People say Rachel Reeves faces a £40bn “black hole” in the UK budget. She is hinting at tax rises — but that gap could be filled, at least in part, by collecting corporation tax already owed. In this video, I explain how billions go unpaid each year, why HMRC is fighting blind, and how three simple changes could fix the system. Honest businesses would win. Tax cheats would lose. And they would not need to hit ordinary people with tax increases.

This is the audio version:

This is the transcript:

People are saying that Rachel Reeves has a £40 plus billion black hole in the UK budget, and she's got to fill it in October.

She's hinting at tax rises.

I am questioning whether there's even a black hole.

But the point is, does she need to tax people more, or does she actually need to collect the tax that's already owed?

It's an important question because the reality is that there are big problems with uncollected tax in the UK, and in particular, one tax, and that is corporation tax, the tax that is charged on the profits of all companies, big and small in the UK and very large amounts of that are going unpaid each year right now.

In fact, let's look at the data.

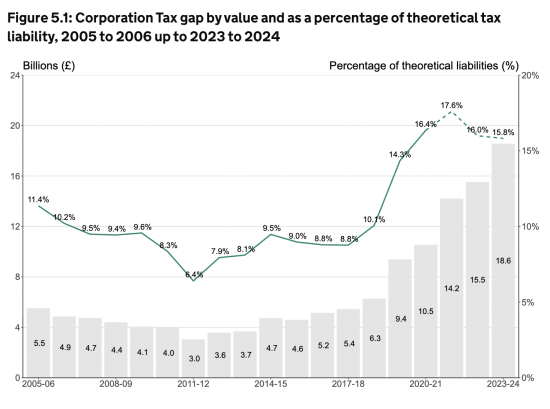

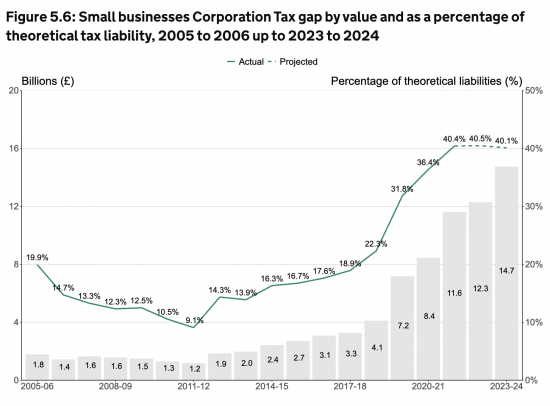

The Revenue says that £18 billion of corporation tax goes unpaid each year, almost half of that black hole that Rachel Reeves is looking to fill. And of that sum - this is of most particular importance - £14 billion is due by small UK companies.

Maybe hundreds of thousands of them.

Maybe not owing vast amounts each, but nonetheless, adding up to £14 billion, a figure so big that it represents £4 out of every £10 that is owed by UK smaller companies.

And if corporation tax isn't paid by these companies, you can be pretty sure that their VAT liabilities and PAYE bills on taxes owing by their employees aren't being paid as well.

So this is a massive hole in our tax system. And the fact is that HM Revenue and Customs is fighting this problem with multiple arms tied behind its back, let's be blunt about it.

It doesn't actually know which of the near 6 million companies that supposedly exist in the UK at any point of time are actually trading. And that is ludicrous.

What is more, it doesn't know which of the many hundreds of thousands of companies which disappear in the UK each year might have traded and owe tax and therefore need to be chased.

It is then literally working in the dark with regard to this issue, and I have no doubt whatsoever that there are criminals out there exploiting this to their personal advantage.

So what could Rachel Reeves do to collect this tax, which is owing?

Very simply and very straightforwardly, she could demand that all our banks report annually to HM Revenue and Customs on which companies they have provided bank accounts to.

Now, that's a very simple demand to make. In fact, they have this information, and they have to collect that information because they have to share it if the owners live outside the UK, but they don't, if they do live within the UK, which is utterly bizarre.

What is more, all those banks have to know who actually owns and controls those companies. In other words, who are the real shareholders who own the entities, and who are the real directors who run them? And so they could be asked to share that information, which they collect for money laundering purposes.

And, let's be clear about this: the banks also have to prove where those companies are trading because they've got to send the bank statements somewhere.

