I note that Tim Worstall is persisting in his claims that my methodology used in the TUC report, The Missing Billions, is flawed.

I have already dismissed his arguments on tax incidence. They are substantiated only by the false assumptions he makes about the reality of transparency in the corporate world. Let me now deal with this second, false, allegation.

Worstall's argument appears entirely dependent upon rhetoric. If ever there was a man to split hairs it is him. I am reasonably confident if there was no person left on earth to argue with Worstall would take issue with a lamp post, and it has to be said that argument with Worstall is totally pointless because it continues ad nauseum without any benefit arising. As a result, candidly, I will not bother. Far too many people of sound mind had been convinced by my argument to need to engage with him in that way.

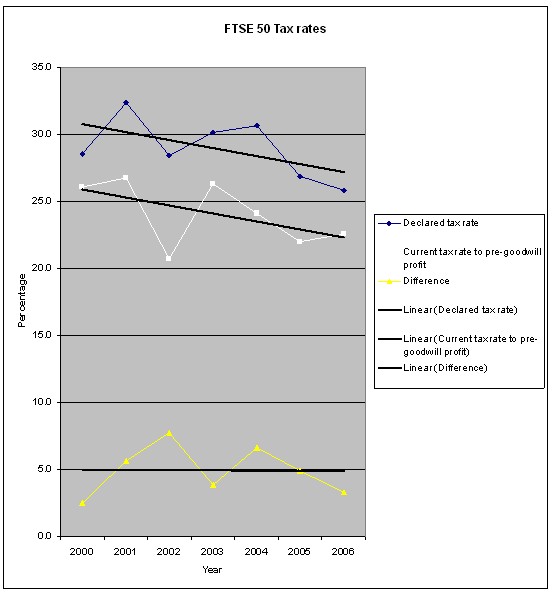

I do instead issue a straightforward challenge. As my research has shown, using the data published by the 50 largest companies in the UK in the period from 2000 to 2006 and considering just the current tax charge and profits with goodwill added back, because the goodwill charge in a set of accounts is almost never allowed for tax, an extraordinary trend is apparent. In 2000 the ratio of current tax declared to pre-goodwill profit was 26.1%. By 2006 it was 22.5%. On a trend basis the decline was just over 3.5% during the seven year the period even though the UK corporate tax rate throughout this period was flat at 30%.

Throughout this period the current tax rate was almost exactly 5% less every year than the declared tax rate placed upon the proper loss account of the companies in question: in other words, always and persistently the companies paid at least 5% less in tax than they declared on their profit and loss accounts. The resulting graph looked like this:

In addition in 2000 there was under £9 billion of deferred tax liability on their balance sheets. In 2006 it was almost £47 billion, an increase in unpaid tax of £38 billion in seven years from just 50 companies.

I'm well aware that Deloittes tried to brand this finding 'just rubbish' but unfortunately for them they audited a significant amount of the data I used to reach this finding. All they managed to do as a consequence was questioned the credibility of their own audit procedures, for these are facts. Whilst the tax rate in the UK was not falling, and whilst the weighted average tax rate around the world taking population as the basis of weighting hardly fell at all, the overall declared corporate tax rates of these companies fell dramatically.

I say that was because of a significant and deliberate increase in the abuse of the world's tax systems by these companies through the undertaking of tax avoidance. Worstall disagrees.

My challenge to Worstall is simple. Produce the data that can show any other explanation for this trend, but I warn you in advance: do not use KPMG's survey of corporate tax rates because that is a simple statistical analysis which takes no account of the population size of the countries in question, or of the size of their GDP and therefore of their relative economic significance. As I noted above, when these factors are taken into account this cannot explain this trend, as I proved in earlier research.

Tim Worstall can nitpick, but I have produced answers and he has not. That is the difference between us and right now I can find no alternative explanation of the evidence I created and which others can now reproduce.

That's why I stick by my work, its methodology and its findings and the obvious inferences that can be drawn from it.

The numbers tell this story loud and clear. That's enough to justify action.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard

You should have a qualified practising accountant review your posts first to avoid looking a fool.

Deferred tax liabilities do not represent tax avoidance – they are an accounting concept that exists to reconcile the actual tax paid to the tax at, say, the 30% corporation tax rate. Why is the actual tax paid lower than 30% of the profit? Because UK tax law allows for certain items to be expensed at a different rate in the accounts than the rate they are expensed for tax purposes – for example, capital allowances are often at a different rate to the depreciation expense: this isn’t tax avoidance – it’s an accounting concept and the deferred tax liability helps users of the accounts understand the difference between the headline tax rate and the actual tax due. It has nothing to do with avoidance!

Jamie

I am a practising chartered accountant who has calculated more deferred tax liabilities than I care to remember.

You have a view.

I think it wrong.

I have explained why, many times.

And if you’re right please offer alternative explanation for the data. That was the challenge and no one seems willing to rise to it. I wonder why?

Richard

If your conclusions from aggregate data are so compelling it should not be difficult to establish specific examples. Surely you need some of these if you want your argument to have credibility

Alastair

Have you been reading the Guardian?

Have you looked at The Missing Billions data?

Richard

I agree that your methodology in the TUC report is fundamentally flawed. Rather than go into the technical details, for the layman: just look at some of the effective tax rates you’ve calculated. Some of them are negative e.g. Vodafone.

Do you really think Vodafone voluntarily paid MORE tax than it needed to, or that it engineered some “additional tax paying schemes”? Of course not, and for the same reason, it is not appropriate to conclude that a lower rate effective rate implies anti-avoidance or loss of revenue for the Treasury.

Charles

You seem not to have given a lot of thought to the data

If a company makes a loss and pays tax then a negative tax rate results

This was the initial data – and was published to justify making the methodological adjustments the work included

This trait was therefore eliminated in the final data

Your comment is, therefore, without foundation

Richard

@Tax Research LLP

I have no issues with the data, only the methodology.

What you are essentially doing is saying that the difference between the expected ETR and the current tax charge is the tax gap representing tax avoidance.

How have you managed to determine that this is due to tax avoidance and not due to other factors?

Charles

Pretty much flat tax rates over the period in all major states (ignore minor ones where little tax should arise)

Some changes in tax base, but as much broadening as concession

And we get the above result

How else do you explain it?

Richard

How

Let me get this straight, you are saying the only significant factors affecting the tax charge are:

– Headline tax rate

– Tax avoidance

– Statutory changes to the tax base

And since headline rate and tax base have remained broadly static, the difference can only be due to tax avoidance?

OK, alternative plausible hypothesis please.

I’m always happy to hear them.

Richard