The budget Osborne has offered today includes some massive tax giveaways. There's almost a billion a year to big business on top of the controlled foreign company £800 million they were already getting. And although he says otherwise, the 45p tax rate is a massive tax giveaway to 300,000 in the UK.

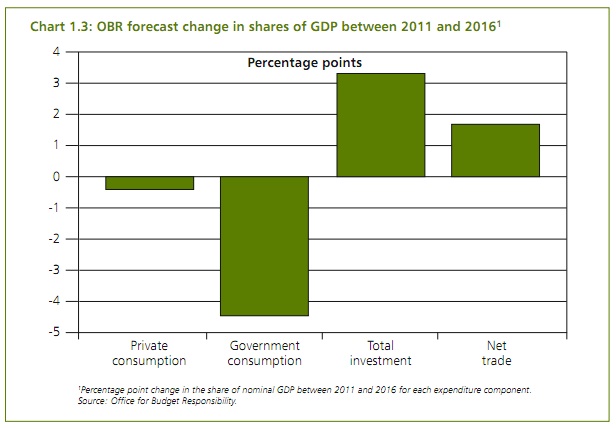

He's doing this because he's still assuming there will be growth. Not as much as he did - the OBR have upgraded this year by 0.1% but downgraded the next two. But what's really worrying is how they think that growth will happen. This is indicated in the following graph, taken straight from the Budget statement:

So we, as consumers, are going to be worse off. That's good news!

And the government is massively contracting.

And although the OBR say worldwide there could be recession, and certainly no growth, they are nonetheless saying exports will grow - which is utterly implausible and is an assumption that comes from cloud cuckoo land!

But the weirdest assumption of all is that business will invest massively more? Why will they do that? Their customers - whether here, or the government, or abroad - are all going to be consuming less but it's assumed business will invest substantially more. That is utterly implausible. They just aren't that irrational. They want a return before they invest - and since this forecast clearly says none will be forthcoming then that isn't going to happen.

In that case, as ever, this is a budget for balancing the government's books that simply will not deliver. And it can't - because the above four variables are the only ones that will drive growth and if business investment does not - as I am sure will be the case - then all his underlying economic assumptions are wrong. And that's particularly worrying. Especially for his credibility when it comes to the next election.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Sorry, but even a lawyer like me can read that is a graph of the changes in the percentage of applicable to each component of GDP over 5 years, so if GDP grows at 2% (and probably much more), that is more than 10% GDP growth, so government consumption in 5 years time will be 4% less of 110% of the current figure. That doesn’t sound like a reduction, just a rebalancing.

Oh dear….lawyers and numbers rarely relate

The graph shows where growth is expected to come from – and there are only four drivers of growth, as shown

My argument is if all four are negative – and that’s what I suspect – then there will be no growth at all

In which case your assumption of growth irrespective is really rather naive, or just wrong

You have causes and effects very mixed up here

Actually that does NOT say we as consumers will be worse off, although *some* will be, but that we shall spend less. Under Gordon Brown, consumers spent 10% more than they earned (yes, there is ample published data for that). OBR forecasts a cut in spending of less than 1%.

It ames no difference – they aren’t creating growth and so what I said follows

The exchange rate

?

The assumption is that business will invest. I don’t see why this is crazy assumption. They will invest to try and take market share of their competitors or protect from those that are attempting to take market share them.

Let’s follow the evidence shall we?

They haven’t been

And there is no sign at all that they are going to do so

That’s why they have enormous cash piles they are lending to governments

Or you can just look at the reports of FTSE100 companies, there is plenty of investment happening. Tesco’s alone are employing an additional 20,000 more people in the U.K. over the next two years.

Just go and read people like Martin Wolf and stop extrapolating the particular to the general, which does not work

Facts are what matters and UK business is sitting on a cash pile of maybe £100 billion according to the E & Y Item Club – which is unprecedented, and have no intention if using it

In addition banks aren’t lending

So data does not support you

Is Osborne planning to draw in this investment from privatising infrastructure projects?

cf the contract The Severn River Crossing PLC

Annual running costs £15 million

Annual income £72 million

http://www.publications.parliament.uk/pa/cm201011/cmselect/cmwelaf/506/50607.htm#a15

It costs £6 for an ordinary car to cross the bridge which is absurdly high.

Attracting capital this way screws us all twice – first because the executives here underpay tax, and second because the services provided are extortionate.

Hey, just wondering if you could clear something please.

Reading Duncan Weldon’s article on LC, he suggests that the OBR’s figures have been adjusted to rely on public consumption, which seems to contradict your article about OBR’s forecast for public consumption above.

http://liberalconspiracy.org/2012/03/22/osborne-is-relying-on-consumer-led-growth-but-will-it-materialise/

This is not a criticism of either article, I genuinely don’t understand. As a humanities student with not much previous interest in economics, I do my best to keep up with various blogs etc, but can’t really understand this data with my limited knowledge. Cheers.

Well – actually, I don’t understand either

That isn’t how the data looks to me!

I will do some more rummaging

Richard