Donald Trump announced yet another massive increase in China yesterday, and at the same time reduced the tariffs on every other country in the world to his ten per cent default rate, which is exactly the rate that the UK was already on, proving that nothing that Keir Starmer and Rachel Reeves had tried to negotiate achieve anything at all.

The consequence of this cut was that a week after Donald Trump had announced what he called Liberation Day, he backtracked massively on his demand that every country with a trade deficit with the USA supposedly pay massive tax liabilities in the USA. Ignore the fact that they were never going to do so. For the purposes of his domestic market political agenda, where he had claimed these tariffs would make America rich again, he has had to abandon that claim, at least for the time being.

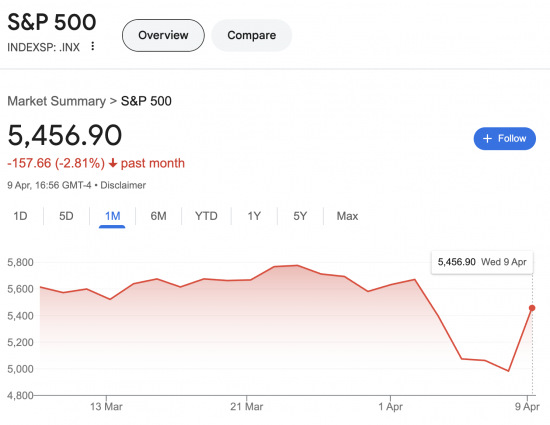

But the consequence was that the US stock markets, which were still open at the time that the announcement was made, rose by approximately 9%, although they did not recover all the losses that Trump inflicted upon them despite doing so.

I cannot help but stand back and think about how lacking in foresight these markets are.

Do they really think that Trump's economic warfare is over?

Do they actually think that the 90-day call is as he describes it when he appears incapable of holding any position for very long?

Have they not noticed that the bond markets were sending out the message that the US government was not to be trusted?

Alternatively, have they not noticed that those markets were emitting signals that higher interest rates are expected because of the inflation?

And have they not noticed that even if Trump scales back on tariffs, it is clear that he intends to undertake a trade war on the basis of regulation, taxation (and European VAT in particular), labour rights and market access issues? All of these could be at least as destructive as anything tariffs could create.

There is also the battle that looks as though it is looming between the US Federal Reserve and Trump to consider.

All these factors should have complicated and reduced market euphoria last night. It appears that they did not. For anyone who claims that markets are efficient and take all factors into account when pricing because they are possessed of a large amount of information about future actions, all of which they can accurately price, yesterday was the clearest indication that such an idea is complete and utter nonsense. Markets did no such thing. They took one piece of information and reacted to it without ever seeking to contextualise what might be happening.

The trouble is, there are real-world consequences of their stupidity, whichever way markets move, and this stupidity is a long way from being over as yet.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

I agree with the sentiment but what is truly stupid is that society tolerates it – allows it to happen. As discussed before, we have stupid politicians, stupid policies and stupid markets because that is what the rich want – stupid people who will not challenge them.

How’s this for stupid?

The other day the Guardian had a chart denoting how long it will take you to get a council house in Britain by area. My own authority stands at 79 years – you’d have to wait for 79 years on the list for a council house to get one.

Here’s one reason why. When we buy a s.106 house (52% OMV from a private developer) or complete a newbuild (of which there are never enough these days because of other economic factors), instead of going through the Homefinder route to be advertised to people on the housing lists who have been waiting and waiting, the council is doing direct matches from people in temporary accommodation (TA) instead – allocating them directly to those cases. This is in direct contradiction to allocations policies and practice – Choice Based Lettings has ceased to exist for those on waiting lists.

Why?

Because it is temporary housing costs (B&B for example) that is bankrupting councils right now because of the weird way it is funded. It is bleeding them dry and the formula for help from government has not changed. If you want a council house, get yourself into TA.

On top of that, even though council housing was central government policy, the debt for the provision of that housing locally was placed on individual Councils! And is STILL being paid down by them – millions a year (if not more) that could be spent on other services. Government brought it in, and has left Councils holding the baby, not following through on their commitment.

A bit off topic I know but if you want to see the consequences of stupid, get into social housing and knock yourself out – there’s plenty.

