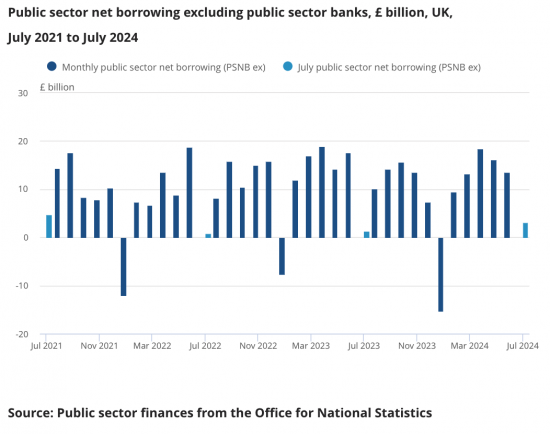

I have noted the new public sector borrowing figures published this morning, summarised as follows:

July borrowing was up very slightly. The cycle continues and will continue since Rachel Reeves is now pursuing Tory policy. There is little to add, barring one thing.

I have already noted this morning a Guardian article making very confident budget predictions, which are, I am sure, based on Treasury information. What I did not mention was the fourth prediction that the article made, which was that Reeves is planning to change the way the so-called national debt is measured to exclude the so-called Bank of England contribution.

Long-term readers of this blog will know that this is an issue to which I gave much attention in about 2020. This is one of the discussions on this claimed contribution. It was published in that year. More followed. But so, too, did practical work.

I followed up on my concern through correspondence and then had an extensive discussion with the Office for National Statistics. The Bank of England, the Treasury and the Office for Budget Responsibility all got involved. The result was a massive improvement in the disclosure of this issue within national debt data.

Turning to today's data, the impact can be seen in table PSA9A of the Excel spreadsheet downloadable from there (you have to be a bit geeky here). That reconciliation of the so-called Bank of England contribution was created as a direct result of my engagement with the ONS: it would not otherwise exist.

As that table shows, the Bank of England's supposed contribution to the national debt is now £205 billion. That is included in the grand total £2,749 billion (table PSA8B_2, column C, by the way, bit it takes a real geek to know that). In other words, it is supposedly 7.5% of the national debt.

The only problem is that, as I pointed out in 2020 and again in 2023 in a submission to parliament, this supposed Bank of England contribution to the national debt does not exist. As I said in that submission:

The national debt is also overstated ... because of the Office for National Statistics' claim that there is a so-called Bank of England contribution towards that debt for which no matching liability exists in the audited account of the Bank of England. The figure in question represents assets that the ONS arbitrarily refuses to accept the existence of when estimating the national debt. The total sum in question cannot be categorised as debt because there is no identifiable person to whom it is owing. The problem arises because the Office for National Statistics does not use double-entry accounting when estimating the national debt.

Like so much of what I suggest, this was ignored at the time. But again, as is true of all that I seek to write here, the claim was true. There is no Bank of England contribution to the national debt: the claim is entirely fictional and is based solely upon the fact that the Office for National Statistics refuses to prepare proper accounts for this debt - and almost seems proud of the fact that they do not do so.

Now, it looks likely that Rachel Reeves might restate the so-called national dent to exclude this figure. I will, I suspect, be the only person able to claim credit for that change. I am staking that claim now, and unashamedly so.

But the real question is, will that let Reeves do what is required for the country? Winning technical arguments is one thing. Securing change is much more important.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Changes to the way the government accounts for the QE debt etc, have been discussed by leading asset managers, particular those involved in Pension LDI risk management, for a number of years, given they are the main source of demand for long-dated government bonds.

Indeed, a combined letter was written from the leading LDI providers arguing for some of the changes that you mention above. Of course, not being part of the industry, you would be entirely unaware of those discussions.

However, I do think it most likely that changes were made in order to satisfy the future buyers of tens or even hundreds of billions of new debt that the DMO needs to issue, rather than at the demand of a single individual not involved in the market whatsoever!

I’m sure you will have a different view.

The issues are entirely unrelated

If you do not appreciate that then I feel sorry for your supposed employer

You have absolutely no idea the nature of the issues that were addressed in those discussions.

But feel free to make your unsubstantiated claims on your blog – perhaps you could publish some of the exchanges that might support your claim?

I think I do

If I did not the ONS and others would not have engaged or changed what they published

So politely, I think you are the one making all the false claims – including as to who your employer is, which I can see, unless you prove otherwise and put the correspondence to which you refer in the public domain. .

Interesting. Glad to know you are dissecting the figures. We need more of that sort of work. I find that looking at housing data most commentators do not analyse the figures and just accept headlines or the ‘evidence’ from free-market lobby groups!!

“The problem arises because the Office for National Statistics does not use double-entry accounting when estimating the national debt”.

It take this to be the central point. This is incompetent. The problem here is that we have economists and statisticians who do not require to understand double-entry in order to produce a set of national accounts, or even be able to read them. It doesn’t sink much lower in incompetence than that.

And the ONS are supposedly informing the public about the facts. Hats off Richard, for your persistence and determination. But you began this in 2020; it should not take four years to fix, unless your institutions are grotesquely obtuse or financially illiterate. If the announcement is made, please push it home; right down the Treasury, BoE and ONS (and OBR) throats; because if they don’t understand that, then we are entitle to challenge everything; and that includes consolidated national accounts, which of course puts another £800Bn of the debt in jeopardy.

You are right, of course, re the latter

Ruled by donkeys!

https://www.theguardian.com/politics/article/2024/aug/21/rachel-reeves-ons-public-finances-report-harsh-budget

Well, Richard now you know why they are going to eliminate the anomaly you pointed out four years ago; it is now simply politically convenient for Reeves at the margin to provide a soapsud whitewash of the national debt to fit whatever story of failure she is going to present as success, according to her own incomprehensible and pointless rules, and point to the triumph of her preferred fiction.

Initially I can’t believe that we have an organisation reporting on a function that it does not understand.

Before Johnson, Covid and BREXIT and would say that that was unbelievable.

But now it seems all too familiar in our failed state.

A civil service that doesn’t understand the need for double-entry accounting. The emperor has no clothes and standing in a swamp!

If cash in circulation is also classed as being part of the national debt then does this £95 billion show up in the accounts or get published somewhere?…..

Value of outstanding notes and coins in circulation in United Kingdom (UK) from January 2014 to June 2023….

As of June 2023, the value of outstanding notes and coins in circulation in the United Kingdom reached almost 95 billion British pounds. This was an increase of almost 10 billion British pounds as compared to June 2020. When broken down by denomination, the twenty-pound note accounted for the highest share of notes in circulation. Twenty-pound notes also had the highest volume of banknotes in circulation in 2023.

https://www.statista.com/statistics/319453/uk-banking-notes-and-coin/

It is implicit in the figures, but via the Bank of England’s genuine net contribution

It takes a decidedly convoluted route to work out it is there – and I have not got time to replicate the working now

When I worked in NHS Finance I had finance colleagues at the Dept of Health who dealt with Treasury on a regular basis and reported that there a recognised Finance qualification was seen as a barrier to career progress. At the time I took it with a pinch of salt but now I read they don’t see the need for double entry accounting so perhaps there was (and still is?) something in it.

I should add HMRC also have real problems with double entry….

Mr Nelson,

I think I am gong to require to lie down with a towel on my head for some time to let that piece of news sink in. I suppose what they really want is a degree in ancient Greek; the doxology of the Civil Service.

Where is that towel, I feel faint?

🙂