Trump is planning trade wars and sanctions that are bound to crash the world economy. But what he knows is that the resulting bailout will make the wealthy even more wealthy, yet again. His policy is both mad and entirely rational from his viewpoint.

This is the audio version:

And this is the transcript:

Can the world economy crash? The answer is that yes, of course, it can. We know it can. It did in 2008. It had another very good go in 2020 when Covid came along. So, the possibility that the world economy can crash is obviously hardwired within it. It is now something that we have to accept.

Is the possibility that the world economy will crash soon a realistic likelihood? And my answer to that is, yes, it almost certainly is. And the reason why comes down to two words. Donald Trump.

Trump has set out to crash the world economy. I really don't think there's much doubt about that. He has declared trade war, and he has said that he will also impose economic sanctions on countries that refuse to use the dollar for trade. He is, in other words, setting out to undermine the credibility of the world's reserve currency, the dollar, by threatening any country that does not want to use it. And he is threatening that any country that wants to take sanctions against the US because it is going to impose sanctions on them via tariffs is going to suffer as a consequence.

You cannot do that if you are the world's major economic power and not give rise to the likelihood. of an economic crash. Simple, straightforward fact.

So, should we be worried about this? Well, yes, of course we should be. But what is the consequence going to be? And why is Donald Trump not worried about this?

And the answer to that is that I'm afraid to say that something has also become hardwired into the world economy. In 2008 and in 2020, the world was saved with bailout money.

In 2008, quantitative easing became a feature of economic life. Before then, the possibility that the government would issue bonds to immediately repurchase them, to pretend that it wasn't actually providing direct finance to itself from its central bank to fund its programmes to ensure that the economy kept going was unknown, but that is what QE did in 2008. And let's be honest, despite all the problems it gave rise to, and it should not have been done in the way that it was, it did keep economies going during that crisis.

And it did exactly the same again in 2020.

Again, I would not have done it as the QE program was managed, and the aftermath of that programme - the quantitative tightening programme now being run by the Bank of England is completely disastrous and was, in fact, the main cause for the crash during Liz Truss's short premiership - but the fact is that the government's ability to create money to support a programme during an economic crash was proved for the second time in a little over a decade to be fundamental to keeping the world economy going.

So what is Trump doing? He's relying on another bailout. That, I am sure, is what underpins his thinking and that of those who are following him. What they know is that those two bailouts, structured as they were, were incredibly good for their own financial well-being.

They probably weren't great for your financial well-being because wages have, in effect, flatlined since 2008.

GDP growth has flatlined since 2008, and since 2020 very large numbers of people have not been able to work who previously did for all sorts of reasons, as a consequence of the fallout from Covid, and we most certainly have not been seeing growth and we are seeing austerity again. So for lots of reasons, most people in the world have suffered since 2008. But Trump and his cohort haven't.

That cohort is the world's wealthy, and they did immensely well out of quantitative easing because the way in which it was structured was to provide funds to the City of London, to the banking arrangements of New York and to the bankers of Frankfurt, and they used that money to basically inflate the value of the world's financial assets.

Stock markets have increased in value since 2008, unsurprisingly, because lots of money - whole walls of money - have flooded in their direction.

Commercial property prices have increased.

Domestic property prices have increased.

Anything which has no productive value in itself - because let's be clear, shares are not actually a productive asset, they're a financial asset, and most commercial property is not in the sense that I am talking about a productive asset because it is used for speculative purposes, and the increase in the value of our properties is not productive in the sense that very large numbers of young people are being excluded from home ownership, and the security that it provides as a result. But there's been no increase, therefore, in productive investment, but the value of assets used for speculative purposes by the wealthy has gone through the roof.

And what does Trump expect if he creates another world financial crisis? He believes there will be a bailout. And he believes that he and his cohort, the world's wealthy, will benefit from there being vastly more money in circulation, with very little to use it on except the inflation in the value of the assets that they own.

That Is what he is banking on. This is literally, I think, his economic policy. This is what he expects as a consequence of his trade wars.

He doesn't care that we suffer.

He won't care about the countries in the developing world - the vast majority of countries in the world, in fact, who have their debts denominated in dollars, who will suffer enormously as a result of their struggle to find the means to repay those debts, as, for the time being, the dollar is inflated in value and interest rates are too high.

He won't care that people are thrown out of work.

All he cares about is the inflation in asset values. And that is what the whole of the world economy is now geared to create, for the benefit of a few, at cost to the vast majority.

Trump's economic policy makes sense if you see it in this way. He runs for president on a bailout economic strategy that is going to work for him and his friends because it will result when the world economy crashes, in yet more money being made available through the central banking system to inflate the value of the assets that they own and they'll say “Thank you very much. We did very nicely out of that; when can we have another crash?”

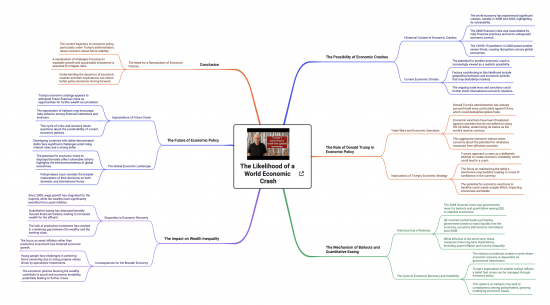

This is the Mapify of this video:

Click here for a larger version.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

[…] have this morning posted a video on why I think it's Trump's economic plan to crash the world economy so that there might be a […]

“Commercial property prices have increased”

This is not 100% accurate with regards to the USA.

Some Commercial property prices have increased and some have taken a nose dive.