I did not know that

Thanks for illumination

There is a lot out there about the waiting list fiasco at the moment but I cannot load up links, but I know Councils are lobbying government about the over hanging housing debt created by building the stock.

Thank you for sharing that PSR.

If I was a Reform UK candidate standing for a council seat in May, I know exactly how I could exploit that, to get elected. It wouldn’t be pretty, and I know who I could (wrongly but convincingly) blame – it would involve comparisons between “British” people on impossibly long council waiting lists and “illegal immigrants” in expensive B&Bs “leapfrogging” over them into brand new council homes, paid for by “hard-working British taxpayers”.

Yes, the distortions and bigotry of that scenario horrify me too (a few years ago the target would have been “teenage girls getting pregnant to get a council house”), but that’s how fascism works – find the vulnerable target and scapegoat them. LINO & the Tories will try something similar.

What horrifies me even more, is that there won’t be anyone standing in May with coherent answers to the real-world problem PSR has shared. Will any council candidates raise the REAL issues (explained by PSR) behind the waiting lists? Will they discuss (or get asked about) the stupidities of how local government (and housing in particular) is (not) financed? Of course not.

Thank you PSR, you are doing us a service. TA is close to my heart at present for tragic personal reasons and I live in one of the few cities still (trying) to build council homes.

Thanks

Thank you for this, and added to this gross stupidity are children’s in care placement costs, bankrupting councils.

Impoverished councils forced to close and sell their own children’s homes (some children will always need them) and then accommodate children in hyperinflated private residential homes, with profits at 25%. £700,000 a year per child is not unusual anymore.

What society thinks it’s in any way OK to marketise children’s services, predate and profit off traumatised vulnerable children. It would be cheaper to spend the money on a home + care, and then give the home to the child when they turn 18, instead of signing them onto Homefinder and depositing them in a hostel.

Millionaire poor children.

https://www.cypnow.co.uk/content/blogs/the-high-cost-of-care

So is it this policy where we get the Reform lines of “immigrants get all the housing first”?

My economics textbook says that in most cases free to enter markets are better than markets which are not free or no markets at all. That they don’t make these assumptions about high degrees of accuracy and efficiency, just that they are better than the alternative.

After I’ve looked up the definition of straw man, I’ll pop it through the shredder and thence to the compost pile.

For the record, those textbooks relate to an artificially constructed academic discipline, and not to the world we live in.

The S&P isn’t a market but a constructed index. It is an aggregate price of something that no one can buy. Why would it behave rationally?

I suspect it was the movements on the bond markets that pushed Trump into this pause. Although tomorrow or next week he could just as easily decide to cancel the pause, or cut it to 30 days. He really is making this up as he goes along. The only rational response to his posturing is to ignore it. But factor in the risk.

If Trump had announced 10% tariffs across the board last week, everyone would have thrown up their hands in horror, but this week everyone is grateful. As a practical matter, if it is and remains a flat 10%, that would be a lot easier for everyone to deal with. But of course we have the threat of further US action if any country reacts to these unilateral changes. If I was leading China, I’d be tempted to simply say “our tariffs will be set automatically at whatever level you impose”. And leave it at that.

Not just European VAT any more. Around 170 of 190 or so countries have a VAT or GST with similar characteristics on sales of goods or services. India, China, Japan, Canada, Australia, etc. Even countries like Saudi Arabia. The only major economy that doesn’t is the US. Most of the rest are small island countries (Bermuda, BVI, etc) or in the Middle East (Kuwait, etc). Some of those have an old fashioned sales tax on the final consumer, like the US, which in effect operates like an unsophisticated VAT – a tax on the final sale, but without taxes charged and refunded on an incremental basis through the supply chain.

Much to agree with

“Why are markets so stupid?”………..why do crowds panic? It is & always will be herd behaviour with economics trying to explain/justify such behaviour in rational terms.

Stock markets are a form of gambling – driven by instinct and collective behaviour, with assorted groups (e.g. high speed trading). trying to game what passes for the system. Were it not for “markets” it is unlikely that we would have the Musks and Bezos’ of this world.

Could be described as cognitively immature because it has a limited task – to grab and make a buck before the other person does. So, in that sense operates at the emotional cognitive level of a small insecure child. Anxious, reactive and not able to process long-term consequences – impacts on self and other.

