It takes some effort for a US president to create chaos and destruction on the scale that Donald Trump has.

I have already commented on much of it, but yesterday, news came through of another impact that he has had, this time on the US economy.

In the first quarter of this year, during which he was President for only a little over two months, the US economy shrank in size by 0.3%, such was the adverse reaction to the economic devastation that he has unleashed.

Since the close of the quarter, things can only have got worse, of course. It would be reasonable to presume that the economic mayhem of April, and its obvious aftermath, is going to have an impact when the tariffs on China really kick in. If so, the chance that the US will move into recession is high, I suspect.

I know that the right-wing ideologues in the White House will claim that this is all part of the plan, and the price they are happy to pay. When, however, the impact of this becomes apparent to people in the USA in terms of job losses, rising prices, falling real income, increasing inflation, reduced public services and an impact on the already limited social safety net available in that country, sentiment is going to change.

So why note this now, in advance of that change of sentiment? Simply because it confirms what commentators like me have already been suggesting, which is that Trump is going to do a staggering amount of economic harm, and that process has already begun, simply because of the change in consumer sentiment he has already created.

This post on this blog is, in that case, for the sake of creating another episode in an ongoing narrative. One of the primary themes of that narrative, at present, is the harm that the far-right is causing. They might have only just begun to wreak havoc, but there is no happy ending to this tale while the far right is in charge.

There is a footnote to add, building on a theme noted yesterday on the stupidity of markets.

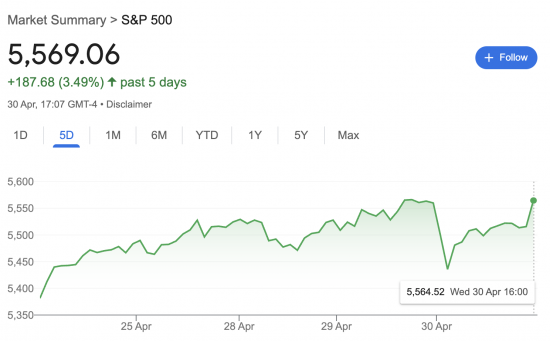

You would have expected the S&P 500 index to fall on the news that the USA's GDP had declined. It did not. It rose, quite markedly:

The disconnect between financial markets and the real world becomes more apparent by the day.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

I certainly agree that Trump is creating mayhem… and that is beginning to be reflected in the data. However, GDP data are distorted downwards by the front-loading of imports to beat tariffs so some care is needed in determining what is going on in the underlying economy. The real impact will not be seen until Q2 data….. but I don’t doubt it will be dire.

The S+P is back at the levels seen on the morning Trump made his big splash on tariffs…. I don’t understand, either. I guess “markets can remain irrational longer than you can remain solvent”.

The BBC’s deputy economics editor (who apparently knows even less than Faisal Islam) claimed yesterday that some of the GDP fall could be explained by DOGE cutting government spending, which is an interesting admission from them.

“Job losses, rising prices, falling real income, increasing inflation, reduced public services, and an impact on the already limited social safety net” – Sounds like a desperate and precarious workforce ripe for exploitation to me. Outcome achieved?

Tom B.,

Are you referring to the UK or USA???? LOL!!!! LOL!!!!

And the response from Trump? It’s all Jo Video’s fault.

Fantastic, truly fantastic. Nothing is ever his fault. Absolutely everything that goes wrong is always someone else’s fault.

I can’t wait for next set of figures which as Clive says will be a lot worse.

I think part of the problem with political economics in democracies is politicians never seem to be held accountable for their failings. They can seriously harm the well-being of the citizens they are elected to protect, but they’re never punished for it!

If I were a Democrat politician in the USA right now I’d be putting forward the idea of a ‘Political Justice Bill’: to make politicians answerable for their actions in office. Once they have a majority in Congress, (probably after the next half term elections), they could pass it into law while the Trump administration is still in power so they know what’s coming when their tenure ends.

A kind of Nuremberg for politicians!

That should focus the minds of a few individuals who are deliberately lying or are unfit for their posts. Congenital liars like ‘Wormtongue’ could do some serious jail time if they get it right.

A Presidential hanging or two would change attitudes in America for the good and probably do no harm in a few other countries I can think of.

Do you think the economic consequences of Trump’s presidency will be felt more in the long-term, or is the damage already too significant to reverse?

The damage is significant

But we do not need to reverse it

We do not need to go back to neoliberalism

We never really go backwards, couple of steps forward and then one back, then two forward again – bit like the Pilgrim’s progress, (although I’m not a Christian).

Trump’s tenure may be nothing but a diversion, maybe even a short cut?

Whatever the future will bring it will be technological. That you can be sure of – it always is!

Afterthought: There’s one thing for sure, I don’t think there is any chance of a deal with Trump. If anyone gets a deal I shall be very suprised. I don’t think his administration has got the will or the skills to successfully conclude deals with all these countries. It may be a bluff anyway, we’d be like a ball in a pinball machine: going round and round, up and down until the game ends and his administration is gone!