There is a lot of noise about Labour's tax plans right now.

There is also a lot of noise about wealth taxes. However, as the Guardian reports this morning, in a headline:

The unsurprising reality is that Labour is not going to be announcing a wealth tax this autumn. I very much doubt that it will be doing so at any time before 2029, but it will, time and time again, be visiting topics that I mentioned within the Taxing Wealth Report.

There is a good reason for that. We do need to tax those with wealth considerably more because the rate at which they pay tax is very low, overall. I explained that in this post, which was part of the Taxing Wealth Report series. The detailed workings that support this are also available.

As I noted then, based on a review of taxes paid, UK national income and changes in UK wealth from 2011 to 2020:

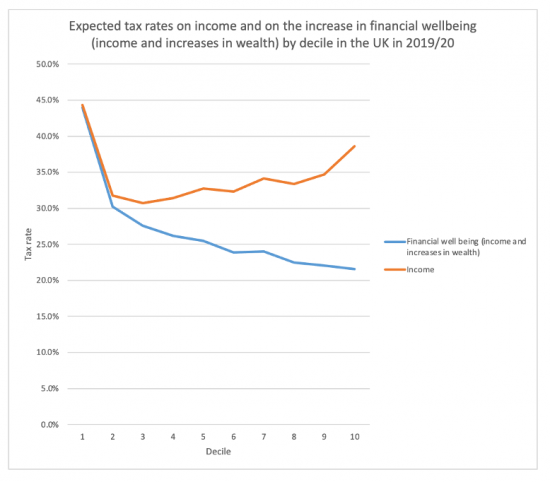

- The UK has a tax system on income that is regressive at the lowest levels of income, broadly flat over the middle range of UK incomes, and is only slightly progressive at the upper end, without, however, replicating the tax rates paid by those on the lowest income.

- Has a very generous system of taxation on wealth, which means that whereas income was on average taxed at 32.9 per cent over this period, increases in wealth were only taxed at 4.1 per cent.

- The combined average tax rate on income and increases in wealth over this period amounted to 25.6 per cent per annum.

- Because of the way in which wealth is distributed in the UK, with most being owned by the top ten per cent of the population, this differential in tax rates means that the UK actually has a deeply regressive tax system.

- Those with the lowest income in the UK were likely to have a combined tax rate on income and increases in wealth of approximately 44 per cent per annum during this period, whilst those in the highest decile of earners in the UK were likely to pay no more than 21.5 per cent per annum on their combined income and increase in wealth.

- If the tax rates on income and increases in wealth were equalised, then additional tax revenue of £170 billion a year might be raised in the UK as a result.

What this suggests is that:

- There is significant additional capacity to tax in the UK, although only from those with the most income and wealth.

- A strong case for reducing the tax paid by those on the lowest incomes can be made.

- On balance, so long as additional sources of tax revenue are charged only (or almost entirely) on those with the highest income in the UK, then there is no reason for any UK government or political party seeking power to suggest that there is no additional capacity to tax in the UK: that capacity very clearly exists.

The Taxing Wealth Report 2024 will explore about thirty ways in which this additional revenue might be raised in ways consistent with these findings.

The unfair UK tax system

The following chart suggests the true scale of the regressivity of the UK's tax system:

Those in the lowest decile of income earners in the UK pay tax at around 44% on their income and gains in financial wellbeing, whilst those in the top decile pay at 21.5%, less than half that rate. That is why there is the capacity to raise more tax from wealth in the UK.

The detailed working note, linked above, shows how these calculations and the chart were prepared.

I am not for a minute suggesting that all the problems associated with wealth and equality in the UK can be solved if Rachael Reeves simply cherry picks some of the topics referred to in the Taxing Wealth Report.

In fact, I do not think all those problems could be solved if all the recommendations made in that report were adopted because not all the problems are capable of solution by tax. Some are too deeply embedded in our economy for that to be possible: systemic economic change is required to achieve that goal, which is where my video series on wealth is going next.

But what I do know is that if the problems of inequality are seen right across the income and wealth deciles of the UK, then a wealth tax by itself cannot address the issues of concern, and of that I am absolutely sure. In fact, the idea that a wealth tax can address these issues is based almost entirely on believing that tax works in the way that the household analogy describes, and that is a myth, as I explain in this morning's video. It is vital that we get this right, and we cannot do so based upon inadequate explanations and policy that does not tackle the real issues.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

If you get a pension and are on Universal Credit – which is basically any couples where one member is over pension age then you pay 100% tax as you lose your Universal Credit pound for pound

Imagine that was done to any other group…

The problem, I think is political optics. Neoliberals focus on over-simple, single headline tax, the marginal income tax rates on earned income, for a salaried or wage employee. Which you are countering here with a complex income-wealth rate. You are right Richard, but I suspect the approach is too complex in terms of the political optics.

The most powerful, cheap to run, effective and efficient tax earners for Government are the ones that hit wage and salary earners first, and hardest – directly or indirectly (PAYE, NI, VAT, and income tax thresholds – the last, a stealth tax).

The problem is slightly different: Inequality. Inequality is something headline tax rates and marginal tax rate emphases do not capture (deliberately, for neoliberal Governments and Press); but which also are the most powerful and effective tax raisers (PAYE et al) which do not either measure or adjust for progressively where it matters most for the poorer income quartiles.

What is needed politically is a simple headline rate that measures the severe adverse impact on disposable income available (typically for necessities) and on living standards, for every 1% rise in these tax rates for those earning up to say £30-£35k; and compared with the trivial or zero effect of these tax impacts on living standards for high earners (including those who can select to pay income tax at dividend tax rates).

