The Mapping the Faultlines project that has given rise to the secrecyjurisdictions.com web site does what it says on the tin: it seeks to map the fault lines that flow through the world’s financial architecture that allows illicit financial flows of at least $1 trillion a year to take place.

As recent US government testimony in the US Senate made clear:

the ability of criminal and other illicit actors to form corporations in the United States without disclosing their true identity presents a serious vulnerability. It creates a pathway for criminal actors to gain access to the international financial system, and creates significant obstacles in our ability to investigate financial crime.

Unsurprisingly, the Tax Justice Network agrees, having said so for a long time before the US Treasury came to share the opinion. As a result we have mapped just how many corporations there are in the world’s major secrecy jurisdictions, all of which we have surveyed. The results can be found here in a report prepared by my TJN research colleague, Markus Meinzer.

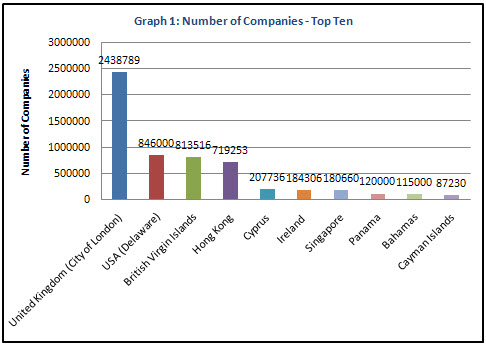

The findings are telling. This is the top ten:

But as Markus notes:

Two caveats must be born in mind when considering this data. First, a large number of companies registered in a jurisdiction is not in itself evidence that all the companies so registered are mere shell companies: some of these will be undertaking genuine economic activity in the jurisdiction. However, as the ratio of companies-per-head of population in a jurisdiction rises the more likely it is that a significant proportion will be shell companies.

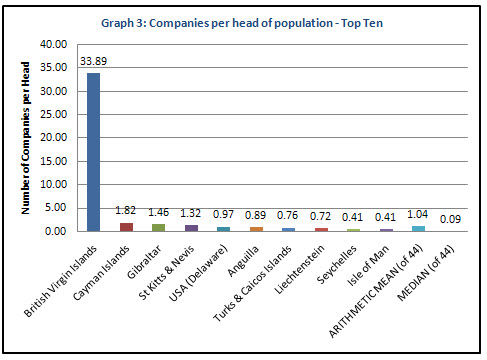

Number of companies per head of population looks like this:

Suddenly the story looks very different. Some of what might be called ‘the usual culprits’ appear.

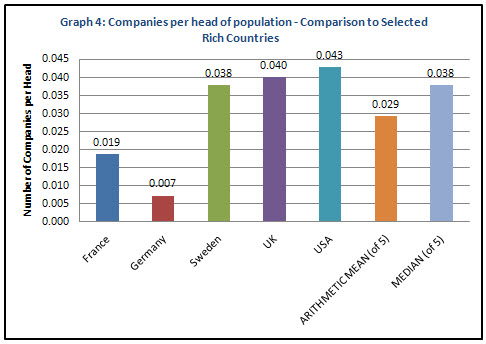

And to see how aberrant this is, this is similar data for states where most companies are likely to have some real economic function:

Germans manage less than a company per 100 people. Ignoring the BNVI as utterly aberrant, Cayman has 1.82 per head and Delaware just under one a person.

This is a massive cause for concern. At least the US Treasury have noticed it.

Now we need change. Change that requires beneficial ownership, real management and accounts on public record. If that happened the abuse these corporations facilitate would be a lot harder to perpetrate. That is our goal.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: