothing of the sort.

I presume it’s similar in the UK (otherwise crossing the income threshold could result in actually result in a non-sensical loss of real income after tax), but maybe it isn’t – which might explain the apparent misunderstanding of the French situation, though I suspect the latter is more a case of deliberate misrepresentation encouraged by the Tory press.

Only applies to the bit over £150k

But Richard, if you look back further 06, 07, 08, 09, then it certainly seems the number of taxpayers earning over one million was higher than now and their earnings were also a lot higher. So either millionaire taxpayers have reacted to the 50% rate or they have been hit far worse in terms of income (as average millionaire income has halved) than other taxpayer groups.

Heard of a recession

And a squeeze on bankers’ bonuses?

Come on!

The point I was making is that we constantly here how the rich haven’t been impacted by the recession and their earnings are actually up, however the evidence in the tax revenues is that this is not quite the opposite.

Personally, I don’t believe that income is ever coming back and hence neither is the tax revenue.

No one who knows anything about this agrees with you…..

Wouldn’t it best to wait for the figures on the number of people earning £1m + in 2011-12, before drawing any conclusions? Or is that too obvious?

[…] Read this comprehensive demolition of the Telegraph story by TJN’s Senior Adviser, aptly entitled The Telegraph’s claim that all the rich have run away because of 50p tax is completely bogus. […]

This is vey wrong-headed. The point is that if you raise taxes to the right of the laffer curve, the rich pay less. It doesn’t matter if they emigrate, or tax avoid, they still pay less. If you lower taxes they pay more.

Dom. Do the rich who will pay more if tax is lowered include the one’s who are currently paying almost nothing in tax?

“If you lower taxes they pay more”. Really, I think you mean they – the wealthiest – pay what they want to pay. It’s like saying if you raise the drinking age to the right of a certain curve, then more people will just drink under age and get hold of false ID, or shops will sell alcohol to underage drinkers and risk it for the extra profit. So rather than clamping down on that practice, we should set the drinking age at whatever age underage drinkers think it should be, otherwise we’ll lose their custom and the VAT revenue. Legislation could be enforced, such as tax haven transparency or border agencies sharing information on immigrants that have entered countries who are suspected as doing so purely for tax exile reasons. As Richard has said “These routes could be easily closed if the political will existed to introduce both a comprehensive general anti-avoidance principle in UK tax law and to tackle the issue of personal service companies to ensure that the profits of these companies were assessed on their owners at the time they arise and not at the time that they are paid out to them, as now.” Why should we let people dictate policy simply because they think their threats or actions will allow things to sway in their favour?

Or rather it’s like saying we must set the drinking age at whatever age underage drinkers think it should be otherwise we’re going to lose out on their VAT revenue when they start buying their alcohol from a country with a lower drinking age…

The number of millionaires is also going to be skewed this year as everyone who can will push earnings into next year. I used to work for morrisons and every year they paid us our bonus in April until you guessed it the 50p rate came along so they pushed it into march having sent us a letter saying it will help us, despite the fact that only the couple of dozen directors at the top would have been impacted by this!!! Shameful!!! I bet they will be doing exactly the same this year, pushing bonus from march back into April, it’s a disgrace in my opinion. But if a company like morrisons is doing it then I bet they all are!

It was the whole sham of pretending they were doing it to help us simplify our tax affairs instead of just admitting that the top 30 earners in the company wanted to avoid tax as well as the fact they were avoiding tax that got under our skin

Oh, but there *was* an effect. Because of taxes, persecution, no aspiration and a failing future, I left – taking around £50,000 of tax money away from y’all. Next year, it will be more; the year after that, more still. (You get the picture.) Sure, it’s tax avoidance to the tune of hundreds of thousands (hopefully millions!), but then, I’m not coming back and when my British passport runs out, I won’t be renewing it. See ya.

No one is mourning