So the truth is that the banks have all the information that HM Revenue and Customs need to be able to tackle this problem.

So what could Rachel do? Very simple, she could change the law on company closures.

Right now, I am quite certain that the vast majority of the tax that is not being paid by small companies is owed by the vast number, the hundreds of thousands of companies that are closed each year, often having only existed for a year or two.

The directors walk away from these companies, leaving the tax debt with them, and they have no personal responsibility for them at all. They know they're in the clear, having basically committed a fraud. So what we need to do is have a change in the law that gives HM Revenue and Customs the power to declare the directors of a company are personally liable for unpaid taxes if they can show with reasonable evidence that there are some likely to be owing. And that reasonable evidence is simply the fact that they've traded and they've paid nothing.

In other words, they could actually make the people committing these frauds personally responsible for them and prevent them from using the power of limited liability to hide from their liability.

And if we then also require banks to report the total amount of money deposited in each of the bank accounts that they run for each company HM Revenue and Customs could prepare a very simple estimate of the likely tax owing by the company in question, and raise an estimated tax assessment, something which they have the legal power to do, and then make the directors personally liable for paying that bill or for providing the necessary accounts and other records that are required to prove the bill isn't owing.

We would, in other words, change the total balance of power with regard to tax collection from small companies. And that's the right thing to do because limited liability was never created to help criminals, yet that's what it's doing.

And all Rachel Reeves needs to change this is political will. She could, if she changed the law, recover billions of additional taxes each year.

It was only in 2017 that the tax loss was half the rate that it is now. At least £7 billion then is within her reach. I suggest it's rather more than that. So she could, in other words, get the money she requires to help fill her black hole.

But, as importantly, honest businesses would no longer be undercut by cheats.

There would be a restoration of trust in the tax system.

And there would be fairer markets and more funds for the government to control inflation and do all the other things that tax has to achieve.

So Rachel Reeves needs to stop targeting working people for tax increases. She instead needs to make sure that the tax system doesn't leak like a sieve. She needs to fix enforcement first before she touches tax rates. We don't need to hammer ordinary people with tax increases in this country at this point in time. We need to hammer tax cheats.

That's how you build a strong, just and fair economy.

Rachel Reeves has the power to do this.

The question is, will she use it?

Taking further action

If you want to write a letter to your MP on the issues raised in this blog post, there is a ChatGPT prompt to assist you in doing so, with full instructions, here.

One word of warning, though: please ensure you have the correct MP. ChatGPT can get it wrong.

Comments

When commenting, please take note of this blog's comment policy, which is available here. Contravening this policy will result in comments being deleted before or after initial publication at the editor's sole discretion and without explanation being required or offered.s

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

In response to your last question, Reeves will not use her powers in that way because of her obsession with her G spot: she will think its stops ‘Growth’ – encouraging new entrants to the market. It is typically Neo-liberal – obsessed with inputs as a matter of faith, not interested at all in actual outputs.

Agreed

There seems to be an idea going round that The Government will require banks to collect the National Insurance numbers of all account holders so HMRC can link accounts to individuals.

I don’t know if its true or not but again it shows how ‘ordinary people’ are being targeted or feel that they are being targeted while the real crooks continue to go free

Details of all bank accounts with interest paid are already supplied to HMRC, universally.

The new law to allow access the banking records of all benefit claimants, including pensioners, has been passed.

What is absurd, is it the same process is not being applied to companies so that tax might be collected. You would almost think that the deliberate blind eye is being turned.

I thought about this as I read your post. Businesses should be scrutinised; looking only at claimants reflects the values of the neoliberal system.

Interesting letter in The Guardian which gets to the point of why things are going wrong in the UK

https://www.theguardian.com/politics/2025/aug/10/the-government-needs-to-face-up-to-reality

“And they would… NOT…need to hit ordinary people with tax increases.”

…

Edited, thanks.

The self employed avoid tax by taking cash in hand for their work. Builders in particular cut the bill to the customer by reducing the bill by avoiding VAT then don’t pay the full level of income tax if any at all. How do HMRC claw this tax back as I’m sure the numbers are vast.

Much smaller than the corporation tax loss – but undoubtesly true.

