I admit I have not the time or energy this afternoon to spend a lot of time on HMRC's new tax gap data.

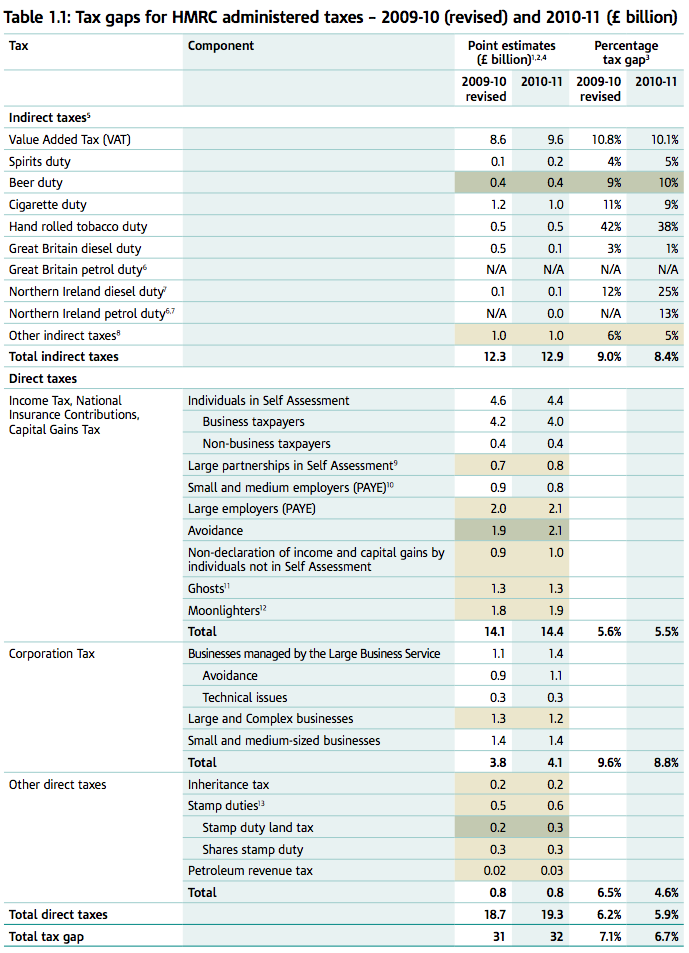

I've already explained that the mysterious decline in this tax gap over the last three years - the majority of which is explained by revisions to tbe basis of calculation - does not look credible - but let me offer just a little commentary now on some of the figures in this year's data, which looks like this:

So let's just make a few observations on why these look implausible.

First, because HMRC choose to ignore it none of the tax avoidance by Google, Amazon, Apples, Starbucks, Facebook and others is in here: that's done with official sanction so it's not going to be counted even though the world at large can see what's happening. If you want the clearest example of why the numbers are wrong, this is it.

Second, throughout the report you get the feeling that many of the falls in the tax gap are not because of any real change. No, they're because less is being done by HMRC to tackle the tax gap. So, for example it is said with regard to corporation tax:

The number of LBS Corporation Tax avoidance risks and technical risks subject to litigation has decreased by around 16 per cent between 2007-08 and 2008-09, from 342 to 288.

Why did the number of cases fall? I'd suggest because there simply aren't resources to chase them, not because the cases aren't there. In fact, they admit they are, saying of the above:

The effect on the tax gap is offset by an increase in average tax under consideration (TuC) per risk from £8.2 million to £9.5 million.

That, in itself is an amazingly small number (do they really mean million?) but the message is clear: the case work is not being done and the tax gap is not being measured as a result.

Third, let's consider the likelihood that tax avoidance by people on PAYE costs just £400 million a year. You mean all those bankers on all that pay only avoid £400 million? Oh please, pull the other one. Or just simply note the number of aggressive tax avoidance schemes being litigated, some involving billions, and realise this is not credible.

Fourth, let's note that this tax gap loses records nothing at all resulting from the maybe 1 million or more personal service companies in use in the UK at the moment, even though they have been subject to much scandal of late. HMRC does not recognise this as tax avoidance so the several billion lost due to avoided employer and employee NIC and tax lost due to income shifting to partners and spouses all misses this estimate. Amazingly, despite the political scandal attached.

And just for now let's note that HMRC officially think that although maybe 35% of all companies asked to make a tax return in the UK each year fail to do so none of this results in tax evasion. Which is, respectfully, just plain daft.

To put it another way, these numbers are manipulated to show a wholly distorted view. For a better one, see here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: