Northern Rock is in trouble because it has financed its mortgage book by borrowing commercial money rather than taking deposits from customers. To do that it has issued 'commercial paper'. And now no one wants it.

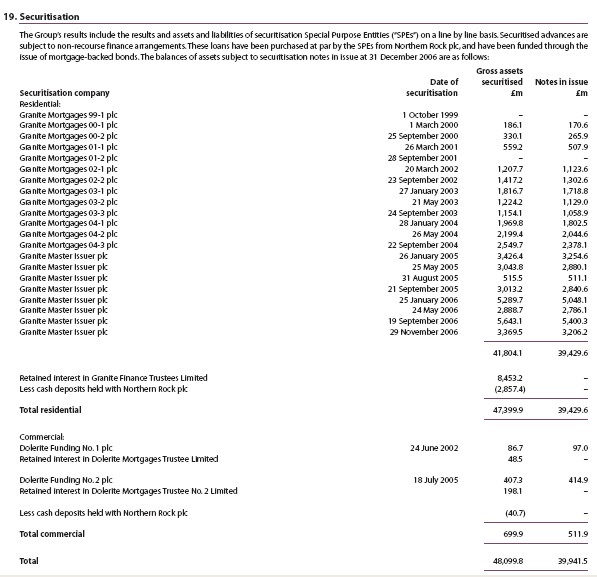

I've looked at that 'paper'. I'm not surprised no one wants it. Most of this 'paper' is issued through a long series of special purpose vehicles which re named in its accounts. To get some idea look at this list:

That's near enough £40 billion of notes in issue.

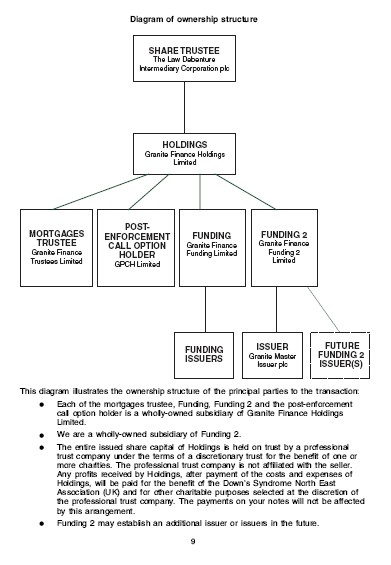

Then look at how just one of these is structured through Granite Master Issuer PLC. The deal structure diagram looks like this:

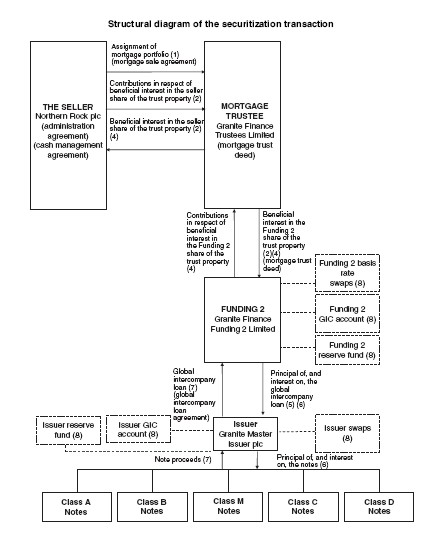

It gets more complicated though. The securitisation structure looks like this:

All of which is a completely prefabricated farce. How can I say that? Take these facts:

1) Note who the share trustee who owns Granite is - it's a Law Debenture Company. This group exists to provide services to special purpose vehicles. No surprise it has offices in London, New York, Delaware, Hong Kong, the Channel Islands and the Cayman Islands.

2) Granite is actually owned by a Law Debenture subsidiary, not by Northern Rock. I've checked.

3) However it does so as trustee - the beneficial ownership is supposedly explained here (it's in the first diagram above as well):

The entire issued share capital of Holdings is held on trust by a professional trust company under the terms of a discretionary trust for the benefit of one or more charities. The professional trust company is not affiliated with the seller.

Any profits received by Holdings, after payment of the costs and expenses of Holdings, will be paid for the benefit of the Down's Syndrome North East Association (UK) and for other charitable purposes selected at the discretion of the professional trust company. The payments on your notes will not be affected by this arrangement.

4) I have a word for this. It is a sham. I can say that because the Northern Rock accounts say:

Basis of consolidation

The financial information of the Group incorporates the assets, liabilities, and results of Northern Rock plc and its subsidiary undertakings (including Special Purpose Entities). Entities are regarded as subsidiaries where the Group has the power to govern financial and operating policies so as to obtain benefits from their activities. Inter-company transactions and balances are eliminated upon consolidation.

In other words that trust is not real. Northern Rock controls Holdings, but pretends not to via complex legal structures for certain purposes to try to avoid some of the risk of ownership arising from doing so, no doubt. Why else do this?

I call this three things:

a) An abuse of the charity involved, who (I stress) need not even have given their assent to be used in this way;

b) A contempt for those who take the real risk on financial markets, which is at the end of the day as this fiasco is showing, you and me and the government;

c) The construction of an arrival device to ensure that as few people as possible, almost certainly the Northern Rock directors included, know just how this deal works. I guarantee you it's a tiny number that do.

And it's this wholly artificial construction, seeking to shift liability and to avoid responsibility and abusing common sense decency with regard to the abuse of charity to achieve commercial aims that is pulling Northern Rock down.

Of course it's not alone. This type of deal is constructed every day off shore. It's the bread and butter of international finance.

It's why we can't trust markets. It's why regulation is needed. It's why ownership has to be revealed. It's why declaring where you're working is so important. It's why accountants have once more to put substance over form.

Now I know that for a change these Northern Rock entities were on balance sheet but most aren't. And can you see as a result why no one will lend inter-bank now? They've all been so busy creating these sorts of artifice that no one dare do so - because they all know the warts in their own system, so presume there must be as many in everyone else's.

It makes me believe, more than ever that the City is rotten to the core. Prove otherwise is my challenge.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

As interesting as this is your conclusions are flawed. Northern Rock is in trouble because its depositors are withdrawing their funds. Perhaps this is more to do with the the british people not believing Gordon Brown?

Alastair

I’m sure you’re an accountant. Only an accountant could offer a comment that crass.

Don’t you think they might have a reason for withdrawing their money? Or is the word ‘why’ not in your lexicon?

Richard

Perhaps you should go and ask them. Based on newspaper reporting it was simply worry about the unknown. And as a result there is now an extra £3bn (and rising) cash piling under mattresses up and down the country.

I will take your insult on the chin – but perhaps you would do better to acknowledge that you are really having a pop at the way in which the global financial market works, rather than the sorry problems of a british bank.

…but whilst I am on the subject I would suggest that your analysis is interesting but your conclusions are crass.

Alastair

I repeat. Why is my conclusion crass?

Richard

Bravo. Someone (like yourself) with a full understanding of the issues has revealed what we have all suspected for a while. This kind of off-balance sheet financing is exactly what Enron were doing, and yet no lessons were learned then, and it is now more commonplace than ever. I suggest you take a look at the structures of some of the other UK banks and mortgage lenders (perhaps starting with Barclays?), I’m sure you’ll find similar stuff – then post it here!

“It’s why we can’t trust markets. It’s why regulation is needed.”

We already have a lot of regulations.In fact, this whole structure would not exist without regulations like basel II.This is what you get with utterly idiotic regulations.

What NR was doing is perfectly legal and perfectly rational: reduce risk-capital requirements and making the “transfer” [?] of risky assets look like a true sale.

If it’s not, please explain why the mighty regulator [FSA] approved their application for IRB status under the Basel framework for calculating regulatory capital, as recently as june 29th 2007, that is the one that requires the least risk capital and allow NR to use its own home-cooked credit ratings.

“I’ve looked at that ‘paper’. I’m not surprised no one wants it”

But you don’t say why you’re not surprised. Name a commercial paper issuer that isn’t an SPV or a finance sub. Your outrage is slightly disingenuous. If, to give a massively disproportionate example, a mass murder leaves money in his will to a charity is that an abuse of the charity? They certainly won’t (I stress) even have given their assent to be used in this way.

[…] Recent Comments Patrick on Northern Rock – the questions needing answersTax Research UK / Non-doms buying political influence on Hecklersjck on Northern Rock – the questions needing answersTom on Northern Rock – the questions needing answersonline wealth on Inheritance Tax – the Observer gets it horribly wrong […]

I note the comments from jck and Patrick.

Patrick shows the sort of mindset I am condemning. If he can’t see it, what can I say? Get a humanity, I guess.

jck is as misguided. Regulation that requires a bank to retain no liquid funds is clearly misguided. It’s what happens when the regulated get too powerful

jck – I suppose you would have described Enron’s SPVs as “perfectly legal and rational” too, until they were unable to roll their CP?

Regulation requires banks to retain liquid funds.In the UK, banks must have 5 days worth of funding.This is plenty in normal times and completely useless in time of crisis.

Tom

Using SPVs is legal, stealing money isn’t.

NR uses SPVs just like every bank in the securitisation business does.

jck

Just because something is normal does not make it ethical or acceptable.

SPVs are abusive. they’re secretive. they seek to subvert disclosure. They often use a charitable structure which is a misrepresentation of the truth. And they’re often registered offshore to make sure no one knows about them.

What bit of them do you think socially advantageous?

Richard

“Just because something is normal does not make it ethical or acceptable.”

I agree entirely.Problem is if one bank uses SPVs, and get a competitive advantage then you do the same or close the shop.

I would prefer to go to the source of the problem, regulations like basel II were supposed to address the problem [of risk capital arbitrage] and the explosion in structured products, SPVs, SIVs and the like shows that the regulators failed.

jck

Now we’re getting towards agreeing

How would you suggest change occur?

Richard

The regulators should concentrate on the broad issue of liquidity and solvency and not get involved into micro managing risk for banks, they can’t do it and trying to just create arbitrage opportunities, securitisation opportunities etc…Simply put we need “decomplexification” of regulation and that should lead to “decomplexification” of financial markets.

jck

Can we have principles based regulation in this sector?

Would it work?

Richard

This is a standard mastertrust, used by the big securitisation guys across the market. Who owns the mastertrust is pretty irrelevant as the equity accounts for €50K. Obviously this is inconsequential when compared to the liability (the notes issued from the trust) and the assets (the mortgages owned by the trust) which run into the ten of billions. The reason that NR dont own the trust is becuase the whole point of SPVs is that they are bankruptcy remote.

SPVs are used everyday in the structured credit business. the reason that charities are the beneficial owners is for tax reasons.

David H

Agreed, entirely.

But commonplace does not mean acceptable.

And abuse is abuse whether accepted in the City or not (or maybe precisely because it is accepted in the City)

And SPVs are about denying responsibility. That’s an exercise in risk shifting. Who to, might I ask, rhetorically, but I’m happy if you want to tell me?

Richard

Who is it abusing ?

Buyers of MBS from mastertrusts are aware of how it works, and they are the ones who hold the risk. If Northern Rock’s mortgage holders default, and assuming that the mortgages are held by granite (the mastertrust), it is the buyers of the MBS that hold the risk….

NOT NR depositors,

NOT the UK taxpayer,

NOT Adam Applegarth (?),

NOT NR bondholders,

NOT the charity – the equity remains completely intact.

so who is getting hurt ?

Just like to pick on something here, in that the term “normal” is aligned to the dominant discursive — perspective of the State and those who influance the said state, not the majority of the people resident in that State.

For the latest twist on how the banks embroiled in this market are clearing the decks for more business but with a little slight of hand disguising the extent of their losses see the article posted on FT today by Lina Saigol ie The Real Deal: beware the banks’ UFOs

David H

I’m curious about your observation. It makes no sense to me, and it won’t to many others I suspect.

What you’re saying is that Northern Rock has, to sell its debt, to pay £50,000 for a trust and £700,000 to PWC in prospectus fees and countless more in legal fees, and they do all that to ensure that those who provide their wholesale funding come at the bottom of the pile when it comes to security.

My experience of banks is that they like their security. As I read the Granite documentation it seems to provide significant protection for its bondholders through a variety of control mechanisms including options. All are, of course, consistent with security i.e. placing the claim of this company above that of other claimants.

Am I wrong? If so, how? And are you really telling me that the whole intention of SPVs is to ensure bondholders are in the position of having subordinated debt? But if not – how are your claims (bar that on tax) right?

And whilst you’re at it, isn’t the use of offshore anonymity harmful? And isn’t it an abuse of the UK tax system to issue securities offshore? And isn’t using a person’s name in a prospectus without their consent and abuse?

And precisely how could the depositors not have been harmed.

I assure you, I’d like to know. The evidence would help a lot of people. If you can prove it I’ll give you all the space you need to do so.