That’s living in a flood area for you

Many high-rise office buildings in major cities are being sold for a song as they no longer have the tenants to support the carrying cost of the buildings because the way we worked has changed.

What you say is credible, given that we have had 2 previous very big previous global shocks, in 2008 & then 2020/21, where governments created and spent money to help people survive (bankers in 2008, ALL of us in 20/21), even though they “couldn’t afford it”. It worked, but then they dealt with the consequences (money supply) in the wrong way (austerity & regressive taxation, making the poor pay not the rich)).

You disagree with HOW they did it, but quite frankly my Reform-tempted neighbours will switch off at that point. The message that works with omnibus passengers (I’m assuming that Mile End bus is still in service?), is the one where you (simply) rubbish the “can’t afford it” argument, using 2008 & 2020/21 as proof, and then make predictions about what governments SHOULD do to prepare for the next one (Trump’s Trade War), and the message for omnibus passengers needs to be uncomplicated, in the style of “get Brexit done” (that was a brilliant piece of communication, for a disastrous bit of governance).

Something like, “Government can make the money to get **** sorted, like they had to do during 2008, and during Covid.”

Then add later in the argument. “We can get the extra spending back later, and keep the economy stable, but this time, collect it from those who can afford to pay, instead of hitting low & middle earners. We don’t NEED austerity!”

That’s the message for the omnibus, and your messengers are US. Every one of us, in our families, workplaces, social groups & bus journeys. We have to do that messaging, relentlessly, each to our own circle, even if it IS embarrassing, or causes tension.

There is a more complex message for those with a grasp of economics who don’t get headaches when someone mentions bonds. QE, QT & interest rates, and that needs tailoring for different audiences, and a particularly challenging one will be for Labour MPs, which must include some loud & scary economics but also some scaey psephology – remind them of their voting figures from 2024, give them the proof that trying to pinch the Re***m vote won’t work. (I think any voter who wants Fa***e style fascism would be well advised to vote Re***m, not Labour, if I wanted FA***e’s agenda I wouldn’t trust Starmer to deliver it).

I think we should be helping omnibus passengers, barristas, care workers, doctors, nurses, housing officers to write to their MPs in a way that scares the pants off them, that shows that we’ve rumbled them, and intend to ACT. Similarly, with social media and press contributions. A variety of messages, templates, at different levels, to professional bodies, alma maters, journalists, pitched at different levels. But the most important ones are the simple ones, simple but not deceptive.

Steph Kelton reminds us “they ridicule you, then you WIN.”

I think that’s where we are now. Your message is being noticed. They are getting desperate. The abuse and ridicule are coming. GOOD! Now lets make sure we win, for the sake of ordinary people around the world.

Be encouraged, don’t despair, don’t let the trolls distract you.

All I can say is this one is doing pretty well on YouTube

It would appear to me that Trump and his ilk policy makers and commentators, on both sides of the pond, fall into one of two broad categories. Those that truly don’t understand money creation and hence are the enablers and champions of the ‘there is no money’ doctrine. Then there are those that, even if it’s only on some animalistic level, understand that the state is the only source of money that does not have to be repaid and doesn’t carry interest.

The great neoliberal con is that they do not want a small state, what they do want is a small welfare state. They want as much government spending as possible to be funneled into the pockets of private suppliers where greedflation and wage and benefit suppression can do their evil work, particularly if there is no state sector in competition for labour.

Neoliberals would be supremely happy with a large deficit and national debt if it happened to be residing in their bank accounts and assets.

The rich are extremely lucky the masses when it comes to understanding the creation and use of money are happy to accept conjecture rather than theory.

A conjecture is a statement that is believed to be true based on limited evidence or intuition, but has not yet been proven. A theory is a well-established framework that has withstood rigorous testing and scrutiny. MMT of course consists of the latter. Not unlike Isaac Newton’s theory of gravity.

In a recent “The Lens” newsletter, Stephanie Kelton quotes Tr**p as explaining that government creates money, and that the USA can’t go bust. She’s not convinced he will remember or act consistently on that reality but she’s seizing the opportunity to get heard. Worth a read.

https://stephaniekelton.substack.com/p/can-donald-trump-revolve-on-debt

Tr**p is going to be President, and his maverick ways will create opportunities as well as disasters. I hate him for the convicted felonious Christofascist racist that he is, but I also hate the neoliberal status quo on economics and geopolitics, and SOME side-effects of his weirdness will create opportunities to put across alternative points of view, expose hypocrisies, and topple some sacred Aunt Sally’s.

Generally in agreement except that I doubt that Trump (too dumb) is anything more than a puppet having his strings pulled – like most politicians unfortunately. When he goes (sooner the better) the puppet masters will simply find another empty head to front their evil aspirations…..as they have been doing for far too long now. When will our politicians wake up & take the money out of politics – it would be surprisingly easy to do, given the will…

@Alan Peyton

Tump too dumb ? That was my first thought on reading Richard’s article. Sadly whether Trump is ventriloquist or dummy won’t alter the dangers of the policies he threatens to enact.

Somehow his supporters (I mean the people who voted for him rather than the puppet masters) are going to argue black is white that he’s doing the right things.

@ Richard

When does this asset inflation get reversed? When nobody can afford the rents? We really need governments to act sooner than that. (Yes I know you are trying)

The reversal is almost always by a crash.

Richard, if you’re right—and I’m sure you are—why aren’t more people calling this type of money manipulation out? Is it because the rich rule and no-one can speak out about them, or is it ignorance of the many? Great post.

Politcians are frightened of the rich