I get your point

But that sounds a much more complex idea to explain – in fact I had to read your suggestion twice, which is rare for me

I put it out there, because if my approach can be formulated simply, it will be unanswerable.

Then can you put it in plainer words?

I put it out there, unfinished to share an incomplete idea. Ideas do not always come, complete and trenchant.

For sure, the wealthy could pay more tax. But a wealth tax is a non starter. And inheritance tax is a very blunt tool. There are plenty of other possible choices, as you have outlined. Not least, capital gains remain undertaxed compared to income.

Your graph is for 2019/20. Has it changed for the better or the worse in the last six years?

It suggests that the tax system is broadly progressive on income, if perhaps not as progressive as we would expect, except for the lowest decile. But regressive when taxes on other increases in wealth are taken into account.

Can you explain why the data on page 13 of your report says that “expected total taxes paid out of income” for the lowest decile is £6134, which is more in cash terms than the next two deciles pay, and only 10% less than the fourth decile? What taxes are the poorest 10% paying more of (in cash terms) than the next 20%?

I will have to take a look – but not now as I am inundated with work this morning – sorry

Decile 1 is an outlier and should be discounted. Around 1/5th of the working age population is economically inactive and if you get picked up by the Labour Force Survey there’s an even chance that you’ll be recorded in the lowest percentile for income. You might not have an income at the time from other sources, perhaps you’re between jobs, not eligible for benefits (more than £16k in savings, or a visa stamped NRPF), borrowing money, in that gap between graduating and ending your tenancy. There’s a lot of nuance down there.

But you would still be paying tax if you bought a pint, paid your Council tax, or ordered a hot take-away.

Income zero, tax paid non-zero – aggregate the effects across the whole of that decile and you get a rate of tax to income out of line. Hence it’s an outlier.

We know the lowest decile is an outlier.

I say so.

But you have nothing to say on wealth. How very odd. Might you be a troll?

ED NOTE

Please comply with the comments policy. T is not an acceeptable posting name.

Leaving aside the fact that the ultra wealthy already arrange their tax affairs to minimise their exposure to IHT, perhaps someone could estimate how much she might raise to plug this mythical black hole.

Have you not seen the Taxing Wealth Report 2024?

I searched for Taxing Wealth Report 2024. The most recent result was February 2023.

https://taxingwealth.uk/

It was not hard to find.

Some of the ultra wealthy that are born into Royal bloodlines can even get legislation introduced to exempt them from IHT.

Put (very) simply…

10 people agree to apply for a loan of £10,000, the liability of each is £1000 (not including interest rates to simplify the analogy).

2 people decide to drop out of the agreement because they found a loophole in the original agreement but keep their £1000 share of the loan. The liability for the whole £10,000 debt falls on the other 8 who now have to repay their own share plus the share of the 2 that dropped out (£1250 each instead of the original £1000 each).

This, at the very basic level, shows what is happening with the tax burden… whilst the majority share the burden others get off without paying their share.

If more people understood that they are paying the price for those who have reneged on the original agreement and taken the money and ran (probably to an offshore haven), they might start to complain a bit more and support the idea of a wealth tax.

I am not sure I buy that, but I see what you are getting at

From the National Audit Office (May 2025) ‘Collecting the right tax from wealthy individuals’

‘HM Revenue & Customs (HMRC) defines wealthy individuals as those earning more than £200,000 a year, or with assets over £2 million, in any of the last three years. In 2023-24, HMRC identified approximately 850,000 individuals as wealthy, around 2% of individual UK taxpayers.’

https://www.nao.org.uk/reports/collecting-the-right-tax-from-wealthy-individuals/

I tend to agree with that definition

Who wouldn’t?

Having looked at the NAO report and separately at the HMRC website it isn’t clear whether this definition is based on net or gross assets (quite important re the real extent of an individual’s housing wealth) or whether they have included the “pot value” of DB pensions.

Poorest are paying most tax, easy tweaks to existing system are possible to make tax more progressive so wealthiest pay more like their share.

If I can understand this, why can’t Rachel? Hmmm

I see that The Guardian reports that further changes to IHT legislation are being considered. I suspect that the “Normal Expenditure Out Of Income” provision might be reviewed. From April 2027 some ‘unused’ pensions will become subject to IHT (as they were prior to 6 April 2015), excepting the inter-spousal exemption. Fundamentally, the idea being that the very tax-privileged pensions saving rules should entail actually, well, buying a pension at ‘retirement’. As an IFA, I have little problem with that.

Such a lot of noise is generated by the MSM about IHT, which is still only paid by <5% of UK estates. It should be remembered that, subject to qualification, there is a simple way of 'pre-funding' an estimated IHT liability by using a whole of life assurance policy. This is uncontroversial, as HMRC do not care where the tax payment comes from, as long as the right amount of tax is collected. The funny thing is, few, in my experience, are prepared to pay life insurance premiums even though they bang on about the 'iniquity' of IHT! I find this hypocritical, I'm afraid, and, after all, its what you end up with after taxation and fees that matter!

Agreed

I wonder why you found it so hard to simply say £5.5bn as I explained in https://taxingwealth.uk/

You know your subject and have devoted much time to it. I, however, don’t and am asking naive questions as a result.

I have no idea what question I have not answered – and just checked all your comments using the details used here.

But you are welcome to be abusive, but not here. You have one chance to explain yourself, because your assumption that I am here to answer questions you can research for yourself is pretty annoying. I have other things to do.