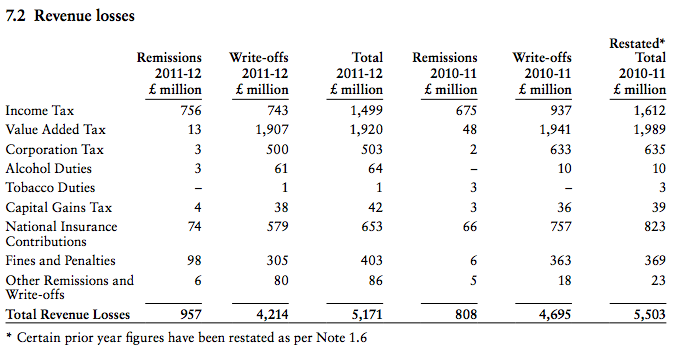

This table comes from HMRC's 2011-12 accounts, just published:

Note which tax has by far the biggest write offs: it's VAT.

OK, 200 million was missing trader fraud, but that does not explain it all, by a long way. This tax is inherently difficult to collect. And 500,000 missing companies don't help. Despite which the tax simplification people place their faith in VAT as it's "unavoidable" they say.

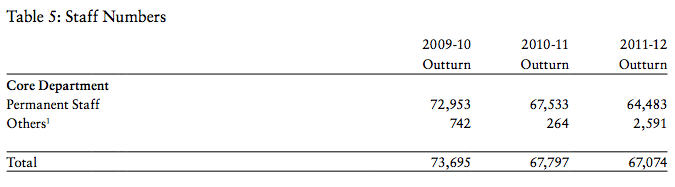

It certainly is not. And especially not when the permanent staff are draining away, rapidly;y, as this table shows:

The casualisation of HMRC continues and revenues are threatened as a result.

That can only be described as mismanagement.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard,

Biggest in raw figures, certainly. But it would be interesting to see what proportions are involved – the write off against the total that HMRC thinks should have been collected. Do HMRC supply such data? (oh, let me guess – “we don’t have the staff”)

T Magazine (Tax insight for business leaders) produced by Ernst & Young was distributed with the FT yesterday. The leading article is on the the rise of indirect tax. Haven’t read it yet, but guess it’s a whinge. But who is responsible for the trend if not the big avoiders of direct taxes?

Perhaps they are using Guernsey’s Chief Minister as a role model?

Meanwhile the Chief Minister of the Isle of Man appears to believe that it is not his job to help anyone; except the island’s secretive financial services industry, which the island has grown dependent on..

Little else is discernable above the patter of rain and the bleating of sheep ….

Why just bring bank Purchase Tax. Or has our Cousins call it Point of Sales Tax. This reduces the number of people/Companies and hopefully fraud.

Tax should be a] simple to administer b] fair and finaly transparant

My suggestions

Sales tax @ 22.5% on everything

Paye Tax @ 22.5% on everything above 80% of minimum wage

Nat Ins @ 22.5% on everything above 80% of minimum wage

Property/Land Tax of 1% of value.

Corporation Tax @ 10% of Turnover , based on the average of the past 5 years, paid 1 year in arear, with no ofsetting previous years losses?

Assett Tax @ 1% of Assetts as shown on Companies balance sheet, based on the average of past 5 years paid 1 tear in arrear.

And I am sorry to say the economy would collapse in days and massive njustuce woulda result

For example, food prices would increase by over 1/3

Good taxes reflect reality

Simple solutions rarely do

But surely the £1.9bn of VAT written off is due to large numbers of VAT registered businesses going bankrupt in the current financial environment? I am not sure that having more staff would have any impact on that. And even so, on net VAT revenue of £100bn and gross VAT revenue of £175bn, a £1.9bn bad debt doesn’t seem excessive?

The overall VAT gap is 13% of revenues

That’s good?