No, you didn’t read that incorrectly. Cayman is insolvent, bust, broke, unable to pay its debts.

This is not a rumour, this is fact. This fact is confirmed by the speaking notes used by the Hon. McKeeva Bush for a meeting held with senior Cayman civil servants, government boards and private sector business leaders last Thursday, of which I seemed to be the first to secure a copy. The text is here, but I will also reproduce it separately on my blog in case Cayman take it down.

The following summarises the current state of play, all revenue in Cayman Island Dollars, which have a fixed exchange rate of CI$1=US$1.2:

|

Revenue, year to 30.6.09 |

487.4 |

|

Costs, year to 30.6.09 |

557.1 |

|

Apparent deficit |

-69.7 |

|

Add: Loss on state businesses |

-11.4 |

|

Overall annual deficit |

-81.1 |

|

Loans as at 30.6.09 |

598.0 |

|

Free cash balances 30.6.09 |

14.3 |

|

Free cash balances 25.8.09 |

-10.5 |

|

Overdraft facility |

-15 |

|

Expected cash deficit in September |

-48.6 |

|

Expected overdraft at 30.9.09 |

-59.1 |

|

Cash requirement in excess of limit |

-44.1 |

|

Facility now requested from UK |

372.0 |

|

Resulting total borrowing |

970.0 |

| Borrowing as a proportion of revenue |

199% |

|

GDP 2004 |

1615.8 |

|

Borrowing as % GDP |

60% |

So desperate is the current crisis that the Caymans turned to the UK to cover September’s deficit, and have been politely told they may not borrow the necessary funds to pay wages and other commitments in that month. The letter saying so is here. It is also on my blog.

That means just one thing: Cayman is insolvent. It cannot pay its debts.

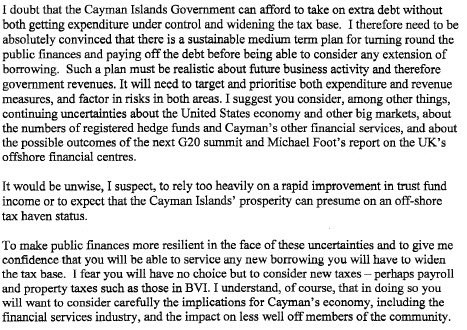

The UK has refused to lend the funds or let Cayman borrow because it does not believe it will cut government spending and it has seen no commitment by Cayman to raise taxes. And the UK makes it clear in no uncertain terms that is exactly what it thinks Cayman should do in the following key paragraphs:

I have the impression the author enjoyed writing those paragraphs, but look at what he is saying:

- The US is fragile;

- The hedge fund business is fragile;

- The G20 will have an impact;

- The Foot Commission will have an impact;

- Trust fund income will fall;

- Cayman cannot assume it will keep tax haven status;

- Taxes must be imposed.

It’s hard to see how much more could have been said to make clear that Cayman’s business model is dead.

This is extraordinary. Bear in mind Cayman has the thirteenth highest GDP per head in the world, and the highest in the Caribbean. It has more multinational corporation subsidiaries than any other tax haven. It has more banks than any other tax secrecy jurisdiction, and more hedge funds too. And it is bust.

So what are they proposing to do? Unbelievably all proposed taxes are on ordinary people in Cayman:

- Imposing taxes on money transfers from foreign workers in Cayman, — Jamaicans being the biggest group;

- Introducing property taxes;

- Revision to various miscellaneous fees, some of which have remained unchanged for decades;

- Increasing customs duties;

- Increasing alcohol and tobacco duties;

- Increasing gasoline tax;

- Legislate the requirement for money in dormant bank accounts to be turned over to the Government; and the

- Introduction of a national lottery

That is grossly unfair on the poor in Cayman (the very people the UK says should be protected), shows no real broadening of the tax base but does, most of all, look like rearranging the deck chairs as the ship is sinking. Which is extraordinary by itself in two ways. First, for a place supposedly so clever this is a remarkably poor list of initiatives, and second it does of course say yet again that the vested interest of wealth is being protected.

The odd thing is that is not possible in this situation. If Cayman really is insolvent, and that seems likely, then it is very clear that law and order may fail, property rights may not be protected, and so on. Wealth, in other words, is under real threat and such is the size of Cayman activity I doubt much of it can get out in a hurry without causing massive instability.

