I have been looking at the Tax Information Exchange Agreements (TIEAs) that have, in the main, been signed as a result of g20 pressure arising in April this year.

There were 180 of these by 10 November, the cut off for my work. I think there’s one more now.

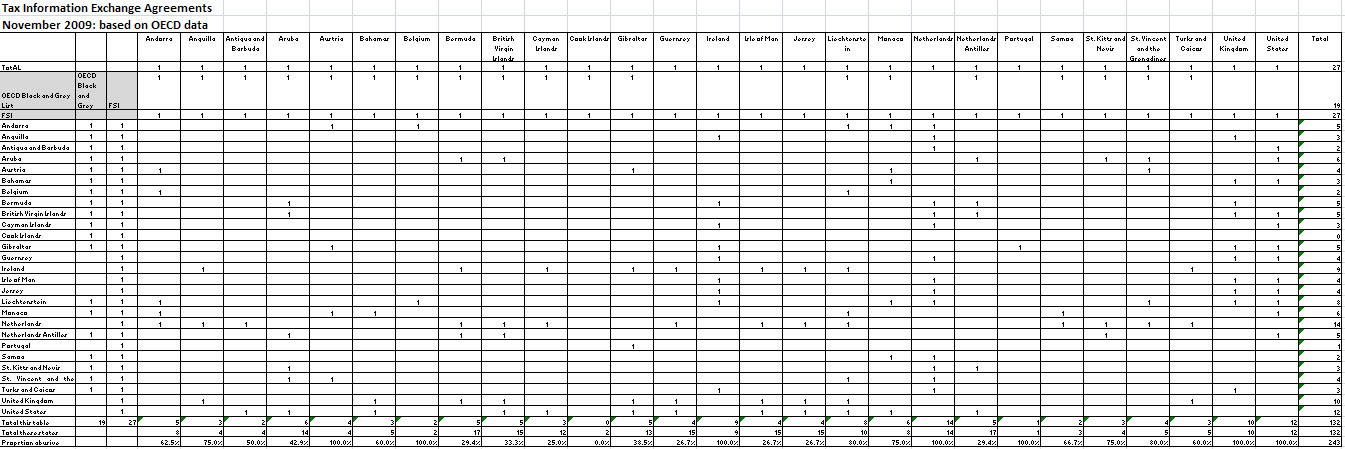

I have plotted them all. In doing so some interesting trends emerge. Take this table, for example. It shows the TIEAs signed by OECD non-compliant grey and black list states with each other.

I am well aware that this table is small: click on it and the whole thing comes up in a separate window.

I stress: the data relates to all TIEAs signed to 10 November 2009.

What the table shows is that 24 TIEAs are between grey list states (I know the total says 48 — but it does, of course, count each agreement twice). The implication is clear: these ‘non-compliant’ secrecy jurisdictions listed by the OECD in April 2009 have been seeking to become ‘internationally compliant’ by signing TIEAs with each other. Remember when noting this that signing just twelve TIEAs makes a place internationally compliant. No information has ever to be exchanged: having the TIEA is enough.

I predicted this would happen as soon as I heard of this requirement. It was too obvious that this would be what they would do.

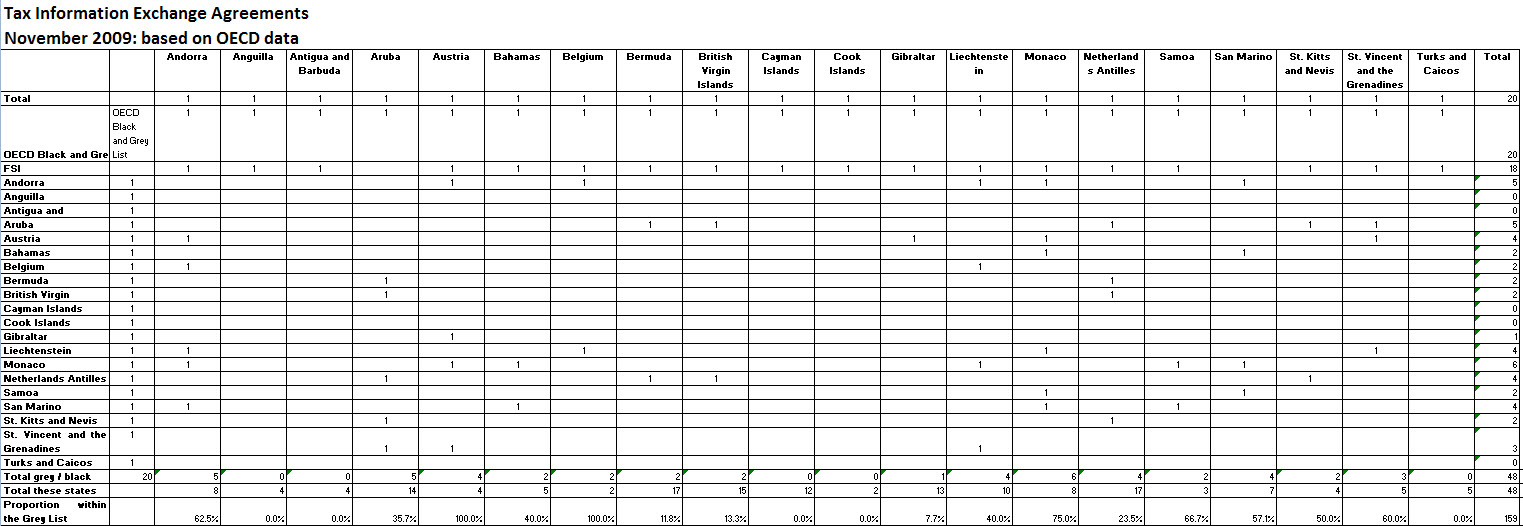

If I expand the sample to the jurisdictions covered by the Financial Secrecy Index published by the Tax Justice Network then 66 of the 180 TIEAs are between secrecy jurisdictions (expanded image is here):

Note that in some cases — like Andorra, Anguilla, Liechtenstein, Monaco and more like them the rate of TIEA with other secrecy jurisdictions is very high indeed. As is very clear: these places are seeking to run a closed shop where they are ‘compliant’ but will never have obligation to ever exchange any information because you can be sure none will be requested.

The rate of 66 out of 180 may not sound worrying, but it is. 67 of the remaining agreements are with Nordic states. Now I’m not chastising those Nordic states, but when 28 of all agreements are with the Faroe Island, Greenland and Iceland the standard is obviously wrong. Such agreements cannot be material to the setting of an international standard but right now they are 15.5% of all agreements.

So what’s left after insider dealing between secrecy jurisdictions and the Nordic states is excluded? Spain has just two agreements, Italy none, Canada 1, Germany 6, France a good (in this context) 11. But surely it is absurd that we aren’t measuring compliance in terms of the recipients of information and not the suppliers? Why is it Spain gets 2 and is told that secrecy jurisdictions need sign no more as they are compliant? That has to be wrong.

And so too are the absentees from the list very notable: India, China, Japan, Brazil, most of Africa, almost all developing countries. When will they get a deal from states that are willingly, knowingly and very deliberately abusing this new standard to sign deals with each other so that the people who need information to enforce their tax laws will not receive it?

The OECD standard for TIEAs is not good enough. It needs urgent reform. And very soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard,

I can tell you for a fact that some major European countries do not want to sign TIEAs with some offshore centres. You will have to ask them why not, because they have been requested to do so and visited by at least one offshore jurisdiction many times but just keep delaying. But to assume that the offshore jurisdictions are refusing to sign up with Italy and Spain would be incorrect.

Richard,

Are you surreptitiously implying that a tax agreement between Solomon Islands and Pitcairn Island is not useful? 😀

[…] Tax Justice Network continue son travail p?©dagogique et politique sur les paradis fiscaux. Un petit compte de Richard Murphy montre comment les paradis fiscaux sont en train de contourner la pression du G20 dans leur fa?ßon […]