But I’d want to know your identity – even if I then agree to keep it private. That’s KYC stuff.

Richard

The miscomprehension of this issue is clear, the holders of the MBS which are issued by the SPV (granite) have NO CLAIM ON NORTHERN ROCK. They have a senior claim on the mortgages sold by Northern Rock to the mastertrust. Likewise, Northern Rock has no claim on the mortgages owned by the SPV (Granite). In this case the SPV is a seperate company whose assets consist of mortgages sold by Northern Rock to the SPV. The SPV purchases these mortgages by issuing bonds. As such the bonds are secured on the mortgages, not on NR. Northern Rock does this in order to transfer long term assets into cash, enabling it to issue more mortgages to its clients now, and not in 10yrs time when the mortgages are paid off.

A simple demonstration of this is that the vast majority of the bonds issued by the SPV are AAA-rated, whilst NR is single-A minus.

Securitisation is the process of delineating assets from a company, which is exactly what happens here. The mortgages sold to the SPV are no longer part of Northern Rock, they are owned by the SPV. The only relation NR has to the mortgages is that it originated them and continues to service them, for which it is paid a fee by the SPV. I hope this makes the situation clearer.

I cannot reveal my identity, I am a trader for an investment bank… cue demonisation below….

David

Now let’s be clear. They didn’t as such sell these mortgages as assign them. The legal title remains with NR.

And second, if they had sold them why, in this case, are they still on balance sheet showing NR still have the risk?

Sorry – your answer does not stack.

Richard

THE COURAGE IS IN BREING ASBLE TO TURN YOUR BACK ON INCOME, And to be able to concentrate on your moral ant ethical belief, whether that be a faith in a higher being or atheism.

I am interested why you choose to discuss SPVs using the example of NR. Granite is a fairly straight-forward structure for the institutional investors who buy these securities. The investors get the mortgage assets and pay NR a lower cost of funding than unsecured debt, which in turn means lower rates for its customers. The structure and unencumbered assets are clearly set-out in the notes to the NR’s financial statements, as you posted above.

Why did you not focus on banks like IKB or Landesbank Sachen where off-balance sheet structures where used to hide risk and these “contingent liabilities” were not stated clearly in the financial statement. As they provided liquidity lines to off-balance sheet ABCP conduits that in IKB’s case invested heavily in subprime assets. The Granite SPV ensures a bankruptcy-remote sale of mortgage assets in which NR retains no risk, but the “secretive” SPVs you speak of are the conduits where banks provide liquidity lines.

I also still don’t see how NR is “abusing” a charity. They made the mistake of stating they would donate to a charity if there was any excess profits in Granite without checking with the charity. NR gained nothing from this, as you say yourself it is buried in prospectus and the institutional investors who buy Granite notes could not care less if it donated to charity. Considering NR has donated 5% of their pre-tax profit to charity for the past ten years (I can’t think of another bank that could make that same statement), you think you could cut them a little slack for forgetting to ask a charity if it could possibly give them donations in the future.

“dancing about architecture”

I think you’re both, taking about the same thing but from different aspects. As weird as it may sound I read comment 24, and it makes sense to me. However, I eat, sleep and drink financial news at present.

Perhaps this will make more sense:

Northern Rock hold the right to be paid for mortgages they originated. They are paid an administration charge by the SPV’s for administering the loan, and collecting the money. The title to the mortgage itself is owned by the SPV.

The SPV has used the mortgages to raise bonds in the commercial/asset backed paper markets. They have loaned the cash raised this way to Northern Rock, in return for being able to parcel up collections of mortgages and sell them on as mortgage backed securities. For which they are paid a commission.

The entity that buys the mortgage backed securities benefits from the income stream generated by people paying for the mortgages, but does not own the underlying asset. (the house or the mortgage lent on it) Only the rights to income generated by it.

The real losers here are the people who were miss-sold mortgages, (subprime) and the entity that bought the mortgage backed security. I say this because if the borrowers cannot pay, the income stream earned by the entity dwindles. In many cases the entity buying the mortgage backed security could only do so because the security was rated AAA. Whereas they would not have been able to buy direct from Northern Rock as it’s debt is only rated at A-

Other problems include the fact that the entity that bought the mortgage backed security cannot sell, as it bought something that was “marked to model” not “marked to market” This is the problem BNP Paribas and many other banks have. So they are forced to hold a security that well under perform, because they cannot take the loss between the price they paid and the as yet unknown market price.

