The Organisation for Economic Cooperation and Development issued a press release in Paris this afternoon saying:

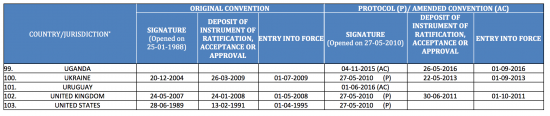

25/08/2016 — In a ceremony at OECD Headquarters in Paris today, Burkina Faso, Malaysia, Saint Kitts and Nevis, Saint Vincent and the Grenadines, and Samoa signed the Multilateral Convention on Mutual Administrative Assistance in Tax Matters, bringing the number of participating jurisdictions to 103.

That's the good news.

Now let's have the bad news. It relates to the 103rd supposed signatory:

The US initialed this protocol six years ago, on the same day that the UK did. But it's never progressed its involvement and as such is not a real party to the process. Its presence on this list is a mere token as a result. After six years of waiting its very clear that the USA does not want to partake in mutual administrative assistance on tax matters.

And that's why it is now the most problematic tax haven in the world.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Exactly so.

The USA’s current and foreseeable trade policy (as one arm of its foreign policy) is in diametric opposition not just to our, but to pretty-well the whole of the rest of the world’s, best interests IMHO.

Our leaving the EU, far from reducing our interdependence with its remaining member-states, will make it even more imperative that we stand four-square with the EU Commission in resisting American pressure, without this – as being in the EU does now – constricting our freedom of action to foster a similar relationship with non-EU countries too.

The Government of the USA is still the biggest threat to democracy and peace in the modern world. It is THE rogue state and is out of control. It has even started a race with Russia as to who can be the state who sticks their nose into other people’s business the most earning the biggest advantage. A new form of cold war. Thanks.

It should be internationally ostracised. I’d close down its embassy tomorrow but make it clear that its tourists would be welcome. Many of us in Europe need to be courageous and not put up with its sly, knowing hegemony anymore.

As your extract makes clear, the US is a party to the original (1988) mutual assistance convention, and has ratified that convention. The US has also signed the protocol to that convention, which was agreed in 2010, but some six years later the US has still not ratified that protocol.

There is a summary of the (very slow) procedural history in the US Congress here: https://www.congress.gov/treaty-document/112th-congress/5

As you will see, the Senate Committee on Foreign Relations has twice recommended the protocol for ratification (most recently earlier this year) but it still needs a two-thirds vote in favour on the floor of the Senate. As with the previous recommendation, I expect a further recommendation from the committee will be required if the protocol is not approved before the current session of Congress is adjourned later this year.

I am sure the US tax authorities and the (current) US President will be very much in favour of the protocol, but for better or for worse the US constitution requires Senate approval. And, as with many other treaties in recent years, the Senate has been in no rush to ratify.

Failure of the US to ratify this protocol may give some indication of the likelihood that the US will rapidly ratify the OECD’s multilateral instrument, to implement some of the BEPS proposals.

Presumably a post-Brexit UK will replace the EU mutual assistance directive at some point.

There are lots of US tax treaties that are still waiting for Senate approval. There is a list at http://www.state.gov/s/l/treaty/pending/. I think all new or amended tax treaties going back to 2010 are on the list. My understanding is that one senator (Rand Paul?) is holding up the ratification process due to an issue on exchange of information. Someone will more knowledge of the process than me may be able to confirm if this is correct.

The Republucans are responsible for this

They say it is a privacy issue

But that is precisely my point: that’s what all tax havens say