So this really is a crisis at the heart of the whole tax haven / secrecy jurisdiction system. The totem of the offshore location is seeing its business model fail, and with it the whole edifice of offshore — including the whole hedge fund edifice that claims to be built around this small island, could fall with it.

This could be a Lehman scale failure.

And all for the sake of a few dollars. But a few dollars none the less the UK will not let them have.

Watch this unfold: if London sticks to its guns (and it should) then Cayman is over as a tax haven — as they themselves predict. The fall out will be enormous. The whole hidden economy could fall apart with it — and do not think that will not have onshore ramifications, because it will.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] I think I owe Jersey and Guernsey an apology. I’ve been predicting both will go bust for a number of years. It seems though that Cayman is trying to beat them to it. […]

[…] Guardian has commented on the Cayman story. I am the expert referred to in what follows: A wealthy tax haven, a tropical paradise: it’s […]

[…] I think I owe Jersey and Guernsey an apology. I’ve been predicting both will go bust for a number of years. It seems though that Cayman is trying to beat them to it. […]

The repercussions would surely hurt the City and therefore the UK. Won’t the UK bail Cayman out at the last minute? Also a Cameron government would wish to maintain the Crown dependencies so as to continue feeding into London

[…] have covered the story in more detail here, but the reaction is interesting: Chris Johnson, a British accountant who has lived there since […]

That is grossly unfair on the poor in Cayman

Do tyuo actually know what you are talking about, it seems you are making stuff up to fill in the Chasms of your lack of knowledge.

There are very very few Caymanians in Cayman, look at the Lviing conditions report in their website. The poorest people in Cayman are expats who do the menial jobs for the locals (cleaning, house keeping, basically indentured servants) for little pay and who then sent what little they have back tothier families kin their home countries as they are not allowed them in Cayman.

This is a minor blip, basically due to old government over spending their resources and not keeping proper records.

Cayman is not looking for money from the UK, please try posting the truth. The loans are from local banks

Your get like Gerbels with your propaganda

There are very very few Caymanians in Cayman, should read

There are very few poor Caymanians in Cayman

@Creg

I think you are probably spot on in your comments about overspending. Cayman does have a thriving tourist industry (over 2 million visitors), which is always going to create a lot of the employment in a country with a population of only 50,000. Assuming only 20% of the country worked in the travel and tourism industry, that would be a hefty amount of income and one that the government should be encouraged to develop. I note that the government, which is almost debt free at present is looking to borrow about 10% of GDP in a once and for all borrowing. The UK, which is already massively in debt and has plenty of obligations (e.g. civil service pensions) which are not shown in the national debt figures), plans to borrow 14% of GDP every year for the next 4 years.

[…] least in theory this will happen this month in Cayman. Those Islands are insolvent. They cannot pay this month’s wage will. At least, not without the permission of the UK, and that […]

[…] in Economics, Other blogs, Politics, Society, Tax Justice at 9:20 am by Paul The Cayman Islands are insolvent. Broke. Unable to make ends meet. Government staff are going unpaid, and the Island authorities […]

[…] why it matters by Paul Sagar September 4, 2009 at 10:09 am The Cayman Islands are insolvent. Broke. Unable to make ends meet. Government staff are going unpaid, and the Island authorities […]

The government of Cayman is providing free education to children living on the island. They also provide a police force to serve people on the island. They probably also provide facilities for refuse disposal, street lighting, law courts and similar.

Doesn’t it make sense that the beneficiaries of these services – the property owners – pay for them? The poor in Cayman don’t own valuable property and will pay nothing. The wealthy benefit from government services will get back much more than they pay. Seems fair to me!

They ought to use this opportunity to abolish Stamp Duty and customs duties, boosting the local economy.

The issue about multinational companies, banks etc registered in Cayman seems like a red herring! The government isn’t providing them with a costly service or scarce resource AFAICT, so why should it charge them? Why should they take money off hedge funds to service property owners?

Many property owners seem to leave properties vacant for most of the year. Charging them the same fee as permanent residents for the services and protections offered is morally just, economically sound and administratively efficient. But it will also encourage higher occupancy of housing and bring benefits of community.

[…] Cayman Islands are insolvent. Broke. Unable to make ends meet. Government staff are going unpaid, and the Island authorities […]

[…] This does, of course, follow the news that I broke that Cayman is bust. […]