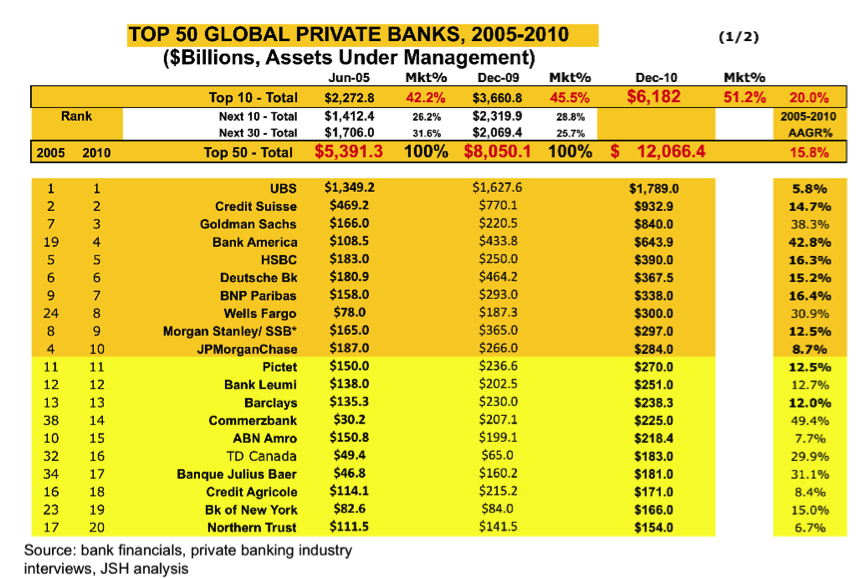

Jim Henry's work for the Tax Justice Network on The Price of Offshore Revisited includes some extraordinary data. This table is one such example. It shows the assets under management in the 20 leading private banks that manage the assets of the world's wealthiest people and data on the assets managed by the top 50 such banks:

Note the problem of Switzerland, and its pernicious influence.

But note something else too. Many of these banks were bailed out by the state, or at the very least relied heavily on its indirect support and implicit guarantees over the last four years. How are they saying thank you? Why, by hiding the assets of the wealthy out of the sight of those states that bailed them out so that tax cannot be paid.

That might be called a double whammy. They cost a fortune to bail out and now they're costing a fortune again.

Do you wonder why I argue for massively enhanced regulation of these organisations and the places where they choose to hide?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard,

From this list, only two institutions were bailed out, UBS and BoA.

UBS was bailed out by the Swiss taxpayers, who made a $7 billion profit on their investment.

BoA took TARP money, but it repaid it within a few months, with a significant return to the US taxpayer. In addition, BoA’s private banking operations came with its purchase of Merrill Lynch in September 2008, and as we know Merrill was definitely NOT bailed out.

Never let the facts get inn the way of a good rant.

The entire sector was bailed out as they’d all have failed without state bailouts of specific banks

Richard,

Following this logic, we should assume that because GM was bailed out, we also bailed out Mercedes and Toyota. This is obviously completely absurd.

Please don’t be daft

Banks are utterly linked together in ne massively co-dependent system

That is utterly untrue of car makers – so your comment is, very politely, absurd

Jason: “From this list, only two institutions were bailed out, UBS and BoA”

This topic is far from my expertise, but some internet searching found more than just two big finance corporations that received loans.

Also, I don’t see the indicator of loan recipients in that table.

“The entire sector was bailed out as they’d all have failed without state bailouts of specific banks” are you implying that if just a few more large bankruptcies were allowed, they’d have ‘fatally’ damaged the fragile financial sector (client confidence, repercussions/ripples)?

OT:

I don’t know enough to determine if this claim is true, because if true, it should be “BIG NEWS”.

Supposedly some TBTF (‘too-big-to-fail’, USA-based only, I assume) borrow(ed) from feds at very low rates (TARP?), then loan back to govt at higher rates. The resulting credit loop provides easy profit from interest difference, after subtracting the TBTF’s bureaucratic cost.

No mention of reptilians, union thugs, freemasons, or black helicopters, so the claim is not outright suspect (to me) 🙂