I've just re-published HMRC's new commentary on my work on the Tax Gap, published by the Treasury Select Committee.

I suspect no one will be surprised to hear that I do not agree with HMRC's analysis. What worries me most though is that they are not even attempting an objective analysis. In a long paragraph that proceeds their analysis they say they think they have good reason to comment on my work. That paragraph is especially telling, and I comment on it as follows, in each case quoting the original text and then my analysis of it:

Finally we have to be aware that because the concept of a tax gap is of public interest others will calculate a total. The external work has tended to produce estimates that we think are misleadingly high. (See the annex for a detailed discussion of why we are convinced that our estimate of around £35bn is much more accurate than the Tax Research UK estimate of £120bn).

It's nice of the Revenue to acknowledge that my work is the de facto alternative to their own; to say it is misleading is a deeply subjective statement implying intent. I have no intention of misleading anyone. My work is offered in good faith to correct very clear errors that I have persistently noted in HMRC's own work. Both our figures are estimates, of course. It is inappropriate to describe one as misleading.

We think that these estimates could be dangerous if not countered by HMRC's published estimates.

Respectfully, now we're moving into the realms of fantasy. To say that it is dangerous to have alternative tax estimates in existence undermines HMRC's credibility. This is misleading. They justify this saying:

Partly because they give a misleading view of HMRC's effectiveness and the amount of uncollected revenues.

Part of the purpose of my work is to argue that HMRC is ineffective. I do not deny that. But then, it is, as a matter of fact ineffective. Because of my work HMRC have had to admit that fact: they never published comprehensive tax gap estimates before I did so. Second, HMRC is ineffective because its senior management have decided to make it their objective to half the number of staff in HMRC in a decade from near enough 100,000 in 2005 to a planned total of just over 50,000 in 2015. Over 30,000 people have already gone. And the simple fact is that you can't close the tax gap without people to check accounts, visit missing traders, pursue uncollected tax and handle investigations. YThose people are no longer at HMRC, which is why they're having to resort to doing deals to get tax in from large companies, and simply ignore the fact that in wide areas of their work they are wholly ineffective. On statistic will suffice for now. As my research has shown, in 2009-10 HMRC asked 1,796,000 companies (out of 2.8 million that existed) to submit tax returns. Only 1,183,000 did submit a return. That means 34% of companies asked to submit a tax return did not do so whilst only 42% of all companies actually submitted a return. If that's HMRC being effective their standards of assessment for effectiveness are pitifully low. And that's why I suggest they're not collecting tax.

They have another reason for thinking my work dangerous though:

But also because [Tax Research UK's estimates] encourage the perception that deliberate non-compliance in the UK is the norm–a perception which could encourage further non-compliance.

Hang on - that's saying whatever the truth is they want to publish as low a number as possible to pretend that HMRC is doing just fine and people aren't fiddling whatever the truth might be. That's little short of an admission that what they are putting out is simply propaganda and is not an attempt at creating a true and fair picture of the problem (something which, unfortunately, their inconsistent choice of methodologies only confirms to be the case).

Is non-compliance the norm? Well I'd suggest 34% of companies ignoring a request to submiot a tax return is just that.

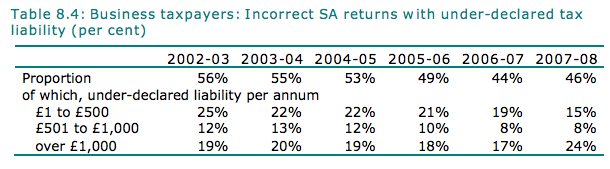

And when it comes to the self employed, this table from their latest tax gap publication is pretty damning:

Near enough half of all self assessment tax returns are wrong according to HMRC. If that is not non-compliance as a norm I do not know what is. Their claim looks very threadbare, if I am kind to it, despite which they say:

We are confident that deliberate non-compliance is far from the norm–and that it is important to demonstrate this by publishing our own estimate of the total tax gap.

I'm sorry - but making misleading claims undermines the whole credibility of that estimate - and as this analysis of just one paragraph shows, HMRC's work is misleading, and I would contend mine is not.

But I will come back to this in more detail on other issues, soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“to say it is misleading is a deeply subjective statement implying intent”

No, the verb mislead does not imply intent. Shan’t bother fisking the rest of it.