The answer is, of course, to have more tax inspectors because doing so would make for a level playing field for all honest businesses whilst improving growth in the economy as a consequence, and helping the government implement its policies through effective taxation systems.

I believe that they (HMRC) now have a specialist department ?in Glasgow? – but how much is it costing when there are those that know how to ‘avoid’ the system?

At the risk of incurring your wrath, Richard, I don’t agree that directors should be made personally liable for any tax outstanding if a company is dissolved. The whole point of limited liability is that anybody can have a go at running an enterprise, and if it fails to work they can walk away from it and try something else – unless there is deliberate intent (which, I’m afraid, there all too often is). Before the Enterprise Act (2002), HMRC (or Inland Revenue and Customs & Excise) were preferential creditors, but now they have to stand in line with everyone else, often getting nothing or, at best, 10% from liquidation of the assets. Repeal of that Act would not be a bad thing IMO. What, also would be a very good move would be that, as you suggest in TWR, a strengthening of HMRC, particularly with a return to local offices. That is also better for taxpayers – I remember the good old days when I could just bowl into the Inland Revenue’s office in Oxford Road, Bournemouth, or C&E in Serpentine Road, Poole and thrash out a deal. At worst I might have to go up to London for a higher authority. Nowadays you are dealing with some bod in Newcastle or some place, possibly a Chatbot for that matter.

I have to disagree with you, quite markedly, Nigel, because you were looking at all of this through rose tinted spectacles. If a director could show that their company had gone bust as a consequence of genuine trading default by, for example, a customer, then I entirely agree that the Revenue should not have a chance to go against them for unpaid tax. That would be wholly unreasonable. But the fact is we are now looking at systemic abuse of the tax system by people who are incorporating companies and not paying their taxes as a consequence, with a potential breakdown of the tax system as a result. Forget the ideal form of limited liability that you’re talking about: we are addressing crime here and crime has to be properly tackled or it goes out of control and your comments failed to take that into account.

I don’t know about rose tinted spectacles. More like faded memories of sunny days. I accept that there are villains out there like the ones you suggest – I know of one locally who sets up limited companies and then puts them into liquidation owing suppliers including, presumably HMRC, lots. Double glazing companies are notorious examples. I did say “unless there is deliberate intent”. I now see that the 2002 Act was modified in 2022 so that only corporation tax and NI cannot be treated as priority debts, which is a step in the right direction.

I repeatedly told clients about director’s negligence, and the fact that it is not reasonable to expect to hide behind limited liability – limited liability cannot protect from negligence and unlawful acts – deliberately not paying taxes (CT, VAT, PAYE, NI) is unlawful if a company just stops trading and the directors walk away to set up another company – many such companies who cease trading have insufficient funds because directors have chosen to pay dividends and directors remuneration before paying other debts.

Agreed

Reeves and Starmer and the Labour Party have been captured by big business, the establishment and powerful vested interests. What they should do and what they will do, have been up to now two completely different things. I have no faith in them, how can I? How can anyone? Starmer promised to tax those with the broadest shoulders then proceeded to attack the poorest and disabled and those who have had the sh*t knocked out of them for over two generations. No mention of this in the msm, because the bottom quintile don’t matter anymore. They’re spying on the bank accounts of those on benefits now. But as we see, the attacks on the poorest are always a first precursor to the general incursion and invasion of the general population, except of course the political and other elites. The Paradise Papers proved that wealthy people here as a matter of course offshore their liquid assets which is to the detriment of the UK.

The system which f*cks the majority over leaves most of us with no recourse but to criticise, organise and fight back. This is the problem they now have. The majority of people want change and the political system itself is now the impediment to that change. Not a good situation and it won’t get any better until there is a sea change. This gives them a chance to change course, do the moral and right thing and make things fairer for the majority. The ball is in their court, for the time being.

I hope they all heed some reason. But I wouldn’t bet on it.

I have just thoroughly enjoyed this video. When I ran a small hotel business in the 1970s the Inland Revenue routinely sent us an estimated tax bill which they demanded we pay. We were told that it was based on what a hotel of our size should be making in profit.

Statement of Expenses for Rachel Reeves – Labour MP for Leeds West and Pudsey since 2010.