Many of the entities are pension funds, insurance companies, and hedge funds, that were all searching for better yield on their investment. The hedge funds will go to the wall, rich people will lose money, pension funds will lose money, and may have to be bailed out, or collapse leaving the state to pick up the tab. The insurance companies will need to raise rates to cover losses, which acts as a tax on spending and investment. They may also go bust, leaving many people without insurance. Or again, leaving the state to pick up the tab.

Remember what happened when insurance companies refused to provide cover for terrorism to airlines?

In essence what Northern Rock did was to paint themselves into a corner, since they raised short term money to pay for long term debt. If ever they were unable to rollover the short term debt, they had nowhere to go, they had no collateral, except for depositors funds and the income they made from servicing the loans.

You could argue that tangentially they still owned the mortgages, but legally they could not touch them, and they have already been used as collateral for the short term money they’ve borrowed.

At least that’s the way I see it..

Mike

I could have looked at off balance sheet funds. In fact I did, here. http://www.taxresearch.org.uk/Blog/2007/09/14/where-is-the-liquidity-crisis/ But, NR is in the moment, and this is an issue which needed attention drawn to it.

I chose to discuss Granite for several reasons. First of all I do not agree that NR retains no risk. It does. If these assets could not be refinanced and they were on its balance sheet there was real risk. I do not care what the contracts say. That’s the reality. This shows that these structures are a farce.

Second I wanted to draw attention to the abusive nature of these structures. I’ll link to a separate post on that issue soon.

Richard

Praxis 22

Thanks!

But the point remains: risk was shifted, and inappropriateky using a strcuture that was a sham (as I will discuss in a post to be made soon). In that case, there was an abuse.

And since the risk did remain with NR since it was on balance sheet (for which I guess credit should be given) NR depositors and others were at risk – as I have argued.

But I appreciate your clarity of elucidation.

Richard

[…] Recent Comments alastair on Death and taxesTax Research LLP on Death and taxesalastair on Death and taxesTax Research LLP on Northern Rock – the questions needing answersTax Research LLP on Northern Rock – the questions needing answers […]

Oh yeah, NR scammed people but good, and with the collusion of the ratings agencies. Since a bank with and A- rating should never have been able to issue AAA securities.

You can tell things are not going well for NR, as the government felt the need to “boost confidence” by guaranteeing all new deposits too. I suspect this is to prop up the bank, so it doesn’t end up on the Govt’s books. If they can keep NR alive long enough, the vultures may have time to do due diligence.

As it is, NR is haemorrhaging cash, it’s £12bn in debt, with only a £20Bn deposit base max. They’re having to borrow to pay back the short term paper as it falls due. Once they default it’s all going to unwind.

Praxis22 claims the title to the mortgage is owned by the SPV while Tax Research LLP says “the legal title remains with NR” can we clarify this point as it seems fundamental to the whole argument

Both of us are right.

Legal title remains with Northern Rock.

Beneficial ownership is transferred to Granite.

Which shows how artificial the arrangement is.

Especially when Granite remains in the NR accounts.

Richard

Thanks Richard- got to agree that’s what I’d call artificial and having worked in the City it doesn’t surprise me that they choose to see it differently.

You are doing a great job revealing what to ordinary citizens are unacceptable abuses of the tax and legal systems – the end result is that the authorities eventually use a sledge hammer to crack a walnut and then the innocent from the resulting tightening.

I think that happened as recently as yesterday when the Chancellor in a move to deal with the private equity tax problem changed the CGT rules as a result of which those who were paying low rates of CGT look as if they will be penalised as will those who have been encouraged by the old rules to hold investments for the longer term.

[…] I don’t care about the publicity. When there are no more questions to be asked I’ll be only too pleased to drop out of the press. But I am delighted the questions I am asking here are being used to bring people to account for what is going wrong in the financial services sector. […]

[…] As I disclosed, it was these structures that helped bring down Northern Rock. […]

[…] The Guardian published two stories on Friday concerning the relationship between Northern Rock and its shadow entity, Granite. I’ll be candid, I know the stories have been influenced by what’s been written here: I was the only source named in the stories. […]

Richard

There is nothing wrong or flawed with this structure.

