Despite the madness of Trump, the continuing reality of tariffs and an unsurprising fall in US GDP, stock markets have recovered their losses. This makes no sense at all. What is happening?

This is the audio version:

This is the transcript:

Stock markets are mad.

Let me be clear what I mean. There is at the moment a rally in stock markets around the world as if the Trump slump that was created by his announcements of tariffs had never happened and we are back to the glory days of thinking that Trump is going to be the salvation for stock markets around the world, and wealth is going to accumulate to those who've already got it in a way to which they have become accustomed.

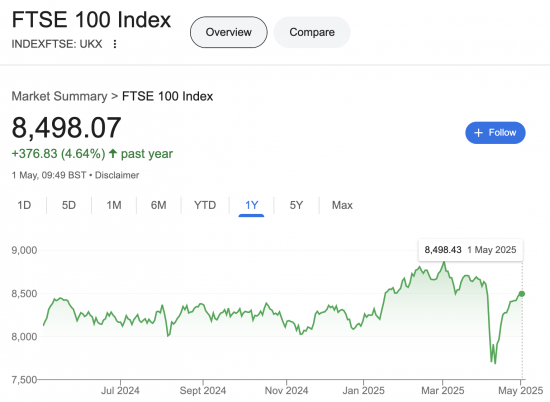

Only, it isn't. There's no way that is going to happen. If you look at this chart of the FTSE 100 in the UK for the last year, you will see something quite amazing.

The first thing is that until Trump came along, the market was remarkably stable. It was at around 8,200, and very little actually really changed very much in the market as a whole in the nine months or so until Trump arrived in office, and then markets jumped.

They went up, and they went to over 8,500.

And then, when Trump announced Liberation Day, they crashed. They went down to around 7,600 and they wobbled a little bit - there's a funny little W around at the bottom of the marketplace.

And then, they've risen again, and now they're back at around nearly 8,500 as if nothing had ever happened. And the world according to Trump is the place where you want to be again.

But that makes no sense. We do actually now have the tariffs that Trump announced. Not as high as he initially said, but nonetheless, tariffs of 10% on every country exporting goods to the USA. Higher tariffs on steel, and cars, and other things, and of course, China is all over the place.

The American economy is in deep trouble as a consequence. There are literally jobs being slashed everywhere already because of the problem with imported goods. Amazon has got rid of 20,000 staff via the UPS distribution network, and there are no doubt others to go all over the place as a consequence of reduced imports from China, which are going to hit American consumers very hard indeed.

Supply chains all over the world are being disrupted.

People don't know where they are, and there is a lack of consumer confidence, not just in the USA, but in the UK and across Europe and elsewhere for countries which really drive demand for goods and which fuel the demand for services. And let me be clear about it: everywhere, the feeling is markets are going to become subdued, and I mean real markets in this case, not stock markets, but the consequence of subdued real markets is that companies don't invest.

Therefore, employment falls.

Therefore, stock prices fall.

Therefore, financial markets should be falling.

And yet that is not happening.

Why is there this massive disconnect between the reality of what Trump is doing and the stock market reaction to it, which is now, well, it was just a blip, it's all been over and done with, and let's get on with the world and pretend that nothing happened, and the reality of the world where people are losing their jobs, consumer confidence has crashed, and all those other things I've just mentioned.

Why is there that disconnect? It's because stock markets and the real world are not connected to each other. They never have been, and they probably never will be, at least not until there is some fundamental change that requires that there be a relationship between real economic value and share prices, and that connection has been gone for decades.

Why has the connection gone? Very simply, very straightforwardly. We decided, in our wisdom - there was no wisdom in it, by the way, but I will use the word ironically - that the stock market was the place where savings for pensions should be stored.

This was a massive error of judgment.

It was promoted in particular by those who put forward the concept of the Big Bang in the 1980s, which liberated, supposedly, financial markets so that they could compete for savers' money in a way that had not happened before. And as a consequence, money was poured into stock markets, aided and abetted by the fact that states, including the UK - but many others as well - decided that they were going to begin to abandon their commitment to providing decent old age pensions to the people in their populations, which they had taken on after the Second World War, and instead, people would have to save at their own peril, at their own risk, and with their own money, for the future that they might want.

So, it was organised that money would move into stock markets, from company pension schemes , from individual pension schemes , and then when enough money did not go in from individuals, the government mandated in the UK, and in some other countries, that people should be required to save for themselves via their employers in stock market based investments, meaning that month in, month out there is a wall of money that goes from the private sector - you, me, and everyone like us in the UK - into the stock market, so that share prices will go up, because the stock market has guaranteed this, and that is because they have actually reduced the number of shares on sale progressively over time by, first of all, reducing the number of companies who are quoted on the stock market, and secondly, by those companies actually buying back their own shares so that there are fewer of them available, so that the price has to rise and therefore it looks as though everything is getting better for everyone when that may well not be the case.