Since 2021, Rachel has received the following donations and perks:

£184,000 from Labour donor Lord David Sainsbury.

£170,000 from Labour donor Gary Lubner.

£153,539.06 from the Trevor Chinn, Lord Alli, Martin Taylor, Gary Lubner funded/Morgan McSweeney run consortium

@LabourTogether

£25,370 from Labour donor Sir Trevor Chinn.

£99,000 from The Green Finance Institute.

@EnergyLiveNews

£75,000 from Labour donor and Tony Blair associate Tim Allen.

£50,000 from Labour donor Alison Wedgwood.

£15,000 from Lord Phillip Harris.

£30,026.61 from

@fgs_global

£27,500 from Sir Clive Hollick.

£150,000 from businessman and former Chairman of Lloyds TSB Victor Blank.

£4,767 from Juliet Rosenfield.

£10,000 from the banker Ian Cornfield.

£10,000 from football regulator and Labour donor David Kogan.

£40,000 from gambling industry tycoon Neil Goulden.

£10,000 from the former CEO of

@SkyBet

Richard Flint.

£20,000 from Baron Bernard Donoughue.

£2,385 in tickets and hospitality from

@the_LTA

for

@Wimbledon

£677 in tickets and hospitality for the kite festival.

£12,800 from Richard Parker and annual use of his holiday home. ️

£4,566 from Commercial Estates Group Ltd.

£660 in tickets and hospitality from the

@BBC

for The Proms.

£998 from in tickets and hospitality from

@NTLive

for The National Theatre.

£1,704 from

@TheCityUK

for a slap-up meal at the Labour Conference.

£1,100 from

@havenleisure

for a short break.

£330 in tickets and hospitality from the

@BetGameCouncil

for a concert.

£360 in tickets and hospitality from

@LloydsBank

for the Chelsea Flower Show.

£699 in tickets and hospitality from

@UKMusicMediaTV

for an Adele concert.

With her salary of £150,000, expenses (£36,592.93+ claimed since 2024)

On 9th July 2025 Rachel voted for the Universal Credit/PIP cuts that will result in further hardship for people who are disabled and vulnerable. Rachel voted to scrap the #WinterFuelPayment to pensioners and to retain the two child benefit cap which contributes to child poverty’ in the U.K.

House of Commons Register of Interests.

Parallel Parliament Register of Interests/expenses.

http://MPsExpenses.Info page.

@ElectoralCommUK

donations page.

UK Parliament Members Register of Interests

They Work For You Register of Interests.

@UKLabour

@RachelReevesMP Rachel Reeves IS A BLACK HOLE SWALLOWING MONEY. She is her own company.

Cor blimey, guvnor! Ol’ Reevesy won’t be struggling to pay her bills, will she, hey, but she’s taking money off the poorest who have been dying in droves for generations! Would you ‘Adam n Eve’ it?!!

How about getting King Charles and the big landowners, big businesses and corporations, Bezos and Amazon, the gas and electricity and water companies to pay theit taxes? How about taxing wealth and expensive properties, inheritance tax on the wealthiest, and then price controls for necessities and help for the poorest who struggle to pay what have become extortionate bills? How about big football clubs pay 3 or 4 % of the wealth they make in often poor communities to fund those areas, how about a tax on all wealth over £10 million with a good of percentage of that ring fenced for infrastructure, cheap public transport and things that help the poor and the workers that keep society running? Perhaps King Charles can give a speech to the nation about it all?

More of us want fairness and economic justice. The present system is further entrenching the wealth of possibly only 2% of the population to the detriment of the rest of us. That should be challenged by everyone not wealthy at every turn. Perhaps if that group calling itself Patriotic Millionaires are serious about paying tax, they can start the ball rolling by doing just that, paying all they owe voluntarily whilst taking out ads in newspapers, buses and bill boards that they want to see the law changed to make tax evasion of any kind illegal with fines triple of the tax avoided. We shall see.

Anything less would surely be unpatriotic, after all.

So what does she actually have to spend her money on? I would really like to know your answer to this.

I wonder how effective HMRC has been in tackling missing trader VAT fraud, which at its peak was said to result in loss of 2bn a month in the UK. Measures introduced to tackle it seem to have been very resource heavy so I fear that a significant loss must still be occurring.

