Deloittes, in a cynical and politically motivated exploitation of central government funding, recently took opportunity of their commission to work on the Foot Review of British tax havens to argue that my calculation of the Tax Gap in the TUC publication The Missing Billions was wrong.

I suggested a figure of £25 billion for direct taxation. They said (page 78) the figure was £2 billion and may be was much lower.

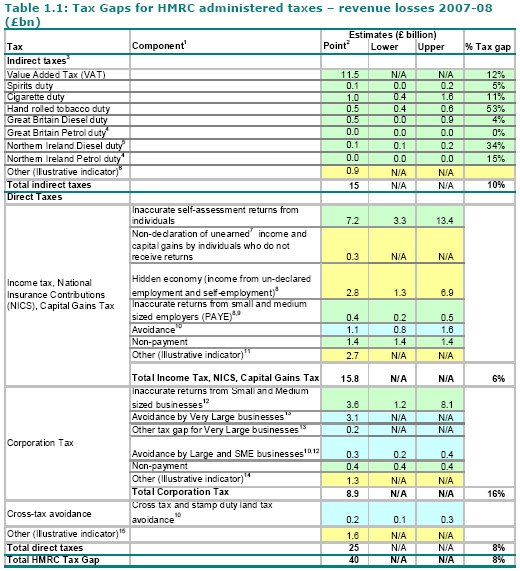

It is curious to note in that light the following table summarising HMRC’s calculation of the tax gap, published today:

Odd to note that the figure for the direct tax gap is‚Ķ£25 billion.

OK, there is £3.1 billion of evasion in there. I accept that was not in my calculation (and I’d add that it is wildly underestimated for reasons noted here) but also note that the corporation tax gap alone is way above that noted by Deloittes.

Which I think dismisses their work once and for all as exactly what it was — politically motivated misinformation. And this does also, I think, show The Missing Billions as being an accurate assessment - as I've always maintained.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I wonder what the tax gap is for Council Tax/NNDR. Since you can’t hide landed property in a tax haven, I guess it would be rather small.

Reading the Deloitte report, they say that the ‘avoidance on UK corporation tax is estimated to be GBP 2 billion’. Shouldn’t that be compared with the aggregate of the two lines ‘avoidance by businesses’ in the above spreadsheet, i.e. 3.4 billion?

@European Bear

No. Deloittes said they compared with my report

My report was about the tax gap i.e the total

They said they could only find £2 billion and willingly let that be compared with my data

So comparison with £3.4 bn is wrong

It’s interesting that you thrown stones at Deloitte by saying they are politically motivated. You are too! Who speaks the truth, I don’t know but you and they both have vested interests.

No John, Richard does not have vested interests. Deloitte is the PAID servant of the wealthy and the large corporations. It’s business model is such that it has nowhere else to go. Richard is politically motivated, yes, you are right there but vested interests, I don’t think so.

This is, on your part, simply an attempt to say that all positions are morally equivalent which serves only to obscure the realities.

@John Buckles

I’ve never denied my motivation

Deloittes do

That’s a big difference

@James from Durham

James

Thanks!

But I have to make clear I am biased – and I am paid, by the TUC for example

But I hope I am open and honest about that

Which is the point I’m seeking to make

Deloittes claim objectivity and in my opinion relentlessly promote the neo-liberal agenda that oppresses most people and deliberately makes the gap between rich and poor bigger

I seek to do the opposite

Which is fairer?

Or is that an unfair question?

Richard

Richard

I was aware that you are paid by the TUC, but you have the capability to do other kinds of paid work, like accountancy! You are not dependent on the TUC. The difference with deloittes is that they don’t have an alternative client base.

“No. Deloittes said they compared with my report”

Deloitte do no such thing, at least not in the article to which you have provided a link. They say that various efforts have been made to estimate the tax gap caused by avoidance, and base their own approach for doing this on your work for the TUC. At no point in this article do they suggest your estimate is far off; they are just looking at a sub-set of your total number.

On a separate note: I find the 7.2 billion in the HMRC’s spreadsheet for inaccurate self-assessments staggering. Are these all honest mistakes, or does this include tax evasion by individuals?

@European Bear

Deloittes say their work provides a ‘meaningful comparator’ with the TUC report

Which somewhat dismisses your argument

Is that right? Don’t the avoidance items in the table only come to £4.7bn? The other items relate to evasion, undeclared income and the black economy, rather than avoidance. Didn’t your £25bn figure relate to avoidance only? Your calculation and the Revenue’s seem a world apart.

That ‘meaningful comparator’ remark is made in reference to their and your analysis of the accounts of the 50 largest companies in the FTSE. They reason that between the sets of data they used and you used there are differences, but by and large they should be comparable.

Again, Deloitte’s focus is solely on corporate avoidance, so their 2 billion number should not be compared with your 25 billion number.

@European Bear

Neither you or they have read the Missing Billions then

And Deloittes – and many others – have willingly allowed their work to be compared with the Missing Billions – and set out to suggest there was a comparison

There isn’t. They used a different methodology despite their claim to the contrary and they suggested that although theer was a significant tax gap it was government policy

It was not – and the HMRC data not shows that was not the case

I measured an expectation gap because that indicated the gap between reasonable expectation over time (Deloittes took one year) and reality. That showed a gap – which overall happens to be the same as that HMRC record for the same expectation

I do not claim more than coincidence

I do claim Deloittes made grossly inaccurate claims in their report about use of methodology and that gaps they found could be ignored – stating they could not be avoidance when it is very clear HMRC think that plausible – and that in this they were deliberately misleading readers

It so happens that HMRC are much closer to my estimate than Deloittes estimate – and I think that is clear indication of which is more credible

Debate over

That doesn’t seem right at all – your estimate was looking at avoidance (rather than evasion or failure to file). The HMRC figures for avoidance come to much less than yours. The fact their total figure is similar to yours seems coincidental.

[…] to HMRC the total direct tax gap in the UK is just £25 billion a year. Of this tax evasion is not specified but at maximum it is […]

[…] to HMRC the total direct tax gap in the UK is just £25 billion a year. Of this tax evasion is not specified but at maximum it is […]