1. The debt (created by the notes issued by Granite to its noteholders) is on balance sheet because Northern Rock controls Granite as accountanting rules define “control”. Even if Northern Rock parent company (or any other group company – to which depositors and shareholders have recourse to) is not liable for the debt.

2. But the holders of the debt do not have recourse to Northern Rock to get back their money if the mortgages default (the note to the accounts makes that clear).

3. Similarly, the holders of the debt are not exposed to Northern Rock if Northern Rock goes bust (other than having to find someone else to service the mortgages).

4. Therefore the holders of the debt demand (and get) a lower rate of interest than if they had lent to Northern Rock – because they are not exposed to Northern Rock’s other businesses.

5. Anyone can say “I hold an asset on trust for X” without X’s consent – whether X is an individual, company or charity (or group of charities).

6. Limited recourse debt owed by a company is always on balance sheet. But other creditors are not affected by limited recourse debt in the same way as ordinary debt. Structural subordination (as opposed to contractual subordination) has a similar effect. If I lend to a holding company and the assets are held by a subsidiary, I’m effectively behind any lender to the subsidiary. However, the accounts would show me in the same position (but legally I am not).

7. Legal ownership and beneficial ownership are two completely separate things. You claim the split is artificial. While that may be the case, if it were wrong or unlawful or contary to regulations, then we would have no charities (which work by dividing legal and beneficial ownership).

This is quite simply all about raising money in the wholesale markets as cheaply as possible. This is done by splitting assets into different baskets. It’s not that complicated.

Tom

I profoundly disagree with you

The deceipt in this structure undermines any chance of good governance

See http://www.taxresearch.org.uk/Blog/2007/11/12/northern-rock-the-core-of-the-issue/

Richard

[…] and covered bonds, or (more likely in my opinion) some of the securitised bonds issued through Granite. Let’s assume that it’s a bit of each that has been repaid because these things do not […]

[…] private equity to which we made a significant contribution to debate. Only the credit crisis and Northern Rock usurped this. This blog can, I think, claim a major role in the way the Northern Rock story […]

[…] Note 19 says the company’s ultimate controlling party is Northern Rock plc. This means it is part of the Northern Rock group. We know that. It is in the Northern Rock accounts – note 19 says so. So do the Northern Rock accounts. […]

the Down’s Syndrome North East Association (UK) does not seem to be a registered charity

I disagree with your conclusions.

Why does the charity need to assent to a trust being set up in their favour?

If I set a trust up for my children or a charity, I don’t need to ask their permission.

You have to look to why the deals are set up in this way, and the mess at Northern Rock is a prime example of why these structures are needed.

1. NR shouldn’t own the mortgages or the assets if they securitise them. Otherwise the bond holders risk not getting their cash back in the event of NR’s bankruptcy.

Solution. Transfer them to another company. Granite.

2. The other company should not be owned by NR too. For the same reason as 1.

Solution. Have it owned by a trust.

3. Granite must endevour to make a proft even if its a small one, otherwise it’s acting ultra vires.

4. Who gets the profits? Can’t be NR for 1 and 2. Its a small profit, so have the trust set up to for a charity.

5. Do the trustees have the skills to run a securitise business? If not get someone in who does.

6. Why Delaware? Same reason as using Channel islands. Channel islands have a lot of experience with trusts and the legal structure associated with this. Same as Delaware.

All of this means that the bond holders are safe from the mess at Northern rock.

Northern Rock did these transactions to get cheaper funding.

1. By over colateralising, they got a higher rating, and a lower interest rate.

2. By securitising, they make a liquid market in their debt, and get a lower interest rate.

3. They get to reuse their capital.

What NR should have done is more of these transactions, then they wouldn’t have been caught by the lack of funding.

However, the sting in the tail of all of this is that little call option. What’s the details on that?

Nick

Nick

Respectfully I think just about eberything you have said is complete nonsense.

First of all the charity should have been told for reasons of good governance and because it was named in a public document.

Second, thereafter you assume there is a difference between Northern Rock and the sham that is Granite. There is not. Granite has no staff, and is run entirely by Northern Rock. So your entire logic falls apart: these entities are one and the same thing and you’re suffering from a delusion if you think otherwise.

Richard

I absolutely agree with tax.

[…] me be clear why I think that. In its prospectus on of the Granite entities said it was owned by the Law Debenture Intermediary Corporation plc, but that despite this the entire issued share […]