That has been quite effectively tackled

There are different problems now

I used to work in the city, I used to do the admin for a wealth advisor who helped wealthy business owners avoid tax.

The scheme went like this:

UK Company director (CD) meets wealth advisor (WA).

WA introduces CD to trust company (TC) based in the Isle of Man (IOM).

All parties agree to establish a trust in IOM called Trust X. TC are appointed trustees.

CD surrender directorship of UK company and are replaced by the WA and recorded at companies house.

Ex CD is registered as the official beneficiary of Trust X.

The UK company makes a contribution to the trust (£1m for example).

TC records this in the bank account established in the Cayman Islands.

TC formalises documentation to make a “loan” to the beneficiaries of the trust (£1m minus fees).

CD/WA/TC and beneficiaries sign legal documents.

£1m sent to beneficiary.

3 months later….

TC “forgives” the loan made to the beneficiary and the debt is written off and records this formally.

I don’t think that would work now.

Do you mean legally? Just to add I remember they had a QC letter which detailed an “opinion” on the structure. I remember it looked very outdated even then (this was 2016-2018). I didn’t check if it was a current QC or not.

With this article do you mean HMRC just aren’t going after the tax they’re legally required to go after and have a duty to do so?

I am sorry, but like many questiions now being asked here, I have no idea what you are asking me because a) I do not have the time to go back and read threads – and I cannot see them when I moderate and b) it’s not clear what you are asking.

This system is by design and it should boil the blood of everyone who knows about it.

Why do I say this? If you believed in Neoliberalism and tax to spend then the most obvious way to increase spending is to collect owing tax. I think the estimate is a 3 fold RoI for HMRC but I might be misremembering.

If you believe in MMT, then it’s painfully obvious that £18Bn is a lot of inflation reduction and can reduce the adverse effects of considerable amounts of spending to improve people’s lives.

If you have any morals then not paying what you owe is disgusting to you.

Here’s the kicker. I think Richard is grossly underestimating the amount of tax liability, not because of VAT and PAYE, but because HMRC has purposefully been hamstrung over the years since David Cameron under the guise of austerity. You wouldn’t do that unless you had something to gain because it makes no logical sense to not collect tax, no matter who you are, unless you’re helping people avoid paying tax. I of course have no proof and you are right to point that out and call this conspiratorial but I can’t find a good reason for reduced effectiveness of HMRC outside of incompetency on a level that would win you a Darwin award.

You may well be right.

it most probably would not work now – but how much did those ‘involved’ make from it? perhaps Benedict K could give us some figures??££ (please).

Many tens of billions in its day.

Back in May last year, I wrote to the Buckinghamshire Council cabinet member on Finance:

Dear Cllr Newcombe

I have a friend who is a councillor in South Oxfordshire District Council. He told me that they initiated an audit & cross check of businesses that received support during the pandemic & those who pay business rates. They found quite a significant number of firms that were not paying the correct amount of rates or even not at all. As a result of their investigations (conducted by an external commissioned supplier, I believe) they managed to recoup large sums of money for both the district & county council.

I have further information if you want

My reason for writing to you is to ask whether BC has done anything similar or has any plans within your work programme to do so?

As a local council taxpayer, I would hope that my council has done something similar to SODC or plans to do so. BC needs all the money it is due.

Thank you for considering his matter – I look forward to your reply.

He replied:

Dear Mr Harvey,

Thank you for your email.

The Audit and Governance Committee regularly receives reports about fraud. However you have raised some very specific points so I have asked the Chief Auditor for the answer to your questions.

—

Since then – NOTHING. Despite being chased by me & local non Conservative councillors…

Depressing

Richard, I appreciate the difficulty of avoiding talking about the “black hole” when talking about the deficiencies of the tax system but I think there is a danger that people could be confused between your message that tax does not fund government spending and how much tax could be raised to fill “the black hole”. A suggested way out is by tying your criticism of the tax system to one of the purposes of tax in a modern monetary sytem. So the unfairness of people avoiding corporation tax or the need to discourage gambling rather than to raise money for the government to spend.

I am challenging their specific narratives and say right up front I do not agree with them .

Unless I reference what they say it is very difficult to challenge them.