Listening to LibDems today you’d think that tax gap is a marginal issue.

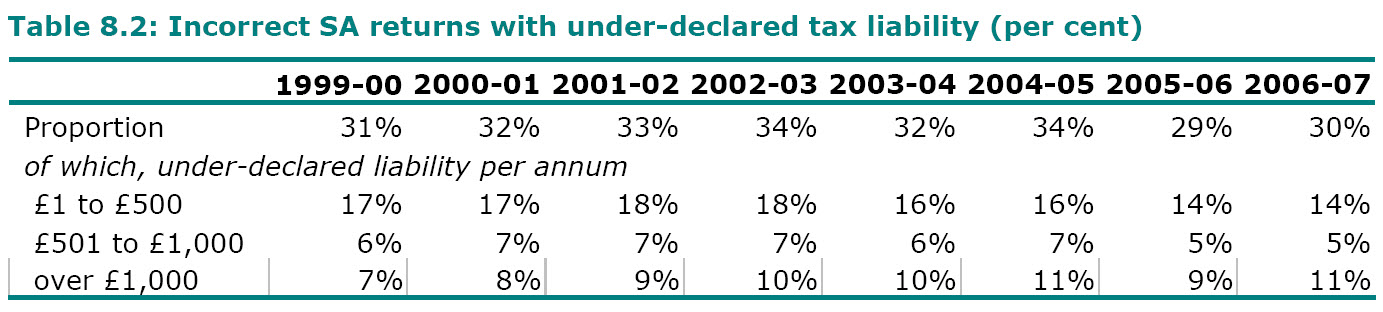

It isn’t. These are tables from the HMRC report on the tax gap issued last week. The first relates to overall errors in self assessment returns.

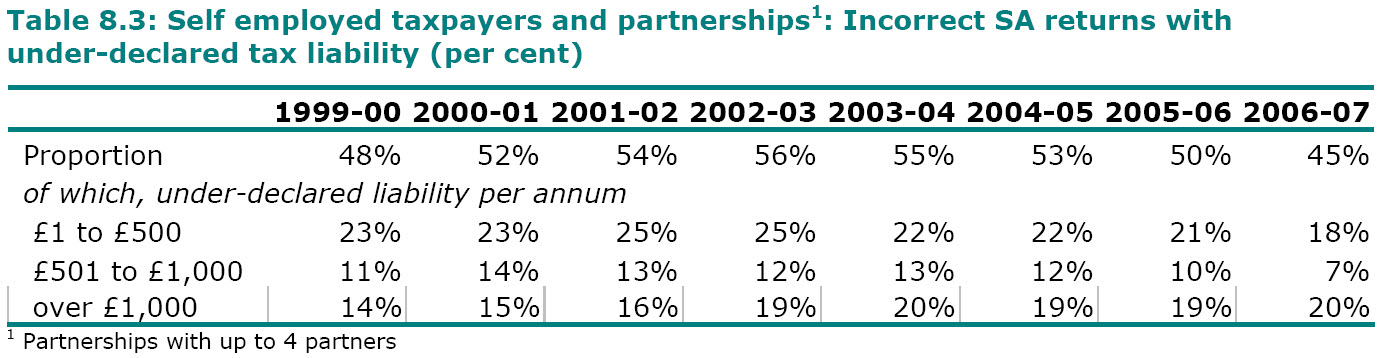

This is the part that relates to those in smaller self employments:

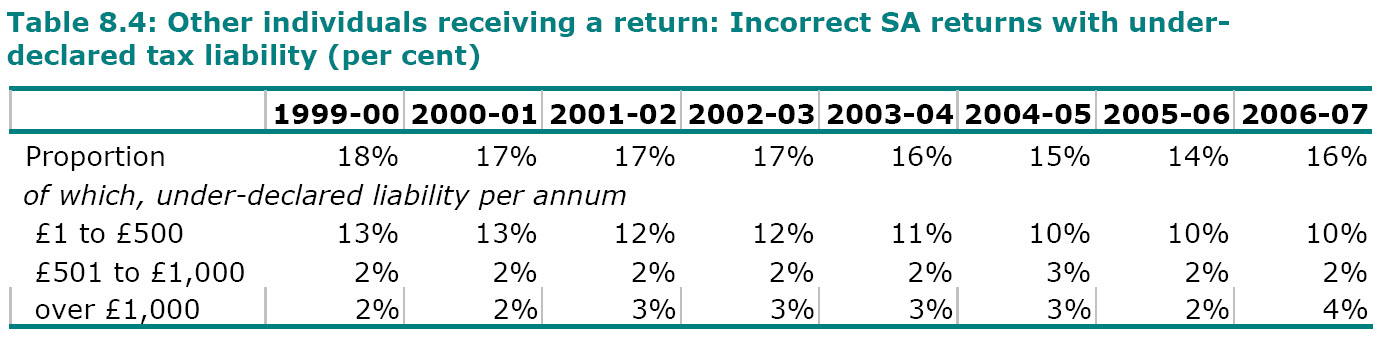

For those in employment the data is:

Overall HM Revenue & Customs say 30% of returns have errors. Overall 12% of liabilities are under-reported as a resulted. For the self employed 45% error rates arise. And remember — these ratios ignore almost entirely the true shadow economy — those who are entirely outside the self assessment system altogether and who quite ludicrously HM Revenue & Customs pretend basically do not exist.

This data does not say there is a marginal problem with tax compliance. This data says there is a massive problem with tax compliance. And note that as is the case with so much data at HMRC the information is ludicrously out of date, largely it seems because they simply haven’t got the resources now to collect and assess it due to job cuts.

Note also as a result that most of this data relates to periods before cuts really began to have impact on the efficiency of HMRC: I expect these ratios have got much worse as job cuts have really begun to have impact on the number of enquiries HMRC can undertake.

Only more resources can tackle this problem.

And the resources required are not a limited range of specialists. The resources required are large numbers — tens of thousands — of qualified tax officials working in tax offices throughout the UK to collect the tax that is owing. I have estimated that £15 to £20 billion a year could be collected if this was done and appropriate legislation was put in place.

And that’s not what the LibDems are saying they’ll do.

Which shows just how out of touch with the reality of the problem they’re facing they are.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] can I be so sure? Because I’ve just shown that the problem with uncollected tax is not the peripheral issue that Clegg and Alexander are […]

If 12% of liabilities are under reported by let us say 20%, and all other liabilities are correctly reported then that is a loss to the exchequer of 2.4% of all revenues, or roughly 1% of GDP. Not acceptable, but equally not nearly enough to cover a 14% deficit.

@Alex

But you, as do HMRC, ignore the fact that maybe 10% of the economy is not declared at all

Errors are obviously going to be made in a proportion of tax returns and some will deliberately choose to risk not declaring, but I though it would be a low single digit percentage.

Very surprised.