We are living in a giant Ponzi scheme where more and more money is being paid into pension and other financial arrangements organised in a structured way, as if this is normal, when in practice it isn't, and it is a very recent and short-term phenomenon.

And the consequence of these increasing share prices, which suit the bosses of the companies whose shares are bought enormously, because they are paid fantastic bonuses running to millions and millions of pounds as a consequence of the increase in their value, is no real value is being created as a result. There is this disconnect.

And the reason why the market has recovered in the way that it has on the chart that I put up and which we are now showing again, is because the wall of money's got to go somewhere and that wall of money is going to arrive in the stock market, whether we like it or not, because the flows coming in from pension funds are bigger, so far, than the flows that are being paid out because there are more pensioners contributing right now than there are withdrawing.

And when that balance changes - and it doesn't even have to become equal - there just have to be enough people withdrawing - there will then be a crash because markets are great at pushing values up, as you can see, and they're terrible when there is a demand for net sales. Then they just don't know how to manage it, so you get the cliff edges that we saw in April, when there was a panic, and there was a dramatic fall in price, and then a steady return to normality as the stock market would see it.

All of this is a financial disaster in the making.

I'm not saying it's going to happen overnight. I don't pretend it is. It will take time. But let's not pretend that there's anything here that is sustainable.

We have a stock market that is, as I have explained, utterly disconnected from reality. They are simply dealing in money. They're not dealing in physical realities. They're not dealing in what you and I are buying or selling, and what companies are investing in or anything else.

They are just playing with money. And ultimately that game is unsustainable because people will ask for their money back, and when they do, we will realise the emperor is wearing no clothes, the stock market does not represent value, the world has been pursuing a myth and the pension savings that have been based upon this whole misconception of where value is created will collapse.

It's a foregone conclusion that it will happen, in my opinion. Do I think, therefore, you should place all your pension savings in the stock market, despite everything that everyone says? I think not. But that is an economic analysis. That is not investment advice, and please don't take it as such. But on fundamentals, there is a problem here.

Stock markets are stupid. They're looking at what they can do with the money they're being given, whether or not there is good reason for them to have it because the structures that guarantee that it will arrive every month are being put in place by compliant governments who are servicing the interest of the financial services industry and not you. And as a consequence, they can play with the money and believe they're doing well when in practice they're simply heading for a bust and a bust, we will get.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

“If something cannot go on forever, it will stop.”

Herbert Stein

Given that we have an ageing population (eg you and me) whats going to happen as all those pension plans start to be cashed in?

Those behind us relaying on share based pensions will lose out.

The stock market is institutional gambling rigged in favour of the financial elite.

Always demanding exemption from regulation to stay “competitive”.

Expect massive profits to be announced with the ensuing huge reward bonuses.

Why it’s given such daily prominence is beyond belief.

Oh and Stock Markets are not mad, as someone I once knew described herself they are ‘differently sane, ie not in the way everyone else is

Sure…..

A good post. We should never have privatised the pension system – we need to create a well funded state pension system. I would abolish NI and instead put a levy on income tax to pay for pensions – this would capture all income rather than just earnings from employment, we need to move on.

A secondary factor is the great credit boom resulting from central banks bailing out every financial crisis since 1981/2. Some of that credit has filtered into stock markets. The result is that another financial crisis is long overdue.

I suspect that the downward drive will resume in the next few months. Disclaimer, this is not investment advice!

Corrupt.

Stock markets are corrupt.

Richard

I wouldn’t for a moment claim that all share price movements are ‘rational’ or ‘justified’.

However at yesterday’s close, the price/earnings ratio for the FTSE All Share Index was 14.81. This is historically relatively low: it ranks at only the 34%ile of all the values seen since 1994. Simply put, share prices are not unusually detached from the company earnings that underpin them (as they would be in a proper Ponzi scheme).

Turning the P/E on its head produces an earnings yield of 6.8% per year, which doesn’t look too unattractive compared with cash rates or gilt yields of about 4%.

Have a nice weekend.

P/e data is historic.

Valuation is meant to be based on future earnings.

Are you sure you know what you are talking about?

“there’s a funny little W around at the bottom of the marketplace”

IIRC thats whats known as a double bottom, a sign the index due for a reversal upwards.- Bullish

An ‘M’ at the top of a good run upwards signals a potential downward movement. – Bearish

So?

Traders use these signals to time their moves in and out of the ‘markets’.

Are there any projections for the USA—since this is where most of the money is now—on when the trend will reverse: more pensioners withdrawing than contributing?

This is simply a population issue, so not yet