It does when used in the context HMRC use

What does the table 8.4 actually mean, is this their estimate or is it tax assessment that they have subsequently adjusted, and if that is the case I am assuming it would include an assessment where say for instance the person claims their entire mobile bill but HMRC disallows a portion as personal expenditure. Because most self employed people I know don’t have a real clue as to what is allowable and often have small amounts disallowed purely through confusion rather than deliberate attempts to reduce tax (in fact they are as likely to not claim for things that are allowable). A simpler tax system would be a big help. I am of course not saying there aren’t a large number of self employed people who cheat on their tax, it is just probably difficult to seperate deliberate from ignorant!

HMRC lump error in with evasion

And however looked at – this rate of non-0compliance on the returns they get (ignore those they don’t receive) proves their claim that compliance is normal is wrong

“I’m sorry — but making misleading claims undermines the whole credibility”

Ha ha, accusing HMRC of making misleading claims whilst complaining about them accusing you of misleading people at the start of the post.

Sauce for the goose, etc…

I’m suggesting they’re saying I’m misleading because they’re suggesting seek the truth is wrong – a subjective and political statement

Their claims are misleading because they’re wrong – as the evidence shows

A little story which shows how inefficient HMRC are and the consequences for collection.

Last year I received a letter from HMRC saying that I owed something like £800 tax on my state pension because I had not declared to them that I had started to receive my pension. I don’t recall any prompt and in any case I had assume, wrongly as it turned out, that the state pension was taxed at source, like the other pensions I have been receiving since retirement. It had taken them 4 years to decide that they needed to chase me for payment, yet the information from the pensions dept must have been available for those 4 years. I wrote a long letter to my MP about this and recently received a response from HMRC saying that they had written off all my outstanding tax debt – over £1k. Some of this related to a period of employment 5 years earlier which they had consistently failed to collect via my tax code, as agreed.

How much more tax due must have been written off in this way when HMRC are challenged?

Millions!

Hundreds of millions, at least

“Hundreds of millions, at least”

Is this another absurd figure you’ve plucked out of the air? Really, that HMRC have written off tax debt on pensions of “hundreds of millions”? At a time when HMRC are publicly questioning your work, do you think it’s a good idea to be making such claims?

And I have to say that Carol’s case sounds exceptional to me. I have never encountered a case in over 30 years where HMRC have written off tax in circumstances like that. I’m sure it must have happened once or twice, but it must be mighty rare.

The you know nothing of tax

So let me get this straight:

– state pension is notified to potential recipients at least 3 times before their birthday which allows them to receive the pension

– this is because the amount is dependant on NI contributions.

– you are responsible for telling the HMRC that you are receiving state pension (see DWP websites, letters and so on)

– why would you think it is net of tax when all information clearly says it isn’t

– as you pay tax on pensions you are aware of the tax position on pensions

– why write to your MP unless you wish to avoid the correct tax due?

So you are a tax avoider who has conned their MP into supporting them.

Over to you Richard.

Far from it

Your are making the most gross of accusations

I candidly think it is absurd that HMRC are not told of pension payments

Even more – I think it absurd that HMRC do not have the primary job of populating a person’s tax return with information on all UK source data e.g. pay, pensions, interest and even dividends, plus beenfits in kind and also pension contributions, all which should all be notified to them

They can do this in Sweden

Why can’t we?

In stead of making wild claims why not think about solving problems?

When I asked my friends of similar age whether they had informed the tax office about taking their state pension – when they had never had any reason to contact them before, having always paid PAYE – not one of them said they remembered doing so.

Sorry – the state pension doesn’t just appear out of nowhere – you have to apply for it in response to a letter(s) from DWP. Your friends must never have filled in an SA form and neither must you as State Pension is included on there.

So – having ultimately found out that you owed £800 in tax because of your failure to declare income, how is this different from others who are (rightly) called to account on this blog?

And I repeat – if the state pays a pension it’s entirely reasonable to think the state taxes it first

As for submitting a tax return – most people don’t and aren’t asked to do so

It’s another debate whether they should

My answer would be yes only if it was populated with most data first, which I think technically possible and desirable

You are very dangerous, but not for the reasons they say. You have let the public know what a tax gap is. Likewise a deficit. Likewise how it is that being a megacorp gives you leverage with HMRC that ordinary citizens don’t have. And so many other things. You’ve made tax, and the idea of paying tax, into something that is the duty of the social individual, responsible business and honest company.

You have, in effect, turned over the stone. HMRC was thriving underneath it.