The Treasury issued this press release on Northern Rock this morning:

HM Treasury today confirms that the guarantee arrangements for Northern Rock plc described in HM Treasury's announcements dated 20 and 21 September 2007 and 9 October 2007 are being extended, at the request of Northern Rock plc, to the following unsubordinated wholesale obligations, whether now existing or arising in the future:

- all uncollateralised and unsubordinated wholesale deposits and other borrowings which are outside the guarantee arrangements previously announced by HM Treasury;

- all payment obligations of Northern Rock plc under any uncollateralised derivative transactions;

- in respect of all collateralised derivatives, and all wholesale borrowings which are collateralised (including, without limitation, covered bonds of Northern Rock plc), the payment obligations of Northern Rock plc to the extent that those obligations exceed the available proceeds of the realised collateral for the relevant derivative or borrowing; and

- all obligations of Northern Rock plc to make payments on the repurchase of mortgages under the documentation for the Granite securitisation programme.The previous announcements have created guarantee arrangements for all unsecured retail products of Northern Rock plc and many of its wholesale deposits and borrowings. This announcement extends these arrangements to a wider range of wholesale products. The extension is in line with the previously announced objectives of the Tripartite Authorities of financial stability and the protection of the taxpayer and consumer and for the purposes of Northern Rock plc's credit ratings in respect of the wholesale obligations described above.

No change is being made to the guarantee arrangements in respect of retail deposits of Northern Rock plc, which remain fully protected under the announcements previously made by HM Treasury. Northern Rock plc will pay an appropriate fee for the extension of the guarantee arrangements.

As previously announced, the arrangements to protect retail and wholesale depositors of Northern Rock plc will remain in place during the current instability in the financial markets. Reasonable notice, which will not be less than 3 months, will be given by HM Treasury of any termination of these arrangements.

As one journalist has already put it to me, he presumes that the Treasury are hoping no one will understand this.

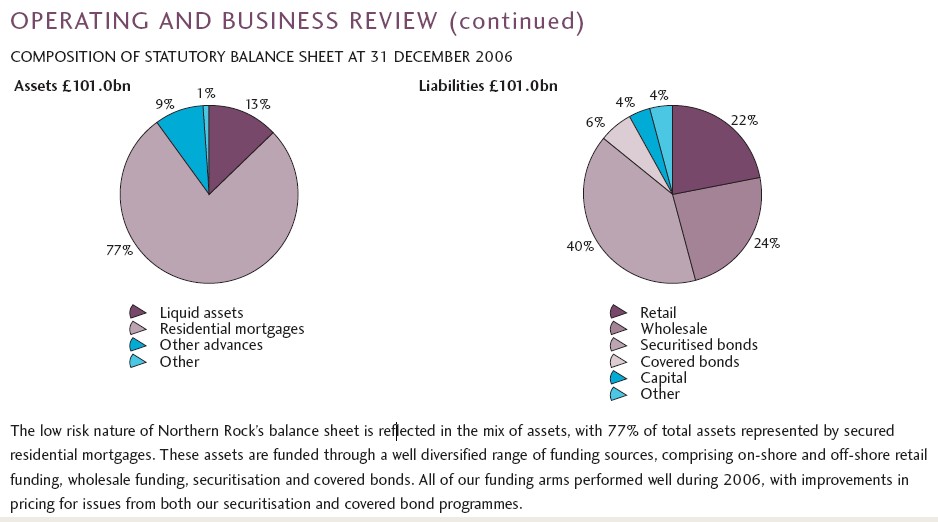

So, let me put it in as plain English as I can. Let's start with the balance sheet we know:

On the asset side it's safe to assume that the liquid assets have gone. We know that the depositors have asked for up to £13 billion of cash back. That wipes this out. But it leaves £88 billion of advances to finance. That's why we then have to turn to the other side of the equation.

On that side, the liabilities, we know that half the depositors have gone. That reduces them to about £10 million. We know £25 billion or so has been advanced by the government to Northern Rock. That replaces the wholesale and covered bonds, or (more likely in my opinion) some of the securitised bonds issued through Granite. Let's assume that it's a bit of each that has been repaid because these things do not all fall due at once. Let's also assume some covered bonds are left. Call it £3 billion. Let's also halve the wholesale money. That accounts for £12 billion and a total of £15 billion has been used to do this in all. But that still means that at least another £10 billion has in that case been used to buy out Granite debt as it fell due.

So, in effect the government has been using State funds to buy back mortgages which had been packaged through the abusive Granite structure.

And now, to get to the nub of the issue, the new press release says that all the remaining covered, securitised and wholesale bond holders are all guaranteed to get their money back in the event that either Northern Rock or Granite cannot sell replacement debt to repay obligations in the open market. Nut Northern Rock will not of course be able to sell any debt in the market now. The ultimate moral hazard has now been created: there is no incentive for anyone to lend to Northern Rock or Granite anymore, especially when in a desperately tight credit market there will be any number of better opportunities. That means that there is only an incentive to ditch Northern Rock debt.

What this means is simple: the obligation to repay all the debt of Northern Rock will now effectively fall onto the government. As does the deposit guarantee. What this means is that after the fall in deposits means that the government did this morning have a total exposure of £35 billion, in effect (£25 billion loan plus £10 billion or so deposit guarantee). But tonight it has this £35 billion plus a guarantee on all the remaining debt on the balance sheet - amounting to about £45 billion. Or £80 billion in all.

The only people who are not guaranteed now are the trade creditors (to whom I would suggest cash in advance is now the only acceptable basis of trading) and the equity.

In which case why, of why, hasn't nationalisation been announced? The equity is worth £400 million or so. It's the only remaining thing for the government to take control of, and take control it must if there is to be any chance of recovery from this mess.

But there are other conditions for a broader recovery too. One is a ban on new securitisation, the second a ban on off balance sheet finance and the third a ban on the abusive structures used for these purposes. One final ban is essential too: that is on the moving of such structures offshore. Their impact falls onshore. They have to be subject to onshore regulation as a result.

Candidly, without getting tough right now and demanding the rebuilding of our financial system we're not going to get out of this mess. And remember, Northern Rock is only the tip of the iceberg.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: