The FT reports this morning that:

British politicians should be wary of provoking a backlash in financial markets by increasing borrowing too quickly, the outgoing head of the UK's Debt Management Office has said, ahead of a general election expected this year.

Sir Robert Stheeman, who has overseen an eight-fold rise in the UK's debt pile over his 21 years as the government's borrowing chief, warned that the job of issuing bonds was getting harder and investors might increasingly act as a restraining influence on fiscal policy.

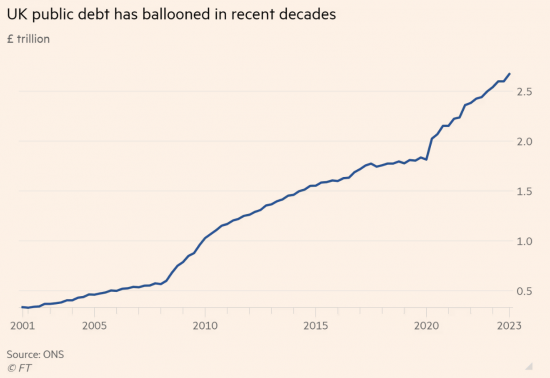

This is total nonsense. I know that because the comment is accompanied by a chart that says UK national debt has risen as follows:

As I noted before Christmas, this is simply untrue. Not only does this ignore the fact that in September 2023 £757bn of government debt is owned by the government - which makes the above chart meaningless - but it also ignores the fact that hundreds of billions of the supposed national debt simply do not exist and are simply represented by false accounting undertaken by the Office for National Statistics.

But there is more to the claim made by Stheeman than this. He is reported to have said:

Stheeman said investors' increasing sensitivity to the scale of government borrowing had been highlighted by the crisis in gilt markets that followed Truss's plans for £45bn of unfunded tax cuts.

I hate to excuse Liz Truss from any blame for the fiasco that was her time in office, but yet again, this is total nonsense. It is true that Kwasi Kwarteng did announce tax cuts costing £45 billion, but they were not uncosted. In conventional logic, they had to be covered by borrowing, and that does not mean they were uncosted.

But it was not that announcement that spooked markets the weekend after he spoke in September 2002. The reality was that the day before he spoke, Andrew Bailey, the Governor of the Bank of England, had announced £80 billion of quantitative tightening.

Quantitative tightening is claimed to be the reversal of quantitative easing, but again, that is total nonsense. Quantitative easing, in reality, cancels government bonds in issue. Claiming that they still exist, but in government ownership, is a farce.

And they are not sold again under quantitative tightening, in any meaningful way. Instead, quantitative tightening represents new bond issues made to force interest rates higher but without having any impact on the funds available to the government to spend. It is, in other words, a real increase in government debt for no social gain because the sole aim is to punish households and businesses that might have had the temerity to borrow. And it was quantitative tightening that spooked the markets in September 2022, not Truss and Kwarteng. We know this because by the following Monday, the Bank of England had to restart the quantitative easing process temporarily to correct the harm that they had caused.

But let's now roll this forward to the present, and quantitative tightening is continuing. It will be £100 billion in the next year - almost four times more than Labour plans to borrow to save the planet. Those quantitative tightening bond sales will not fund the government. They won't save the planet. They just switch central bank reserve account balances into bonds to reduce the amount of cash available within the economy so that:

- interest rates stay high

- investment stays low

- government spending is crushed, and

- we get a recession.

Those are the aims of the quantitative tightening programme - to which saving the planet is being sacrificed.

And that programme is not mentioned by Stheeman - negligently, in my opinion - or by the FT, irresponsibly, in my opinion.

In the next year, the UK government will, as a matter of fact, need to raise considerably in excess of £100 billion to fund government deficits.

It so happens that near-record levels of existing government debt needs refinancing in the next year as well.

On top of all that the Bank of England is going to sell £100 billion of debt into the market to make sure that £28 billion to fund essential investment cannot happen.

Does anyone else smell a conspiracy here? I do. The establishment is conspiring to make sure that Labour cannot borrow to fund a Green New Deal.

How to stop that? It's really very easy. All it would take is for Labour to say it would stop giving its consent to quantitative tightening - as it can because it requires Treasury consent as does everything involving both quantitative easing and quantitative tightening - and all the money it would need to fund its programme would be available, and at lower cost.

The big question is, why isn't Rachel Reeves saying this?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

That’s the sort of thing you quietly do after a successful election, not blab about it and let the tory press run amok before. Starmers gonna get bored being ‘sensible’ very quickly. £1 says rachel goes under the bus and is replaced with a suitable ‘find me the money type’ after 12 months

…”the UK government will, as a matter of fact, need to raise considerably in excess of £100 billion to fund government deficits.

……near-record levels of existing government debt needs refinancing in the next year as well. ……the Bank of England is going to sell £100 billion of debt into the market.”

But The Market doesn’t have to buy this £100 Bn + of Government debt – The Market (banks) might just decide to say ‘no thanks’ ?

It won’t

It just forces the price up

That is why the Bank is doing it

She’s not saying it because she is a creature of the system that creates this nonsense – a system of lying.

Either that, or she simply doesn’t understand what’s going on, because she’s acting on an outdated paradigm.

There’s a reason why I call her and Starmer (and the Party they mislead, in both senses!) Flat-earther economists.

Why isn’t Labour saying that? I suggest that, in large part, it’s because they, including Rachel Reeves, don’t understand how money works, and, as a consequence put their trust in “experts” from the FT or the BofE.

As an aside I am very suspicious of the rôle of the BofE in the fall of the Truss government. The timing of the BofE’s announcement of £80 bn in QT does not look like a coincidence. Did Andrew Bailey have no idea what would be in Kwarteng’s budget? The BofE may be theoretically independent but surely the Bank and the Treasury talk to each other.

So we had a situation where the BofE together with the financial markets managed to bring down a government within a few weeks of its existence. This strikes me as very worrying. It could be seen as a coup to get “their man” into 10 Downing Street.

This doesn’t let the Truss government completely off the hook. Kwarteng should have known what the BofE was going to announce on the eve of his budget and should have told Bailey not to carry out more QT. However there is something worrying about a central bank actively undermining the policies of a government, whether one agrees with said policies or not.

Mr Hurley, you noted:

“Why isn’t Labour saying that? I suggest that, in large part, it’s because they, including Rachel Reeves, don’t understand how money works”.

Given Reeves worked at the BoE it stretches credulity to imagine that she (and others) has not been exposed to recent (last 10 years) discussions on money.

She (& others) are not stupid (they would not be where they are if they were). Thus not “understanding” recent discussions seems unlikely.

Which leaves considerations such as “cognitive dissonance” – they have formed a view and nothing will change this – anything outside the accepted narative is treated as noise.

This (or something similar) seems to be the most likely explanation.

Certainly Reeves, given her “career formation” @ the BoE, is likely to have an outlook heavily inflenced (for worse or for worser) by this.

Expressed more uncharitably: Reeves & others suffer from bone headed stubborness, an unwillingness to change and an inability to articulate a different story.

Agreed

I’ve listened to Reeves being interviewed by Maitlis and another interviewer of that ilk and I have to say she didn’t shine intellectually in the company. It makes me wonder, perhaps the appeal of Neoliberal economics is it preaches (le mot juste) a form of superstition as opposed to MMT’s more scientific approach and therefore has greater appeal for the weaker mind.

“Does anyone else smell a conspiracy here? ”

Just the central bank playing politics. Nothing new & has happened before. Germany 1961 – Erhard (Chancellor) revalued the DMark – cue Bundesbank foaming at the mouth. The Bbank then engineered a recession (by curtailing the capacity of commercial banks to issue business & household loans). Erhard was booted out (replaced by Kiesinger). Few years down the track, Blessing (BBank president) admitted that he had engineered a change of gov “we had to use brute force to put things in order”. Kiesinger’s bunch did a “stability and growth pact” to keep wages low (and thus keep inflation low and Germany exporting).

The current narrative from “the loyal opposition” is from the same play book & it is not just a case of the BoE calling the shots (and getting rid of politicos it does not like) but it now has well trained placemen/women (e.g. Reeves) embedded in what passes for the political process in the UK. The hunger for power & the desire for a ministerial position & limmo ensure that opposition MPs toe what passes for the “party line”.

Mr Stheeman’s time at the DMO has been characterised by rising govt “debt” while bond yields were forced down, eventually to record lows. Unless he’s been mostly asleep at the wheel, his little parting shot is ideologically motivated.

Slightly tangential to this discussion, but from my personal experience I think the ITV film series “Mr Bates vs the Post Office” is opening eyes….

Yes, this really has dragged on for two decades.

Yes, the Post Office really did behave that appallingly.

Yes, ministers (including Ed Davey) did ignore approaches from MPs and swallowed the PO line without following up.

Yes, “the justice system” really did fail these people. (and indeed still is – recompense is still a mess)

And if all that is true, what else is not as I think/want to believe/imagine it.

Agreed

Ed Davey (Minister responsible for Post Office Affairs at start of Horizon debacle) was approached in 2010 by a Alan Bates sub-postmaster requesting a meeting to discuss the unreliable/faulty Horizon IT Accounting System. Davey’s response……..he did not believe a meeting “would serve any purpose”!

https://www.theguardian.com/business/2024/jan/03/post-office-workers-wrongly-accused-of-stealing-still-awaiting-payouts

The conspiracy I smell is (once again) the extinction of the Middle Classes.

From BBC Verify

“Also, Ben Zaranko from the independent think tank the Institute for Fiscal Studies (IFS) says because the current government has announced around £8bn of future climate-related investment and has pledged another £2bn of investment in the hydrogen industry, Labour’s plans imply an extra £18bn, rather than £28bn a year.”

The cost of not fighting climate change is huge and and an individual’s wealth will not protect them from the consequences.

I am still trying to work out the logic that climate spending is all by borrowing but funding my pension is by taxation. As Andy Verity pointed out there is no fund out of which the govt spends. Surely there is a total funding and total spending and the gap and the way it is done is the issue being debated?

Agreed

Not the independent left wing think tank the IFS………

Therefore I assume its the independent right wing think tank the IFS?

“Independent’ of what precisely?

I note Tony Blair is now saying the huge cost of getting the UK to ‘Net Zero’ should not be paid by members of the public. Sounds like more heavy duty Government borrowing will be required?

Sounds more like denial of the need for net zero

I wish Blair would get an allotment and retire

I turned 58 in December and I am left with a profound sense of disappointment in that I left politics to what I thought were cleverer, more able people than myself only to find that this is not the case.

It’s not about intelligence after all (intelligence can be learned, acquired), because as we have seen countless times, intelligence can be misused.

It’s about deeper things – honesty, integrity, empathy, doing the right thing and being inclusive about wealth.

What a waste of a life is all I can say.

Oh well………………………………………………………………….

You’re playing your part

Your comments are widely read

A waste would have been to have said or done nothing.

We can never know the good ( or the bad) that we do. With my history teacher hat on, I remember the early trade unionists, Chartists, Suffragists and Suffragettes, a whole host of campaigners who died before they saw the fruit of their efforts.

Change is one of the few things we can rely on. In 1980 few expected the collapse of Soviet rule in eastern Europe, let alone the whole USSR.

We can only try for, and hope for a better world. It is not a waste.

Agreed

I do find the claim that Truss and Kwartengs efforts weren’t the main drivers of the crash that brought them down rather interesting.

From my understanding, Truss doing things like stopping an OBR report increased uncertainty. Given her statements, financial markets concluded she’d raise inflation in order to deal with increasing debt, and so started selling their bonds and pounds to immunise themselves from that.

In that case, the BoE kicking up interest rates through QT right before that is just an aggravating factor as opposed to being the problem, no?

That is an interpretation

I have a different one

The main problem with seeing the BofE’s actions as merely an aggravating factor is the timing. When a central bank makes an announcement the day before a budget statement one would naturally expect it to support rather than undermine that statement.

Kwarteng should have prevented this from happening and, to that extent, he is partly responsible for the collapse of the Truss government. But was Andrew Bailey completely unaware of the contents if Kwarteng’s budget? If not, it was irresponsible to make the announcement when he did. If so, it looks suspiciously like an attempt to undermine the government.

In any case the debacle shows where the real power lies, namely, with the BofE and the financial markets and not with the government. In any case there are a lot of questions that need answering and the answers must go well beyond merely saying Liz Truss is a mad woman, even if there is some truth to that.

If any other organisation — e.g. a trade union — had brought down a government in a matter of weeks there would be no end to the fuss that would be made.

I am with your second paragraph

I should clarify I broadly agree with Richards analysis – there is something suspicious going on with this whole affair.

It was a bit of a nitpick because I hadn’t really seen that analysis before.

I think it also has to be noted that Ed Balls and George Osborne admitted on GMB that people from both parties will collude to pass unpopular policies eg raising tuition fees.

Given that Labour have appeared very hesitant to commit to 28 billion a year, and have kept watering it down, one now wonders if the plan is to commit and then later say the fiscal rules prevented it thanks to this.

Looking back now, one does wonder if ex-Banker Rishi Sunak was cutting deals with old friends of his to get his position; He was very ready to swoop in after Truss got kicked out.