In respect of ‘efficiency’ who defines this, and who is advantaged by this efficiency? It seems weighted to advantage wealthy and powerful people and corporations, regardless of impacts on those with less.

The market seems from an outsider perspective a moral and ethical vacuum. Knowledges about pro social values and relationships are completely absent, so it’s moral development is also like a very young child, except a young child has the capacity to grow and mature. The market’s development is hopelessly arrested.

So, yes the market is stupid and limited, and no idea why politicians and their fellow travellers think it’s a good idea we subordinate to ‘the market; and let the markets decide on more and more critical aspects of our lives.

Thank you and well said, Richard.

If the capital markets colleagues I work and have worked with are any indication, what you have written is not a surprise. Few have studied political economy. Few are interested in news and current affairs beyond tabloid simplicity. You may be stunned to hear how many buy Trump’s view of the US being ripped off (and war on wokeness). There aren’t many Clive Parry types.

Having worked on regulatory and trade policy from May 2008 – June 2016, I have always thought there’s unfinished business and this would come to bite us. My fear is that risk has migrated from banking to what we call shadow banks. As a physical embodiment of that, the aptly named Citadel is having a skyscraper built that will be taller than JP Morgan’s HQ in NYC.

This community will be delighted to hear that shadow banks in the form of hedge funds, private equity and other investment vehicles have the ear of the British government more than banks.

Thanks

… yes indeed. In 2008 Hedge funds and Private Equity were the dogs that did not bark; they took their losses and never presented as a systemic risk to our financial infrastructure. It was banks and broker-dealers that failed and, ever since, regulators have done what they can to a) reduce the risk of failure and (more importantly) b) reduce the risk of contagion or call on the public purse in the event of a failure.

Broadly, I think they have been successful…. but has risk just migrated?

In the intervening 18 years hedge fund risk and PE risk has ballooned…. and as Donald Rumsfeld said – there are “known unknowns” (risk in the banking system) but there are “unknown unknowns” (HFs and PE positions).

We are already seeing some fallout in USTs from basis trades and swap spread trades held with massive (100x ??) leverage. (That may sound a lot of leverage but even I, when running a small hedge fund, could get 50x leverage so 100x for “serious HFs” is quite likely).

We have already seen some pension funds take a PE hit with Thames Water…. but what else lurks? It is clear that PE exits are proving very tricky…. and just got trickier this last week or so.

There WILL be a financial crisis coming but when and in what flavour we don’t know.

Your conclusion is correct

And my saying so is as unhelpful as you saying it 🙂

What I do know is there will be be a bail out

“ rose by approximately 90%” ? 9% ?

Indeed.

A typo. Corrected. I make them.

A typo or you simple can’t do basic maths?

Like you, I make typing mistakes.

Thank you for making my point for me

Your abuse failed.

This was the question I wanted to see asked today. It does also lead to another.

Why is nobody else questioning this?

Headlines seem to be “normality restored” “markets surge” etc.

This is at best a 90 day break before more chaos and uncertainty. they have forgotten that a pause was emphatically denied 24 hours before being lifted.

The only upside if this pause holds is that it gives people a chance to reduce their exposure to US tarrifs. That’s not good for the US economy either.

But as long as the stock markets are green nobody seems to care.

The oligarchs who appear to be leading Trump do not make profits when share and bond prices are steady. They depend upon sudden changes in the values – particularly if they have some control over the direction of the movement – or of course they can simply bet upon a particular outcome.

I think we have just witnessed a pre-arranged pantomime.

The message I get from the weeks since Trump took office is that the sooner reduce our dependency on the US the better. Given the status of the US in world affairs, I cannot see decoupling our economy being a quick process. I suspect that the best we can hope for (given the current incumbents in Downing Street) would be to have realistic alternatives for each and every dependency we have. But, in financial affairs, the UK seems to be tightly coupled to the US (heaven help us!).

We know how the markets can react from past experience. The herd instinct is very strong; trouble is, the markets can at times behave like lemmings, particularly if Trump really does force an effective bond default on us all. As time passes, and events unfold, it echoes the 1930s far too frequently to feel comfortable.

Our dependency on the US is enormous

They own rather too much fo us

I am not at all cognisant of stock market procedures, but would not a massive fall in prices, followed by a huge rise, be exploited by those in the know (ie all Trump’s cronies) to make a fortune overnight? Was this deliberate tinkering on his part?

Yes, to your first question

Who knows, to the second.

It is worth reminding ourselves of the activities of George Soros in 1992.

https://theeconreview.com/2018/10/16/how-soros-broke-the-british-pound/

Markets are not stupid… but people are.

Who are more stupid? (a) People like me that are speculating to try and make a crust or (b) people that think market prices are telling us something profound about the world?

It’s a tough call to make in the stupidity stakes. However, I offer a little insight to my thinking through this recent period.

Over the years (on and off) I have lost more shirts being short the US stock market than a dodgy dry cleaner… but for once I was doing OK – then Trump suspended tariffs. Was the bounce from 5,000 to 5,500 (S+P futures) sensible? Probably no…. but I did buy back at 5400. Was it sensible – absolutely yes. It allows me to stop the pain/losses, regather my thoughts… and, in this case, re-short the market as I think there is more trouble ahead. (Note – that is not an investment suggestion!!).

Looking at June S+P futures prices, Trumps election victory saw the market at 6,000 and at we ended 2024 at 6,200. People finally woke up and it fell to 5,650 on general fear of Trump nonsense. Then collapsed, in an absolute panic, to 4,850 after his reciprocal tariff speech. We stabilised at 5,000 ish and then, in the face of bond market dump he halted tariffs and we rallied to 5,500 – half way back up from the bottom to the start of the year, 2/3s back towards pre-speech levels. Is that too high? In my view, yes….. but it is not completely crazy.

Why do I do it? I don’t really know but it is exciting and, having done it for 40 years I doubt I will stop… oh, and despite some terrible decisions it has not been so bad.

What I see is “playing”the markets.

“It’s a good time to buy”, he said. Now if you say this to only a few rich friends, it could be seen as insider trading, but telling it to everyone, it’s ok.

Markets are a gambling game. You will never be able to make sense of them. If common sense would prevail, the markets would not be highly over valued, would reflect commodities prices based on strong economic data instead of computer algorithm valuation and speculation. But there is no money to be made by using common sense.

see the Guardian today – and it did cross my mind previously – manipulating the markets & insider trading – it would be interesting to know who made huge profits

Susan.

Insider trading on an industrial scale.

$100,000 worth of 24 hour call options on the S&P 500 bought. Worth $21 million by the end of the day.

Have a look at this link for explanation and evidence.

https://x.com/strxwmxn/status/1910135766434324880

thanks Ivan – but who will go to prison when Trump can give out pardons?

On the question of affordable homes, in Scotland, since 2007 when they first came to power, the Scottish Government have built 136,705 of this type of housing. No doubt the usual critics would say this isn’t enough, but it compares very favourably with the other nations of the U.K.

Thought this might be appropriate.

https://www.youtube.com/watch?v=lOACr8XLn6M

Thnak you

I liked that

New home starts in the UK affordable sector for Councils were under 10,000 units last year, I’m sure that is the case and just over 30,000 in the Housing Association sector.

Reeves thinks that increasing 80% market rents rents beyond the rate of inflation, is what will help Councils to build.

All this will do is create a crisis for those working people in social housing if those rents are applied to their homes – their housing costs will not be as affordable. The rents we are charging now are well above anything we’ve seen before and causing hardship.

Reeves will do anything except invest – put the money in from the government and subsidise it. The poor will fund their own housing remedy, it’s their fault.

Rent rate rises have been retarded by the Tories, held back and reduced since 2015 because of concerns with the cost of housing benefit – this was a big hit to the build up of working surpluses to build new council housing. But people forget that 80% market rents are pegged to market rents which have risen exponentially recently.

It’s a real mess and the revenue funding of all social housing is all wrong and very risky for councils as the housing revenue accounts are now self standing and not topped up by government at all, for development and re-investment as routinely as it used to be. The Government is letting go.

Councils everywhere are thinking of selling housing stock and other property as a Labour Government stands by and lets them.

This is a government for the vultures in the private sector (who no doubt have funded Labour) waiting to pick up distressed assets. That is Reeve’s economic plan in a nutshell.

Labour are reprehensible. They look down their noses at people perceived to be not working, crow about caring for working people whilst sacking working people in the NHS and civil service.

I ask you?

Indeed….